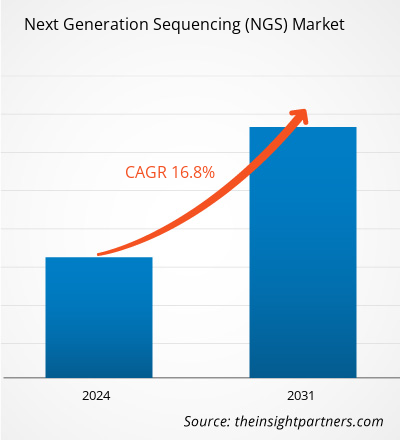

The Next Generation Sequencing (NGS) market size is projected to reach US$ 34.75 billion by 2031 from US$ 10.00 billion in 2023. The market is expected to register a CAGR of 16.8% during 2023–2031. Increased throughput and reduced costs is likely to remain key trends in the market.

Next Generation Sequencing (NGS) Market Analysis

As per CDC, each year 41 million deaths are due to noncommunicable diseases (NCDs), equivalent to 74% of all deaths globally. Out of all NCD deaths, 77% are in low- and middle-income countries. Cardiovascular diseases account 17.9 million people death for most NCD deaths, followed by cancers (9.3 million), respiratory diseases (4.1 million), and diabetes (2 million). Recent improvements in sequencing techniques have authorized precision medicine to be a model for disease prevention, diagnosis, and treatment, particularly implemented for the treatment of cancer.

Next Generation Sequencing (NGS) Market Overview

Many companies are undergoing strategic developments that support the market’s growth. For instance 2022, Illumina launched NovaSeq X Series to generate more than 20,000 whole genomes per year. In the same year, Ultima Genomics launched onto the short-read sequencing and announced the USD100 genome Sequencer. Along with the such launches, fews advancements or DNA sequencing new class, called third generation sequencing (TGS), is currently under active. These technologies can sequence single DNA molecules without amplification, and they allow the construction of reads much longer than NGS. Each technologies can produce very long reads of up to 15,000 bases long from single molecules of DNA and RNA.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Next Generation Sequencing (NGS) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Next Generation Sequencing (NGS) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Next Generation Sequencing (NGS) Market Drivers and Opportunities

Advancements in Next-Generation Sequencing (NGS) to Favor Market

Next-generation sequencing (NGS) carries a shift in genomics research, offering unmatched capabilities for analyzing DNA and RNA molecules in a high-throughput and cost-effective manner. This transformation have increased the genomics advancements across diverse domains. Recent advancements have been directed towards reduced costs, faster and more accurate sequencing, and improved data analysis. These holds great promise for unlocking new insights into genomics and improving diseases understanding and personalized healthcare. NGS advancements have positively impacted various research areas, including clinical genomics, infectious diseases, cancer, and microbiome studies.

New Guidance Launched by WHO On The Use Of Targeted Next-Generation Sequencing

In March 2024, the World Health Organization (WHO) published recommendations on using a new class of diagnostic technologies, the targeted NGS tests for the diagnosis of drug-resistant tuberculosis (TB) in the updated guidelines on tuberculosis. The WHO has also launched a new TB sequencing portal with more than 56,000 sequences per new guidelines. The portal, developed in partnership with FIND and Unitaid, signifies the most advanced sequencing and phenotyping knowledgebase for TB. This will contribute to collective understanding of Mycobacterium tuberculosis genome mutations and their association with drug resistance.

Next Generation Sequencing (NGS) Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Next Generation Sequencing (NGS) market analysis are product, technology, application, and end user.

- Based on product, the Next Generation Sequencing (NGS) market is divided into platforms, services, and consumables. The consumables segment held a larger market share in 2023.

- By technology, the market is segmented into genome sequencing, exome sequencing, resequencing & targeted sequencing, and other. The resequencing & targeted sequencing segment held the largest share of the market in 2023.

- By application, the market is segmented into diagnostics, drug discovery, precision medicine, and other. The diagnostics segment held the largest share of the market in 2023.

- In terms of end user, the market is divided into academic & research institutes, pharmaceutical & biotechnology companies, hospitals & clinics, and others. The academic & research institutes held the largest share of the market in 2023.

Next Generation Sequencing (NGS) Market Share Analysis by Geography

The geographic scope of the Next Generation Sequencing (NGS) market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market. In the US, according to new data from the Centers for Disease Control and Prevention (CDC), the number of TB cases climbed in 2023. In 2023, the cases increased by 16% from 2022, reaching 9,615 TB cases, the highest number reported since 2013. Additionally, 2.9 cases per 100,000 persons represented a 15% increase from 2022. The government are taking the initiative to reduce the number of TB. For instance, to address the global TB epidemic by 2035, the World Health Organization (WHO) has defined various strategies. To go along with WHO, companies also entering strategic partnerships. For instance, in October 2022, Illumina Inc. and GenoScreen entered into an alliance enabling global access to a package combining Illumina sequencing products to detect anti-TB drug resistance and promptly inform treatment decisions rapidly. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Next Generation Sequencing (NGS) Market Regional Insights

The regional trends and factors influencing the Next Generation Sequencing (NGS) Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Next Generation Sequencing (NGS) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Next Generation Sequencing (NGS) Market

Next Generation Sequencing (NGS) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 10.00 Billion |

| Market Size by 2031 | US$ 34.75 Billion |

| Global CAGR (2023 - 2031) | 16.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

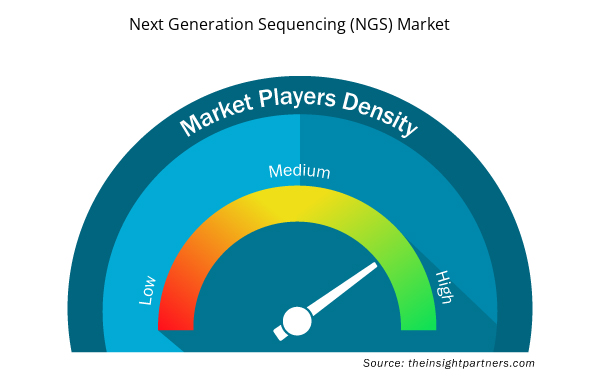

Next Generation Sequencing (NGS) Market Players Density: Understanding Its Impact on Business Dynamics

The Next Generation Sequencing (NGS) Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Next Generation Sequencing (NGS) Market are:

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Qiagen N.V.

- Beijing Genomics Institute

- Perkinelmer, Inc.

- F. Hoffmann-La Roche AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Next Generation Sequencing (NGS) Market top key players overview

Next Generation Sequencing (NGS) Market News and Recent Developments

The Next Generation Sequencing (NGS) market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Next Generation Sequencing (NGS) market are listed below:

- In March 2022, as per the Press Release by Thermo Fisher Scientific, CE-IVD marked Ion Torrent Genexus Dx Integrated Sequencer is launched, a next-generation sequencing (NGS) platform that delivers results in as little as a single day. Designed for clinical laboratories, the fully validated system enables users to perform diagnostic testing and clinical research on a single instrument.

- In October 2022, press released by Illumina Inc. stated that they have partnered with GenoScreen to accelerate progress to end tuberculosis (TB) worldwide. The partnership will expand capabilities for countries most impacted by tuberculosis to more effectively detect and combat multidrug-resistant TB (MDR-TB).

Next Generation Sequencing (NGS) Market Report Coverage and Deliverables

The “Next Generation Sequencing (NGS) Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Next Generation Sequencing (NGS) market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Next Generation Sequencing (NGS) market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Next Generation Sequencing (NGS) market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Next Generation Sequencing (NGS) market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product ; Service ; Application ; & End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

North America held the largest market for Next Generation Sequencing (NGS). The growth of the region is attributed to continuous rise in the use of Next Generation Sequencing (NGS), innovations in software designs, and increasing awareness among people regarding the benefits for digital healthcare applications.

The driving factors are increasing adoption of Internet of Things (IoT) & connected devices in healthcare and the advantages offered by Next Generation Sequencing (NGS) (SaMD).

Increasing number of wearable medical devices is likely to remain key trends in the market.

S3 Connected Health, BrightInsight, Inc. and CompliancePath are among the top players operating in the Next Generation Sequencing (NGS) market.

The Next Generation Sequencing (NGS) market size is projected to reach US$ 93.08 billion by 2031.

The market is expected to register a CAGR of 15.1% during 2023–2031.

Get Free Sample For

Get Free Sample For