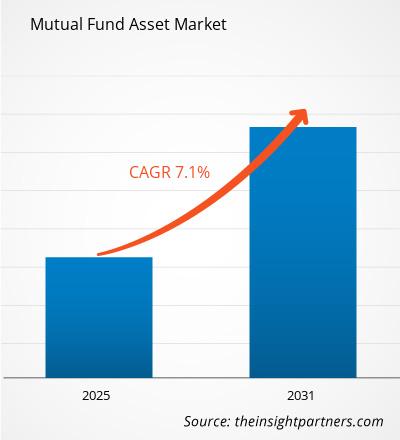

The mutual fund asset market size is expected to grow at a CAGR of 7.1% from 2025 to 2031. It is anticipated that regulatory agencies, governments, and other authorities in a number of nations will strengthen and grow their current mutual fund sector. Furthermore, the regulatory agencies persist in their efforts to improve market penetration and expansion through partnerships with e-wallets, e-commerce distribution, and other related platforms. Moreover, the governments of the various areas actively support and participate in the work of mutual fund distributors. Therefore, by improving the quality and depth of the engagement with channel partners, this element is speeding up the growth of mutual fund providers' income.

Mutual Fund Asset Market Analysis

The market is driven by demographic shifts, technological advancements, growing disposable incomes in developing economies, and an increasing emphasis on sustainable and diversified investment strategies. Investors can diversify their holdings among a variety of assets, including stocks, bonds, and commodities, by using mutual funds. By distributing investments throughout different industries and asset classes, diversification reduces risk and may produce more steady and reliable returns. Professional management, which mutual funds offer, contributes to the market's expansion.

Mutual Fund Asset Market Overview

- One of the most popular investment options available to small investors is a mutual fund. It also provides a reasonably priced way to participate in a diversified portfolio. Additionally, it pools the funds of multiple investors and uses them to purchase securities like bonds, equities, short-term loans, and other financial instruments.

- The ownership of an investor in the fund and the profits from their investments are represented by each share. The growing interest in mutual funds, which allow both large and small fund savers to take part in investment plans, is contributing significantly to the market's expansion. The development of the mutual fund assets market is also fueled by the use of digital technology, ease, and fair pricing in terms of investments, and sophisticated portfolio management services.

REGIONAL FRAMEWORK

Mutual Fund Asset Market Driver and Opportunities

Ability to Diversify Investment Portfolio to Drive the Mutual Fund Asset Market

- Due to investors' rising appetite for diverse portfolios, the global market for mutual fund assets is expanding. A convenient means of distributing risk across multiple asset classes, mutual funds are attractive to both new and experienced investors.

- Institutional investors have a major impact on the mutual fund assets market because of their huge capital and long-term investing plans. Their strategic decision-making and large investments shape market dynamics.

Increasing Adoption of Digital Technologies to Create Lucrative Market Opportunities

- The use of technology like blockchain, artificial intelligence, cloud computing, big data & analytics, robo-advisors, and others has accelerated in the mutual fund business. Moreover, mutual fund businesses use these technologies to lower costs and risk for the mutual fund market, centralize procedures to generate efficiencies, and offer simple access to complex services.

- Because more integrated and value-added services have been installed, this has assisted in creating client loyalty. Consequently, there is a greater deployment and implementation of technologies, which is driving the market expansion in order to provide efficient and convenient services while lowering operational costs. This, in turn, is expected to create lucrative opportunities for the mutual fund asset market during the forecast period.

Mutual Fund Asset Market Report Segmentation Analysis

The key segments that contributed to the derivation of the mutual fund asset market analysis are type, investment strategy, investment style, distribution channel, and investor type.

- The institutional segment is predicted to register significantly during the forecast period. Institutional investors, such as insurance companies, pension funds, and sovereign wealth funds, have significant financial resources and long-term investment aims.

- The ease and flexibility of buying mutual fund units directly from investors without the need for middlemen like brokers or financial advisors is provided by direct sales. The direct sales segment dominated the market share in 2023.

- The open-ended segment held a prominent market share in 2023. Its characteristics of flexibility and liquidity account for its prominence. There is no set quantity of shares in open-ended mutual funds; instead, they can issue new shares or redeem existing ones in response to demand from investors. This gives investors instant access to their money by enabling them to buy or sell shares at any moment.

Mutual Fund Asset Market Share Analysis By Geography

- The scope of the Mutual Fund Asset market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. Asia Pacific region is expected to grow at the fastest CAGR during the forecast period.

- The Asia Pacific region is seeing rapid middle-class population growth and economic expansion, which is increasing disposable income and the requirement for investment options. Mutual funds are becoming a more popular choice for those building wealth since they allow them to diversify their investment portfolios.

- Mutual fund participation is increasing in markets like China and India because of technological advancements and legal changes that make investing more accessible. Furthermore, the expansion of financial markets and the liberalization of investment guidelines in numerous Asia Pacific countries have unlocked opportunities for both international and domestic fund managers to provide an extensive range of mutual funds.

MARKET PLAYERS

Mutual Fund Asset Market Report Scope

Mutual Fund Asset Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the Mutual Fund Asset market. Some of the recent key market developments are listed below:

- 2023, key global fund manager Franklin Templeton announced the introduction of the Franklin Sealand China A-shares fund, intending to provide retail investors in Singapore with a chance to invest in the China A-shares market. The fund's principal focus is on investing in equity securities of Chinese companies registered on the local stock exchange and China A-shares, with the goal of achieving long-term capital appreciation. [Source: Franklin Templeton, Company Website]

Mutual Fund Asset Market Report Coverage & Deliverables

The Mutual Fund Asset market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Mutual Fund Asset Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Mutual Fund Asset Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 7.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Investment Strategy

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The global mutual fund asset market was estimated to grow at a CAGR of 7.1% during 2023 - 2031.

The ability to diversify investment portfolios and sustainable investment trends are the major factors that propel the global mutual fund asset market.

The increasing adoption of digital technologies is anticipated to play a significant role in the global mutual fund asset market in the coming years.

The major players holding majority shares are BlackRock, Inc., The Vanguard Group, Inc., Charles Schwab & Co., Inc., JPMorgan Chase & Co., and FMR LLC.

Asia Pacific is anticipated to grow with a high growth rate during the forecast period.

Get Free Sample For

Get Free Sample For