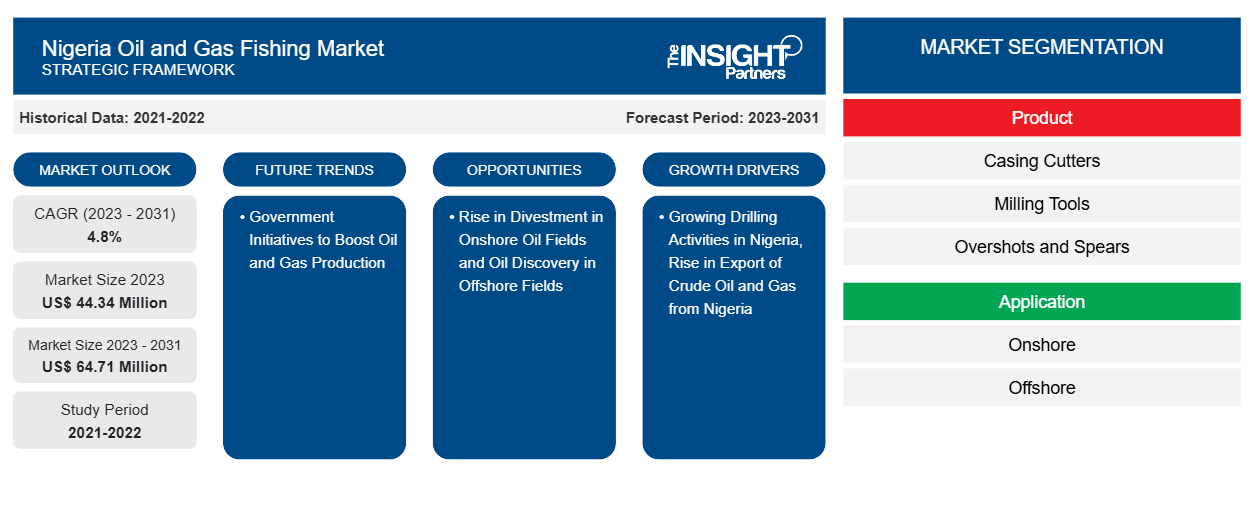

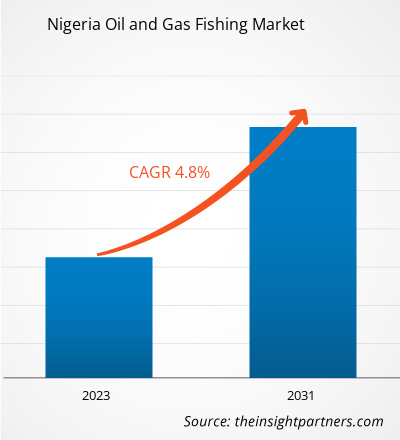

The Nigeria oil and gas fishing market size is projected to reach US$ 64.71 million by 2031 from US$ 44.34 million in 2023. The market is expected to register a CAGR of 4.8% during 2023–2031. Government initiatives to boost oil and gas production are likely to remain key trends in the market.

Nigeria Oil and Gas Fishing Market Analysis

The oil & gas sector is experiencing substantial investments from the government, with many planned projects in the development stages. This will remain steady, specifically with the government initiatives and financing for oil & gas infrastructure development. There is a continuous rise in drilling activities since the oil & gas sector is well-positioned to serve the growing requirements of Nigeria.

Growing oil & gas exploration and production and the rising number of drilling activities are major driving factors for the Nigeria oil and gas fishing market. In addition, an increase in initiatives toward well maintenance is anticipated to support the growth of the Nigeria oil and gas fishing market.

Nigeria Oil and Gas Fishing Market Overview

In the context of oilfields and gas plants, fishing relates to the recovery of unwanted objects or materials left in the wellbore. While drilling, equipment such as tools, drill bits, and casing might get trapped or lost owing to unfavorable well conditions and mechanical breakdowns. Fishing techniques primarily help recover lost or stuck objects in the wellbore.

Major stakeholders in the Nigeria oil & gas fishing market ecosystem are raw material suppliers/distributors, hardware assemblies/fishing product manufacturers, and end users. A few popular oil & gas fishing product manufacturers and service providers are Archer Nigeria Limited, Baker Hughes Incorporated, Halliburton Company, Weatherford International PLC., Equity Petroleum Services Nigeria Ltd. NOV Inc., Schlumberger Ltd., Tecon Oil Services Ltd., Samtex Oilfield Services Nigeria Limited, and Uniterm Nigeria Limited, among others.

The ecosystem of the Nigeria oil & gas fishing market begins with the production and distribution of raw materials such as iron and steel. The fishing product manufacturers then assemble the manufactured parts to form fishing tools, which are then tested. Fishing product providers are focused on high-quality manufacturing of premium-grade oil & gas field equipment that surpasses international standards. This phase is followed by the supply of the oil & gas fishing products to the oilfield and gas plant operator companies. The major end-users of oil & gas fishing products are various oil fields and gas fields. The mounting number of oil & gas drilling activities in the crude oil & gas exploration industry and the continuously developing offshore oil & gas sector are among the major factors driving the oil & gas fishing market in Nigeria.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nigeria Oil and Gas Fishing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nigeria Oil and Gas Fishing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Nigeria Oil and Gas Fishing Market Drivers and Opportunities

Growing Drilling Activities in Nigeria

Nigeria, an oil and gas-rich country in Africa, produces crude oil daily from onshore and offshore sources for export; it generates more than 80% of its foreign currency from oil. To maintain steady revenue, the number of operational oil rigs is rapidly increasing across the country. As per the monthly report from the Organization of Petroleum Exporting Countries, as of February 2024, the number of operational oil drilling rigs across Nigeria increased to 30 as compared to 8 and 10 rigs in 2021 and 2022, respectively. In addition, according to the Nigerian Upstream Petroleum Regulatory Commission, the number of oil drilling rigs in Nigeria increased by more than 250% over the last three years. Moreover, the oil & gas industry in Nigeria has set targets to increase production of crude oil to 2.6 million barrels per day by 2026 from the production level of ~1.5 million barrels per day in 2023. This gap between actual oil production and technical potential has created an investment opportunity for investors as well as the government of Nigeria to develop additional sources of revenue through offshore oil and gas production, addressing the current foreign exchange gap and strengthening its economic resilience. Thus, the growing drilling activities in Nigeria boosts oil and gas production, which results in a rise in fishing services or activities to recover unwanted material or components stuck in the well during drilling activities, which drives the Nigeria oil and gas fishing market.

Rise in Divestment in Onshore Oil Fields and Oil Discovery in Offshore Fields

Recent divestment in the onshore oil & gas sector in Nigeria resulted in the decline of production and increased demand for cleaning oil and gas assets or unwanted material stuck in the wells to ensure their viability for the long term. The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) offered the short-term option to make a faster exit for oil majors by cleaning or paying to clean the assets such as oil and gas wells and related infrastructure with the aim of protecting environment, local communities, and extending the life of the asset.

Nigeria Oil and Gas Fishing Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Nigeria oil and gas fishing market analysis are product and application.

- Based on product, the Nigeria oil and gas fishing market is segmented into casing cutters, milling tools, overshots and spears, fishing jars, and others. The overshots and spears segment held the largest market share in 2023.

- The Nigeria oil and gas fishing market, on the basis of application, is bifurcated into onshore and offshore. The offshore segment held a larger share of the market in 2023.

Nigeria Oil and Gas Fishing Market Share Analysis by Geography

The geographic scope of the Nigeria oil and gas fishing market report offers a detailed analysis of Nigeria.

Nigeria is one of the largest oil and gas producers in Africa. As per CIA World Factbook, Nigeria's crude oil export consumers are China, India, the US, Spain, Brazil, France, and the Netherlands. The country's energy transition is one of the major concerns for the government of Nigeria. Striving policy reforms such as the elimination of petrol subsidy, the introduction of the Presidential Compressed Natural Gas Initiative, and strategic collaborations with state parties and corporate objects aim at fortifying a sustainable energy future for Nigeria. These strategic alliances were a persistent theme at COP28.

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has commenced the 2024 Licensing Round during the Offshore Technology Conference in Houston, Texas. This is one of the major steps taken by Nigeria's government to develop its oil & gas sector and draw the attention of international stakeholders. The Licensing Round provides exploration blocks with substantial economic capability, reinforced by a regulatory framework concentrated on the policies under the Petroleum Industry Act 2021.

Nigeria Oil and Gas Fishing Market Regional Insights

The regional trends and factors influencing the Nigeria Oil and Gas Fishing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Nigeria Oil and Gas Fishing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Nigeria Oil and Gas Fishing Market

Nigeria Oil and Gas Fishing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 44.34 Million |

| Market Size by 2031 | US$ 64.71 Million |

| Global CAGR (2023 - 2031) | 4.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Nigeria

|

| Market leaders and key company profiles |

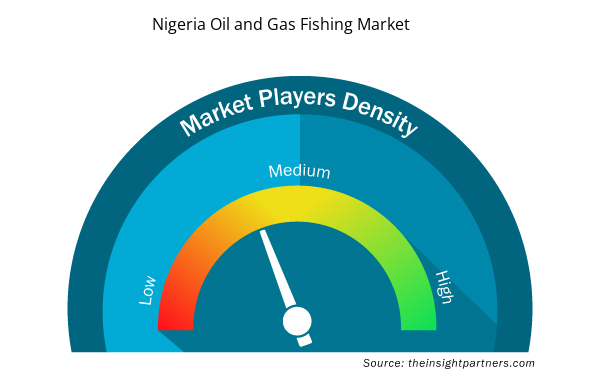

Nigeria Oil and Gas Fishing Market Players Density: Understanding Its Impact on Business Dynamics

The Nigeria Oil and Gas Fishing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Nigeria Oil and Gas Fishing Market are:

- Archer Nigeria Limited

- Baker Hughes Co

- Equity Petroleum Services Nigeria Ltd.

- NOV Inc.

- Schlumberger Ltd.

- Tecon Oil Services Ltd.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Nigeria Oil and Gas Fishing Market top key players overview

Nigeria Oil and Gas Fishing Market News and Recent Developments

The Nigeria oil and gas fishing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Nigeria oil and gas fishing market are listed below:

- Brown & Root Energy Services (BRES), a business unit of Halliburton Company (NYSE: HAL), has been selected by The Shell Petroleum Development Company of Nigeria Limited (SPDC) and its partners to work on the development of the first major offshore oil and gas facility for SPDC in Nigeria. The contract, valued at approximately US$ 300 million, was awarded to BRES after successfully completing a consolidation study for the project. [Source: Brown & Root Energy Services (BRES), Press Release, April 2024]

- Archer acquired 65% of Vertikal Services AS and strengthened its engineering services portfolio. Vertikal Service AS (Vertikal) is a Norwegian energy services company established in 2003. Based in Volda, Vertikal has 125 employees and provides inspection, installation, and maintenance services to energy customers in the MMO, drilling, offshore and onshore wind, and hydro segments. Vertikal performs work using advanced industrial rope access techniques on complex structures such as offshore and onshore wind turbines, hydropower stations, and offshore oil and gas installations. (Source: Archer Nigeria Limited, Press Release, July 2023)

Nigeria Oil and Gas Fishing Market Report Coverage and Deliverables

The “Nigeria Oil and Gas Fishing Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Nigeria oil and gas fishing market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Nigeria oil and gas fishing market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Nigeria oil and gas fishing market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Nigeria oil and gas fishing market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Government initiatives to boost oil and gas production to stimulate the Nigeria oil and gas fishing market growth in the coming years.

Overshots and Spears are expected to dominate the market over the forecast period.

Archer Nigeria Limited, Baker Hughes Co, Equity Petroleum Services Nigeria Ltd., NOV Inc., Schlumberger Ltd., Tecon Oil Services Ltd., Weatherford International Plc, Halliburton, Samtex Oilfield Services Nigeria Limited, and Uniterm Nigeria Limited are the key market players operating in the Nigeria oil and gas fishing market.

Growing drilling activities in Nigeria and rise in export of crude oil and gas from Nigeria are contributing to the growth of the Nigeria oil and gas fishing market.

Rise in divestment in onshore oil fields and oil discovery in offshore fields is expected to be the key opportunity in the market.

Trends and growth analysis reports related to Energy and Power : READ MORE..

The List of Companies - Nigeria Oil and Gas Fishing Market

- Archer Nigeria Limited

- Baker Hughes Co

- Equity Petroleum Services Nigeria Ltd.

- NOV Inc.

- Schlumberger Ltd.

- Tecon Oil Services Ltd.

- Weatherford International Plc

- Halliburton

- Samtex Oilfield Services Nigeria Limited

- Uniterm Nigeria Limited

Get Free Sample For

Get Free Sample For