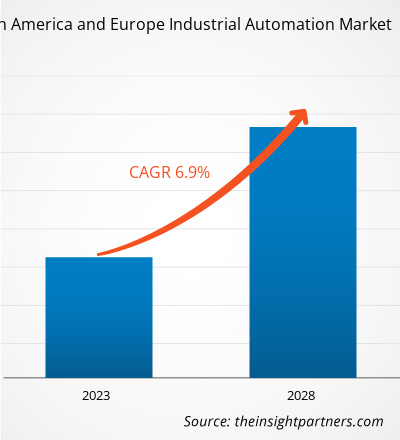

The North America and Europe industrial automation market is expected to grow from US$ 85.05 billion in 2022 to US$ 127.11 billion by 2028; it is estimated to grow at a CAGR of 6.9% from 2022 to 2028.

The rising adoption of machine vision systems for industrial automation is one of the major factors driving the industrial automation market across North America and Europe. Machine vision users and systems integrators have exploited better imaging, optics, illumination, and software for nearly 40 years. Even though machine vision is nearly a mature technology, lower component, software, and engineering costs, as well as increased simplicity of use and application expansion continue to drive machine vision acceptance across industries.

In 2021, due to the COVID-19 pandemic, manufacturers accelerated the deployment of machine vision technology for industrial automation to keep operations running effectively and meet the increasing demand.

Additionally, logistics-related apps experienced a rise due to a surge in online purchase volumes. Imaging systems in retail distribution centers and automated warehouse storage and retrieval systems, as well as PPE-related items, such as face masks, face shields, protective garments, and respirators, were among the products that gained immense traction. Other factors influencing the uptake of machine vision systems for industrial automation include predictive maintenance, packaging inspection, automated barcode reading, product and component assembly, defect reduction, and 3D vision inspection.

The rise in investment by companies to develop new products through machine vision technology for industrial automation is further propelling the industrial automation market growth. For instance, in January 2022, the Khronos Group launched a new initiative with the European Machine Vision Alliance (EMVA) to produce an open, royalty-free API standard to regulate camera system runtimes in embedded, mobile, industrial, XR, automotive, and scientific industries. Thus, the rise in investments by companies is boosting the uptake of machine vision systems for industrial automation.

North America and Europe Industrial Automation Market: Key Players

ABB Ltd.; Schneider Electric SE; Siemens AG; Emerson Electric, Co.; and Rockwell Automation, Inc. are among the prominent players in the industrial automation market. The market is diversified with many players offering various products for implementing industrial automation catering to domestic and international demand. These companies have a diverse portfolio of industrial automation solutions offering industrial robots, sensors, machine vision systems and other components such as relays and switches. Major vendors for robotic systems are Yaskawa, ABB, Kuka, and Fanuc, while Teledyne, Siemens, Cognex, and Dalsa are among the key market players of machine vision systems. Sensor’s solutions are at the core of the industrial automation systems and the market is being catered by several prominent players in this space including Honeywell, Omron, Siemens, Sensata, Eaton, and Robert Bosch. Rockwell Automation, Siemens, Schneider, Eaton and ABB are the key vendors operating in the motors and drives segment.

North America and Europe Industrial Automation Market: by Component

Based on component, the North America and Europe industrial automation market is segmented into hardware and software. The hardware segment dominated the market with a larger industrial automation market share in 2021. Innovations in hardware are a prerequisite for complementing and fulfilling any significant technological development in the industry. The primary type of industrial hardware used for automation are motor & drives, sensors, robots, machine vision systems, and others. However, software segments is expected to account for a second largest industrial automation market share in the North America & Europe regions along with fastest growing CAGR during the forecast period.

Impact of COVID-19 Pandemic on North America and Europe Industrial Automation Market

Over the years, the industrial automation market has experienced a rise in adoption across all industries owing to rapid investments made by several governments to promote the adoption of automation. However, due to the sudden onset of the COVID-19 crisis, the manufacturing facilities of industrial automated solutions across the globe were adversely impacted, leading to low production volumes. Further, the demand for such solutions declined rapidly, owing to the temporary closure of end-use manufacturing and other retail outlets. The automotive sector recorded a 20% decline in manufacturing in 2020 owing to the spread of COVID-19. However, with the normalization of economic and manufacturing activities from Q3 of 2021, the adoption of automated solutions experienced a need to reduce human interactions across facilities, thereby enabling the market to revive from both the supply and demand sides in 2021.

North America and Europe Industrial Automation Market: Market Initiative

Market initiatives are strategies adopted by industrial automation market players to expand their footprint worldwide and meet the growing customer demand. The North America and Europe industrial automation market players are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings.

- In July 2022, ABB and SKF have announced that they are collaborating in the automation of manufacturing processes. Through this collaboration, the companies will identify and evaluate solutions to improve manufacturing capabilities.

- In June 2022, Siemens AG launched Siemens Xcelerator platform to accelerate digital transformation across different industrial facilities.

- In October 2020, Emerson Electric announced that it has completed the acquisition of Progea Group which is a provider of industrial internet of things (IIoT), plant analytics, human machine interface (HMI) and supervisory control and data acquisition (SCADA) technologies.

Thus, the abovementioned factors are expected to contribute to the North America and Europe industrial automation market growth.

North America and Europe Industrial Automation Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The North America and Europe industrial automation market is segmented into component, system, and end user. Based on component, the North America and Europe industrial automation market is categorized into hardware and software. By system, the North America and Europe industrial automation market is segmented into supervisory control and data acquisition, distributed control system, programmable logic control, and others. In terms of end user, the North America and Europe industrial automation market is segmented into oil & gas, automotive, food & beverage, chemical & materials, aerospace & defense, and others.

North America and Europe Industrial Automation Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 85.05 Billion |

| Market Size by 2028 | US$ 127.11 Billion |

| Global CAGR (2022 - 2028) | 6.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Smart Water Metering Market

- Excimer & Femtosecond Ophthalmic Lasers Market

- Microplate Reader Market

- Legal Case Management Software Market

- Green Hydrogen Market

- Ceramic Injection Molding Market

- Environmental Consulting Service Market

- Malaria Treatment Market

- Mail Order Pharmacy Market

- GMP Cytokines Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The North America and Europe industrial automation market is expected to be valued at US$ 85.05 billion in 2022

The driving factors impacting the North America and Europe industrial automation market are:

1. Rising Uptake of Automation Across Food & Beverage Industry

2. Increase in Machine Vision Systems Adoption for Industrial Automation

The future trend expected to positively impact the North America and Europe industrial automation market is surging demand for automation in the E-commerce industry

The key players holding the major market share of the North America and Europe industrial automation market are ABB Ltd.; Schneider Electric SE; Siemens AG; Emerson Electric, Co.; and Rockwell Automation, Inc.

The hardware segment led the North America and Europe industrial automation market in 2022.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - North America & Europe Industrial Automation Market

- ABB Ltd.

- Bosch Rexroth AG

- Emerson Electric Co.

- Hitachi Ltd.

- Honeywell International, Inc.

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

Get Free Sample For

Get Free Sample For