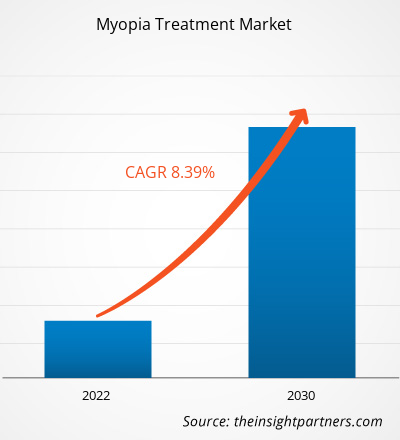

The market value is projected to grow from US$ 10,276.67 million in 2022 to US$ 19,571.85 million by 2030. The myopia treatment market is further anticipated to record a CAGR of 8.39% from 2022 to 2030. The application of artificial intelligence in myopia treatment will likely remain a key trend in the market.

Myopia Treatment Market Analysis

Governments in developing and developing countries are taking initiatives to increase awareness regarding myopia treatment, which will likely drive market growth. For instance, in July 2021, the India Vision Institute (IVI) announced a long-term initiative to aid in the fight against myopia in recognition of the growing threat that the condition poses in India. Furthermore, significant research and development activities by key players operating in the market create ample opportunities. For instance, Arctic Vision has entered into an exclusive license agreement with Evenovia, Inc., a clinical-stage company engaged in developing a pipeline of microdose array print (MAP) therapeutics, to develop and commercialize MicroPine, a treatment for progressive myopia, and MicroLine, a treatment for presbyopia, in Greater China, which includes mainland China, Taiwan, Hong Kong, and Macau, as well as South Korea.

Myopia Treatment Market Overview

The market for myopia treatments is expanding significantly due to increased consumer awareness of available options. According to recent market analysis, there has been a notable increase in the use of myopia control measures due to increased awareness of myopia management strategies, especially among parents and eye care professionals. For example, CooperVision announced, on December 11, 2023, a groundbreaking initiative to close the gap in access to myopia care for children from low-income families in the United States. The nation's top eye care provider is collaborating with three top optometry schools to offer extended myopia therapy to a test group beginning in 2024. The program's inaugural events took place in Boston and Chicago. There has been a noticeable shift toward proactive myopia management strategies as awareness campaigns, educational initiatives, and comprehensive research studies continue to shed light on the possible consequences of unmanaged myopia. Myopia treatment technologies—orthodontia and pharmaceutical interventions, in particular—have become more widely used due to this trend, leading to a notable rise in market size—more than 25% in just the last two years. The market is expanding, and a proactive culture of vision care is being fostered by the combined efforts to increase public awareness of myopia as a public health concern and support the viability of myopia management solutions and awareness. This drive will probably keep pushing the boundaries of the myopia treatment market

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Myopia Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Myopia Treatment Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Myopia Treatment Market Drivers and Opportunities

Rising Demand for Myopia Treatment Products Due to Increase In Prevalence is Favor the Market Growth

Myopia is becoming more and more common around the world, which is concerning for public health because it is more common in children and young adults. A recent study projected that the average percentage of myopia will rise from 30% to nearly 50% by 2050, or 5 billion people worldwide. The myopia hotspots are in East and Southeast Asia, where 80–90% of the population suffers from myopia. These countries include China, Japan, South Korea, Taiwan, Singapore, and Taiwan. In the United States, myopia is also becoming more common; in just three decades, it has nearly doubled to 42% of the population. Thus, an increase in the prevalence of myopia is likely to drive the market's growth.

A significant Focus on Developing Technologically Advanced Products Is Likely to Create Significant Opportunities for Key Players.

The market for myopia treatments has much potential due to the growing accessibility of cutting-edge technologies for treating targeted myopia. Myopia was corrected more successfully and with fewer complications due to technological advancements like photorefractive keratectomy (PRK), implantable collamer lenses (ICL), and laser-assisted in-situ keratomileusis (LASIK). For instance, at the 41st European Society of Cataract and Refractive Surgeons (ESCRS) congress in August 2023, Johnson & Johnson Vision unveiled the ELITATM Platform, a next-generation laser vision correction solution. Surgeons treating myopic patients with astigmatism or who do not use the ELITATM Platform can treat them with the novel SILK (Smooth Incision Lenticule Keratomileusis) procedure. Due to its ultra-precise laser pulse and rapid laser delivery technology, the ELITATM Platform provides surgeons with a straightforward and seamless lenticular removal procedure with recovery and results the following day. Historically, many patients cannot afford and access these cutting-edge technologies. However, as they become more accessible, they offer the myopia treatment market a chance to grow and offer better treatment choices to a more significant number of patients. Apart from these cutting-edge technologies, other novel treatments like atropine eye drops and orthokeratology, or "ortho-k," are becoming increasingly well-liked as successful ways to manage myopia. The market for myopia treatments has a lot of potential due to the growing accessibility of cutting-edge technologies for treating targeted myopia. With more easily accessible and efficient treatment options available to patients, the market can help improve vision health outcomes and solve a major gap in the global healthcare system.

Myopia Treatment Market Report Segmentation Analysis

Key segments that contributed to the derivation of the myopia treatment market analysis are type, treatment, age group, and end user.

- Based on type, the myopia treatment market is divided into high myopia, degenerative myopia, and progressive myopia. The high myopia segment held the most significant market share in 2022.

- By treatment, the market is categorized into low-dose atropine eye drops, ortho-k, contact lenses, and refractive surgery (LASIK, PRK). The low-dose atropine eye drops segment held the major share of the market in 2022.

- By age group, the market is segmented into adult myopia and childhood myopia. The adult myopia segment held the largest share of the market in 2022.

- Based on end user, the myopia treatment market is divided into hospitals and clinics, specialty clinics, and refractive surgery centers. The hospitals and clinics segment held the most significant market share in 2022.

Myopia Treatment Market Share Analysis by Geography

The geographic scope of the myopia treatment market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The market for myopia treatment in the US holds the largest share among the countries of North America. The growing number of myopia-related cases of vision loss and the increasing frequency of distant vision impairment from untreated myopia will be the main drivers of market growth in the US. Additionally, two significant factors driving the growth of the North American market are the increasing government support for eye health and technological advancements. Moreover, growing consumer awareness of myopia is boosting market expansion. For instance, the official co-sponsor of the Brien Holden Vision Institute's 2024 Myopia Awareness Week is the Review of Myopia Management. The partnership will help Myopia Awareness Week, which is planned for May 13–19, 2024, both domestically and internationally, reach a wider audience.

Myopia Treatment Market Regional Insights

The regional trends and factors influencing the Myopia Treatment Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Myopia Treatment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Myopia Treatment Market

Myopia Treatment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 10,276.67 Million |

| Market Size by 2030 | US$ 19,571.85 Million |

| Global CAGR (2022 - 2030) | 8.39% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

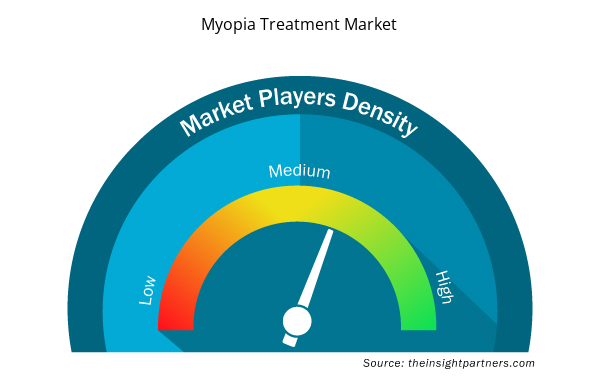

Myopia Treatment Market Players Density: Understanding Its Impact on Business Dynamics

The Myopia Treatment Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Myopia Treatment Market are:

- Alcon

- Haag-Streit Holding (Metall Zug)

- Ziemer Group

- NIDEK CO.LTD

- 2EyesVision

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Myopia Treatment Market top key players overview

Myopia Treatment Market News and Recent Developments

The myopia treatment market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the myopia treatment market are listed below:

- Eyenovia, Inc., a commercial-stage, ophthalmic company, announced that it has re-acquired the rights to MicroPine in the U.S. and Canada. MicroPine, an investigational eight microliter ophthalmic spray of atropine delivered by Eyenovia’s proprietary Optejet device, is being evaluated as a potential treatment for pediatric progressive myopia which is characterized by elongation of the sclera/retina. (Source: Eyenovia, Inc., Press Release, January 2024)

- NIDEK CO LTD launched the NP-1/NP-1C Preloaded IOL Injection System. The NP-1/NP-1C is a fully preloaded injection system with an aspheric hydrophobic soft acrylic lens designed for smoother, safer, and secure IOL implantation. This newly developed injector is designed for smooth, controlled delivery. The NP-1/NP-1C allows quick and easy operation using a simple two-step process involving, filling the viscoelastic material and pressing the plunger. (Source: NIDEK CO LTD, Press Release, October 2023)

Myopia Treatment Market Report Coverage and Deliverables

The “Myopia Treatment Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Myopia treatment market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Myopia treatment market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Myopia treatment market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Myopia treatment market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Treatment, Age Group, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to register a CAGR of 8.39% during 2023–2031.

Alcon, Haag-Streit Holding (Metall Zug), Ziemer Group, NIDEK CO., LTD, 2EyesVision, Carl Zeiss AG, CooperVision, Topcon Healthcare Inc, Bausch Health, and Johnson & Johnson Vision (Johnson & Johnson),

Key factors driving the market are rising demand for myopia treatment products due to increase in prevalence and increased awareness of myopia treatment

Application of artificial intelligence in myopia treatment is likely to remain a key trend in the market.

North America dominated the myopia treatment market in 2023

Get Free Sample For

Get Free Sample For