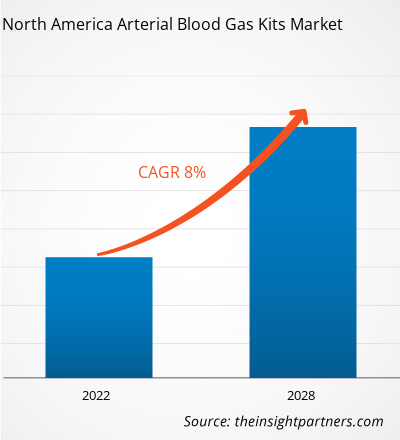

The arterial blood gas kits market in North America is expected to grow from US$ 176.3 million in 2021 to US$ 302.7 million by 2028; it is estimated to grow at a CAGR of 8.0% from 2021 to 2028

Huge population suffers from various types of respiratory diseases across the world. Smoking, infections, and genetic factors can cause serious respiratory complications. Chronic obstructive pulmonary disease (COPD), asthma, and pneumonia are a few medical conditions exerting a huge burden on the public healthcare system in various countries worldwide. The American Lung Association reported that COPD is the third leading cause of death in the US, where over 16.4 million people are diagnosed with the condition. Furthermore, according to the US Department of Health and Human Services, around 25 million people in the US had asthma in 2019, which is one of the most common respiratory diseases in the world. As per the World Health Organization (WHO), globally pneumonia accounted for 15% of the total deaths of children below the age of 5 years in 2017, which reporting 808,694 deaths. Patients suffering from respiratory disorders usually experience trouble in breathing and oxygen shortage. Arterial blood gas (ABG) test is carried out to measure the amount of oxygen and carbon dioxide dissolved in arterial blood. The test helps in delivering care to patients suffering from acute and chronic respiratory disease. Thus, the growing prevalence of acute and chronic respiratory diseases propels the demand for arterial blood gas kits.

COVID-19 pandemic has served vital growth opportunities for the arterial blood gas kits market. The market has experienced exponential growth during the pandemic due to tremendous demand for oxygen level testing through arterial blood gas kits. North America is the leading market that has significantly contributed to the growth of the market. There have been various factors, including increased incidences of COVID-19 positive patients, growth in arterial blood gas kits technologies, increasing production of kits, and many other factors. The cases majorly led to the demand for arterial blood gas kits testing in the countries like the US, Canada, and Mexico. Similarly, other countries have experienced a rise in the incidences of COVID-19 positive, which have demanded arterial blood gas kits testing. The other major factor that has driven the market’s growth is developments for arterial blood gas kits. Besides various product approvals are gaining traction in the market. For instance, in July 2017, Teleflex Incorporated has received U.S. Food and Drug Administration (FDA) approval for Arrow Seldinger Arterial Catheterization Device which can be used for arterial blood gas estimation. Besides, the FDA has increased its efforts to support the health of people and has imposed several guidelines and for hospitals and medical device companies. Various companies also enhanced their research and development activities for diagnostics tests and therapeutic devices. Thus, increased production by the companies has resulted in profits, and the outbreak of COVID-19 has shown a positive impact on market growth.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the arterial blood gas kits market. The North America arterial blood gas kits market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Arterial Blood Gas Kits Market Segmentation

By Product

- 1 mL (Syringe Volume)

- 3 mL (Syringe Volume)

- Others

By End User

- Hospitals

- Clinics

- Others

By Country

- North America

- US

- Canada

- Mexico

Companies Mentioned

- Becton Dickinson and Company

- Radiometer Medical ApS

- Smiths Medical

- Vyaire Medical

- Opti Medical Systems, Inc.

- Westmed Medical

- Siemens Healthineers AG

- ITL Biomedical

- i-SENS, Inc.

- Teleflex Incorporated

North America Arterial Blood Gas Kits Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 176.3 Million |

| Market Size by 2028 | US$ 302.7 Million |

| Global CAGR (2021 - 2028) | 8.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aesthetic Medical Devices Market

- Emergency Department Information System (EDIS) Market

- Animal Genetics Market

- Workwear Market

- Medical and Research Grade Collagen Market

- Artwork Management Software Market

- Hydrocephalus Shunts Market

- Constipation Treatment Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Real-Time Location Systems Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada

Trends and growth analysis reports related to Life Sciences : READ MORE..

- Becton Dickinson and Company

- Radiometer Medical ApS

- Smiths Medical

- Vyaire Medical

- Opti Medical Systems, Inc.

- Westmed Medical

- Siemens Healthineers AG

- ITL Biomedical

- i-SENS, Inc.

- Teleflex Incorporated

Get Free Sample For

Get Free Sample For