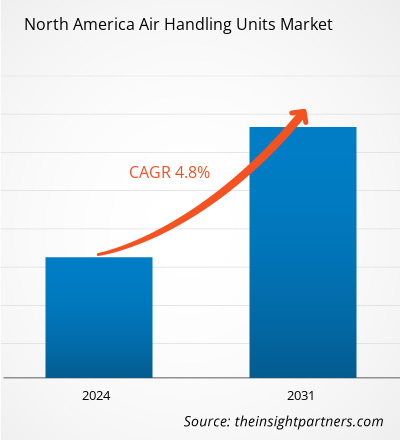

The North America air handling units market size is expected to reach US$ 4.65 billion by 2031 from US$ 3.20 billion in 2023. The market is estimated to record a CAGR of 4.8% from 2023 to 2031. The growing technological advancements are likely to bring in new trends in the market.

North America Air Handling Units Market Analysis

The North America air handling units market is predicted to witness strong growth due to the increasing demand for energy-efficient heating and cooling solutions in the region. As the unit is energy efficient and provides improved air quality, its demand is increasing across industries such as food processing, pharmaceuticals, and chemicals. Furthermore, the region is witnessing an increasing number of construction projects, which is expected to propel the demand for AHUs. For example, the construction of the Tampa Gas Worx Mixed-Use Community project—which involves the construction of a 20 ha mixed-use development in Ybor City, Tampa (Florida, US)—started in Q1 2023 with an aim to enhance residential, office, and retail facilities in the region. The project is expected to be completed by Q3 2026. Thus, the rising number of construction projects in the region is likely to create lucrative opportunities for the market. Moreover, the growing technological advancements in AHUs by integrating IoT, AI, and machine learning will further make the AHUs more cost-effective and energy-efficient, which will continue to propel the market growth.

North America Air Handling Units Market Overview

The air handling unit (AHU) is an essential component of a heating, ventilation, and air conditioning (HVAC) system. The AHU is crucial for conditioning and circulating air across a building or space. An AHU is often made out of a housing or cabinet that includes a blower or fan, heating or cooling elements (such as a coil/heat exchanger), air filters, and airflow dampers. The AHU is connected to ductwork, which distributes conditioned air throughout the building or space. The AHU may additionally include humidifiers, dehumidifiers, or air purification systems, depending on the specific requirements of a building or space.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Air Handling Units Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Air Handling Units Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Air Handling Units Market Drivers and Opportunities

Diversifying Applications Across Various Industries

AHUs efficiently regulate and circulate air within a building or other confined environment, leading to a rise in demand across various industries. AHUs are utilized in a number of industrial operations to control temperature, humidity, and air quality. They are widely used in pharmaceutical manufacturing, food processing, and other industries that demand precise environmental control. In the food and beverage processing industry, AHUs are utilized to provide accurate temperature control, humidity regulation, and air quality management, making the unit a crucial component in maintaining product quality, extending shelf life, reducing spoiling, and assuring consumer safety of the products. Also, clean rooms, which are highly controlled environments used in sectors such as semiconductor production, biotechnology, and pharmaceuticals, rely heavily on AHUs. The AHUs in these plants are required to maintain incredibly low humidity, temperature, and particle matter levels. In addition, laboratories require highly regulated settings to carry out tests and research. AHUs are used to keep temperatures and humidity consistent while also providing ventilation to prevent the accumulation of potentially harmful chemicals or pollutants. Furthermore, hospitals require high air quality to avoid the spread of infection and sickness. AHUs filter and circulate air throughout the facility, ensuring that patients and workers breathe clean, healthy air. Thus, as AHUs regulate the air quality and manage the temperature according to different industrial needs, their demand is increasing in various sectors.

Growing Number of Construction Projects

According to the International Monetary Fund, the US has the largest commercial property market in the world. In addition, the construction industry in Canada and Mexico is witnessing significant growth with the growing industrialization in the countries. Also, surging investments in the development of smart city initiatives are expected to fuel the growth of the construction industry in the country. A few of the mega-construction projects are listed below:

- Los Angeles plans to host the LA 2028 Summer Olympics. With this announcement, new facility construction began in 2023 and is expected to be completed by the first half of 2028. This vast project is focused on building housing for Olympians and facilities for the competition.

- The construction of Prince Edward County Memorial Hospital began in Q3 2024 and is expected to be completed in Q1 2028 in Prince Edward, Ontario. The project is aimed to enhance better healthcare facilities for people in the region.

- The construction of the South Capitol Street and M Street Mixed-Use Development project was initiated in Q2 2024 in Washington, DC, and is expected to be completed by Q4 2024. The project is aimed to provide better residential, retail, and office facilities in the city.

- Owing to the rise in tourism and upcoming Olympic events, several airport construction and terminal expansion activities are being undertaken in the US. The Port Authority of New York and New Jersey invested US$ 19 billion to build a new John F. Kennedy International Airport (JFK), recording a major transformation of one of the busiest airports in the US. The project has entered into the construction phase and is scheduled for completion by 2026.

Thus, the growing number of such high-end construction activities is expected to fuel the demand for AHUs in the region, as these units are used to adjust the temperature and humidity and provide comfortable and refreshing air-conditioned air in these arenas.

North America Air Handling Units Market Report Segmentation Analysis

Key segments that contributed to the derivation of the North America Air Handling Units Market analysis are configuration, capacity, type, and application.

- Based on configuration, the North America air handling units market is segmented into packaged air handling units, modular air handling units, custom air handling units, rooftop mounted air handling units, and others. The packaged air handling units segment dominated the market in 2023.

- Based on capacity, the North America air handling units market is segmented into below 5,000 m3/h, 5,001–30,000 m3/h, 30,001–50,000 m3/h, and above 50,001 m3/h. The below 5,000 m3/h segment dominated the market in 2023.

- Based on type, the North America air handling units market is segmented into AHU with heat recovery and AHU without heat recovery. The AHU with heat recovery segment dominated the market in 2023.

- Based on application, the market is segmented into commercial, industrial, and residential. The commercial segment dominated the market in 2023.

North America Air Handling Units Market Share Analysis by Geography

The North America air handling units market is segmented into the US, Canada, and Mexico. The US dominated the market in 2023. It is a developed country in terms of infrastructure, modern technology, standard of living, and many other factors. Various industries in the region are witnessing tremendous growth. In 2023, North America accounted for 53.3% of global pharmaceutical revenues, compared to 22.7% in Europe. According to IQVIA (MIDAS May 2024), the US market accounted for 67.1% of sales of new medications launched between 2018 and 2023, compared to 15.8% in Europe (top five markets). Thus, the growing pharmaceutical industry in the region will spike the demand for AHUs to protect drugs and medications.

North America Air Handling Units Market Regional Insights

The regional trends and factors influencing the North America Air Handling Units Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses North America Air Handling Units Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for North America Air Handling Units Market

North America Air Handling Units Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.20 Billion |

| Market Size by 2031 | US$ 4.65 Billion |

| Global CAGR (2023 - 2031) | 4.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Configuration

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

North America Air Handling Units Market Players Density: Understanding Its Impact on Business Dynamics

The North America Air Handling Units Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the North America Air Handling Units Market are:

- Carrier Global Corp

- Air Wise Sales Inc.

- Daikin Industries Ltd

- Johnson Controls International Plc

- Haakon Industries

- VTS Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the North America Air Handling Units Market top key players overview

North America Air Handling Units Market News and Recent Developments

The North America air handling units market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the North America air handling units market are listed below:

- Carrier expanded its HVAC products made in India with a range of air handling units (AHUs) and fan coil units (FCUs). These units are crafted to meet the diverse needs of India’s commercial buildings, providing custom solutions for healthy indoor environments with high-efficiency air filtering needs.

(Source: Carrier, Press Release, January 2024)

- Daikin plans to upgrade its air handling units (AHU) product portfolio by introducing advanced ventilation solutions tailored to the 'compact' market segment. As part of this strategy, Daikin is pleased to announce the launch of a new AHU range: Compact L.

(Source: Daikin, Press Release, October 2024)

North America Air Handling Units Market Report Coverage and Deliverables

The "North America Air Handling Units Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- North America air handling units market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- North America air handling units market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- North America air handling units market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the North America air handling units market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Queue Management System Market

- Foot Orthotic Insoles Market

- Aerosol Paints Market

- Europe Tortilla Market

- Battery Testing Equipment Market

- Vision Guided Robotics Software Market

- Artificial Intelligence in Defense Market

- Asset Integrity Management Market

- Diaper Packaging Machine Market

- Integrated Platform Management System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

US is anticipated to grow at the fastest CAGR over the forecast period.

The growing technological advancements are likely to be the future trends of the North America air handling units market.

The packaged air handling units segment segment led the North America air handling units market with the highest share in 2023.

The North America air handling units market is expected to reach US$ 4.65 Billion by 2031.

The key players holding majority shares in the North America air handling units market include Daikin Industries Ltd, Carrier Global Corp, Trane Technologies Plc, Johnson Controls International Plc, and LG Electronics Inc.

The North America air handling units market was estimated to be valued at US$ 3.20 billion in 2023 and is anticipated to grow at a CAGR of 4.8% over the forecast period.

Pressing need for energy-efficient solution and diversifying applications across various industries drive the adoption of North America air handling units solutions.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - North America Air Handling Units Market

- Carrier Global Corp

- Air Wise Sales Inc.

- Daikin Industries Ltd

- Johnson Controls International Plc

- Haakon Industries

- VTS Group

- Trane Technologies Plc

- TROX GmbH

- WOLF Anlagen-Technik GmbH & Co. KG

- Rheem Manufacturing Co

- Munters Group AB

- Sabiana SpA

Get Free Sample For

Get Free Sample For