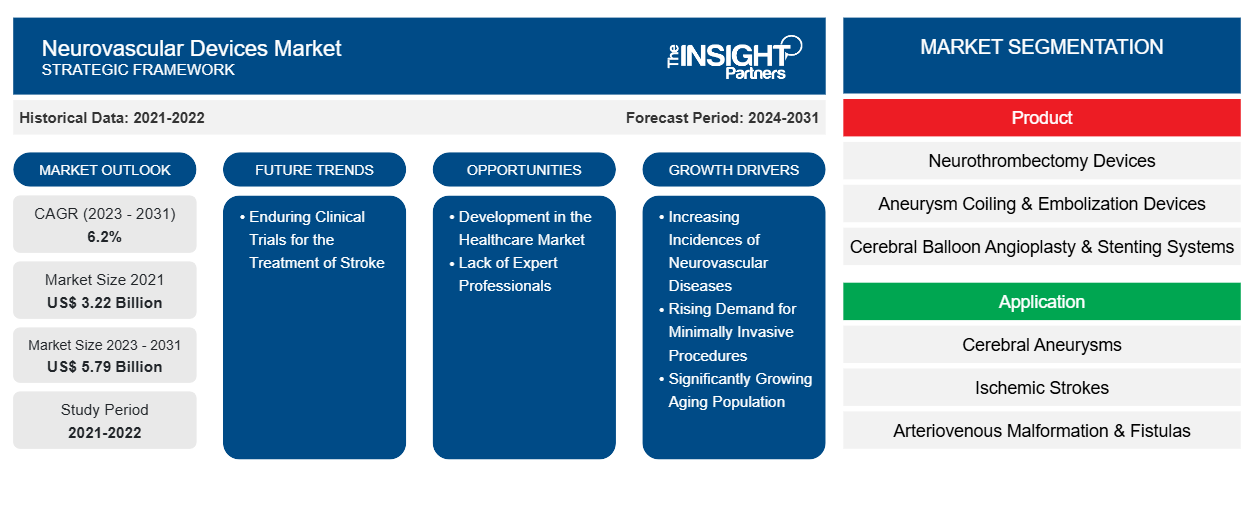

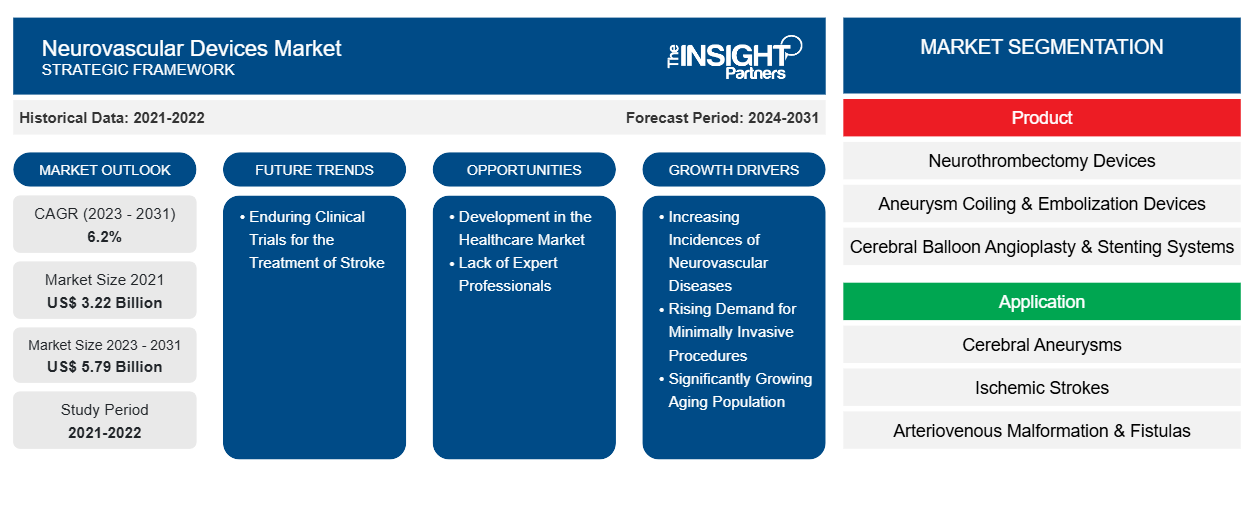

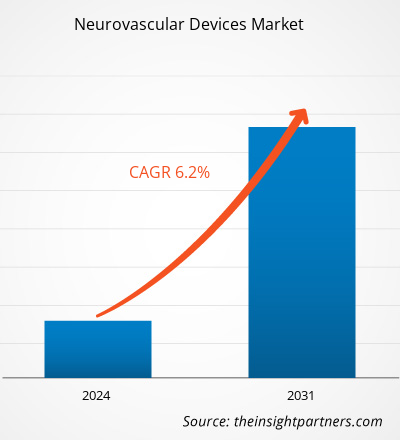

The neurovascular devices market size in 2021 stood at US$ 3.22 billion and is projected to reach US$ 5.79 billion by 2031 from US$ XX billion in 2023. The market is expected to register a CAGR of 6.2% in 2023–2031. Growing ongoing clinical trials and rising prevalence in the cases of stroke in developed as well as developing economies are likely to remain key neurovascular devices market trends.

Neurovascular Devices Market Analysis

Advanced imaging techniques and minimally invasive procedures have enabled healthcare professionals to perform more precise and less invasive procedures, ultimately reducing the risks associated with traditional surgical approaches. The increasing prevalence of neurological diseases is one of the critical factors driving the neurovascular devices market growth. Factors such as an aging people and modifying lifestyle changes have led to an increased incidence of diseases such as stroke and cerebral aneurysms, further highlighting the need for neurovascular interventions. Furthermore, there has been a substantial shift toward minimally invasive techniques and devices, thereby reducing the invasiveness of the neurovascular procedures. This shift has resulted in shorter hospital stays, faster recovery times, and lower patient healthcare costs, making these procedures more accessible and attractive to patients and healthcare providers. These technological and medical advances have collectively contributed to the impressive growth of the neurovascular device market and improved patient care and outcomes.

Neurovascular Devices Market Overview

Neurovascular devices treat diseases of the blood arteries that supply oxygen-rich blood to the brain. For a complex aneurysm, neurovascular thrombectomy devices are used to remove the clot that caused the stroke. Many endovascular devices, such as snares, vacuum cleaners, and blood clot extraction devices, fall into this category. The market is expanding for many reasons, such as the rapid pace of technical innovation in this sector. Neurovascular devices include stenting systems, embolization devices, and neurothrombectomy devices used to treat neurovascular diseases such as brain aneurysms. The increasing prevalence of these diseases in the population and increasing government initiatives to raise awareness of treatment options are expected to drive product demand to treat these diseases.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Neurovascular Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Neurovascular Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Neurovascular Devices Market Drivers and Opportunities

Rising Demand for Minimally Invasive Procedures to Favor Market

Minimally invasive surgeries are seeing high adoption due to their cosmetic appeal and shorter recovery times, which could further streamline the market expansion of neurovascular devices. Surgical procedures have continually introduced innovations and improvements to make them safer for patients. Minimally invasive surgery has become the standard for surgical procedures traditionally performed using an open technique. These surgical procedures include laparoscopic surgery, endoscopic surgery, and robotic surgery. The increased demand for minimally invasive neurosurgical procedures, the increasing knowledge of neurosurgeons about minimally invasive procedures, and the increase in research studies in the field of neurovascular therapy may provide lucrative opportunities for key competitors in the coming period. Such scenarios are expected to favor the industry landscape.

Increasing Growth Strategies– An Opportunity for Neurovascular Devices Market Growth

Increasing organic growth strategies, such as product approvals from regulatory authorities to expand product portfolios of key players, are projected to drive market growth. For example, Scientia Vascular, a US-based medical device company, announced in May 2021 that it had received $50 million in funding from Vivo Capital, a healthcare investment firm, to develop guidewires and microcatheters to treat stroke. Innovative technologies will continue to expand the range of neurovascular tools available to treat various types of aneurysms more safely and efficiently. Aneurysm management constantly evolves, with sophisticated technology at the forefront of innovation.

Neurovascular Devices Market Report Segmentation Analysis

Key segments that contributed to the derivation of the neurovascular devices market analysis are product, application, and end user.

- Based on product, the neurovascular devices market is divided into neurothrombectomy devices, aneurysm coiling & embolization devices, cerebral balloon angioplasty & stenting systems, and support devices. In 2023, aneurysm coiling & embolization devices segment held the largest share of the market, and the same segment is anticipated to register the highest CAGR during the forecast period. The segment is further categorized into embolic coils, bare detachable coils, coated detachable coils, flow diversion devices, and liquid embolic agents.

- By application, the market is segmented into cerebral aneurysms, ischemic strokes, arteriovenous malformation & fistulas, and others. In 2023, ischemic strokes segment held the largest share of the market, and the same segment is anticipated to register the highest CAGR during 2023–2031.

- In terms of end user, the market is segmented into hospitals, ambulatory surgical centers, and specialized clinics. In 2023, hospitals segment held the largest share of the market, and the same segment is estimated to register the highest CAGR during the forecast period. The hospital segment is expected to grow at the fastest rate during the coming year owing to the availability of better healthcare facilities as well as reimbursement policies from government bodies.

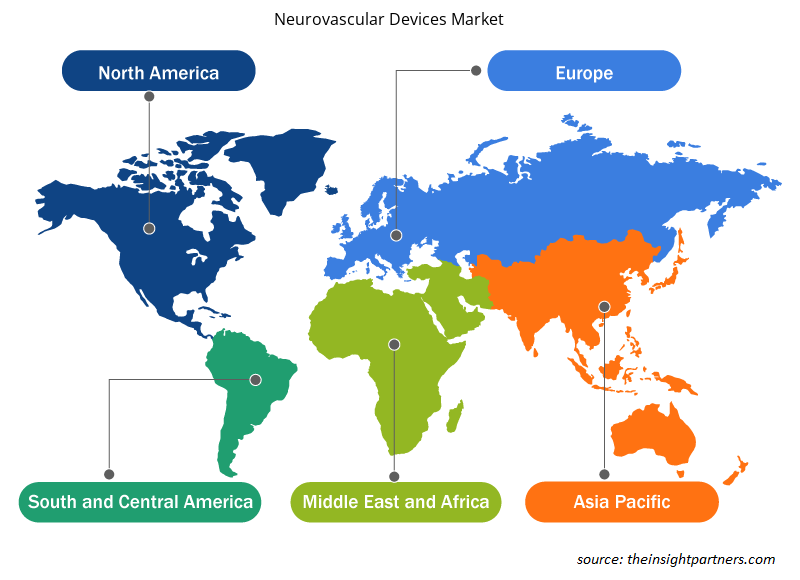

Neurovascular Devices Market Share Analysis by Geography

The geographic scope of the neurovascular devices market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the neurovascular devices market. The growth of the market in North America is attributed to the increasing prevalence of various neurological diseases and higher diagnosis and treatment rates. Additionally, increasing healthcare spending to support neurological care in the region and adequate reimbursement for various neurological diseases will encourage the introduction of advanced, novel treatment options. For example, private and public health insurers such as Medicare, Medicaid, and others offer favourable reimbursement policies for neurovascular products, including all embolic and fluid coils. Furthermore, technological advancements and increasing research and development activities leading to product launches and approvals, as well as partnerships and acquisitions by key players, contribute to the market's growth. For example, in July 2022, Rapid Medical, a developer of advanced neurovascular devices, received FDA 510(k) clearance for TIGERTRIEVER for the treatment of large vessel occlusions at the Society of Neurointerventional Surgery (SNIS) 2022 Annual Meeting in Toronto. The device is one of the smallest revascularization devices used to remove thrombi from delicate brain blood vessels during an ischemic stroke. These developments are expected to drive market growth in the region over the forecast period as they offer a less traumatic approach than existing devices. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Neurovascular Devices Market News and Recent Developments

The neurovascular devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for neurovascular devices:

- Medtronic received CE Mark for Evolut FX TAVI System for treatment of severe aortic stenosis. The transcatheter aortic valve implantation (TAVI) system, the newest-generation TAVI system of the CoreValveTM/Evolut TAVI platform. (Medtronic, Press Release, 2023)

- Stryker announced that it completed the acquisition of Cerus Endovascular Ltd., a privately held, commercial-stage, medical device company engaged in the design and development of neurointerventional devices for the treatment of intracranial aneurysms. Cerus Endovascular’s CE Marked products, the Contour Neurovascular System, and the Neqstent Coil Assisted Flow Diverter, will expand Stryker’s current portfolio of aneurysm treatment solutions. (Stryker, News, 2023)

- ASAHI INTECC CO., LTD. announced that they have concluded a contract with Sensome SAS (“Sensome”), a French medical device company, for a development and manufacturing partnership of a next-generation smart stroke guidewire. (ASAHI INTECC CO., LTD., News, 2023)

- Stryker launched a state-of-the-art Neurovascular R&D lab with advanced technology to accelerate stroke care innovation in Asia Pacific. (Stryker, News, 2022)

- Genesis MedTech Group reached a consensus to fully acquire Hua Medtech as part of its plans to set up a specialised neurovascular franchise, which entered into strategic cooperation with Penumbra, Inc., for the domestic sales and production of products with Penumbra's technology for the Chinese market. (Genesis Medtech, News, 2021)

Neurovascular Devices Market Regional Insights

The regional trends and factors influencing the Neurovascular Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Neurovascular Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Neurovascular Devices Market

Neurovascular Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3.22 Billion |

| Market Size by 2031 | US$ 5.79 Billion |

| Global CAGR (2023 - 2031) | 6.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

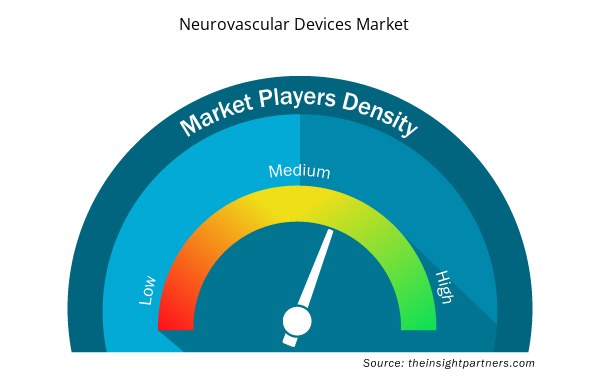

Neurovascular Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Neurovascular Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Neurovascular Devices Market are:

- Medtronic plc,

- Stryker Corporation.,

- Johnson & Johnson Services, Inc.,

- Acandis GmbH & Co. KG.,

- MicroPort Scientific Corporation,

- Terumo Corporation,

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Neurovascular Devices Market top key players overview

Neurovascular Devices Market Report Coverage and Deliverables

The “Neurovascular Devices Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Equipment Rental Software Market

- Electronic Signature Software Market

- Thermal Energy Storage Market

- Electronic Data Interchange Market

- Extracellular Matrix Market

- Dairy Flavors Market

- Lymphedema Treatment Market

- Pressure Vessel Composite Materials Market

- Organoids Market

- Artificial Intelligence in Healthcare Diagnosis Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product , Application ; and End User and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Get Free Sample For

Get Free Sample For