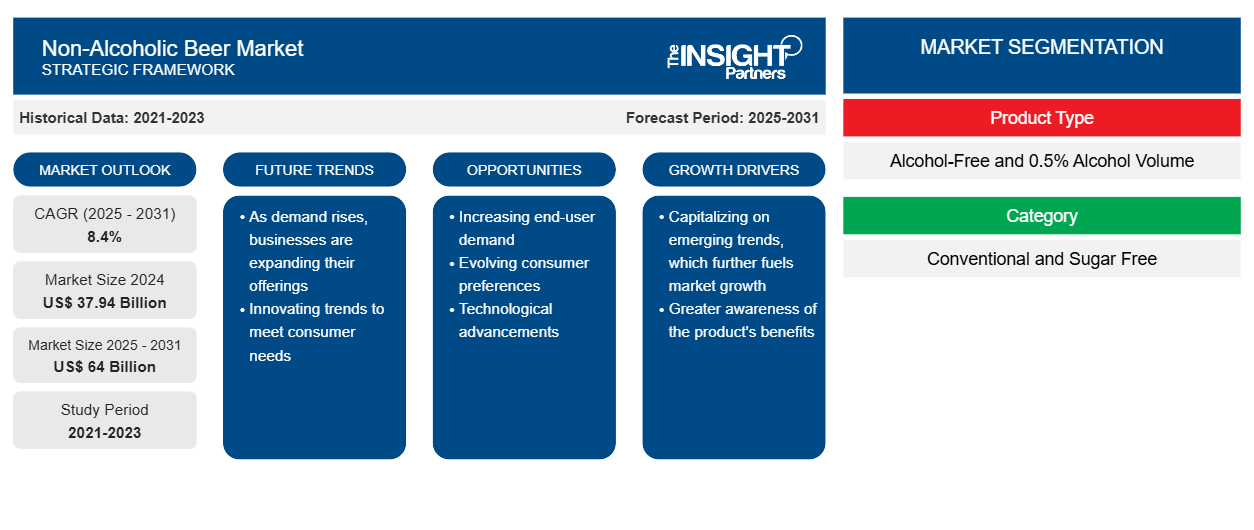

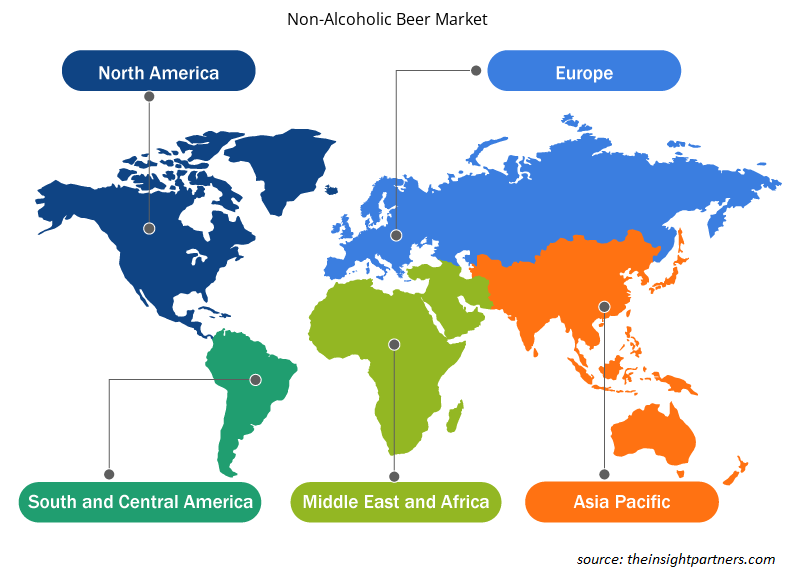

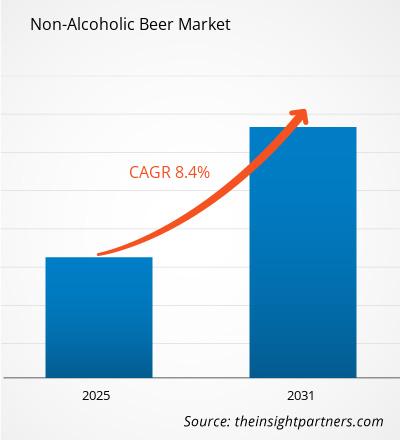

The Non-Alcoholic Beer Market size is projected to reach US$ 64 billion by 2031 from US$ 35 billion in 2023. The market is expected to register a CAGR of 8.4% in 2023–2031. Expanding target demographics including athletes & social drinkers and surging demand from developing economies are likely to remain key non-alcoholic beer Market trends.

Non-Alcoholic Beer Market Analysis

Over the past few years, awareness regarding health and nutrition has increased significantly. Due to hectic working schedules and busy lifestyles, people cannot concentrate on their health and fitness. This has led to various health issues such as diabetes, obesity, skin diseases, eye problems, heart diseases, and cancer. The growing prevalence of such diseases has increased health awareness among consumers. Consumers are increasingly spending on health-boosting products to reduce the risk of chronic diseases. According to the US Center for Medicare and Medicaid Services (CMS), healthcare spending in the US accounted for US$ 4.1 trillion, up by 9.7% from the previous year. People are increasingly spending on nutrient-enriched food and beverages to boost their health. This factor has created a massive demand for healthy beverages.

Non-Alcoholic Beer Market Overview

Non-alcoholic beer mimics the taste and appearance of traditional beer but significantly lower alcohol content. It is produced through a brewing process similar to regular beer, including the fermentation of malted beer, including the fermentation of malted barley, hops, water, and yeast. However, techniques like vacuum distillation or reserve osmosis remove most alcohol, leaving behind the beer's flavor and aroma. Shifting consumer preferences and adopting a health-conscious lifestyle contribute to the market's growth. Key players in the market are developing new products to cater to the growing consumer demand and expand its product portfolio. Further, the non-alcoholic beer market has seen innovation in flavor profiles and marketing strategies appealing to a diverse demographic, including athletes, pregnant women, and individuals looking to reduce alcohol consumption. These factors are expected to propel the market demand.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Non-Alcoholic Beer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Non-Alcoholic Beer Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Non-Alcoholic Beer Market Drivers and Opportunities

Strategic Initiatives by Key Players to Favor Market

The rising popularity of functional and non-alcoholic beer has encouraged manufacturers to formulate products with the characteristics of both drinks. For instance, in 2022, Constellation Brands, Inc. launched Corona Sunbrew 0.0% with alcohol i.e., a non-alcoholic beer added with 30% of the daily value of Vitamin D per 330 mL serving in Canada.

Rising Innovation in Flavors

Rising demand for healthy alternatives has resulted in key players in the market innovating their products to lunch products with different flavors. For instance, in September 2023, Polish brewer Warka collaborated with CANPACK to launch an alcohol-free canned beverage. Warka Energy 0.0% is a new subbrand that combines non-alcoholic beer with lemonade, natural caffeine, and ginseng extract. Such innovations have created opportunities for the non-alcoholic beer market.

Non-alcoholic Beer Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Non-alcoholic Beer Market analysis are product type, packaging type and distribution channel.

- Based on product type, the non-alcoholic beer market is divided into alcohol-free and 0.5% alcohol by volume.

- By packaging type, the market is segmented into bottles and cans.

- In terms of distribution channel, the market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The specialty stores segment dominated the market in 2023.

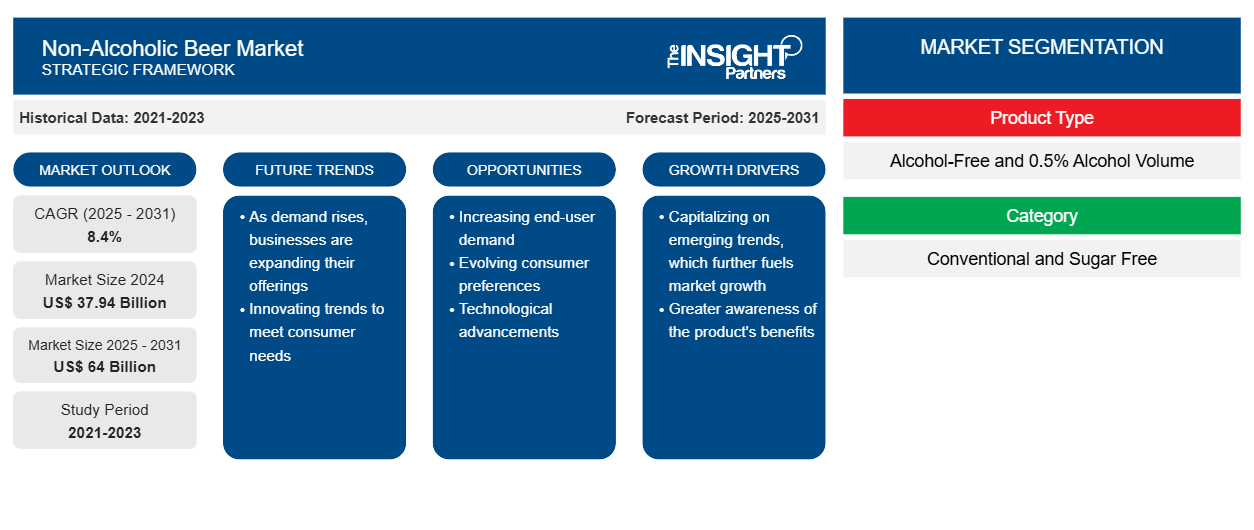

Non-alcoholic Beer Market Share Analysis by Geography

The geographic scope of the non-alcoholic beer market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the non-alcoholic beer market. North America is a significant region for the non-alcoholic beer market due to the increasing number of individuals opting for healthier alternatives. According to the Bacardi Cocktail Trends report in January 2022, in partnership with The Future Laboratory, approximately 58% of consumers globally are shifting to non-alcoholic and Low Alcoholic Volume (ABV) cocktails and beverages. With consumers' expanding acceptance of the non-alcoholic category, manufacturers in the market are offering innovative products and have been modernizing the current product portfolio, which is likely to increase future growth. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Non-alcoholic Beer Non-Alcoholic Beer Market Regional Insights

The regional trends and factors influencing the Non-Alcoholic Beer Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Non-Alcoholic Beer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Non-Alcoholic Beer Market

Non-Alcoholic Beer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 37.94 Billion |

| Market Size by 2031 | US$ 64 Billion |

| Global CAGR (2025 - 2031) | 8.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

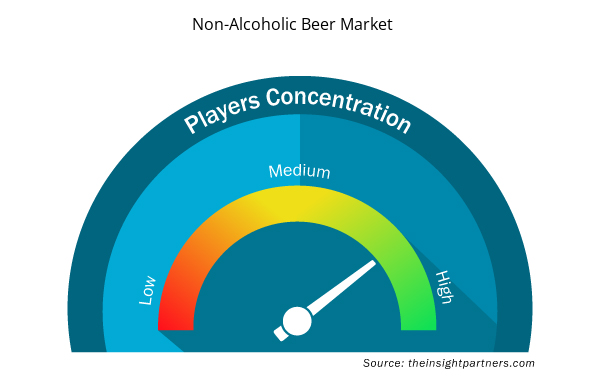

Non-Alcoholic Beer Market Players Density: Understanding Its Impact on Business Dynamics

The Non-Alcoholic Beer Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Non-Alcoholic Beer Market are:

- UHeineken International B.V.

- Weihenstephan

- Athletic Brewing Company

- Radeberger Gruppe KG

- UNITED BREWERIES LTD

- Anheuser-Busch InBev

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Non-Alcoholic Beer Market top key players overview

Non-alcoholic Beer Market News and Recent Developments

The non-alcoholic beer market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for speech and language disorders and strategies:

- In 2023, Molson Coors announced the launch of Staropramen 0.0, an alcohol-free beer. The product will be available in 330ml bottles and multipacks across its retail channel—the launch aimed to expand its product portfolio in the non-alcoholic beer segment.

- In 2023, AB InBev announced an investment of US$ 32.70 million in technology upgrades to expand their no-alcohol and low-alcohol brewing capabilities.

Non-alcoholic Beer Market Report Coverage and Deliverables

The “Non-alcoholic Beer Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Get Free Sample For

Get Free Sample For