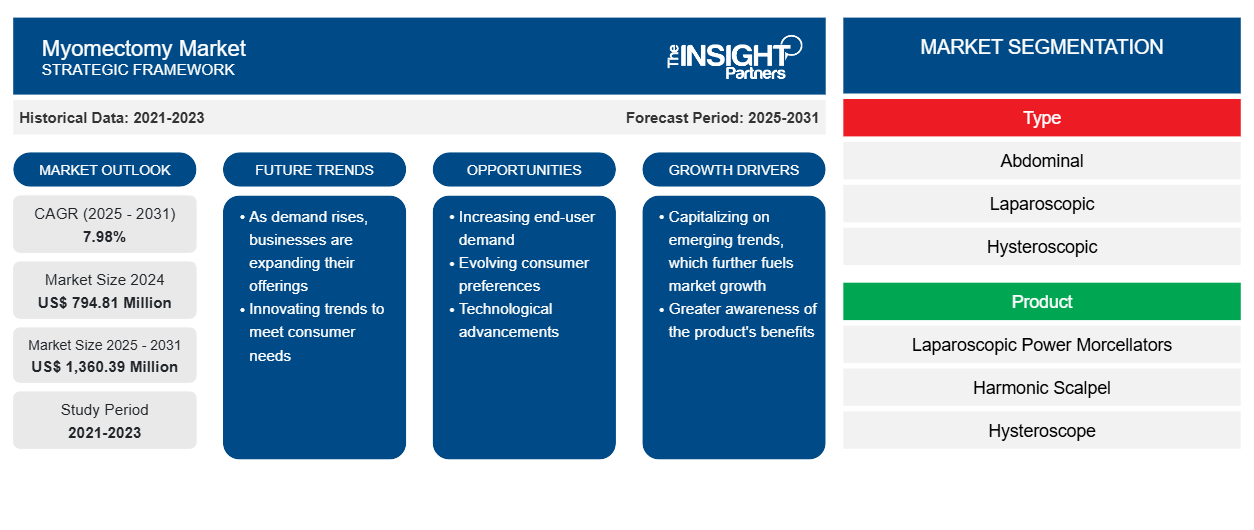

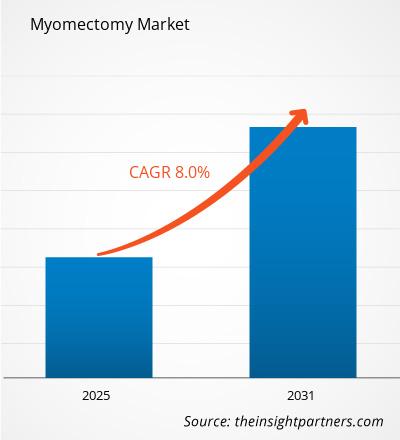

[Research Report] The myomectomy market size is expected to grow from US$ 681.67 million in 2022 to US$ 1,292.78 million by 2031; it is estimated to register a CAGR of 7.98% from 2022 to 2031.

Analyst’s Viewpoint

The myomectomy market analysis explains factors such as the increasing incidence of uterine fibroids and the growing demand for minimally invasive surgeries, which drive market growth. Furthermore, the adoption of robotic-assisted surgical technology in myomectomy is expected to introduce new market trends. However, the high cost of new medical devices and myomectomy procedures is expected to hamper the market growth.

Myomectomy is a surgical procedure that encompasses the removal of non-cancerous growth of tissue, known as uterine fibroids or uterine leiomyomas, that develop in the uterus. Myomectomy allows doctors to remove fibroids that cause symptoms while leaving the uterus intact. This means that a woman can continue to have menstrual periods and may choose to become pregnant.

Market Insights

Increasing Incidences of Uterine Fibroids (UFs) Drives Myomectomy Market

The global burden of UFs has increased in recent years, with a significant increase in incidence and disability-adjusted life years (DALYs) worldwide. According to an article published by Frontiers in November 2022, the estimated occurrence of UFs is between 20% and 77%, and the estimated prevalence is between 40% and 60% among women under the age of 35 and between 70% and 80% among women over the age of 50. In the same article, a study was conducted using statistics from the Global Burden of Disease Study (2021) to observe changes in UF prevalence over 30 years. The study concluded that 3,873,678 new cases of UFs were reported in 2021, representing a growth rate of 67.14% compared to the global incident cases from 1990 to 2021. In this duration, deaths and disability-adjusted life years of UFs worldwide increased by 0.17 and 60.18%, respectively.

Similarly, in an article published by PubMed in 2021, fibroids affect women mainly during their reproductive years, and ~70% of white women and more than 80% of women of African ancestry are diagnosed with fibroids during their lifetime.

This rising prevalence of UFs in women has increased the demand for myomectomy surgery to remove fibroids. For instance, according to a study, “Perioperative Myomectomy Outcomes Based on the Current Coding Rules,” published by the American College of Obstetricians & Gynecologists in July 2022, 8,363 myomectomy procedures were performed from 2014 to 2021, out of which 3,117 (37.3%) were conducted via minimally invasive surgery (MIS) while 5,246 (62.7%) were done through laparotomy. Of the MIS procedures, 2,080 (66.7%) were classified as smaller myomectomies and 1,037 (33.3%) as larger ones.

Market Trends

Launch of Advanced Surgical Technologies Emerge as a Future Trend in Myomectomy Market

Advanced surgical instruments, imaging technologies, and robots have made myomectomy procedures precise and less invasive. According to an article published in the Journal of Obstetrics and Gynecology Research in October 2021, a study including sixty-one women with symptomatic fibroids received robotic single-port myomectomy (RSPM) was performed to evaluate the procedure's feasibility. The study concluded that RSPM is a feasible surgical option for women with symptomatic fibroids. It is expected to increase indications of single-port myomectomy by solving ergonomic problems that come with single-port laparoscopic myomectomy.

These technological innovations offer patients shorter recovery times, less scarring, and reduced post-operative complications, leading to a rise in demand. Many companies and healthcare institutions provide advanced surgical procedures to fulfill the demand and gain market value. For instance, in August 2023, Apollo Adlux Hospitals in Kochi launched the 4th generation robotic-assisted surgery system, Da Vinci Xi. This installation is expected to improve clinical outcomes across multiple surgeries at the Departments of Gynecology, Surgical Gastroenterology, and Urology. As a result, more than 90% of patients can go home on the same day as their surgery, leading to a quick recovery period.

Similarly, in April 2023, St. Luke's Medical Center, a leading healthcare institution in the Philippines, announced using the Da Vinci Surgical System for gynecological procedures. With the adoption of robot-assisted surgical technologies, St. Luke's offers Robotic-assisted Laparoscopic Prostatectomy, Robotic-assisted Myomectomy, and Robotic-assisted Hysterectomy. Such a combination of technological advancements gives doctors more control and accuracy during surgery, making it a safe option for patients. Therefore, technological advancements are a standalone factor driving market growth during 2021-2031.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Myomectomy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Myomectomy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope

The myomectomy market is segmented based ontype,product

,

end-user, and geography. By type, the market is segmented into abdominal, laparoscopic, and hysteroscopic myomectomy. By product, the market is segmented into laparoscopic power morcellators, harmonic scalpels, hysteroscopes, and others.The myomectomy market, by the end user, is segmented into hospitals, specialty clinics, and ambulatory surgical centers. Based on geography, the market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Type-Based Insights

Based on type, the myomectomy market is segmented into abdominal, laparoscopic, and hysteroscopic myomectomy. The abdominal myomectomy segment held the largest market share in 2022 and is anticipated to register the highest CAGR during 2022–2031. The abdominal myomectomy segment held a significant share in the myomectomy market in 2022 owing to the rising number of patients with UFs undergoing abdominal myomectomy procedures for treatment. Abdominal myomectomy is the most commonly performed and widely preferred treatment for fibroids.

The laparoscopic myomectomy segment is expected to register the highest CAGR from 2022 to 2031. It provides a less invasive approach to myomectomy procedures, resulting in faster patient recovery than other methods. The surgeon removes the fibroids using small instruments inserted through a few small incisions. These benefits of laparoscopic myomectomy are expected to boost growth in this segment during the forecast period.

Product-Based Insights

The myomectomy market, by product, is segmented into laparoscopic power morcellators, harmonic scalpels, hysteroscopes, and others. The other segment held the largest market share in 2022, and the same segment is anticipated to grow fastest from 2022 to 2031. This is attributed to the benefits offered by these instruments, including their ability to facilitate less invasive surgeries, resulting in minimal bleeding without harming the reproductive organs.

End User-Based Insights

Based on end users, the myomectomy market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and others. The hospitals segment held the largest market share in 2022. This can be attributed to the rising number of skilled physicians. Hospitals also have better facilities than other surgical centers to perform minimally invasive procedures.

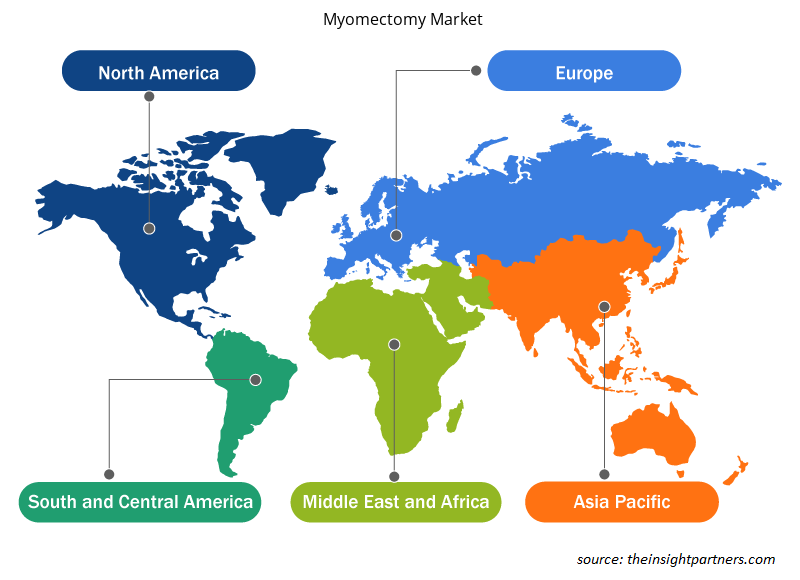

Regional Analysis

Based on geography, the global myomectomy market is segmented into North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. In 2022, the myomectomy market in North America held the largest global market share. The market in North America is segmented into the US, Canada, and Mexico. The US dominated the market in North America. This can be attributed to various factors, including the increasing number of patients experiencing uterine fibroid problems, the availability of high medical reimbursement facilities in the region, rising government initiatives, and an increase in myomectomies related to surgical procedures and hospital visits. According to the article published by the US Office on Women's Health in February 2021, Fibroids cause symptoms including pain, heavy bleeding, frequent urination, and rectal pressure and are common in women aged 40 to early 50s. ~20% to 80% of women are diagnosed with UFs by age 50.

Additionally, the presence of major companies such as CooperSurgical, Inc.; Medtronic; Stryker Corporation, and Intuitive Surgical, and the availability of technological innovations contribute to the region's market growth. Furthermore, the increasing government healthcare spending creates opportunities for further myomectomy market growth.

The Asia-Pacific region is anticipated to experience high growth during 2021 - 2031. This can be attributed to the increasing number of women suffering from uterine fibroids, greater awareness regarding disease diagnosis and treatment, and the rapid modernization of healthcare infrastructure.

Industry Developments and Future Opportunities:

- In November 2022, Olympus launched the Moresolution Power Morcellator in the U.S. The device is manufactured by TROKAMED GmbH and distributed by Olympus America, Inc. The Moresolution Morcellator is intended for advanced gynecologic procedures involving large, calcified tissue specimens and is a minimally invasive option for patients undergoing low-risk hysterectomy and myomectomy.

- In June 2022, UroViu Corp launched Hystero-V, a 12-Fr sized, single-use hysteroscope with a hydrophilic coating for gentle insertion and superior visualization for highly effective intrauterine examinations. It eliminates the need for reprocessing and offers ease-of-use, portability, and time-saving benefits for efficient and comfortable procedures.

- In April 2022, Ethicon Launched Enseal X1 Straight Jaw Tissue Sealer an advanced bipolar energy device featuring stronger sealing, and easy access to targeted tissue in multiple surgical procedures. It is indicated for use in open and laparoscopic general, gynecological, urologic, and ENT surgeries.

- In July 2021, Medtronic plc announced the completion of six gynecological (GYN) surgeries, including hysterectomies and myomectomies, by a team of doctors at Pacifica Salud Hospital in Panama City using the Hugo robotic-assisted surgery (RAS) system.

- In December 2019, Sysmex Corporation launched the Hinotori Surgical Robot System, a surgical robot unit, and the HF Series Instrument, a reusable active endotherapy device for medical institutions in Japan for urologic and gynecologic operations.

Medtronic; Stryker Corporation; CONMED Corporation; CooperSurgical Inc.; Ethicon, Inc.; Hologic, Inc.; Minerva Surgical, Inc.; INSIGHTEC; Karl Storz GmbH; Intuitive Surgical; and B. Braun Melsungen AG are some of the key companies operating in the myomectomy market. These leading players focus on expanding and diversifying their market presence and clientele, tapping business opportunities in the myomectomy market.

Report ScopeMyomectomy Market Regional Insights

The regional trends and factors influencing the Myomectomy Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Myomectomy Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Myomectomy Market

Myomectomy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 794.81 Million |

| Market Size by 2031 | US$ 1,360.39 Million |

| Global CAGR (2025 - 2031) | 7.98% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Myomectomy Market Players Density: Understanding Its Impact on Business Dynamics

The Myomectomy Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Myomectomy Market are:

- Medtronic

- Stryker Corporation

- CONMED Corporation

- CooperSurgical Inc.

- Ethicon, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Myomectomy Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Product, End Users, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Medtronic

- Stryker Corporation

- CONMED Corporation

- CooperSurgical Inc.

- Ethicon, Inc.

- Hologic, Inc.

- Minerva Surgical, Inc.

- INSIGHTEC

- Karl Storz GmbH

- Intuitive Surgical

- B. Braun Melsungen AG

Get Free Sample For

Get Free Sample For