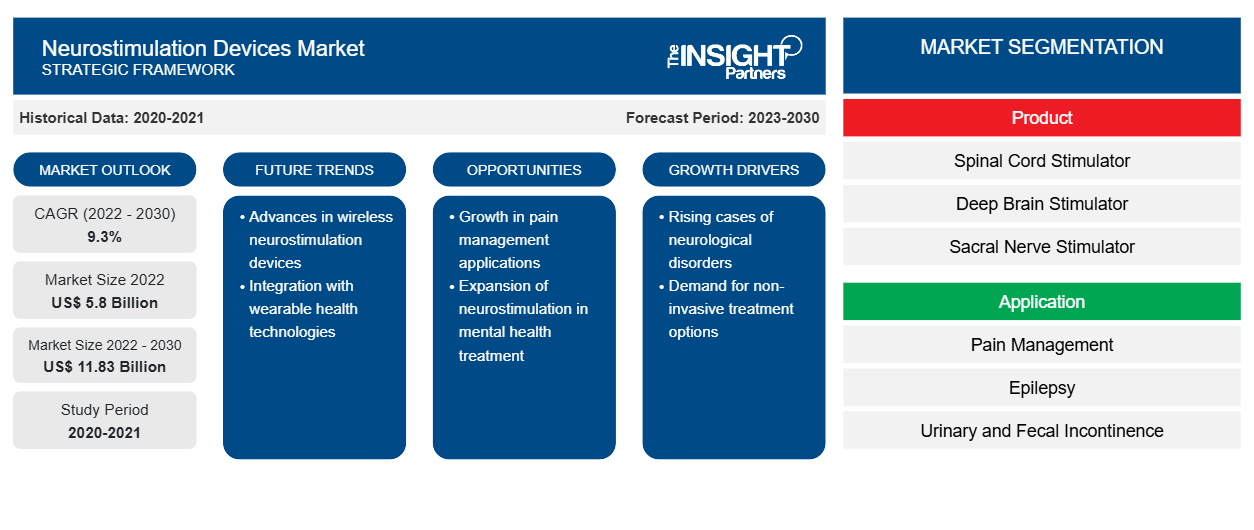

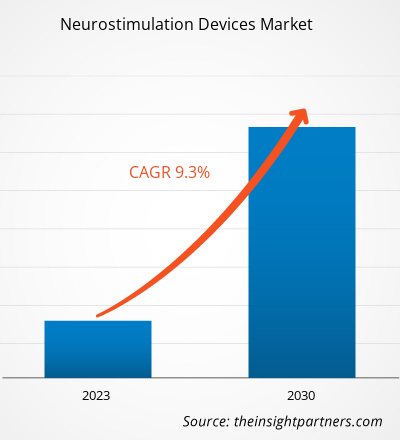

[Research Report] The neurostimulation devices market is expected to grow from US$ 5,802.47 million in 2022 and is expected to reach US$ 11,825.95 million by 2030; it is anticipated to record a CAGR of 9.3% from 2022 to 2030.

Market Insights and Analyst View:

Neurostimulation devices are medical devices designed to modulate the nervous system's activity. They are used to treat various neurological conditions and chronic pain. There are several types of neurostimulation devices, including spinal cord stimulators, deep brain stimulators, vagus nerve stimulators, and peripheral nerve stimulators. These devices can significantly improve the quality of life for individuals with various neurological conditions. The increasing prevalence of neurological diseases and increasing spinal cord injury cases are the key factors behind the market development. However, the lack of expert professionals is hampering the neurostimulation devices market growth.

Growth Drivers and Challenges:

The geriatric population is susceptible to neurological diseases. Common neurological disorders affecting older people are neuropathy, Parkinson's disease, Alzheimer's disease, dystonia, and others. According to the National Institutes of Health (NIH), 8.5% of the world's population (i.e., ~617 million people) is 65 years and above. Countries such as the US and Canada have high prevalence rates of movement disorders and psychiatric disorders associated with growing geriatric populations. According to the Parkinson's Foundation, Parkinson's symptoms are common at an average age of 60.

The Canadian Psychological Association states that obsessive-compulsive disorder (OCD) affects ~2% of the population in Canada. The World Health Organization (WHO) states that epilepsy is a seizure-causing neurological disorder that affects ~50 million people worldwide. As per the American Academy of Neurology, stroke is the third leading cause of death in the US, followed by Alzheimer's as the sixth leading cause. Statistics from the same source show that nearly one million Americans are affected by Parkinson's, and at least 60,000 new cases are reported annually. The growing incidence of neurological diseases coupled with lifestyle-related disorders such as depression and chronic pain leads to the increasing adoption of technologically advanced products.

According to the WHO, nervous disorders contribute to ~6.3% of the global disease burden. Also, according to the same source, the disorders are one of the leading causes of death worldwide. They cause 13.2% of deaths in developed countries and 16.8% in low- and middle-income countries. High mortality and disease burden necessitate the clinical urgency for integrating long-term solutions. Furthermore, growing awareness regarding the tremendous burden of neurological disorders has increased the demand for neurostimulators as a therapy.

Therefore, the growing geriatric population prone to neurological diseases, increasing prevalence of the diseases, and rising awareness regarding the tremendous burden of neurological disorders drive the neurostimulation devices market size.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Neurostimulation Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Neurostimulation Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

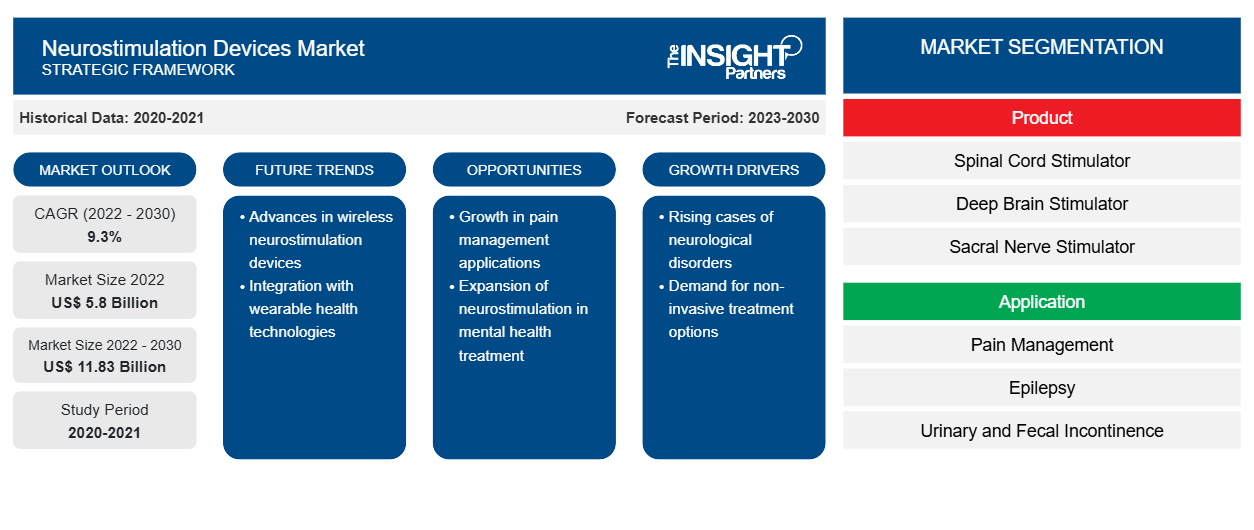

The global neurostimulation devices market is segmented on the basis of product, application, and end user. Based on the product, the market is segmented into spinal cord stimulators, deep brain stimulators, sacral nerve stimulators, and vagus nerve stimulators. In terms of application, the neurostimulation devices market is segmented into pain management, epilepsy, urinary and fecal incontinence, Parkinson’s disease, and others. The neurostimulation devices market, by end user, is segmented into hospitals, specialty clinics, and others. The neurostimulation devices market, based on geography, is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on product, the neurostimulation devices market is segmented into spinal cord stimulators, deep brain stimulators, sacral nerve stimulators, vagus nerve stimulators, and others. The spinal cord stimulator segment held the largest market share in 2022 and is anticipated to register a higher CAGR during 2022–2030. Spinal cord stimulation can treat patients with severe, chronic pain due to various conditions, including failed back surgery/arachnoiditis, neuropathic pain/neuropathy, and complex regional pain syndrome/reflex sympathetic dystrophy. A few SCS devices use a low-frequency current to change the pain sensation with a mild tingling called paresthesia. Other SCS devices use high-frequency or burst pulses to mask the pain without a tingling sensation.

Spinal cord stimulation has become a basic in interventional pain management to treat various chronic pain conditions. Advances have been made since its initial inception in 1967, leading to new technologies allowing for minimally invasive placement and internalized batteries. For instance, in May 2023, Abbott received approval from the U.S. Food and Drug Administration (FDA) for SCS devices for treating chronic back pain in people not able to receive back surgery, known as nonsurgical back pain. Furthermore, in August 2023, Medtronic plc received CE Mark approval for its Inceptiv closed-loop rechargeable SCS. It is the first Medtronic SCS device to offer a closed-loop feature that senses each person's unique biological signals and adjusts stimulation every moment, as needed, to keep therapy in harmony with the motions of daily life. Such developments are boosting the adoption of SCS, fueling the segment growth in the global neurostimulation devices market.

The neurostimulation devices market, by application, is segmented into pain management, epilepsy, urinary and fecal incontinence, Parkinson’s disease, and others. The pain management segment held the largest market share in 2022, and the same is anticipated to register a higher CAGR during 2022–2030.

Chronic pain affects geriatric people, trauma and surgery patients, people undergoing different therapies, and those linked to various physical and mental conditions. As per the US Centers for Disease Control and Prevention (CDC), back pain is the second leading reason for hospital visits, and ~60% and 80% of people experience lower back pain during their lifetime, which is one of the major reasons for hospital admission or surgeries.

Neurostimulation is a safer and more efficient solution for alleviating chronic pain and is widely adopted. Numerous biotech companies are launching neurostimulators to help opioid addicts overcome pain and other withdrawal symptoms. For example, in April 2021, Spark Biomedical, a leading medical device company, rolled out a new neurostimulation device called Sparrow Therapy System to help opioid addicts work through withdrawal symptoms. The device uses low doses of electricity to stimulate endorphin production, which helps to alleviate the pain and fear that patients experience during withdrawal. Furthermore, in March 2021, Mainstay Medical launched ReActiv8, an implantable neurostimulation device for chronic low back pain (CLBP), in Australia. The device can potentially be helpful to adults with intractable CLBP linked with the dysfunction of the lumbar multifidus. In January 2023, the FDA approved Abbott’s Proclaim X.R. spinal cord neurostimulation system, which supports patients with diabetic peripheral neuropathy to manage chronic pain. Thus, the application and benefits mentioned above positively influence the neurostimulation devices market during 2022–2030.

Regional Analysis:

Based on geography, the neurostimulation devices market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. The market in North America has been analyzed with a prime focus on three major countries—the US, Canada, and Mexico. The US held the largest share of the North America neurostimulation devices market in 2022. It is estimated to hold the largest share of the neurostimulation devices market in North America during the forecast period owing to the growing prevalence of neurological diseases, high spending on research and development, product approvals by the U.S. Food and Drug Administration (FDA), and technological advances. In the U.S., the incidence of neurovascular diseases is rising significantly and is becoming the leading cause of death. Rising incidence of neurological diseases such as Parkinson's disease (P.D.), increasing awareness about neurological disorders, and growing investments in developing transcranial stimulators are among the main factors driving the overall neurostimulation devices market in the US. Deep brain stimulation (DBS) devices have been observed to control the tremors associated with Parkinson's disease effectively. Low dopamine readings and other genetic factors are among the leading causes of Parkinson's disease. According to a study titled "2022 Alzheimer's Disease Facts and Figures," published in the Alzheimer's Association, nearly 6.5 million Americans aged 65 and above were diagnosed with Alzheimer's disease in 2022. That number is projected to rise to 13.8 million by 2060. According to the Parkinson's Foundation, the number of people to suffer from Parkinson’s disease in the US was expected to increase to 1.2 million by 2030. Technological advancements and new product launches drive the neurostimulation devices market. In January 2020, Abbott's neurostimulator Infinity DBS System received approval from the USFDA for treating Parkinson's disease. This system allows for the targeted treatment of a specific area of the brain, called the inner globus pallidus (GPi), which is associated with the symptoms of Parkinson's disease. Therefore, the increasing prevalence of neurological disorders and technological advancements fuel the neurostimulation devices market growth in the US.

Competitive Landscape and Key Companies:

Neurostimulation device market developments have been characterized as organic and inorganic growth strategies. Various companies focus on organic growth strategies such as product launches, expansion, enhancement, and relocation. Inorganic growth strategies in the market are mergers and acquisitions, partnerships, and collaborations. These activities have paved the way for the expansion of businesses and customer base of neurostimulation devices market players.

- In August 2023, Mainstay Medical Holdings plc announced the completion of enrollment in its RESTORE randomized clinical study of ReActiv8 for the treatment of intractable chronic low back pain. The study is designed to provide a direct comparison to optimized medical management to test the hypothesis that adding ReActiv8 Restorative Neurostimulation therapy to current care paradigms significantly improves back pain-related disability.

- In April 2023, Synapse Biomedical, Inc. announced the FDA approval (PMA) of the NeuRx Diaphragm Pacing System (NeuRx DPS) for use in patients suffering from spinal cord injuries who rely on mechanical ventilation. PMA is the most stringent type of device marketing application required by the FDA.

- In August 2023, Abbott announced the U.S. Food and Drug Administration (FDA) approved its new Proclaim Plus spinal cord stimulation (SCS) system featuring FlexBurst360 therapy. The next generation of Abbott's proprietary BurstDR stimulation, FlexBurst360 therapy, offers pain coverage across six areas of the trunk and/or limbs. It enables programming that can be adjusted as a person's therapeutic needs evolve.

- In May 2023, Abbott announced the U.S. Food and Drug Administration (FDA) approval of its spinal cord stimulation (SCS) devices for treating chronic back pain in people who have not had or are not eligible to receive back surgery, known as nonsurgical back pain.

- In January 2021, Medtronic plc received U.S. Food and Drug Administration (FDA) approval for Vanta, a high-performance recharge-free implantable neurostimulator (INS) with a device life that can be optimized up to 11 years. The Vanta neurostimulator offers nearly twice the device life at comparable settings than competitive primary cell devices.

- In January 2022, Medtronic plc received approval from the U.S. Food and Drug Administration for its Intellis rechargeable neurostimulator and Vanta recharge-free neurostimulator for treating chronic pain associated with diabetic peripheral neuropathy (DPN).

Neurostimulation Devices Market Regional Insights

Neurostimulation Devices Market Regional Insights

The regional trends and factors influencing the Neurostimulation Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Neurostimulation Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Neurostimulation Devices Market

Neurostimulation Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5.8 Billion |

| Market Size by 2030 | US$ 11.83 Billion |

| Global CAGR (2022 - 2030) | 9.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

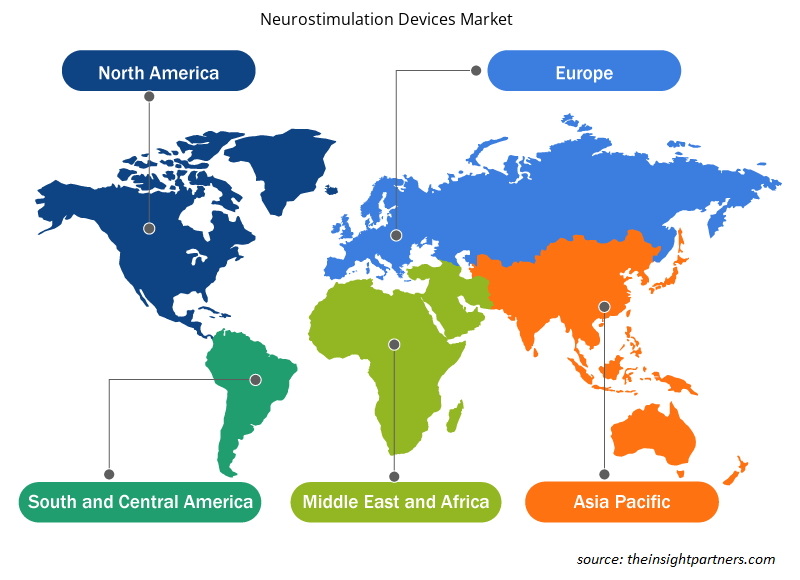

Neurostimulation Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Neurostimulation Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Neurostimulation Devices Market are:

- Medtronic Plc

- Boston Scientific Corp

- Abbott Laboratories

- Nevro Corp

- LivaNova Plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Neurostimulation Devices Market top key players overview

Company Profiles

- Medtronic Plc

- Boston Scientific Corp

- Abbott Laboratories

- Nevro Corp

- LivaNova Plc

- Synapse Biomedical Inc

- Nalu Medical, Inc

- ElectroCore Inc

- MicroTransponder Inc

- Mainstay Medical

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Diaper Packaging Machine Market

- Social Employee Recognition System Market

- Ketogenic Diet Market

- Mesotherapy Market

- Drain Cleaning Equipment Market

- Nuclear Decommissioning Services Market

- Redistribution Layer Material Market

- Industrial Inkjet Printers Market

- Pharmacovigilance and Drug Safety Software Market

- Sweet Potato Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The factors that are driving the market is the growing prevalence of neurological diseases and increasing cases of spinal cord injury are the key driving factors behind the market development. However, lack of expert professionals is hampering the market growth.

The neurostimulation devices market majorly consists of the players such Medtronic Plc, Boston Scientific Corp; Abbott Laboratories, Nevro Corp; LivaNova Plc, Synapse Biomedical Inc, Nalu Medical, Inc, ElectroCore Inc; MicroTransponder Inc, and Mainstay Medical among others.

The neurostimulation devices market is analyzed in the product, application, and end user. The market based on product, is segmented into spinal cord stimulator, deep brain stimulator, sacral nerve stimulator, vagus nerve stimulator, and others. The spinal cord stimulator segment held a larger market share in 2022 and the same is anticipated to register a higher CAGR during the 2022-2030. The neurostimulation devices market, by application, is segmented into pain management, epilepsy, urinary and fecal incontinence, Parkinson’s disease, and others. The pain management segment held a larger market share in 2022 and the same is anticipated to register a higher CAGR during the 2022-2030. The neurostimulation devices market, by end user, is bifurcated into hospitals, specialty clinics, and others. The hospitals segment held the largest share of the market in 2022 and specialty clinics segment is anticipated to register the highest CAGR in the market during 2022-2030.

Neurostimulation devices are medical devices designed to modulate the activity of the nervous system. They are used to treat various neurological conditions and chronic pain. There are several types of neurostimulation devices, including spinal cord stimulators, deep brain stimulators, vagus nerve stimulators, peripheral nerve stimulator. These devices have the potential to significantly improve the quality of life for individuals with various neurological conditions.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Neurostimulation Devices Market

- Medtronic Plc

- Boston Scientific Corp

- Abbott Laboratories

- Nevro Corp

- LivaNova Plc

- Synapse Biomedical Inc

- Nalu Medical, Inc

- ElectroCore Inc

- MicroTransponder Inc

- Mainstay Medical

Get Free Sample For

Get Free Sample For