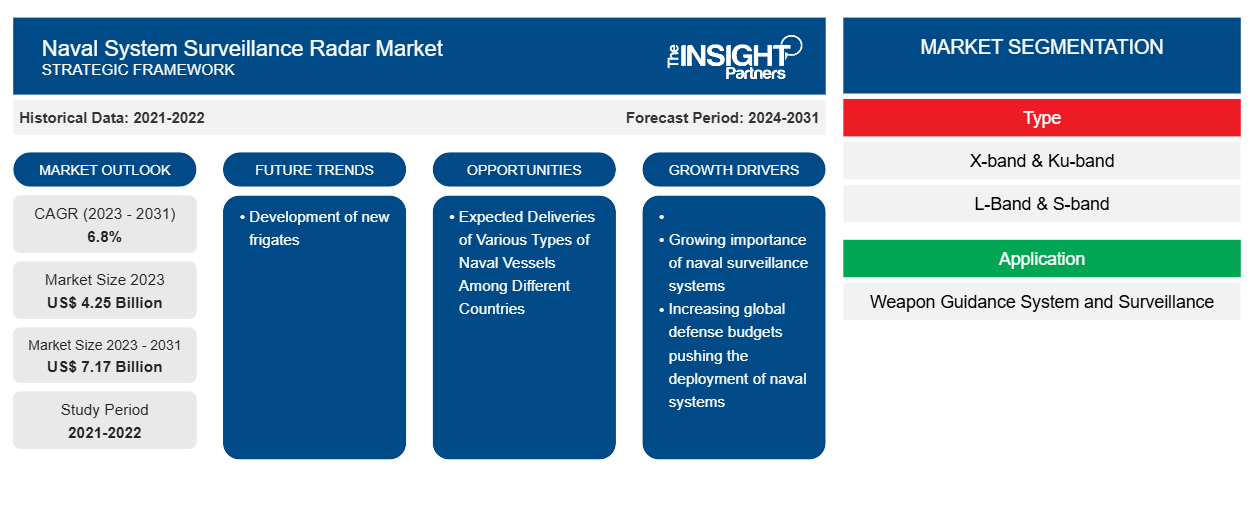

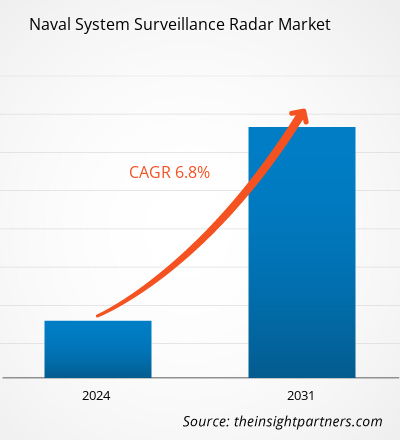

The naval system surveillance radar market size is projected to reach US$ 7.17 billion by 2031 from US$ 4.25 billion in 2023. The market is expected to register a CAGR of 6.8% during 2023–2031. Development of new frigates is likely to remain a key trend in the market.

Naval System Surveillance Radar Market Analysis

Naval system surveillance radar is one of the key products of orders, surveillance, navigation, navy intelligence, and many more among the naval forces. There is a low to low threat of substitutes in the naval system surveillance market. Owing to the fact that the naval sectors globally procure only naval system surveillance radar for national security and navigation exercises. Thus, a complete substitute is not available in the market in the current scenario. However, technology upgrades and advancements prevail. Hence, the impact of threats to substitutes on the naval system surveillance radar market is expected to remain low during the coming years.

Naval System Surveillance Radar Market Overview

The major stakeholders in the global naval system surveillance radar market ecosystem include component manufacturers, naval system surveillance radar manufacturers, and end-users amongst others. A naval radar system is made up of various components which are procured by the system manufacturers from a huge base of component manufacturers. These component manufacturers supply the base parts to the global naval system surveillance radar players. The manufacturers are the companies that are engaged in manufacturing the final surveillance radar systems after integrating each component. Some of the major players operating in the market include Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Saab AB, and Thales Group amongst others. The end-user of the global naval system surveillance radar market includes all naval forces across the globe. the naval forces integrate the radar with submarines, boats, ships, and naval vessels amongst others for applications such as surveillance and weapon guidance systems.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Naval System Surveillance Radar Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Naval System Surveillance Radar Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Naval System Surveillance Radar Market Drivers and Opportunities

Increasing Global Defense Budgets Pushing the Deployment of Naval Systems

The rise in global military expenditure is one of the major factors pushing the procurement and deployment of naval systems including radars across different regions. For instance, according to the data published by the Stockholm International Peace Research Institute (SIPRI), between 2019 and 2022, global military spending experienced a rise of around 8.4% which shows a string growth in investments in military technologies. Such factors have been pushing the deployment of naval systems and thereby driving the growth of the naval system surveillance radar market.

Expected Deliveries of Various Types of Naval Vessels Among Different Countries

The expected future deliveries of different types of naval vessels such as frigates, corvettes, carriers, submarines, and destroyers is likely to boost the demand for naval system surveillance radars across different regions in the coming years. For instance, in 2023, the US had a fleet of around 243 naval vessels. Also, as per The Insight Partner’s secondary research, more than 65 naval vessels (including 15 frigates, 21 destroyers, 19 submarines, 9 aircraft carriers, and 3 patrol vessels) worth of orders have been already placed from the US naval forces. This will further generate the demand for new installations of naval system surveillance radars in the US. Such factors are likely to generate new opportunities for market vendors in the coming years.

Naval System Surveillance Radar Market Report Segmentation Analysis

Key segments that contributed to the derivation of the naval system surveillance radar market analysis are type and application.

- Based on type, the naval system surveillance radar market is segmented into X-band & Ku-band, L-band & S-band, and others. The X-band & Ku-band segment held a larger market share in 2023.

- Based on application, the naval system surveillance radar market is segmented into weapon guidance system and surveillance. The surveillance segment held a larger market share in 2023.

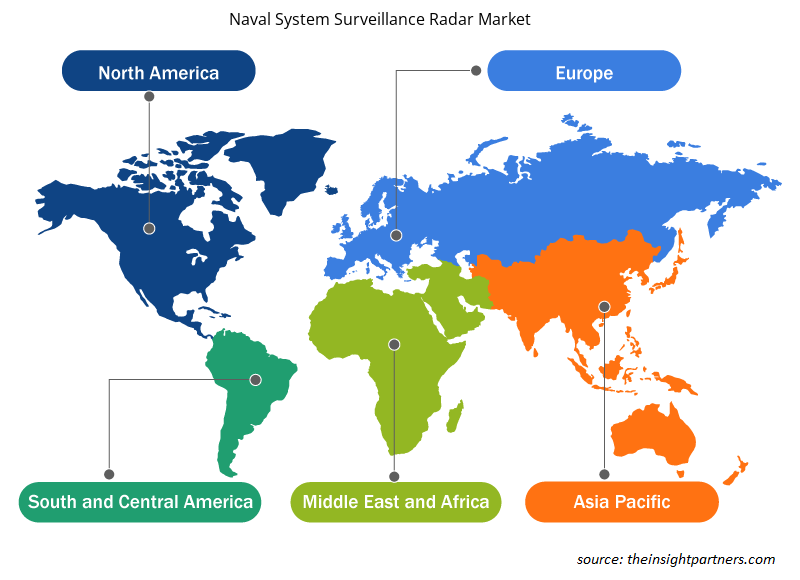

Naval System Surveillance Radar Market Share Analysis by Geography

The geographic scope of the naval system surveillance radar market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America has dominated the market in 2023 followed by Europe and Asia Pacific regions. Further, Asia Pacific is also likely to witness highest CAGR in the coming years. The US dominated the North America naval system surveillance radar market in 2023. The US accounts for the largest share in the naval system surveillance radar market in North America due to the early adoption of radar technology. Additionally, the US has the largest defense budget in the world and a large amount of budget is contributed towards the adoption and procurement of upgraded weapons systems. According to research by the United States Department of Transportation's Maritime Administration (MARAD), the shipbuilding industry contributes significantly to the country's GDP. The entire budget request for the Department of Navy for FY 2023 is US$ 230.8 billion, with the Navy receiving US$ 180.5 billion and the Marine Corps receiving US$ 50.3 billion. The Navy is requesting US$ 53.35 billion in procurement funding, a 5.4% increase over FY 2023. This contributes to the demand for naval system surveillance radar across the country. The United States ranks 3rd in the world and the country has 484 navy fleets according to a Global Firepower. The rising fleet across the US Navy also acts as a supporting factor for the naval system surveillance radar market growth in the country.

Naval System Surveillance Radar Market Regional Insights

The regional trends and factors influencing the Naval System Surveillance Radar Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Naval System Surveillance Radar Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Naval System Surveillance Radar Market

Naval System Surveillance Radar Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.25 Billion |

| Market Size by 2031 | US$ 7.17 Billion |

| Global CAGR (2023 - 2031) | 6.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

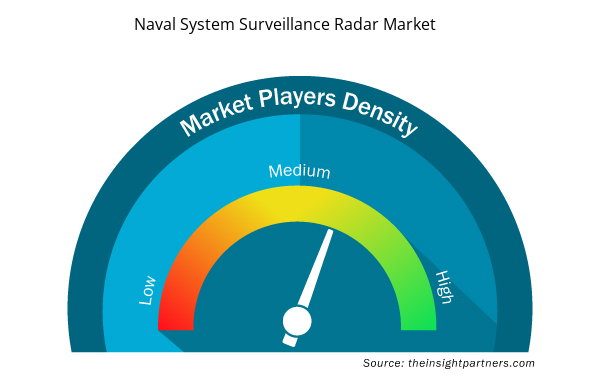

Naval System Surveillance Radar Market Players Density: Understanding Its Impact on Business Dynamics

The Naval System Surveillance Radar Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Naval System Surveillance Radar Market are:

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Saab AB

- Thales Group

- BAE Systems

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Naval System Surveillance Radar Market top key players overview

Naval System Surveillance Radar Market News and Recent Developments

The naval system surveillance radar market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the naval system surveillance radar market are listed below:

- Northrop Grumman Corporation has secured a contract worth US$ 167 million for the modification of the US Navy’s G/ATOR radar technology. (Source: Northrop Grumman Corporation, Press Release, Apr 2024)

- The U.S. Navy is putting the advanced AN/SPY-6 naval radar on 29 new ships, and now it will add this system to the first existing ships, starting with a $619 million contract with Raytheon, an RTX business. (Source: Raytheon Technologies Corporation, Press Release, Apr 2023)

Naval System Surveillance Radar Market Report Coverage and Deliverables

The “Naval System Surveillance Radar Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Naval system surveillance radar market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Naval system surveillance radar market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed porter’s five forces analysis

- Naval system surveillance radar market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the naval system surveillance radar market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America region dominated the naval system surveillance radar market in 2023.

Growing importance of naval surveillance systems and increasing global defense budgets pushing the deployment of naval systems are some of the factors driving the growth for naval system surveillance radar market.

Development of new frigates is one of the major trends of the market.

Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Saab AB, Thales Group, BAE Systems Plc, Israel Aerospace Industries Ltd, Leonardo SpA, Ultra, and HENSOLDT AG are some of the key players profiled under the report.

The estimated value of the naval system surveillance radar market by 2031 would be around US$ 7.17 billion.

The naval system surveillance radar market is likely to register of 6.8% during 2023-2031.

Get Free Sample For

Get Free Sample For