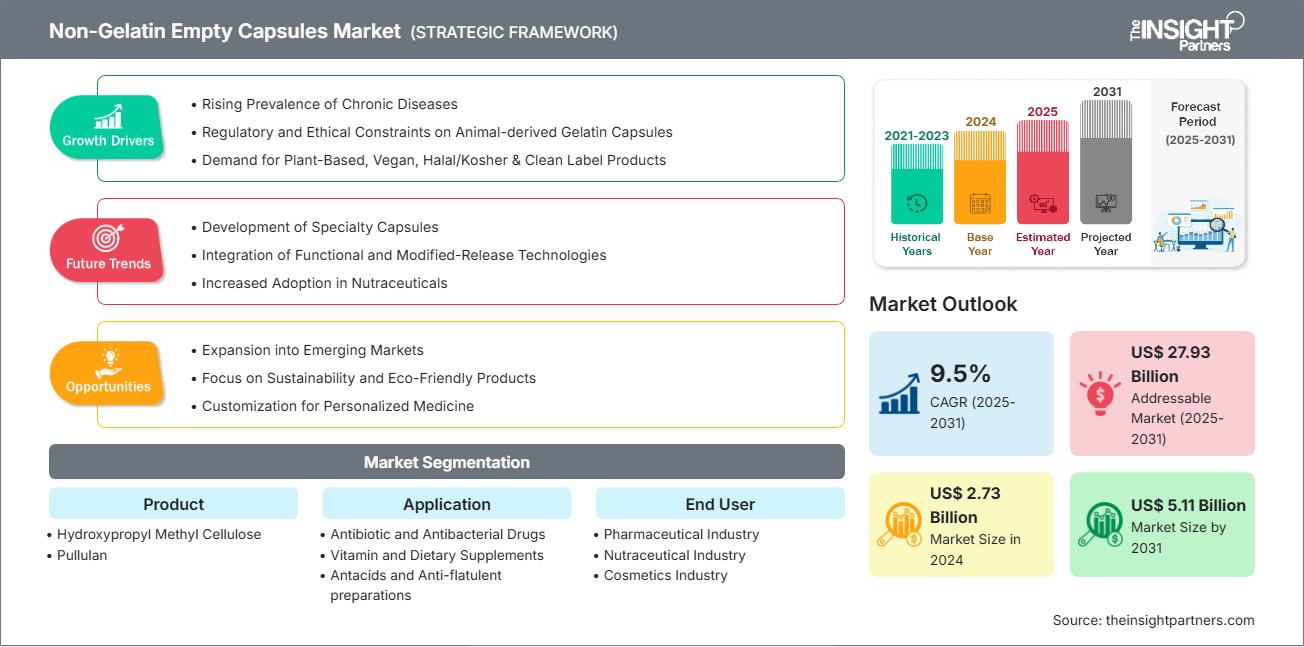

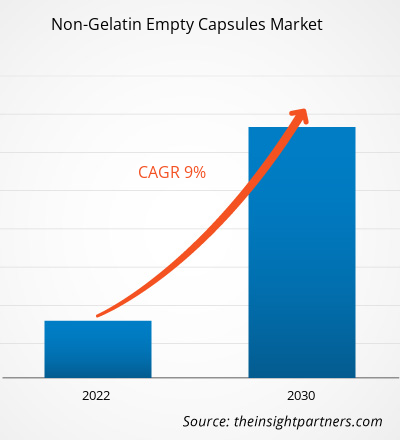

The Non-Gelatin Empty Capsules Market size is projected to reach US$ 5.11 billion by 2031 from US$ 2.73 billion in 2024. The market is expected to register a CAGR of 9.5% during 2025–2031.

Non-Gelatin Empty Capsules Market Analysis

The global non-gelatin empty capsules market is impacted by the rising need for vegetarian, vegan, and allergen-free products, the growing consumption of nutraceuticals and pharmaceuticals, the continuous rise of chronic diseases, and the innovative technologies for capsule delivery. Besides, sustainability issues and cultural/religious plant-based choices also contribute to the impact.

Non-Gelatin Empty Capsules Market Overview

The pharmaceutical and nutraceutical markets are the predominant areas where non-gelatin capsules comprising Hydroxypropyl Methylcellulose and pullulan are preferred. The emerging trend of veganism, the accompaniment of these restrictions, and culture are the major factors driving the demand for such capsules. Also, the enhancement in technology regarding capsules, along with the backing from the regulations, is gradually opening up the non-gelatin capsules market. In North America and APAC, the market is developing due to infrastructure and consumer awareness.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Non-Gelatin Empty Capsules Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Non-Gelatin Empty Capsules Market Drivers and Opportunities

Market Drivers:

- Rising Prevalence of Chronic Diseases: The growing number of people suffering from chronic diseases is increasing the need for supplements and drugs, thereby promoting the use of non-gelatin capsules as an alternative to those made of gelatin.

- Regulatory and Ethical Constraints on Animal-derived Gelatin Capsules: The stringent regulations and the moral issues related to animal gelatin compel the industry players to prefer non-gelatin capsules as a solution for compliance and catering to up-to-date customer preferences.

- Demand for Plant-Based, Vegan, Halal/Kosher & Clean Label Products: The trend of consumers demanding ethical, religious, and clean-label products is the main factor driving the usage of non-gelatin capsules obtained from plant-based or microbial sources.

Market Opportunities:

- Expansion into Emerging Markets: Emerging markets with enhanced healthcare infrastructure present significant growth opportunities for the non-gelatin capsule industry, as increasing health consciousness and the rising consumption of dietary supplements continue to reinforce each other.

- Focus on Sustainability and Eco-Friendly Products: Concerns regarding the environment are forcing the manufacturers to come up with non-gelatin capsules that are biodegradable, sustainable.

- Customization for Personalized Medicine: The field of personalized medicine is advancing, and in this connection, there are opportunities to produce non-gelatin capsules with the specific characteristics required for different patients, thereby enhancing the therapeutic results and the acceptance of the users.

Non-Gelatin Empty Capsules Market Report Segmentation Analysis

The non-gelatin empty capsules market is segmented into distinct categories to provide a clearer understanding of its operations, growth potential, and current trends. Below is the standard segmentation approach used in industry reports:

By Type:

- Hydroxypropyl Methyl Cellulose (HPMC): HPMC capsules are becoming popular as they are made from plants, which is in line with the trend of consumers demanding more vegetarian and vegan products. They remain stable under different conditions and are suitable for controlled-release formulations, making them a first choice in pharmaceuticals and nutraceuticals.

- Pullulan: Pullulan capsules are commonly chosen for their clean-label nature as they are free of preservatives and are a source of no allergens for sensitive consumers. Their incorporation in high-end nutraceuticals is becoming more widespread, which is mainly due to the increasing trend of plant-based and natural supplements consumption.

By Application:

- Antibiotic and Antibacterial Drugs

- Vitamin and Dietary Supplements

- Antacids and Anti-flatulent preparations

- Others

By End User:

- Pharmaceutical Industry

- Nutraceutical Industry

- Cosmetics Industry

- Research Laboratories

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The regional trends and factors influencing the Non-Gelatin Empty Capsules Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Non-Gelatin Empty Capsules Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Non-Gelatin Empty Capsules Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 2.73 Billion |

| Market Size by 2031 | US$ 5.11 Billion |

| Global CAGR (2025 - 2031) | 9.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Non-Gelatin Empty Capsules Market Players Density: Understanding Its Impact on Business Dynamics

The Non-Gelatin Empty Capsules Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Non-Gelatin Empty Capsules Market top key players overview

Non-Gelatin Empty Capsules Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in South America, the Middle East, and Africa have untapped opportunities for non-gelatin empty capsules providers to expand.

The growth of the non-gelatin empty capsules market varies across regions due to factors such as rising healthcare awareness, aging population, dietary supplement demand, and pharmaceutical industry expansion. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

- Key Drivers: Consumer awareness is at a very high level, with strict regulations and a strong inclination towards plant-based products.

- Trends: Use of plant-based capsules in the pharmaceutical and nutraceutical industries.

2. Europe

- Market Share: Substantial market share

- Key Drivers: Implementation of strict regulations concerning animal-derived products and a substantial number of vegetarians and vegans.

- Trends: Consumer loyalty to sustainable and ethical products.

3. Asia Pacific

- Market Share: Fastest-growing region with a rising market share every year

- Key Drivers: An enormous population that is becoming more and more health-conscious, the middle class that is getting larger, and the disposable incomes that are on the rise.

- Trends: Growing capsule manufacturing capabilities.

4. South and Central America

- Market Share: Growing market with steady progress

- Key Drivers: The awareness of nutraceuticals and wellness supplements has been increasing among consumers.

- Trends: More focus on healthcare infrastructure development.

5. Middle East and Africa

- Market Share: Although small, it is growing quickly

- Key Drivers: The rising government investment in the pharmaceutical sector, and the increasing incidence of chronic diseases.

- Trends: Rise in the requirement for oral drug delivery systems.

Non-Gelatin Empty Capsules Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as ACG and Natural Capsules Limited. Regional and niche providers add to the competitive landscape across regions.

The high level of competition urges companies to stand out by offering:

- Advanced Products

- Product Approvals

- Compliance with Regulatory Guidelines

Opportunities and Strategic Moves

- The worldwide non-gelatin empty capsule industry is benefiting from an increasing demand for vegan, halal, and kosher supplements as a result of ethical consumer preferences.

- Firms allocate resources to research and development of plant-based raw materials, product innovation, and broadening of the distribution network to attract the growing customer base and abide by the regulations.

Other companies analyzed during the course of research:

- Medi‑Caps Ltd.

- Sunil Healthcare Limited

- Farmacapsulas S.A.

- Shanxi Guangsheng Medicinal Capsule Co., Ltd.

- United Capz Pvt. Ltd

- Roxlor LLC

- Snail Pharma Industry Co., Ltd.

- Nectar Lifesciences Ltd.

Non-Gelatin Empty Capsules Market News and Recent Developments

- Qualicaps Announces International Introduction of the QualiCaps Qwv-150: The Next Evolution in Efficient Capsule Processing. Qualicaps unveiled the Qwv-150, a revolutionary tw o-in-one capsule processing machine. Leading to the innovative Qwv-150, the new Qualicapstec technology merges the Visual Inspection and Weight Checking functions into a single, compact unit without interruption, which enhances operational efficiency and processing performance. The performance is complemented by higher ease of use and accuracy, while the processing capacity is considerably increased up to 150,000 capsules per hour

Non-Gelatin Empty Capsules Market Report Coverage and Deliverables

The "Non-Gelatin Empty Capsules Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Non-Gelatin Empty Capsules Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Non-Gelatin Empty Capsules Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Non-Gelatin Empty Capsules Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Non-Gelatin Empty Capsules Market

- Detailed company profiles

Frequently Asked Questions

What are the factors driving the non-gelatin empty capsules market?

Which are the leading players operating in the non-gelatin empty capsules market?

What would be the estimated value of the non-gelatin empty capsules market by 2031?

What is the expected CAGR of the non-gelatin empty capsules market?

Which region dominated the non-gelatin empty capsules market in 2024?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For