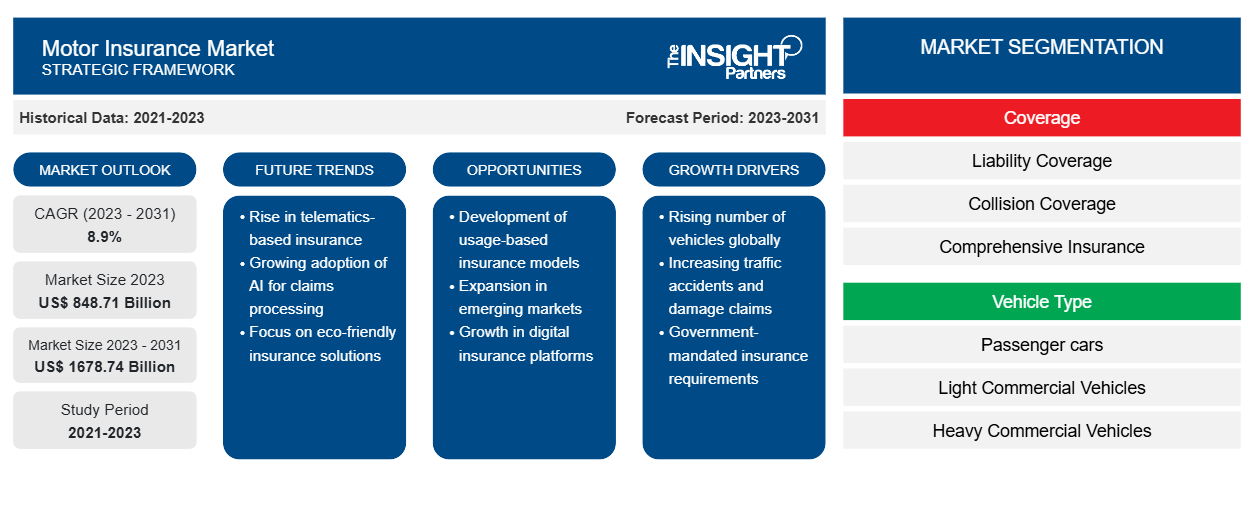

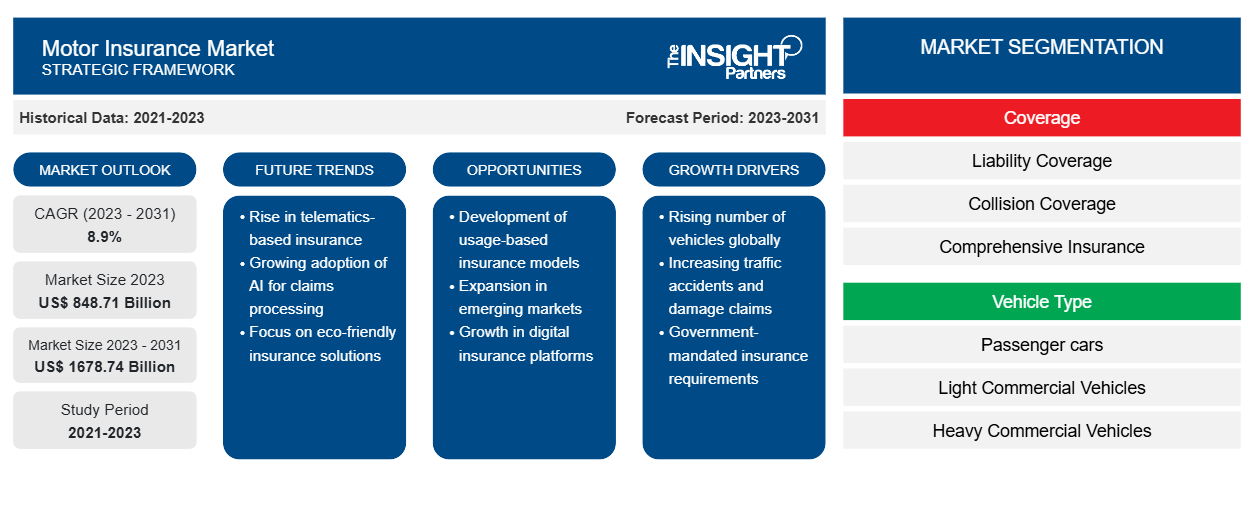

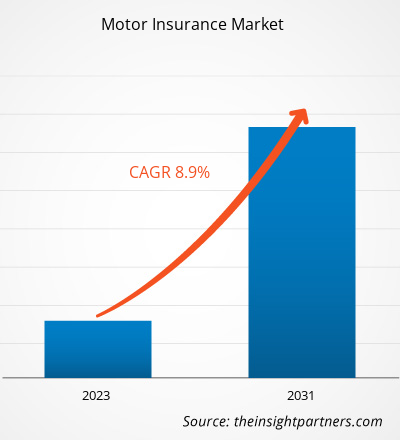

The Motor Insurance Market size is expected to grow from US$ 848.71 billion in 2023 to US$ 1678.74 billion by 2031; it is anticipated to expand at a CAGR of 8.9% from 2023 to 2031. Factors such as increasing motor ownership and increasing automotive sales are driving the motor insurance market growth.

Motor Insurance Market Analysis

The motor insurance market is expected to witness significant growth due to the adoption of advanced technologies such as telematics and artificial intelligence. Telematics technology, which involves the use of devices to monitor driving behavior, is expected to play a crucial role in personalized insurance offerings and risk assessment. Artificial intelligence and machine learning algorithms can help insurers automate claims processing, fraud detection, and customer service, leading to improved efficiency and customer experience. Insurers are increasingly focusing on enhancing the customer experience by providing seamless digital services and personalized offerings. The rise of Insurtech startups and partnerships between traditional insurers and technology companies are driving innovation in the industry. Improved customer engagement through mobile apps, online claims processing, and 24/7 customer support is expected to be a key area of focus.

Motor Insurance Market Overview

- Motor insurance, also known as vehicle insurance or auto insurance, is a type of insurance policy that provides coverage for motor vehicles such as cars, motorcycles, trucks, and commercial vehicles. It is a mandatory policy in many countries to protect the general public from any accidents that might occur on the road.

- Usage-based insurance (UBI) is gaining popularity, allowing insurers to offer personalized premiums based on individual driving behavior. UBI utilizes telematics data to track factors such as mileage, speed, and driving patterns, enabling insurers to offer discounts to safe drivers. These motor insurance market trends provide an opportunity for insurers to attract customers by offering flexible and customized insurance plans.

- The growing adoption of electric vehicles (EVs) presents new opportunities and challenges for the motor insurance industry. Insurers will need to develop specialized insurance products and risk assessment models for EVs, considering factors such as battery life, charging infrastructure, and repair costs. This shift towards EVs opens up avenues for insurers to provide innovative coverage options and attract environmentally conscious customers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Motor Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Motor Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Motor Insurance Market Drivers and Opportunities

Rising Number of Accidents to Drive the Motor Insurance Market

- The motor insurance market growth is influenced by various driving factors that contribute to the determination of auto insurance rates. One significant factor is the increasing number of crashes, traffic collisions, and accidents. These incidents play a vital role in shaping insurance prices as they result in claims and potential financial losses for insurers. The rise in accidents can be attributed to several reasons, including distracted driving, such as texting or talking on the phone while driving, which has become a prevalent issue in many cities.

- Additionally, the location of the insured vehicle also affects insurance rates, with higher premiums often seen in large metropolitan areas where disposable income is higher. Motor insurance provides coverage for various aspects, including the cost of injured individuals, medical expenses, lost wages, vehicle repairs, and property damage resulting from accidents. As a result, people are increasingly adopting auto insurance to protect themselves from potential financial losses, leading to an increased demand for motor insurance in the market.

Motor Insurance Market Report Segmentation Analysis

- Based on coverage, the market is segmented into liability coverage, collision coverage, comprehensive insurance, and others. The liability coverage segment is expected to hold a substantial motor insurance market share in 2023.

- Liability coverage is a fundamental component of motor insurance that provides financial protection to the insured party in the event they cause damage to someone else's property or injure another person. It is typically a mandatory requirement in most states and provinces. Liability coverage helps cover the costs of property repairs, medical expenses, legal fees, and other related damages resulting from an accident for which the insured is at fault. The specific coverage limits and details may vary depending on the insurance policy and jurisdiction.

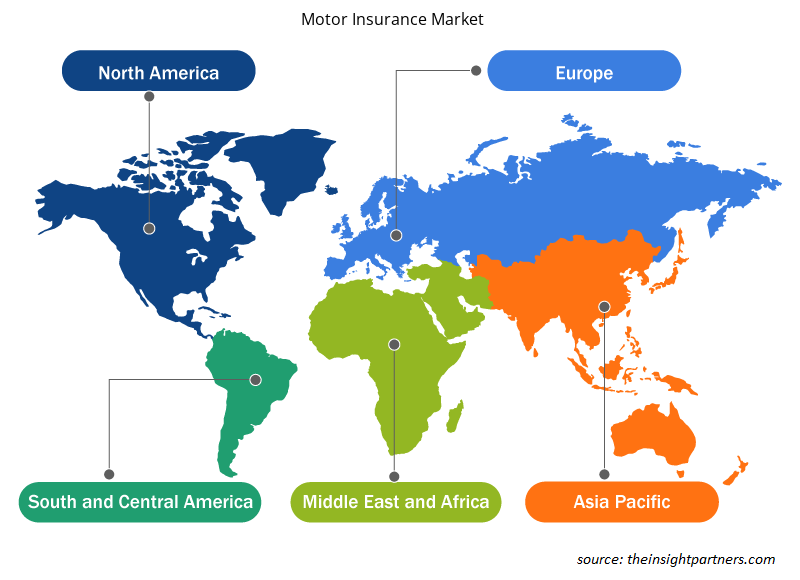

Motor Insurance Market Regional Analysis

The scope of the market report is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant motor insurance market share. The market in North America is a significant and dynamic industry that provides coverage for automobiles and vehicles. This market is characterized by a wide range of insurance providers offering various policies to cater to the diverse needs of consumers. In North America, motor insurance is mandatory in most states and provinces, ensuring that drivers have financial protection in the event of accidents, property damage, or bodily injury. The market is highly competitive, with numerous insurance companies competing to attract customers through competitive pricing, coverage options, and additional benefits. Factors such as population growth, urbanization, and an increase in vehicle ownership contribute to the steady growth of the market in North America.

Motor Insurance Market Regional Insights

Motor Insurance Market Regional Insights

The regional trends and factors influencing the Motor Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Motor Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Motor Insurance Market

Motor Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 848.71 Billion |

| Market Size by 2031 | US$ 1678.74 Billion |

| Global CAGR (2023 - 2031) | 8.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Coverage

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Motor Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Motor Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Motor Insurance Market are:

- Admiral Group plc

- Allianz

- Allstate Insurance Company

- GEICO

- ICICI Lombard

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Motor Insurance Market top key players overview

The "Motor Insurance Market Analysis" was carried out based on coverage, vehicle type, application, and geography. In terms of coverage, the market is segmented into liability coverage, collision coverage, comprehensive insurance, and others. Based on vehicle type, the market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. Based on application, the market is segmented into personal motor insurance and commercial motor insurance. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Motor Insurance Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the market. The motor insurance market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. A few recent key market developments are listed below:

- In March 2024, State Farm, one of the largest insurers, experienced substantial financial losses in 2023 after withdrawing from the California homeowners' market. Despite an increase in policy numbers for its property and casualty insurance companies, State Farm encountered underwriting losses due to high claims severity and significant catastrophe events impacting both auto and homeowners' insurance sectors.

[Source: State Farm, Company Website]

Motor Insurance Market Report Coverage & Deliverables

The market report on “Motor Insurance Market Size and Forecast (2021–2031)”, provides a detailed analysis of the market covering below areas: -

- Market size & forecast at global, regional, and country- level for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Coverage, Vehicle Type, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the market are Admiral Group plc; Allianz; Allstate Insurance Company; GEICO; and ICICI Lombard.

The market is expected to reach US$ 1678.74 billion by 2031.

The market was estimated to be US$ 848.71 billion in 2023 and is expected to grow at a CAGR of 8.9% during the forecast period 2023 - 2031.

Integration of telematics and AI technologies is anticipated to play a significant role in the market in the coming years.

The rising number of accidents and increasing motor ownership are the major factors that propel the market.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Admiral Group plc

- Allianz

- Allstate Insurance Company

- GEICO

- ICICI Lombard

- Liberty Mutual Insurance

- Permanent General Companies, Inc.

- Progressive Casualty Insurance Company

- State Farm Mutual Automobile Insurance Company

- Tokio Marine Holdings, Inc.

Get Free Sample For

Get Free Sample For