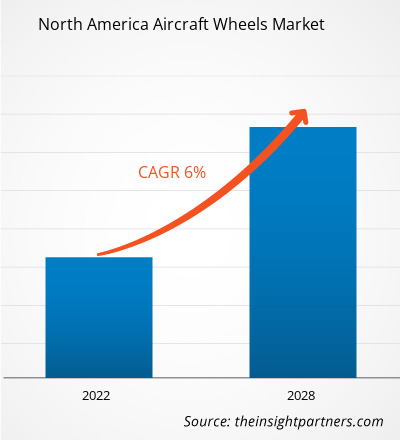

The aircraft wheels market in North America is expected to grow from US$ 603.49 million in 2021 to US$ 906.17 million by 2028; it is estimated to grow at a CAGR of 6.0% from 2021 to 2028.

The demand for aircraft is rising across the world owing to the rapidly growing airline industry in the developing economies due to continuously increasing demand for passenger airline services. In addition, the aviation industry is undergoing expansion at a rapid pace, recording significant production volumes and deliveries of aircraft (commercial and military) fleets. Specifically, the commercial aviation industry has witnessed tremendous growth in the past few years with the emergence of new low-cost carriers (LCCs) and fleet expansion strategies adopted by the full-service carriers (FSCs). Further, commercial aviation is surging owing to the mounting number of air travel passengers and aircraft procurements. This surge in aircraft production boosts the demand for aircraft wheels. The production volumes of aircraft are continuously rising to bridge the gap between its demand and supply. For instance, Boeing and Airbus received new aircraft orders of 1,008 and 831 in 2018 and 2019, respectively and delivered 806 and 800 aircraft in the given respective years. However, in 2020, the number of aircraft orders and deliveries dipped due to the COVID-19 outbreak. On the other side, with the huge backlogs of aircraft delivery and with the fresh receiving orders, the North America Aircraft Wheels market is expected to pull back its growth in the post-pandemic era. Furthermore, the demand for line fit wheels is growing with the rising production of aircraft as the main landing gear system consists of multiple wheels. The detailed chart of required wheels for the respective aircraft model is given below in Table 1. Also, Table 2 highlights the count of orders and deliveries of Airbus and Boeing in 2018, 2019, and 2020 along with the total production of military aircraft in the given years.

The US is the worst-hit country in North America. The continuous growth of infected individuals has led the government to impose lockdown across the nation's borders during Q2 and Q3 of 2020. The majority of the manufacturing plants either were temporarily shut or operated with minimum staff; the aircraft OEMs and aircraft components and associated product manufacturers witnessed disruption in supply chain; these are some of the North American countries' critical issues. Since the US has a larger density of aircraft manufacturers and aircraft associated technology and component manufacturers, followed by Canada and Mexico. The outbreak of the virus has severely affected the production of each. The lower number of manufacturing staff has resulted in lesser production quantity. From the aircraft OEM’s perspective, Boeing, the aviation giant in the region, has witnessed a significant fall in orders and production, which is one of the key restraining factors for the aircraft line fit wheels market. Apart from Boeing, several other aircraft OEMs such as Bombardier, Textron, and Gulfstream, among others, also experienced tremors of COVID–19 on their orders and production lines. From the supply side, the region has higher numbers of aircraft wheels market players. The restricted workforce, disruption in the supply chain, and limited volumes of orders have sternly shaken the aircraft wheels market players in the region.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America aircraft wheels market. The North America aircraft wheels market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Aircraft Wheels Market Segmentation

North America Aircraft wheels Market – By Type

- Nose Wheel

- Main Wheel

North America Aircraft Wheels Market – By Aircraft Type

- Fixed Wing Aircraft

- Rotary Wing Aircraft

- UAV

North America Aircraft Wheels Market – By Fit Type

- Line Fit

- Retro Fit

North America Aircraft Wheels Market – By End-user

- Military

- Commercial

North America Aircraft Wheels Market – By Country

- US

- Canada

- Mexico

North America Aircraft wheels market – Companies Mentioned

- Collins Aerospace

- Meggitt PLC

- Honeywell International Inc.

- Parker Hannifin Corporation

- BERINGER AERO

- Lufthansa Technik

- Grove Aircraft Landing Gear System Inc

- MATCO Manufacturing Inc

- NMG Aerospace

North America Aircraft Wheels Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 603.49 Million |

| Market Size by 2028 | US$ 906.17 Million |

| Global CAGR (2021 - 2028) | 6.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

- Collins Aerospace

- Meggitt PLC

- Honeywell International Inc.

- Parker Hannifin Corporation

- BERINGER AERO

- Lufthansa Technik

- Grove Aircraft Landing Gear System Inc

- MATCO Manufacturing Inc

- NMG Aerospace

Get Free Sample For

Get Free Sample For