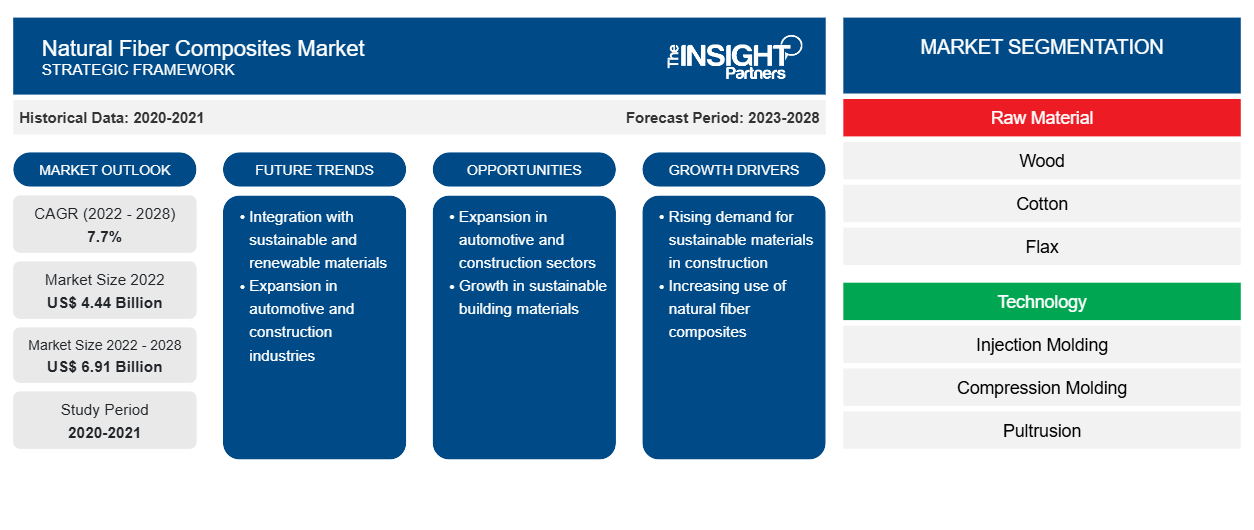

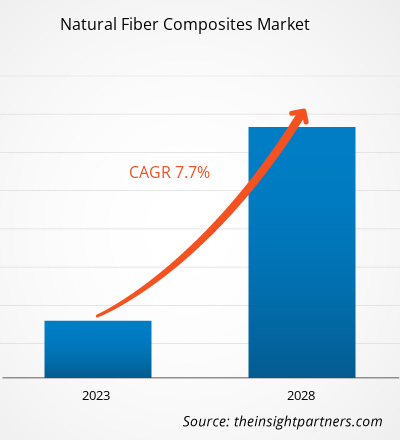

The natural fiber composites market is expected to grow from US$ 4,438.83 million in 2022 to US$ 6,910.46 million by 2028; it is estimated to register a CAGR of 7.7% from 2022 to 2028.

Natural fiber composites are composite materials with a polymer matrix embedded with high-strength natural fibers. Natural fibers are used as a component of composite materials, where the orientation of fibers impacts the properties. In composite materials, natural fibers often refer to plant fibers extracted from lignocellulosic biomass such as wood fibers and other plant fibers from the stem, leaf, fruit, and seed.

The demand for fiber-reinforced (glass and carbon fibers) composites is relatively high. However, they are expensive and are not environmentally friendly. These fibers are nonrenewable and nonrecyclable. Many European Union and Asian countries have introduced regulations for the automotive industry. According to European Union legislation passed in 2006, 80% of vehicles should be reused or recycled; in the 2015 revision, this percentage rose to 85%. According to a 2015 regulation in Japan, 95% of vehicles should be reused or recycled. Moreover, drawbacks such as high fiber density, poor recyclability, and handling hazards limit the use of glass fiber composites. These drawbacks of glass fiber composites boost the demand for natural fiber composites.

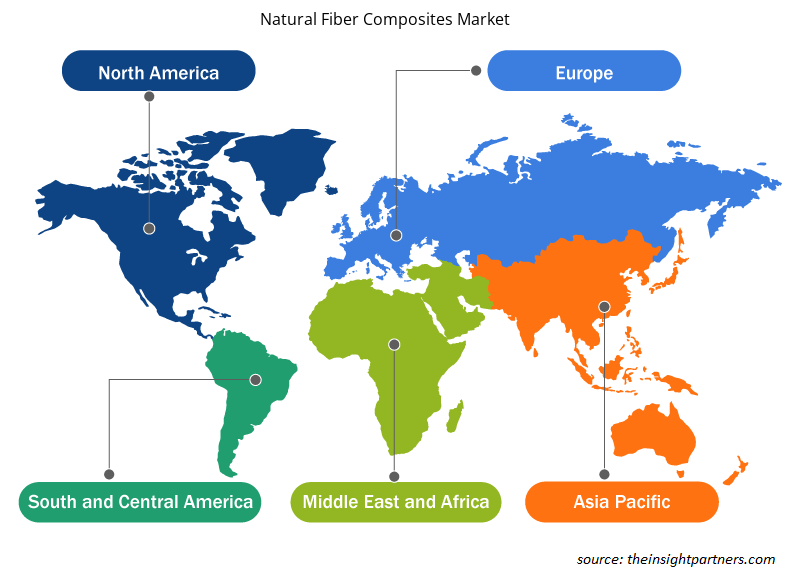

The natural fiber composites market is segmented into five major regions—North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. In 2022, Europe held the largest market share, and Asia Pacific is estimated to register the highest CAGR during the forecast period. High demand for natural fiber composites from the automotive and construction industries favors the growth of the European natural fiber composites market. Further, Asia Pacific, the most populated region in the world, hosts one of the world's most rapidly developing construction and automotive industries. This factor contributes to the high demand for natural fiber composites in the region.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Natural Fiber Composites Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Natural Fiber Composites Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Natural Fiber Composites Market

Before the COVID-19 pandemic, the natural fiber composites market was mainly driven by industries such as automotive, building & construction, sporting goods, and marine. In 2020, various industries had to slow down their operations due to disruptions in supply chains caused by the shutdown of national and international borders. The pandemic hampered manufacturing processes due to restrictions imposed by government authorities in various countries. Natural fiber reinforced composites have major applications in the aerospace and automobile industries, wherein they are used to manage the body weight of vehicles and fuel management. It is used in cement paste and mortar in the construction sector. Hence, with the reduction in activity in these sectors, the demand for natural fiber composites also decreased. The pandemic also caused fluctuations in the prices of raw materials. All these factors led to a decrease in demand for natural fiber composites.

However, in 2021, the economies started reviving as various industries resumed business activities. As a result, several industries, including automotive and building & construction, showed signs of recovery in their operations. Various industries are also overcoming the consequences of disruptions in their raw material supply chains. With such a promising recovery, the global industrial sector is expected to provide the impetus for the natural fiber composites market growth in the coming years.

Market Insights

Strategic Developments by Key Players Favor Natural Fiber Composites Market Growth

In July 2022, BMW Group, the premium carmaker's venture capital firm, invested in a Swiss clean tech company Bcomp Ltd, a manufacturer of high-performance components made from natural fibers. Such strategic developments by key players are expected to bolster the natural fiber composites market growth in the coming years. In addition, key market players are involved in strategies such as mergers and acquisitions to expand their geographic presence.

Raw Material-Based Insights

Based on raw material, the natural fiber composites market is segmented into the wood, cotton, flax, kenaf, hemp, and others. The hemp segment is expected to register the highest CAGR during the forecast period. Hemp fibers are found in the stem of the plant, making them strong. They are essential for the fortification of composite materials. With the surging demand for sustainable, biodegradable, and recyclable materials, the use of hemp fibers as support in composite materials has increased. Natural fiber composites made from hemp are biodegradable.

End User-Based Insights

Based on end user, the natural fiber composites market is divided into automotive & aerospace, building & construction, electrical & electronics, sporting goods, and others. The automotive & aerospace segment dominated the market in 2022. Natural fiber composites are widely used in fabricating electric car components because of their lightweight qualities. Due to their better stiffness and strength compared to other synthetic fibers and better acoustic insulation properties, these composites are also employed in vehicle door panels, seat backs, floor panels, underfloor pans, and trunk liners.

UPM-Kymmene Corp, Flexform Technologies LLC, Polyvlies Franz Beyer GmbH, Amorim Cork Composites SA, Tecnaro GmbH, Lanxess AG, Bcomp Ltd, Cobra Advanced Composites Co Ltd, Plasthill Oy Ltd, and Lingrove Inc are among the major players operating in the natural fiber composites market. These companies mainly focus on product innovation to expand their market share and follow emerging market trends.

Natural Fiber Composites Market Regional Insights

Natural Fiber Composites Market Regional Insights

The regional trends and factors influencing the Natural Fiber Composites Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Natural Fiber Composites Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Natural Fiber Composites Market

Natural Fiber Composites Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.44 Billion |

| Market Size by 2028 | US$ 6.91 Billion |

| Global CAGR (2022 - 2028) | 7.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Raw Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

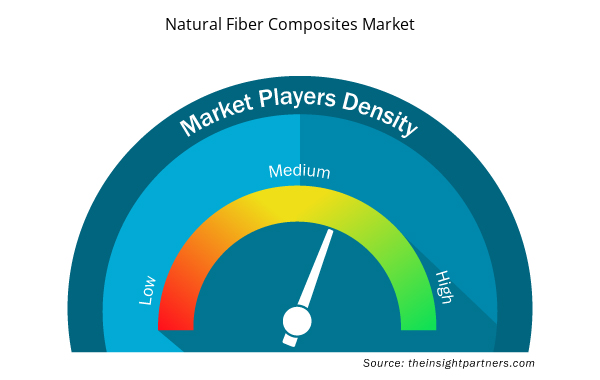

Natural Fiber Composites Market Players Density: Understanding Its Impact on Business Dynamics

The Natural Fiber Composites Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Natural Fiber Composites Market are:

- UPM-Kymmene Corp

- Flexform Technologies LLC

- Polyvlies Franz Beyer GmbH

- Amorim Cork Composites SA

- Tecnaro GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Natural Fiber Composites Market top key players overview

Report Spotlights

- Progressive industry trends in the natural fiber composites market to help companies develop effective long-term strategies

- Business growth strategies adopted by market players in developed and developing countries

- Quantitative analysis of the natural fiber composites market from 2020 to 2028

- Estimation of global demand for natural fiber composites

- Porter's Five Forces analysis to illustrate the efficacy of buyers and suppliers operating in the natural fiber composites industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the natural fiber composites market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the natural fiber composites market at various nodes

- Detailed overview and segmentation of the market and growth dynamics of the natural fiber composites industry

- Size of the natural fiber composites market in various regions with promising growth opportunities

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Raw Material , Technology, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The primary advantage of natural fiber composites is that they are eco-friendly since they are low-cost, bio-based, sustainable, and reduce energy consumption. Natural fiber composites have drawn significant attention as alternative building materials, especially wood substitutes in developing countries. A high demand for sustainable and renewable composites from the automotive industry for the manufacturing of fuel-efficient, lightweight vehicles as well as rising adoption of electric vehicles (EVs) drives the natural fiber composites market. All these factors are driving the natural fiber composites market growth.

In 2022, the automotive segment held the largest market share. The rising demand for hybrid and electric vehicles has led to an increase in investments by automakers across the world. The flourishing automotive industry worldwide continues to be a key contributor to the growth of the natural fiber composites market. Natural fibers support the universal goal of the automotive industry to manufacture lightweight products with reduced fuel consumption and increased vehicle speeds, without compromising safety standards.

During the forecast period, the injection molding segment is expected to register highest CAGR. The injection molding process is a popular manufacturing method for mass production. Although the reinforcement fiber degrades during the process, high processability is a key factor that triggers the popularity of injection molding. Increasing demand for composite materials from automotive, hardware/apparatuses, medical, and bundling enterprises are driving the growth of the injection molding segment during the forecast period.

In 2022, the wood segment held the largest market share. Manufacturing wood fiber that is used to manufacture hardboard and insulation board is similar to that of MDF fiber. Wood contains polymers such as cellulose, lignin, and various hemicelluloses that have very different properties than synthetic polymers with which they are most often combined. Wood is stiffer, less expensive, and stronger than these synthetic polymers, making it a useful filler or reinforcement. These factors contribute to the dominance of the wood segment in the natural fiber composites market in 2022.

The major players operating in the natural fiber composites market are UPM-Kymmene Corp, Flexform Technologies LLC, Polyvlies Franz Beyer GmbH, Amorim Cork Composites SA, Tecnaro GmbH, Lanxess AG, Bcomp Ltd, Cobra Advanced Composites Co Ltd, Plasthill Oy Ltd, and Lingrove Inc.

In 2022, Europe accounted for the largest share of the global natural fiber composites market. The natural fiber composites market growth in this region is attributed to the high use of these materials in the automotive, aerospace, building & construction industries, among others. The construction sector in Europe has consistently expanded due to the rising population. Also, rapid shifts in the remodeling business trends, such as remodeling for accessibility, customizations, and technological integrations, are likely to fuel construction sector. All these factors led to the dominance of Europe region in 2022.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Global Natural Fiber Composites Market

- UPM-Kymmene Corp

- Flexform Technologies LLC

- Polyvlies Franz Beyer GmbH

- Amorim Cork Composites SA

- Tecnaro GmbH

- Lanxess AG

- Bcomp Ltd

- Cobra Advanced Composites Co Ltd

- Plasthill Oy Ltd

- Lingrove Inc

Get Free Sample For

Get Free Sample For