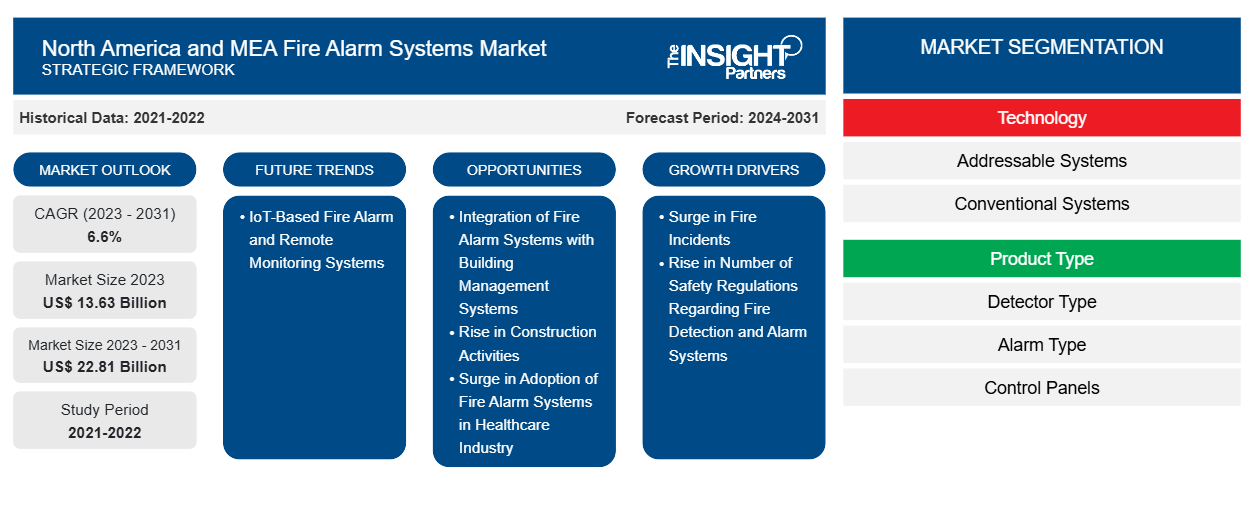

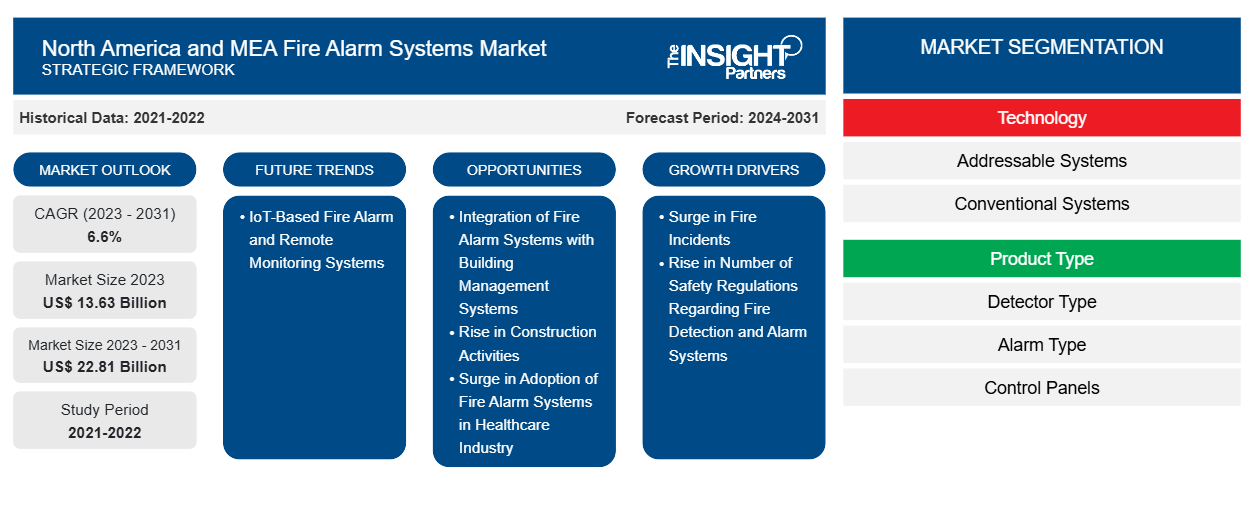

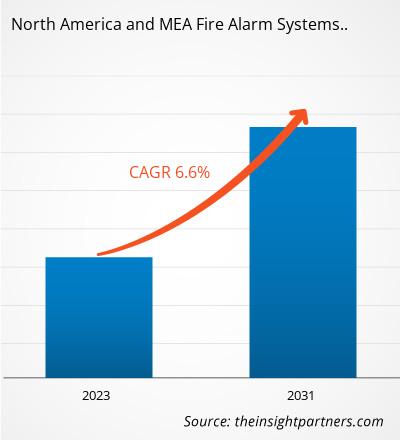

The North America and MEA fire alarm systems market size is expected to reach US$ 22.81 billion by 2031 from US$ 13.63 billion in 2023. The market is anticipated to record a CAGR of 6.6% from 2023 to 2031. IoT-based fire alarms and remote monitoring systems are likely to bring new trends to the market in the coming years.

North America and MEA Fire Alarm Systems Market Analysis

The North America and MEA fire alarm system market is predicted to witness significant growth during the forecast period owing to the rising number of fire incidents. In 2022, local fire departments responded to approximately 1.5 million fires in the US, according to the National Fire Protection Association (NFPA). These incidents resulted in 3,790 civilian deaths and 13,250 documented civilian fire injuries. The projected property damage from these fires was US$ 18 billion. Due to these rising fire incidents, the government of the US is taking various strict initiatives to install fire alarm systems in residential, commercial, and industrial settings, which is boosting the growth of the market.

To increase efficiency and provide a safer building environment, various companies are working on integrating fire alarm systems with building management systems (BMS), which is likely to create an opportunity for the market growth during the forecast period. In addition, the growing number of construction projects in the country is expected to offer numerous opportunities to the market players in the coming years. Furthermore, the growing adoption of fire alarm systems in healthcare facilities is expected to fuel the market growth in the forecasted period. Moreover, the rise in technological advancements, such as the integration of IoT, video smoke detection, and remote monitoring, are expected to bolster the North America and MEA fire alarm system market in the near future.

North America and Overview

Fire alarms are usually installed in fire alarm systems to provide zonal coverage for residential and commercial properties. The warning signal might consist of a loud siren/bell, a flashing light, or both. A few fire alarm systems provide extra warnings, such as a voice message or a phone call. Most advanced fire alarm systems employ wireless technology and smart devices to protect as well as manage automated buildings via a remote control panel; for example, a mobile app that can be downloaded, installed, and maintained on a smartphone.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America and MEA Fire Alarm Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America and MEA Fire Alarm Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America and Drivers and Opportunities

Rise in Number of Safety Regulations Regarding Fire Detection and Alarm Systems

Fire-related hazards are severe and lead to loss of life and valuable assets. As a result, the US government has set various strict rules and regulations regarding fire detection and alarm systems. The design, manufacturing, installation, and operation of fire detection and alarm systems must be in accordance with either Sections 76.27-5 through 76.27-35 or SOLAS Chapter II-2, Regulation 7, and FSS Code Chapter 9, according to the Code of Federal Regulations.

- The rules and regulations included in Sections 76.27-5 are mentioned below:

- The government must approve the use of detectors, manual alarm stations, cabinets, control panels, alarms, and other notifying devices.

- The fire detection and alarm system must be capable of immediate operation at all times that the vessel is in service.

- The fire detection and alarm system must control and monitor input signals for all connected detectors and manual pull stations or call points.

- The fire detection and alarm system must provide fire or fault output signals to the pilothouse or fire control station.

- The fire detection and alarm system must notify crew and passengers of a fire when needed.

- The fire detection and alarm system must be arranged and installed in a way that the presence of a fire in any of the protected spaces will be automatically registered visibly and audibly in the pilothouse or fire control station. The visible notice must indicate the zone where the alarm originated. On vessels of more than 150 feet (45.72m), there must also be an audible alarm in the engine room.

In addition to these rules, under Section 76.27-15, heat detectors must not be rated lower and higher than 130°F (54°C) and 172°F (78°C), respectively. The operating temperature of heat detectors located in spaces of high normal ambient temperatures must be up to 260°F (130°C). Also, the operating temperatures of heat detectors in saunas might be up to 284°F (140°C). In addition, the required sensitivity and other performance criteria of detectors must be set forth in 46 CFR 161.002. Further, according to Section 76.27-20, audible alarms must generate sound pressure levels set forth in 46 CFR 161.002. Similarly, the UAE has taken a significant step toward enhancing residential safety by implementing a new regulation mandating the installation of fire alarms in all residential buildings since January 2024. This regulation supports the nation's commitment to ensuring the safety and well-being of its residents. Also, the South African Bureau of Standards (SABS) published a revised version of “SANS 10139, code of practice for design, installation, commissioning, and maintenance of fire detection and alarm systems in non-domestic premises,” which aligns South Africa’s fire safety standards similar to other countries. Therefore, the rise in the number of safety regulations regarding fire detection and alarm systems boosts the growth of the North America and MEA fire alarm system market.

Rise in Construction Activities

The US has the world’s largest market for commercial property, according to the International Monetary Fund. The surging investments in the development of smart city initiatives are likely to fuel the growth of the construction industry in the country in the coming years. Also, the construction industry in the MEA is growing significantly. Saudi Arabia, the UAE, Oman, and Egypt are initiating several infrastructure projects, including new railway projects, megacities, harbors, airports, and housing projects, among others. A few of the mega-construction projects are listed below:

- Los Angeles plans to host the LA 2028 Summer Olympics. With this announcement, new facility construction began in 2023 and is expected to be completed by the first half of 2028. This vast project is focused on building housing for Olympians and facilities for the competition.

- In Q2 2024, the construction of the South Capitol Street and M Street Mixed-Use Development project has started in Washington, DC, and is expected to be completed by Q4 2024. The project aims to provide better residential, retail, and office facilities in the city.

- Owing to the rise in tourism and upcoming Olympic events, several airport construction and terminal expansion activities are being undertaken in the US The Port Authority of New York and New Jersey invested US$ 19 billion to build a new John F. Kennedy International Airport (JFK), recording a major transformation of one of the busiest airports in the US The project has entered into the construction phase and is scheduled for completion by 2026.

- In May 2024, the Sultanate of Oman announced to construction of six new airports, and most of them are expected to be operational by 2028–2029, according to Naif al Abri, Chairman of the Civil Aviation Authority.

- In September 2024, Saudi Arabia funded US$ 1.3 trillion in real estate construction and infrastructure projects to diversify its economy from oil, recording over a million residential units.

Fire alarm systems help detect and warn people about the presence of fire or smoke in a building or any other enclosed space. Thus, the rise in construction activities is expected to create lucrative opportunities for the North America and MEA fire alarm system market growth during the forecast period.

North America and MEA Fire Alarm Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the North America and MEA fire alarm systems market analysis are technology, product type, and application.

- Based on technology, the North America and MEA fire alarm systems market is bifurcated into addressable systems and conventional systems. The addressable systems segment dominated the market in 2023.

- By product type, the North America and MEA fire alarm systems market is segmented into detector type, alarm type, and control panels. The detector type segment is further segmented into smoke detectors, heat detectors, flame detectors, and others. Similarly, the alarm type segment is subsegmented into audible alarms, visual alarms, and manual call-points alarms. The detector type segment held a larger share of the market in 2023.

- In terms of application, the North America and MEA fire alarm systems market is segmented into commercial, industrial, and residential. The commercial segment dominated the market in 2023.

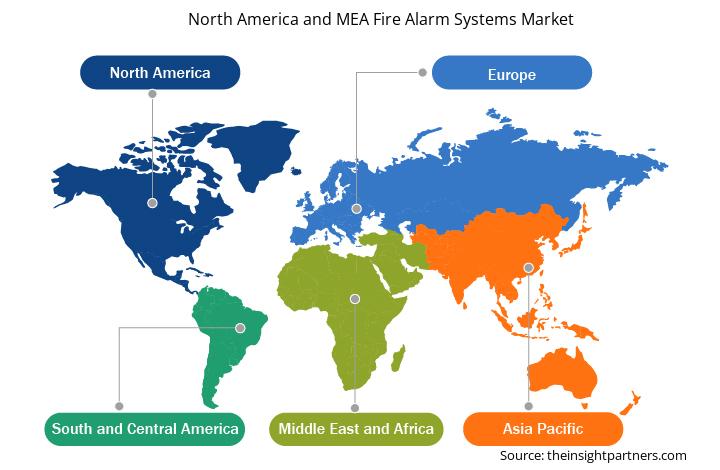

North America and MEA Fire Alarm Systems Market Share Analysis by Geography

The North America and MEA fire alarm systems market is segmented into two major regions: North America and the Middle East & Africa (MEA). North America dominated the market in 2023.

The economic competitiveness of North America continues to grow through economic, commercial, and residential cooperation; integration; and policy alignment. The construction of residential and commercial buildings in these countries is growing owing to various investments in the construction sector. For instance, in October 2023, Fluor, a global engineering and construction firm, completed the construction of Bayer’s US$ 250 million pharmaceutical plant in Berkeley, California. Also, in October 2024, the President of Mexico announced the Housing and Regularization Program, which aims to construct 1 million homes as well as grant 1 million deeds during her administration. Such growing construction activities in the region are expected to fuel the market growth in the coming years.

North America and MEA Fire Alarm Systems Market Regional Insights

The regional trends and factors influencing the North America and MEA Fire Alarm Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses North America and MEA Fire Alarm Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for North America and MEA Fire Alarm Systems Market

North America and MEA Fire Alarm Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 13.63 Billion |

| Market Size by 2031 | US$ 22.81 Billion |

| Global CAGR (2023 - 2031) | 6.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

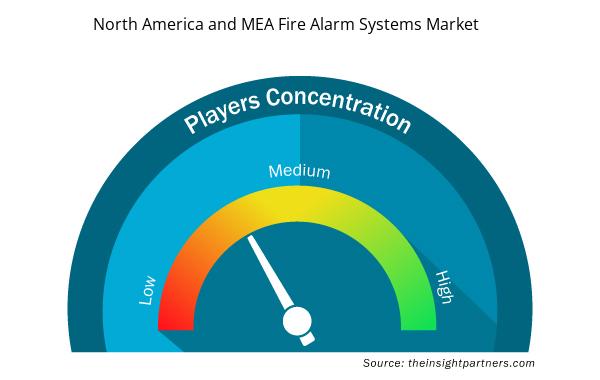

North America and MEA Fire Alarm Systems Market Players Density: Understanding Its Impact on Business Dynamics

The North America and MEA Fire Alarm Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the North America and MEA Fire Alarm Systems Market are:

- Eaton Corp Plc

- Bosch Sicherheitssysteme GmbH

- Fike Corporation

- Gentex Corp

- Honeywell International Inc

- Napco Security Technologies Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the North America and MEA Fire Alarm Systems Market top key players overview

North America and MEA Fire Alarm Systems Market News and Recent Developments

The North America and MEA fire alarm systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the North America and MEA fire alarm systems market are listed below:

- Fike Corporation, a global manufacturer and supplier of fire protection systems, announced the global FM approval of one of its latest fire detection solutions, Fike Fire Watch. FM Global recommended this portable fire watch system in its datasheet 10-3 Hot Work Management.

(Source: Fike Corporation, Press Release, October 2024)

- Honeywell launched the first fire alarm system with UL-approved self-testing smoke detectors that can be tested automatically, changing the way fire and life safety systems are installed, tested, and maintained. The NOTIFIER INSPIRE fire alarm system with Self-Test detectors is designed to help create a safer building environment by increasing facility managers' awareness of system needs while equipping service providers with digital self-testing tools that streamline maintenance and support regulatory compliance and system uptime.

(Source: LG Electronics, Press Release, March 2023)

North America and MEA Fire Alarm Systems Market Report Coverage and Deliverables

The "North America and MEA Fire Alarm Systems Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- North America and MEA fire alarm systems market size and forecast at regional, and country levels for all the key market segments covered under the scope

- North America and MEA fire alarm systems market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- North America and MEA fire alarm systems market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the North America and MEA fire alarm systems market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America is anticipated to grow at the fastest CAGR over the forecast period.

The addressable systems segment led the North America and MEA fire alarm system market with a significant share in 2023.

The North America and MEA fire alarm system market is expected to reach US$ 22.81 billion by 2031.

The North America and MEA fire alarm system market was estimated to be valued at US$ 13.63 billion in 2023 and is anticipated to grow at a CAGR of 6.6% over the forecast period.

Rise in technological advancements in fire alarm systems is expected to propel the growth of the market in the coming years.

Surge in fire incidents and rise in number of safety regulations regarding fire detection and alarm systems drives the North America and MEA fire alarm system market.

The key players operating in the North America and MEA fire alarm system market include Eaton Corp Plc, Bosch Sicherheitssysteme GmbH, Fike Corporation, Gentex Corp, Honeywell International Inc, Napco Security Technologies Inc, Schneider Electric SE, Siemens AG, Johnson Controls International Plc, Carrier Global Corp, and Mircom Technologies Ltd.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies -North America and MEA Fire Alarm Systems Market

- Eaton Corp Plc

- Bosch Sicherheitssysteme GmbH

- Fike Corporation

- Gentex Corp

- Honeywell International Inc

- Napco Security Technologies Inc

- Schneider Electric SE

- Siemens AG

- Johnson Controls International Plc

- Carrier Global Corp

- Mircom Technologies Ltd

Get Free Sample For

Get Free Sample For