MARKET INTRODUCTION

The multivendor ATM software provides end-users with one software interface across multiple platforms. It enables financial institutions such as banks to customize the ATM model suitable for a particular location while choosing hardware from any supplier. The many benefits associated with the multivendor ATM software are attracting financial and non-financial institutions towards switching to these solutions. The introduction of new technologies would create significant growth prospects for software providers in the coming years.

MARKET DYNAMICS

The multivendor ATM software market is anticipated to grow in the forecast period owing to driving factors such as ongoing modernization of ATMs coupled with the growing demand for the latest software and hardware solutions. Also, the need for self-service ATM software is likely to fuel market growth. However, limitations associated with ATM management may hinder the growth of the multivendor ATM software market during the forecast period. Nonetheless, new technologies such as QR codes and contactless payment are likely to create lucrative growth opportunities for the multivendor ATM software market in the coming years.

MARKET SCOPE

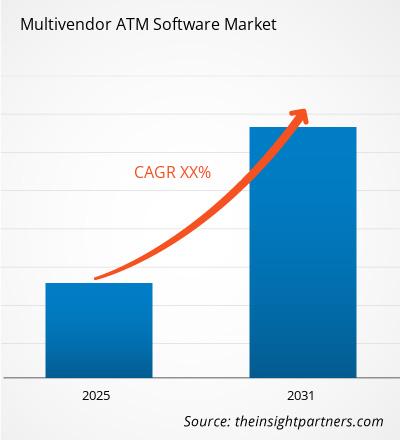

The "Global Multivendor ATM Software Market Analysis to 2031" is a specialized and in-depth study of the technology, media and telecommunications industry with a special focus on the global market trend analysis. The report aims to provide an overview of multivendor ATM software market with detailed market segmentation by component, function, end user, and geography. The global multivendor ATM software market is expected to witness high growth during the forecast period. The report provides key statistics on the market status of the leading multivendor ATM software market players and offers key trends and opportunities in the market.

MARKET SEGMENTATION

The global multivendor ATM software market is segmented on the basis of component, function, and end user. Based on component, the market is segmented as software and services. On the basis of the function, the market is segmented as dispense, deposit, bill payment, and others. The market on the basis of the end user is classified as banks & financial institutions and non-financial institutions (independent ATM deployers).

REGIONAL FRAMEWORK

The report provides a detailed overview of the industry including both qualitative and quantitative information. It provides an overview and forecast of the global multivendor ATM software market based on various segments. It also provides market size and forecast estimates from the year 2021 to 2031 with respect to five major regions, namely; North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. The multivendor ATM software market by each region is later sub-segmented by respective countries and segments. The report covers the analysis and forecast of 18 countries globally along with the current trend and opportunities prevailing in the region.

The report analyzes factors affecting multivendor ATM software market from both demand and supply side and further evaluates market dynamics affecting the market during the forecast period, i.e., drivers, restraints, opportunities, and future trend. The report also provides exhaustive PEST analysis for all five regions namely; North America, Europe, APAC, MEA, and South & Central America after evaluating political, economic, social and technological factors affecting the multivendor ATM software market in these regions.

MARKET PLAYERS

The reports cover key developments in the multivendor ATM software market as organic and inorganic growth strategies. Various companies are focusing on organic growth strategies such as product launches, product approvals and others such as patents and events. Inorganic growth strategies activities witnessed in the market were acquisitions, and partnership & collaborations. These activities have paved the way for the expansion of business and customer base of market players. The market players from multivendor ATM software market are anticipated to lucrative growth opportunities in the future with the rising demand for multivendor ATM software in the global market. Below mentioned is the list of few companies engaged in the multivendor ATM software market.

The report also includes the profiles of key multivendor ATM software companies along with their SWOT analysis and market strategies. In addition, the report focuses on leading industry players with information such as company profiles, components and services offered, financial information of the last three years, key developments in the past five years

- Auriga SpA

- Chetu Inc.

- Diebold Nixdorf, Incorporated

- GRGBanking

- Korala Associates Limited (KAL)

- Nautilus Hyosung America, Inc. (NHA)

- NCR Corporation

- Printec Group

- SBS Software Ges.mbH

- Vortex Engineering Pvt Ltd, Incorporated.

The Insight Partner's dedicated research and analysis team consist of experienced professionals with advanced statistical expertise and offer various customization options in the existing study.

Multivendor ATM Software Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | XX% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- High Speed Cable Market

- Print Management Software Market

- Ceramic Injection Molding Market

- EMC Testing Market

- Enteral Nutrition Market

- Electronic Toll Collection System Market

- Nuclear Waste Management System Market

- Wire Harness Market

- Micro-Surgical Robot Market

- Adaptive Traffic Control System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies

1. Auriga SpA

2. Chetu Inc.

3. Diebold Nixdorf, Incorporated

4. GRGBanking

5. Korala Associates Limited (KAL)

6. Nautilus Hyosung America, Inc. (NHA)

7. NCR Corporation

8. Printec Group

9. SBS Software Ges.mbH

10. Vortex Engineering Pvt Ltd, Incorporated.

1. Auriga SpA

2. Chetu Inc.

3. Diebold Nixdorf, Incorporated

4. GRGBanking

5. Korala Associates Limited (KAL)

6. Nautilus Hyosung America, Inc. (NHA)

7. NCR Corporation

8. Printec Group

9. SBS Software Ges.mbH

10. Vortex Engineering Pvt Ltd, Incorporated.

Get Free Sample For

Get Free Sample For