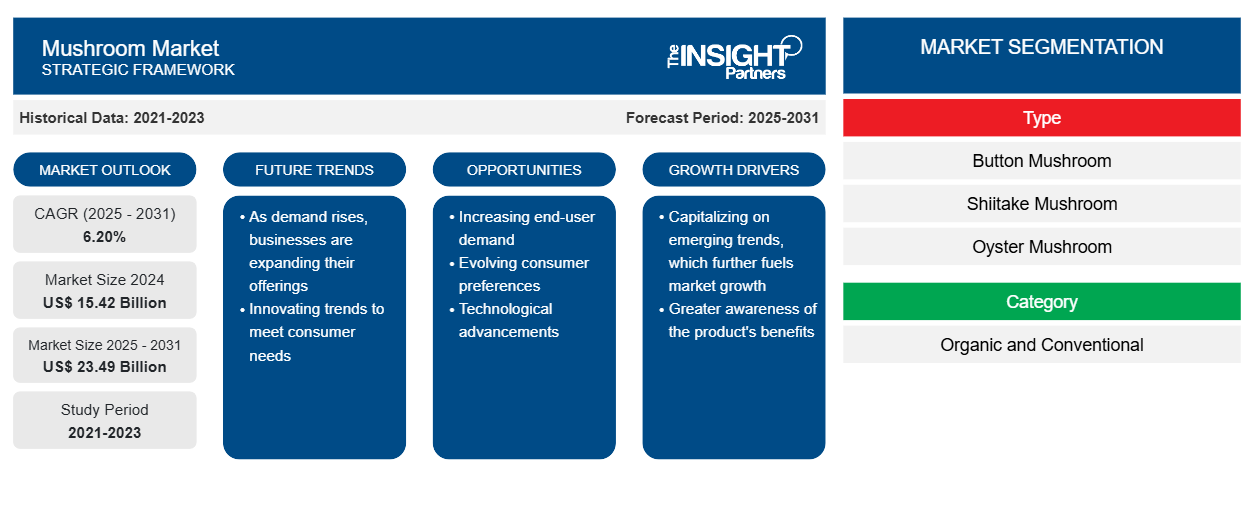

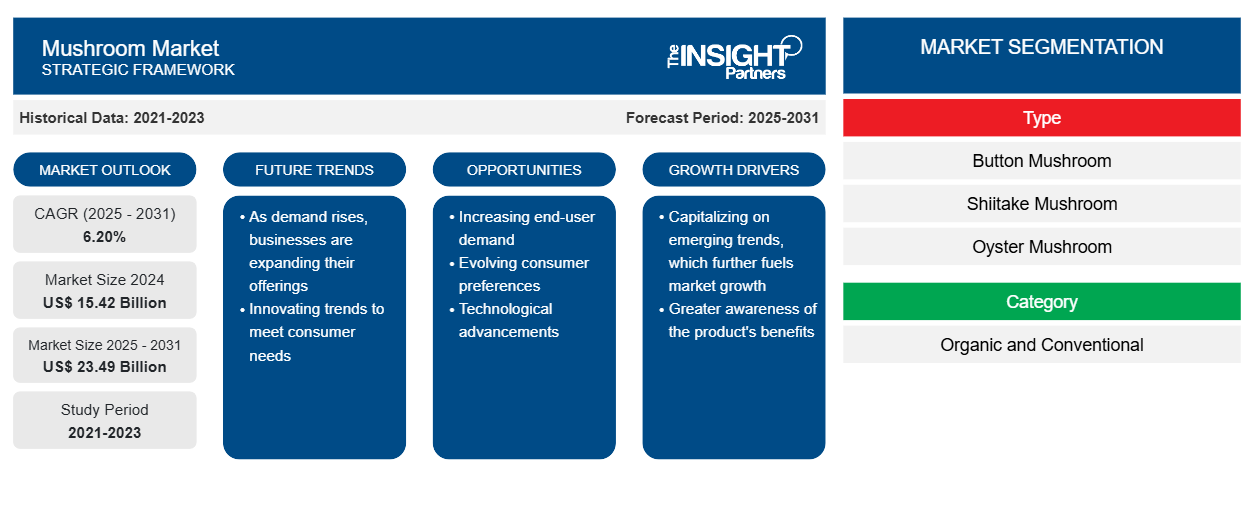

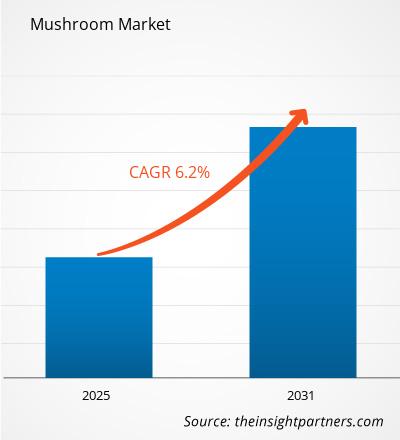

The mushroom market size is expected to grow from US$ 13.67 billion in 2022 to US$ 19.63 billion by 2031; it is estimated to record a CAGR of 6.2% from 2022 to 2031.

Edible mushrooms are the fleshy and edible fruiting bodies of several species of macro fungi. Mushrooms are cultivated majorly in China, the US, the Netherlands, France, and Poland. White mushrooms, cremini mushrooms, shiitake mushrooms, oyster mushrooms, enoki mushrooms, chanterelle mushrooms, porcini mushrooms, portobello mushrooms, and brown mushrooms are commonly consumed mushroom types globally. Mushrooms are also high in antioxidants such as selenium and glutathione. In addition, they contain high levels of vitamins B and D, phosphorus, magnesium, calcium, and potassium.

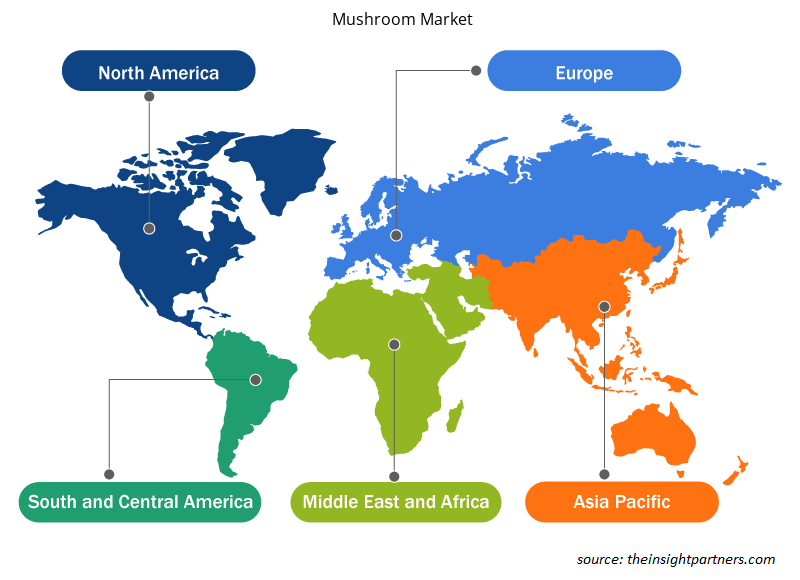

In 2021, Asia Pacific held the largest share of the mushroom market; however, Europe is estimated to register the highest CAGR during the forecast period. The market growth in the region is attributed to consumer inclination toward the consumption of nutrition-rich food, and increasing medicinal use of mushrooms owing to their antibiotic properties. They have also been studied for their synergistic effects with anticancer drugs. The compounds or substances extracted from mushrooms can be utilized in immunosuppressants, cholesterol inhibitors, and psychotropic drugs. Asia Pacific is the largest producer of mushrooms, with countries such as China, Japan, India, Thailand, the Philippines, and Indonesia being prime contributors to the regional production volumes. Government initiatives to promote mushroom production also favor the growth of the market in this region. Asia Pacific Edible Mushroom Training Center located in Fuzhou is heavily engaged in research studies, development, and international technology training. It also engages in exchange, and economic and trade cooperation on edible mushrooms, in turn, promoting the industrialization and internationalization of edible mushrooms.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mushroom Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mushroom Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Mushroom Market

Lockdown impositions, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA). The social and commercial restrictions subsequently resulted in disruptions in supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. However, the demand for mushrooms increased owing to increasing consumer preference for plant-based food and rising awareness regarding the health benefits of mushrooms. Thus, the discontinuation of manufacturing activities and the rise in demand led to a demand and supply gap. In 2021, various businesses announced possible delays in mushroom consignments and projected a slump in future sales. Further, bans imposed by governments of various countries in Europe, Asia Pacific, and North America on international travel forced several companies to discontinue their collaboration and partnership plans.

Market Insights

Strategic Developments by Key Players to Drive Mushroom Market During Forecast Period

Product innovation, plant capacity expansion, and mergers & acquisitions are among the key strategies implemented by mushroom manufacturers to strengthen their market positions and expand their customer base. For instance, Big Mountain Foods, announced its partnership with Sprouts Farmers Market, a leader in gut-healthy foods, to launch the first Lion’s Mane mushroom product line across North America. Therefore, continued strategic developments by market players are expected to provide immense opportunities to the mushroom market during the forecast period.

Type Insights

Based on type, the mushroom market is segmented into button mushroom, shiitake mushroom, oyster mushroom, and others. The button mushroom segment held the largest market share in 2021, and the shiitake mushroom segment is expected to register the highest CAGR from 2022 to 2031. Button mushroom is largely cultivated mushroom globally due to lower incubation time taken by their spores. In addition, the lower cost of button mushrooms than other types and numerous nutritional benefits favor the market growth for this segment.

Category Insights

Based on category, the mushroom market is segmented into organic and conventional. The conventional segment held a larger market share in 2021. However, the organic segment is projected to register a higher CAGR during the forecast period. Variety of mushroom are grown conventionally in various countries using chemical fertilizers and pesticides. These category uses genetically modified organisms, which ensures the consistent crop yield. However, with the growing popularity of organic products because of their high quality and sustainability, the preference for conventional products may reduce in the coming years. However, local food manufacturers may continue to use conventional mushrooms owing to their affordability and availability.

Giorgio Fresh Co.; B and G FOODS INC; Banken Champignons B.V.; Monterey Mushrooms, LLC; Woodstock Foods; Bonduelle SA; Monaghan Group; WALSH MUSHROOMS GROUP; Smithy Mushrooms; and Bluff City Fungi are among the major players operating in the mushroom market. These companies mainly focus on product innovation to expand their market size and follow emerging market trends. Such products are expected to gain high traction among consumers during the forecast period.

Report Spotlights

- Progressive industry trends in the mushroom market to help companies develop effective long-term strategies

- Business growth strategies adopted by the market players in developed and developing countries

- Quantitative analysis of the market from 2022 to 2031

- Estimation of global demand for mushrooms

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the mushroom market

- Recent developments to understand the competitive market scenario

- Market trends and outlook, and market drivers and restraints

- Assistance in the decision-making process by highlighting strategies of mushroom market players

- Size of the mushroom market at various nodes

- Detailed overview and segmentation of the market, as well as the mushroom industry dynamics

- Size of the mushroom market in various regions with promising growth opportunities

Mushroom Market Regional Insights

The regional trends and factors influencing the Mushroom Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mushroom Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mushroom Market

Mushroom Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 15.42 Billion |

| Market Size by 2031 | US$ 23.49 Billion |

| Global CAGR (2025 - 2031) | 6.20% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

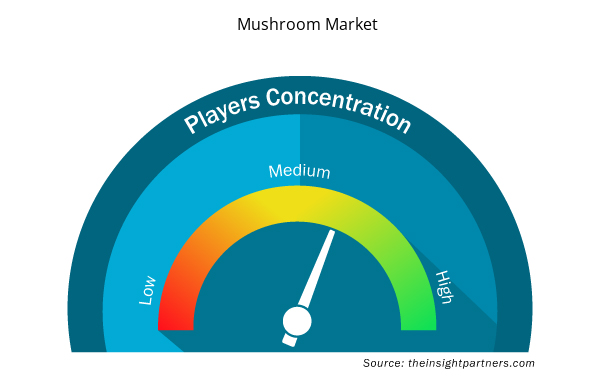

Mushroom Market Players Density: Understanding Its Impact on Business Dynamics

The Mushroom Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mushroom Market are:

- CMP Mushrooms

- Costa Group

- Gourmet Mushrooms, Inc.

- Monterey Mushrooms, Inc.

- The Mushroom Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mushroom Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Hot Melt Adhesives Market

- Foot Orthotic Insoles Market

- Retinal Imaging Devices Market

- Bioremediation Technology and Services Market

- Surgical Gowns Market

- Mice Model Market

- Battery Testing Equipment Market

- Rugged Servers Market

- Virtual Pipeline Systems Market

- Lyophilization Services for Biopharmaceuticals Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Category, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

Ans. The Asia Pacific region led the mushroom market with the highest market share in 2018. The continuous economic growth in developed and developing countries like India and China, coupled with the presence of huge disposable incomes with individuals in countries like Japan and Australia, has facilitated the rapid growth of the automotive industry in this region. China is the largest producer of mushrooms in the APAC region. The production in the region is mostly devoured by the change in eating habit of consumers and medicinal use of mushrooms since it includes antibiotics, anti-cancer drugs, cholesterol inhibitors, psychotropic drugs, an immunosuppressant. The Asia Pacific region is also the quickest increasing local market for mushrooms.

Ans. Growing demand for mushrooms is a major breakthrough in the food industry. Mushrooms have been used as food by mankind since time age-old times after collecting from the forests. However, mushrooms could not be domesticated due to its complex nature. Nevertheless, China was the first ones to do the artificial cultivation of the tropical and subtropical mushrooms about thousand years ago but the real commercial ventures started when the Europeans started cultivation in greenhouses and caves during 16th and 17th century.

Ans. The leading type of mushroom is the button mushroom that has noted to grow at a significant CAGR. Button Mushroom also known as table mushrooms, common mushrooms, Champignon de Paris, and Cultivated mushrooms is one of the most popular mushroom variety grown and consumed globally. Cultivation of button mushrooms was started in the sixteenth century by the Europeans. White button mushroom on a large scale is produced in central Europe (mainly western part), North America (USA, Canada) and S.E. Asia (China, Korea, Indonesia, Taiwan, and India). These white button mushrooms are traded as the fresh mushrooms for canning purposes and also is used to make soups, sauces and other food products. Protein in mushrooms is very high which helps for digestibility and contains all the essential amino acids. It also has medicinal properties, a high amount of retene is present in the button mushroom which is supposed to have an antagonistic effect on some forms of tumors. In Egypt, they were valued for the belief of giving the consumer special powers or eternal life. In France, the white button mushrooms were cultivated in the catacombs and White button mushrooms are still cultured underground in Western France today. In addition to cultural folklore, the mushrooms were used in traditional Chinese medicine to help regulate the body’s energy and to provide additional antioxidants to promote overall health and well-being.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies

- CMP Mushrooms

- Costa Group

- Gourmet Mushrooms, Inc.

- Monterey Mushrooms, Inc.

- The Mushroom Company

- Monaghan Mushrooms

- Okechamp SA

- Scelta Mushrooms B.V.

- Greenyard

- Giorgio Fresh Co.

Get Free Sample For

Get Free Sample For