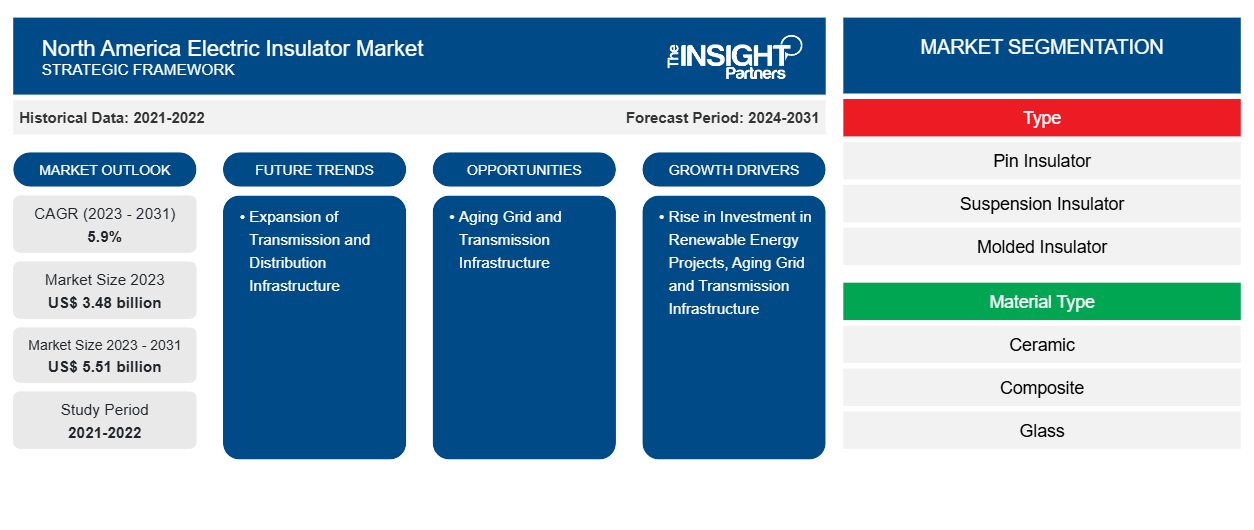

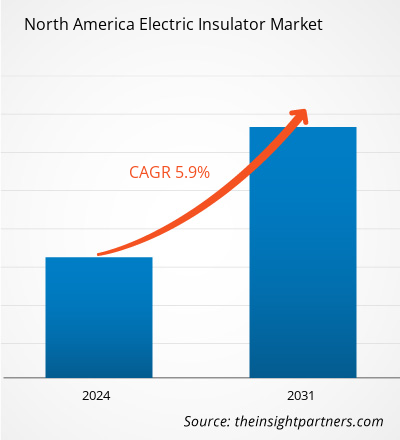

The North America electric insulator market size is projected to reach US$ 5.51 billion by 2031 from US$ 3.48 billion in 2023. The market is expected to register a CAGR of 5.9% during 2023–2031. Expansion of transmission and distribution infrastructure is likely to remain one of the key market trends.

North America Electric Insulator Market Analysis

An electrical insulator is a substance that resists the flow of electric current. Its principal function is to oppose or obstruct the movement of electric charges, preventing the inadvertent transfer of electricity between conducting materials. The North America electric Insulator market is mainly driven by the increasing demand of electric insulators in the power grid utility sector. With ageing power grid components, there is an increasing focus on replacing the critical grid components in the region. This is driving the North America market growth.

Electric Insulator Market Overview

Electric insulators are crucial for ensuring stability and safety in power transmission and distribution applications by protecting various components, such as substation equipment, transmission lines, and steel towers, from the unwanted flow of current. Electric insulators are used extensively to provide mechanical support and electrical protection to several systems and equipment that are deployed in transmission and distribution centers and substations worldwide. Further, the companies operating in this market are focusing on providing high-quality electric insulators by using advanced technologies and superior materials to meet the growing demands of end users. Pin insulators, suspension insulators, strain insulators, post insulators, and shackle insulators are a few of the key types of electric insulators that are being used in transmission, substation, distribution, and railways applications. These insulators are used for low, medium, and high voltage applications in several industries and utilities. The growing investment in renewable energy and refurbishment of existing grids is driving the North America electric insulator market. Moreover, the market holds a huge opportunity owing to rising investment in smart grids, which will further drive the North America electric insulator market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electric Insulator Market Drivers and Opportunities

Aging Grid and Transmission Infrastructure to Favor Market

According to the White House, most of the electric grids in the US were built in the 1960s and 1970s. Currently, over 70% of the electricity grids in the country are more than 25 years old. Due to such aging infrastructure, the citizens have to face various challenges. For example, as per the data from the U.S. Energy Information Administration, in 2021, US electricity customers were without power for more than seven hours on average. More than five of those seven hours were during different major events, such as snowstorms, hurricanes, and wildfires. This shows that the country's existing energy infrastructure will not be able to endure the continuing impacts of extreme weather events such as Hurricane Ida, Dixie Wildfire, and the 2021 Texas Freeze. Furthermore, the lifespan of transmission infrastructure lasts between 50 and 80 years. For the regular and uninterrupted supply of electricity, the need for regular maintenance and replacement of transmission infrastructure is required. According to the 2022 report from the transmission policy group Grid Strategies, American Electric Power, an energy company that owns 40,000 miles of transmission lines, announced that 30% of its transmission lines need to be replaced over the next 10 years. Thus, the aging grid and transmission infrastructure is fueling the need for refurbishment of the existing infrastructure, propelling the growth of the electric insulator market in North America.

Rising Investment in Smart Grids

As American homes and companies incorporate a growing number of electronic gadgets and technical capabilities, the need for utilities to learn about changing electricity demand in real time is increasing. In this case, integrating smart grids can assist in giving all grid customers more dependable electricity. To cater to this, the governments of various countries in North America are investing in smart grids. For instance, in September 2022, the US Department of Energy (DoE) was working on seeking input on a US$ 10.5 billion program for smart grids and other upgrades to strengthen the electricity grid of the country. This funding is allocated in three parts, under which US$ 2.5 billion will be used for grid resilience, US$ 3 billion for smart grids, and US$ 5 billion for grid innovation. Similarly, in September 2023, the government of Canada announced that, through its Smart Renewables and Electrification Pathways Program (SREPs), it will provide approximately US$ 3.27 billion (CAD 4.5 billion) until 2035 for smart renewable energy and electrical grid modernization projects. Thus, the rising investment in the smart grid infrastructure is expected to create an opportunity for the growth of the North America electric insulator market.

North America Electric Insulator Market Report Segmentation Analysis

Key segments that contributed to the derivation of the North America electric insulator market analysis are type, material type, voltage, application, and end user.

- Based on type, the North America electric insulator market is divided into pin insulators, suspension insulators, molded insulators, and others. The pin insulators segment held the largest market share in 2023.

- Based on material type, the market is divided into ceramic, composite, glass, and others. The ceramic segment held the largest market share in 2023.

- Based on voltage, the market is divided into low, medium, and high. The medium segment held the largest market share in 2023.

- By application, the market is segmented into transformers, switchgear, busbars, cables, surge protection devices, and others. The transformers segment held the largest share of the market in 2023.

- By end user, the market is segmented into utilities, industries, and others. The utilities segment held the largest share of the market in 2023.

North America Electric Insulator Market Share Analysis by Country

The geographic scope of the North America electric insulator market report is mainly divided into the US, Canada, and Mexico.

The North America electric insulator market is segmented into the US, Canada, and Mexico. The region is witnessing a rise in the demand for electricity owing to the economic and population growth. According to the International Energy Agency (IEA), in 2021, the total electricity production was 5,397,346 GWh, 19% of the global share. Also, as per the same source, natural gas is the largest source of electricity generation in the region, contributing ~36% of the total electricity generation. Similarly, hydropower, wind, and solar PV contribute 12.8%, 8.1%, and 3.1%, respectively, in total electricity generation.

To increase electricity generation from renewable sources, the governments of various countries in the region are taking different initiatives. For instance, on April 4, 2024, the US Department of the Interior announced an investment of US$ 19 million to install solar panels over irrigation canals in Oregon, California, and Utah, which will simultaneously decrease evaporation of critical water supplies and advance clean energy goals. Similarly, in September 2023, the government of Canada announced it would support the funding for 12 clean energy projects across Alberta. The funding for these projects has been provided through the Smart Renewables and Electrification Pathways Program (SREP). The program will invest ~US$ 3.32 billion (CAD 4.5 billion) by 2035 for smart renewable energy and electrical grid modernization projects. Thus, such government initiatives in renewable electricity generation are expected to fuel the growth of the electrical insulators market in the region.

North America Electric Insulator Market Regional Insights

The regional trends and factors influencing the North America Electric Insulator Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses North America Electric Insulator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for North America Electric Insulator Market

North America Electric Insulator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.48 billion |

| Market Size by 2031 | US$ 5.51 billion |

| Global CAGR (2023 - 2031) | 5.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

North America Electric Insulator Market Players Density: Understanding Its Impact on Business Dynamics

The North America Electric Insulator Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the North America Electric Insulator Market are:

- Hitachi Energy Ltd

- Hubbell Inc.

- MacLean Power LLC

- TE Connectivity Ltd

- Lapp Insulators Group

- Powertelcom

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the North America Electric Insulator Market top key players overview

North America Electric Insulator Market News and Recent Developments

The North America electric insulator market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the North America electric insulator market are listed below:

- Blackstone announced that private equity funds affiliated with Blackstone had closed the acquisition of Power Grid Components, Inc. ("PGC") from Shorehill Capital LLC. (Source: Power Grid Components Inc., Press Release, December 2023)

- The Spanish Private Equity fund PHI Industrial finalized the acquisition of Lapp Insulators, a ceramic insulator company headquartered in Germany, a carve-out from the German multinational Pfisterer. Details of the transaction have not been disclosed. (Source: Lapp Insulators Group, Newsletter, January 2022)

North America Electric Insulator Market Report Coverage and Deliverables

The “North America Electric Insulator Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- North America electric insulator market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- North America electric insulator market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- North America electric insulator market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the North America electric insulator market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The North America Electric Insulator market was estimated to be US$ 3.5 Billion in 2023 and is expected to grow at a CAGR of 5.9% during the forecast period 2023- 2031.

Rise in investment in renewable energy projects and ageing grid transmission infrastructure are the major factors that propel the North America Electric Insulator market.

Expansion of transmission and distribution infrastructureis anticipated to play a significant role in the North America Electric Insulator market in the coming years.

The incremental growth expected to be recorded for the North America Electric Insulator market during the forecast period is US$ 2.02 billion.

The North America Electric Insulator market is expected to reach US$ 5.51 billion by 2031.

The key players holding majority shares in the North America Electric Insulator market are Hitachi Energy Ltd, Hubbell Inc., MacLean Power LLC, TE Connectivity Ltd, and Lapp Insulators Group.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

- Hitachi Energy Ltd

- Hubbell Inc

- MacLean Power LLC

- TE Connectivity Ltd

- Lapp Insulators Group

- Powertelcom

- Power Grid Components Inc.

- Peak Demand Inc.

- Victor Insulators, Inc.

- CK Composites Co., LLC.

Get Free Sample For

Get Free Sample For