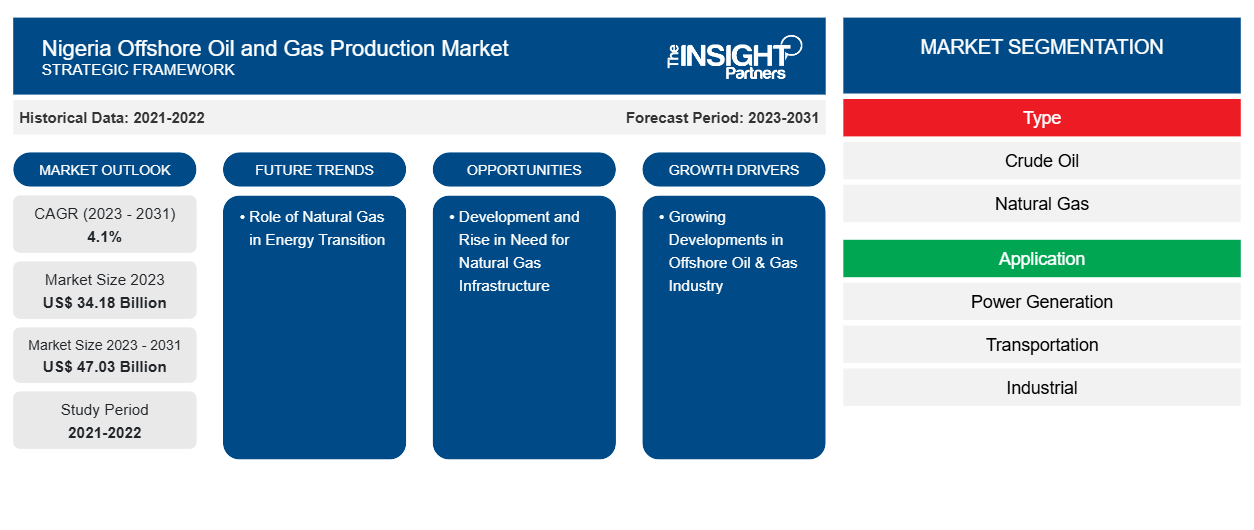

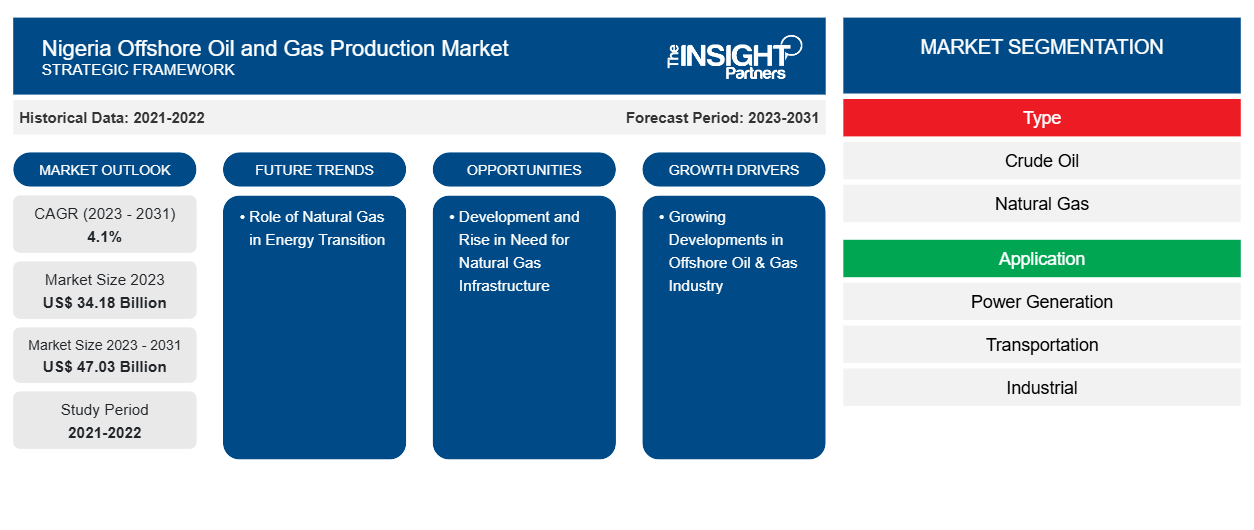

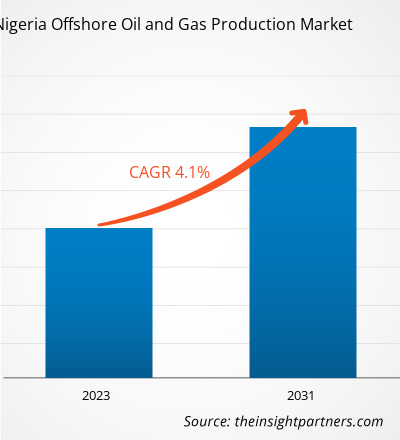

The Nigeria offshore oil and gas production market size is projected to reach US$ 47.03 billion by 2031 from US$ 34.18 billion in 2023. The market is expected to register a CAGR of 4.1% during 2023–2031. Rising use of natural gas in energy transition is likely to remain key trend in the market.

Nigeria Offshore Oil and Gas Production Market Analysis

Growing developments in the offshore oil & gas industry in Nigeria, divestment in onshore oil and gas production by oil majors and increasing focus and investments in the offshore oil & gas sector by international oil companies propel the offshore oil and gas production market. However, security threats and obstacles in the Nigerian oil & gas industry restrain the market growth. Moreover, developments in the oil & gas industry and the rising need for natural gas infrastructure are expected to create opportunities for key companies operating in the market during the forecast period. Furthermore, the role of natural gas in the country’s energy transition goal is expected to be the key trend in the Nigeria offshore oil and gas market from 2023 to 2031.

The Nigeria offshore oil and gas production market is segmented on the basis of type and application. By type, the market is bifurcated into crude oil and natural gas. Based on application, the Nigeria offshore oil and gas production market is segmented into power generation, industrial, transportation, and others.

The ecosystem of the Nigeria offshore oil and gas production market comprises a complex network of stakeholders operating in seismic research, drilling and discovery, development, and production. It is included in the exploration & production or upstream sector of the oil & gas industry value chain. The upstream sector is the stage in the value chain where oil and gas are searched, developed, and produced so that they can be sold on the wholesale market. It represents the source of oil and gas supply, and the activities of the value chain indicated. This sector is technologically advanced and the most complex in the upstream, midstream, and downstream sectors. It also involves high-risk economic activities, and the potential for returns is generally the highest.

Nigeria Offshore Oil and Gas Production Market Overview

The oil & gas industry is the major industry in Nigeria's energy market and plays an important role in the country’s economy. The industry has been a major source of revenue generation in the country and is currently the source of nearly 95% of the foreign exchange earnings. Investors looking to get into the oil & gas industry can quickly become overwhelmed by the complex jargon and unique metrics used throughout the industry. Nigeria is the largest oil and gas exporter in Africa. The country exports most of the oil it produces despite having a refining capacity of nearly 450,000 BPD. While in the past, most oil was transported through Nigeria to the US. Today, Nigerian oil is transported primarily to Asia, Europe, and South America.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nigeria Offshore Oil and Gas Production Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nigeria Offshore Oil and Gas Production Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Nigeria Offshore Oil and Gas Production Market Drivers and Opportunities

Growing Developments in Offshore Oil & Gas Industry

There is an increase in developments and investments by major international oil and gas players in scaling up production and expanding their presence in the Nigerian offshore oil & gas industry owing to the increasing insecurity and oil theft. A few major initiatives and developments in the industry in Nigeria are listed below:

- In January 2024, TotalEnergies, along with its partners, started production of oil and gas from the Akpo West Floating Production Storage and Offloading (FPSO) facility on the PML2 license in Nigeria. The offshore field is expected to add 14,000 bbl of condensate production by Mid-2024 and up to 4 million cubic feet of gas per day by 2028.

- In December 2023, Shell Plc announced its plans to invest US$ 1 billion over the next decade to boost natural gas output in Nigeria for domestic supplies and exports. Through this investment, the company aims to extend the Bonga FPSO vessel life and development of Bonga North, Bonga South-West, and Nnwa Doro facilities in the short to long term.

- In January 2024, Chevron announced its plans to increase its investments in Nigeria's deepwater areas. The company plans to acquire seismic data in several deepwater areas and expand its Agbami field project. The American multinational also acquired a stake in offshore OPL 215—joining TotalEnergies—and extended three of its deepwater licenses for 20 years.

- In May 2023, TotalEnergies Upstream Nigeria Limited secured its renewal of a production license in offshore Nigeria. This 20-year renewal expansion plan enables the oil major to develop hydrocarbons in the OML 130 block containing the Akpo and Egina fields.

- In May 2024, the Nigerian National Petroleum Co. Ltd. collaborated with First E&P and restarted oil production from the offshore Madu field in Nigeria.

Thus, growing developments in the offshore oil & gas industry in Nigeria drive the Nigeria offshore oil and gas production market growth.

Development and Rise in Need for Natural Gas Infrastructure

Nigeria is committed to monetizing its natural gas resources and becoming a leading LNG exporter in global markets. Its most notable project – the US$ 5 billion Nigeria LNG Train 7 expansion – is expected to increase processing capacity by 35%, from 22 million tonnes to 30 million tonnes per year. As a result of such initiatives, the country can export higher volumes of gas to markets such as Europe, where Nigeria exported 9.4 billion cubic meters of LNG in 2023. However, to accelerate exports, Nigeria needs significant investments in deep-sea natural gas projects and infrastructure development.

Nigeria has issued a call for upstream investment, with a strong focus on deep offshore and a licensing round in 2024 to attract new operators. The country is also using gas monetization as a means to eliminate gas flaring and has flared around 275 million cubic feet per day (cfd) in 2023. The gas flared in Nigeria has the potential to generate 1,125 GW of electricity for the country, presenting significant opportunities for gas-power infrastructure. Meanwhile, Nigeria's Upstream Petroleum Regulatory Commission has cleared 48 gas flaring sites for commercialization as part of efforts to expand the domestic gas market and decarbonize upstream activities.

Nigeria Offshore Oil and Gas Production Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Nigeria offshore oil and gas production market analysis are type and application.

- Based on type, the Nigeria offshore oil and gas production market is bifurcated into crude oil and natural gas. The crude oil segment held a larger market share in 2023.

- The market, in terms of application, is segmented into power generation, transportation, industrial, and others. The transportation segment accounted for the largest market share in 2023.

Nigeria Offshore Oil and Gas Production Market Share Analysis by Geography

The geographic scope of the Nigeria offshore oil and gas production market report offers in detail country analysis of Nigeria. Nigeria has been the largest crude oil producer in Africa for many years. According to the Nigerian Upstream Petroleum Regulatory Commission, the total volume of crude oil (including condensate) produced in the country accounted for 552.84 million barrels in 2023.

Nigeria Offshore Oil and Gas Production Market Regional Insights

The regional trends and factors influencing the Nigeria Offshore Oil and Gas Production Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Nigeria Offshore Oil and Gas Production Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Nigeria Offshore Oil and Gas Production Market

Nigeria Offshore Oil and Gas Production Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 34.18 Billion |

| Market Size by 2031 | US$ 47.03 Billion |

| Global CAGR (2023 - 2031) | 4.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Nigeria

|

| Market leaders and key company profiles |

Nigeria Offshore Oil and Gas Production Market Players Density: Understanding Its Impact on Business Dynamics

The Nigeria Offshore Oil and Gas Production Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Nigeria Offshore Oil and Gas Production Market are:

- TotalEnergies SE

- CNOOC Ltd

- Shell Plc

- Chevron Corporation

- ExxonMobil Corporation

- Africa Oil Corp.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Nigeria Offshore Oil and Gas Production Market top key players overview

Nigeria Offshore Oil and Gas Production Market News and Recent Developments

The Nigeria offshore oil and gas production market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- TotalEnergies, with its partners, announced the start of production from the Akpo West field on the PML2 license in Nigeria. Akpo West, located 135 km off the coast, is tied back to the Akpo Floating Production Storage and Offloading (FPSO) facility that started-up in 2009. The facility produced 124,000 barrels of oil equivalent per day in 2023. Akpo West is expected to add 14,000 barrels of condensate production per day by mid-2024, to be followed by up to 4 million cubic meters of gas per day by 2028. (Source: TotalEnergies, Press Release, July 2024)

Nigeria Offshore Oil and Gas Production Market Report Coverage and Deliverables

The “Nigeria Offshore Oil and Gas Production Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Nigeria offshore oil and gas production market size and forecast at country levels for all the key market segments covered under the scope

- Nigeria offshore oil and gas production market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Nigeria offshore oil and gas production market analysis covering key market trends, country framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Nigeria offshore oil and gas production market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Partnership, business expansion, agreements, and investments are the key strategies adopted by the players in Nigeria offshore oil and gas production market.

Increasing role of natural gas in the energy transition targets of Nigeria is expected to be the key trend for the Nigeria offshore oil and gas production market.

Increase in development and rise in need for natural gas infrastructure are expected to be the key opportunities in Nigeria offshore oil and gas production market.

TotalEnergies SE, CNOOC Ltd, Shell Plc, Chevron Corporation, ExxonMobil Corporation, Africa Oil Corp., Nigerian National Petroleum Corporation, Lekoil Nigeria Ltd., Pinnacle Oil and Gas Limited, and Midwestern Oil and Gas Company Limited are the key market players operating in the Nigeria offshore oil and gas production market.

Growing developments in the offshore oil and gas industry and government initiatives towards new offshore drilling and development projects are anticipated to be the key drivers behind the Nigeria offshore oil and gas production market growth during the forecast period.

Trends and growth analysis reports related to Energy and Power : READ MORE..

The List of Companies - Nigeria Offshore Oil and Gas Production Market

- TotalEnergies SE

- CNOOC Ltd

- Shell Plc

- Chevron Corporation

- ExxonMobil Corporation

- Africa Oil Corp.

- Nigerian National Petroleum Corporation

- Lekoil Nigeria Ltd.

- Pinnacle Oil and Gas Limited

- Midwestern Oil and Gas Company Limited

Get Free Sample For

Get Free Sample For