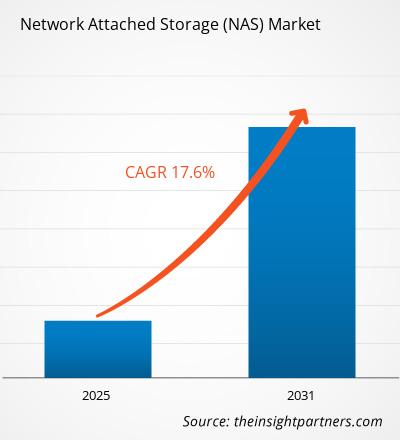

The network attached storage (NAS) market size is projected to reach US$ 113.49 billion by 2031 from US$ 31.02 billion in 2023. The market is expected to register a CAGR of 17.60% in 2023–2031. The integration of on-premises NAS with cloud storage is likely to remain a key network attached storage (NAS) market trend.

Network Attached Storage (NAS) Market Analysis

The network attached storage (NAS) market has grown significantly in recent years, owing to technical improvements, a growing demand for effective storage solutions, and an increase in digitalization. It provides a storage and retrieval service that allows several clients to retrieve data from a centralized place. The NAS industry is primarily driven by advantages such as ease of setup, flexibility, and scale-out, as well as low installation and maintenance costs. The increase in data flow necessitates an effective storage system, which raises the demand for NAS solutions.

The increase in data flow necessitates an effective storage system, which promotes the demand for NAS. The increase in unstructured data highlights the necessity for a scale-out NAS system to drive the NAS business. Furthermore, the government is working to improve SMEs' ability to grow their businesses efficiently. It offers incentives, initiatives, and investments to help SMEs embrace digital solutions, resulting in the adoption of NAS systems and driving the NAS market.

Network Attached Storage (NAS) Market Overview

Network-attached storage (NAS) is a file storage system that allows multiple users and different client devices to access data from a centralized disk capacity. It offers large capacity, easy access, and minimal cost. Network-attached storage (NAS) devices consolidate storage into a single location and support cloud tiers and functions such as archiving and backup. Network-attached storage (NAS) handles unstructured data such as video, audio, text files, websites, and Microsoft Office documents. The goal of network-attached storage (NAS) is to help users collaborate and share more data efficiently.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Network Attached Storage (NAS) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Network Attached Storage (NAS) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Network Attached Storage (NAS) Market Drivers and Opportunities

Increase in Data Traffic to Favor Market

The rising connected device usage, simple internet access, and lower internet service costs all contribute to increased data storage demand and fuel the network attached storage (NAS) market. Furthermore, the growing use of big data analytics and cloud-based services, such as online content, apps, videos, and social media, increases the demand for an effective storage solution like a NAS system and serves as a catalyst for NAS market growth. According to Telefonaktiebolaget LM Ericsson's 'Mobile data traffic outlook,' total global mobile data traffic, excluding fixed wireless access (FWA), reached around 93 Exabytes (EB) per month at the end of 2022 and is expected to reach 392 EB per month by the end of 2031. Furthermore, when 4G traffic falls, 5G will account for 100% of mobile data traffic increase by 2031.

Deployment of 5G Network to Favor Market

The development of 5G networks is dramatically boosting data traffic because it provides bigger data volumes and lower latency than 4G and other networks. According to Cisco's estimate, 5G is expected to serve more than 10% of global mobile connections by the end of 2023, with an average speed of 575 Mbps. Because of rising data traffic, organizations and enterprises need services to store, process, and distribute their data effectively and reliably, leading to the demand for network attached storage solutions.

Demand for Real-time Data – An Opportunity in the Network Attached Storage (NAS) Market

The growing requirement for real-time data is driving the growth of the NAS market. The surging adoption of Internet of Things (IoT) technologies and connected devices, as well as the increasing adoption of hybrid cloud storage, are creating lucrative opportunities for NAS market players.

Network Attached Storage (NAS) Market Report Segmentation Analysis

Key segments that contributed to the derivation of the network attached storage (NAS) market analysis are storage solution, deployment, organization size, product, and end-user.

- Based on storage solution, the market is divided into Scale-up NAS, Scale-out NAS. The Scale-out NAS segment held a significant market share in 2023.

- Based on deployment, the market is bifurcated into on-premise, remote, and hybrid. The on-premise segment held a larger market share in 2023.

- Based on organization size, the market is bifurcated into SMEs and large enterprises. The large enterprises segment held a larger market share in 2023.

- In terms of product, the market is segmented High-end Enterprise NAS, Midmarket NAS, Low-end NAS. The High-end Enterprise NAS segment held a significant market share in 2023.

- Based on end-user, the market is bifurcated into BFSI, consumer goods and retail, telecommunications and ites, healthcare, energy, government, education and research, media and entertainment, manufacturing, business and consulting, and others. The consumer goods segment held a significant market share in 2023.

Network Attached Storage (NAS) Market Share Analysis by Geography

The geographic scope of the Network Attached Storage (NAS) market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

APAC has established itself as one of the most rapidly expanding network attached storage (NAS) markets. Several reasons have contributed to APAC's dominant position in the market. For starters, APAC has been at the forefront of sophisticated technology adoption and digitization. Furthermore, increases in consumer disposable income, changes in lifestyle, and shopping patterns are only a few of the variables driving the growing purchase of goods and products through online platforms. Consumers prefer to purchase online because it provides a wider assortment of products and saves time and money when compared to traditional stores. Furthermore, increased internet and smartphone penetration is increasing customers' desire for online purchasing, accelerating the expansion of the e-commerce business.

According to the India Brand Equity Foundation, India's online consumer base was 150 million in 2021 and is projected to reach 350 million by 2031. Thus, the rising e-commerce industry creates a demand for massive volumes of data storage. With the increasing volume of online transactions, e-commerce businesses require an efficient solution for storing, accessing, and processing their data. Network attached storage (NAS) is regarded as an efficient and scalable solution for data storage in order to boost the e-commerce sector and digitalization, resulting in increased use of network attached storage (NAS) solutions and driving the market.

Network Attached Storage (NAS) Market Regional Insights

Network Attached Storage (NAS) Market Regional Insights

The regional trends and factors influencing the Network Attached Storage (NAS) Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Network Attached Storage (NAS) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Network Attached Storage (NAS) Market

Network Attached Storage (NAS) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 36.48 billion |

| Market Size by 2031 | US$ 113.49 billion |

| Global CAGR (2025 - 2031) | 17.60% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Storage Solution

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

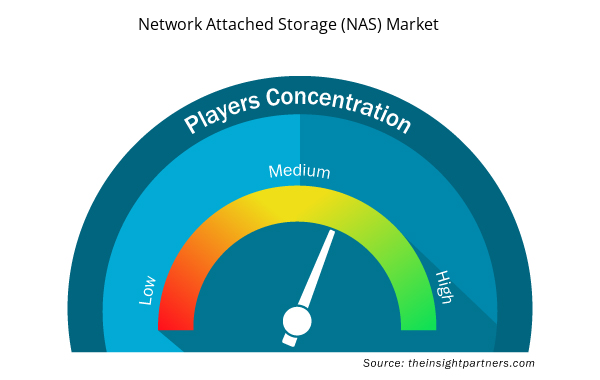

Network Attached Storage (NAS) Market Players Density: Understanding Its Impact on Business Dynamics

The Network Attached Storage (NAS) Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Network Attached Storage (NAS) Market are:

- Buffalo Americas, Inc.

- Dell EMC

- Hewlett Packard Enterprise Development LP

- Hitachi Vantara Corporation

- NetApp

- NETGEAR

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Network Attached Storage (NAS) Market top key players overview

Network Attached Storage (NAS) Market News and Recent Developments

The network attached storage (NAS) market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In October 2023, Ugreen added Ugreen NAS devices to its portfolio. (Source: Ugreen, Press Release)

- In October 2023, QNAP Systems, Inc. launched the QGD-1600 and QGD-160, new smart edge switches, to provide enhanced LAN security and versatile network management solutions. These switches are developed to integrate the functions of NAS (Network-Attached Storage) and switches. (Source: QNAP Systems, Inc, Newsletter)

Network Attached Storage (NAS) Market Report Coverage and Deliverables

The “Network Attached Storage (NAS) Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Network Attached Storage (NAS)Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Network Attached Storage (NAS) Market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Network Attached Storage (NAS) market analysiscovering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Network Attached Storage (NAS)Industry, landscape, and competition analysis, covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Storage Solution, Deployment, Organization Size, Product, End-user

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For