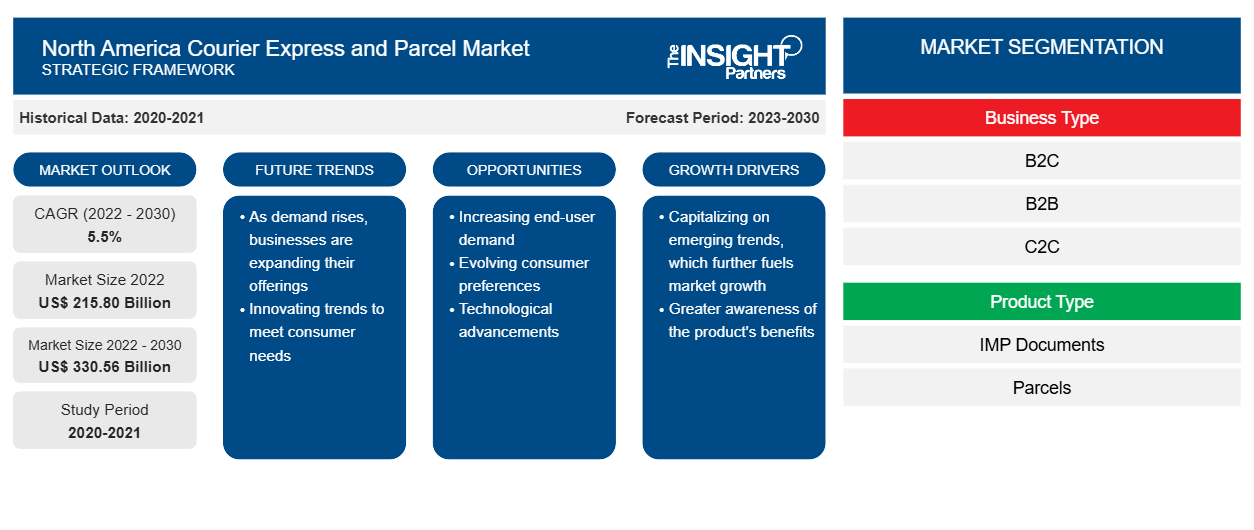

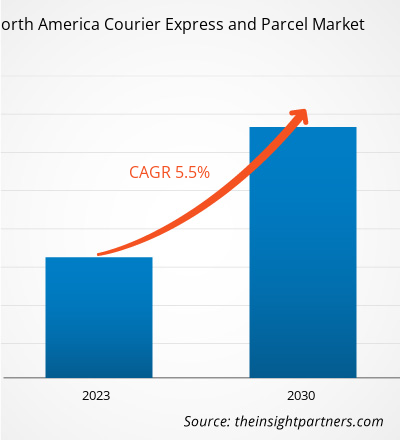

The North America courier express and parcel market was valued at US$ 215.80 billion in 2022 and is projected to reach US$ 330.56 billion by 2030; it is expected to register a CAGR of 5.5% during 2022–2030.

Analyst Perspective:

The North American courier express and parcel market consists of a sophisticated and dynamic process that is carefully structured to convey goods from warehouses to customers' doorsteps as quickly as possible. Customers including manufacturing, retailers, e-commerce agencies, individuals, and many small and medium-size businesses seek transport facilities to courier their products from one place to another at a faster pace. Orders are often placed through e-commerce platforms or retail shops, sparking a series of cautiously coordinated processes. Retailers process orders and manage inventory in strategically located warehouses, optimizing availability for on-time delivery.

The North america courier express and parcel market ecosystem constitutes a network of diverse stakeholders, technology integrations, logistical infrastructures, and evolving consumer behaviors. The primary stakeholders are e-commerce giants and retailers, then logistics companies come into the picture. These organizations take help from technological companies that offer tools such as route optimization and delivery management. Apart from software companies, many drone manufacturers and service providers play a notable role in the courier express and parcel market.

Market Overview:

Courier express and parcel refers to logistics and postal companies that primarily transport consignments/parcels with comparatively low volume and weight, e.g., letters, small packages, documents, or small items. Parcel shipping measures parcel volume shipments with weights up to 31.5 kg for business-to-business, business-to-consumer, and consumer-to-consumer.

The North America courier express and parcel market is projected to experience significant growth with various driving factors, such as rising e-commerce sales, robust economic expansion, and the escalated need for faster delivery solutions. Also, leading players are investing in technological innovations such as the adoption of electric vehicles and automated sorting systems for parcel deliveries, and growing government initiatives. In December 2023, JD Logistics expanded its express delivery service to countries across North America and Europe. JD Logistics, the logistics arm of Chinese e-commerce giant JD.com, has announced the launch of its international express delivery service. Currently available in Shenzhen and Guangzhou, the expansion will initially cover 23 countries across North America and Europe, facilitating one-way deliveries from China.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Courier Express and Parcel Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Courier Express and Parcel Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increasing E-Commerce Retail Sales with Surge in Internet Users is Driving the North America Courier Express And Parcel Market Growth

The number of internet users across North America reached 439.76 million, and around 90.0% of the people in North America were connected to the Internet in 2023. Currently, 348 million people shop online in North America, and the number of people shopping online is likely to reach 50 million by 2025.

The growing number of online shoppers with the surge in Internet users in North American countries such as the US, Canada, and Mexico is the major factor driving the growth of courier express and parcel market. During the COVID-19 pandemic, there was a massive increase in online orders that subsequently propelled the demand for parcel shipping. The volume of parcel shipments in the US increased by 64% between 2014 and 2022, i.e., from 13.2 billion to 21.2 billion parcels. Revenues from retail e-commerce increased at higher rates in the US between 2017 and 2022. Retail e-commerce sales increased from US$ 459 billion in 2017 to almost US$ 905 billion in 2022. The popularity of retail e-commerce is a major factor driving the North America courier express and parcel market growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

Based on business type, the North America courier express and parcel market share is segmented into B2C, B2B, and C2C. Among these, B2C held the largest share in 2022, primarily owing to rising online shopping trends with the surge in demand from e-commerce. More than 70% of North Americans shopped online. In 2022, there were ~268 million digital buyers in the US, expected to reach 285 million by 2025. These B2C customers are expected to offer significant opportunities for various e-commerce companies. Whole Foods, Nike, and Petco connect with each customer.

Business to consumers (B2C) refers to selling goods directly from the firms to consumers who are the end users of that product or service. B2C companies are firms that sell directly to consumers without any mediators. Major B2C companies include Amazon.com, Meta, eBay, Netflix, and The New York Times Co. Increasing e-commerce sales in North America owing to rising consumer preference toward online shopping is the major factor driving the courier express and parcel market for the B2C segment. According to the US Department of Commerce, e-commerce sales in the US reached ~US$ 1.03 trillion in 2022 and increased from US$ 960.44 billion in 2021. Thus, the remarkable e-commerce product or service growth propels the courier express and parcel market for the B2C segment.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The north america courier express and parcel market share is growing at a moderate pace with the increasing adoption of automation and advanced technologies for parcel deliveries. In April 2021, Amazon.com, Inc. expanded its investment in building a fulfillment center in Fort Wayne (Indiana, US). In addition, key players are launching additional shipping routes to improve efficiency and provide last-mile deliveries.

In November 2023, UPS launched large-scale picking automation at its Kentucky warehouse, US. UPS Supply Chain Solutions Inc. announced a new agreement with Geek+ (a developer of autonomous mobile robots). The company’s warehouse is situated near Louisville (Kentucky, US). The company has planned an investment of around US$ 79 million to adopt this Pop-Pick solution, with over 700 robots set to be deployed at the US$ 79 million (£63m) facility, which is named the ‘Velocity’ warehouse.

In May 2023, Instacart (a grocery technology company in North America) announced its partnership with PetSmart (a pet retailer) to offer same-day delivery from the Instacart Application. The company has nearly 1,500 PetSmart stores across the US to offer same-day delivery from its 150 PetSmart stores across Canada.

Thus, the expansion of such facilities and rising partnerships between retailers and delivery companies are likely to stir the growth of the North American courier express and parcel market during the forecast period. The North America courier express and parcel market has been segmented into 3 major countries: the US, Canada, and Mexico.

Key Player Analysis:

United Parcel Service Inc, Purolator Inc, TForce Logistics LLC, Lone Star Overnight LLC, Amazon.com Inc, Deutsche Post AG, Intelcom Courrier Canada Inc, Updater Services Ltd., Better Trucks Inc, OnTrac Logistics Inc, Canada Post Corp, Canpar Express Inc, General Logistics Systems BV, FedEx Corp, and, Pitney Bowes Inc are the prominent courier express and parcel market players in the market.

Recent Developments in North America Courier Express and Parcel Market

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the North America courier express and parcel market. The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The market courier express and parcel market players present in the market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by key players in the North America courier express and parcel market are listed below:

Year | News |

April-2021 | Lone Star Overnight, a regional parcel delivery company, announced that it will incorporate Saturdays into its normal delivery schedule starting May 1, 2021. LSO will also deliver B2C e-commerce packages as part of its normal service at no additional charge. |

North America Courier Express and Parcel Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 215.80 Billion |

| Market Size by 2030 | US$ 330.56 Billion |

| Global CAGR (2022 - 2030) | 5.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Business Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Carbon Fiber Market

- Wire Harness Market

- Single Pair Ethernet Market

- UV Curing System Market

- Online Exam Proctoring Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Unit Heater Market

- Space Situational Awareness (SSA) Market

- Smart Water Metering Market

- Electronic Toll Collection System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Business Type, Product Type, Destination, Mode of Transport, End User, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The parcel delivery companies are modernizing their infrastructures to increase efficiency by implementing advanced technologies in their systems. For instance, in June 2022, GLS and DHL implemented automation to accelerate parcel sorting. In June 2022, GLS equipped its facility center in Hayward (California) with an automated sorting system. This automated system is integrated with advanced technologies such as Artificial Intelligence and machine learning to scan, weigh, and measure up to 5,000 parcels per hour without human intervention. Further, DHL has planned to deploy 1,000 robots by 2025 across its facilities in the world.

United Parcel Service Inc., Canada Post, Amazon.com Inc., FedEx Corp, DHL Group, and United States Postal Service are the top key market players operating in the North America courier express and parcel market.

The growing number of online shoppers with the surge in Internet users in North American countries such as US, Canada and Mexico is the major factor driving the growth of courier express and parcels. During the COVID-19 pandemic, there was a massive increase in online orders that subsequently propelled the demand for parcel shipping. The volume of parcel shipments in the US increased by 64% between 2014 and 2022, i.e., from 13.2 billion to 21.2 billion parcels.

The US courier express and parcel market held the largest share in 2022, owing to an increase in online shopping and Internet users. According to The Insight Partners’ estimate, more than 70% of people in North America shop online. In 2022, there were around 268 million digital buyers across the US. Parcel volume shipment in the US reached around 21.2 billion in 2022.

Digitalization is a vital trending strategy for parcel delivery companies. Companies are spending billions of dollars in digitizing their delivery systems. For instance, in October, 2019, DHL planned to spend US$ 2.19 billion on digitization strategy for next five years. The company has planned to improve its customer and employee experience and enhance its operational excellence through digitization.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - North America Courier Express and Parcel Market

- United Parcel Service Inc

- Purolator Inc

- TForce Logistics LLC

- Lone Star Overnight LLC

- Amazon.com Inc

- Deutsche Post AG

- Intelcom Courrier Canada Inc

- United Delivery Service, Ltd

- Better Trucks Inc

- OnTrac Logistics Inc

Get Free Sample For

Get Free Sample For