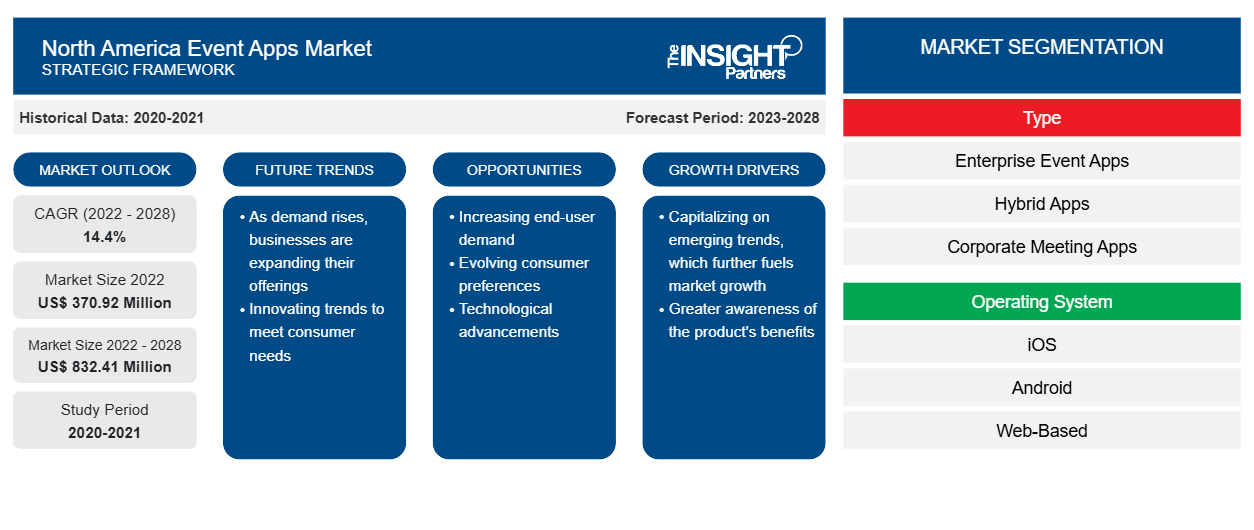

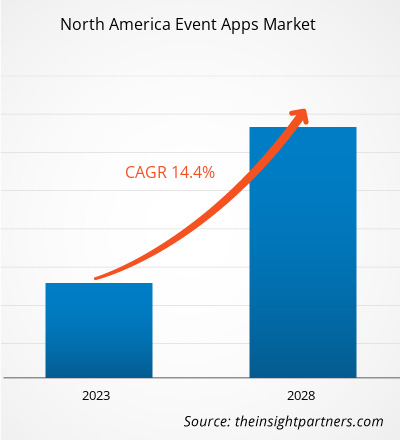

The North America event apps market is expected to grow from US$ 370.92 million in 2022 to US$ 832.41 million by 2028; it is estimated to register a CAGR of 14.4% from 2022 to 2028.

Event apps enable event planners to plan and present their events well-organized, ensuring a personalized experience for attendees. An event app helps in better execution, precise management of events, and robust engagement of attendees. Event apps also allow people to connect to their audience from anywhere, providing a way to engage with the audience before, during, and after the event, saving time and money. Such advantages are propelling the North America event apps market growth.

Benefits of event apps such as better value to the audience, access to event information at fingertips, and enhanced planning and management solutions are propelling the North America event apps market growth. For instance, Crowdcompass, a US-based mobile event app provider for in-person and virtual events, enables people to attend events to absorb content and network, provides attendees with interesting content, and centralizes the event management process into one common channel. The growing demand for conferences, trade shows, universities, and even entertainment events is anticipated to boost the North America Event Apps market growth. Integration of advanced solutions such as networking, content absorption, and audience engagement increases convenience for attendees and improves management efficiency for planners, which is further anticipated to propel the North America event apps market growth.

Impact of COVID-19 Pandemic on North America Event Apps Market

Governments in the region enforced travel restrictions, lockdowns, and social distancing measures to curb the spread of COVID-19. This adversely impacted the North American Event apps market in March 2020. Corporate events, conferences, exhibitions, seminars, fundraising, trade shows, festivals, music and art performances, product launches, and sporting events were the most commonly held events in the event industry in the pre-pandemic era. According to the industry experts, conferences accounted for 62% of the events in the industry, followed by corporate events at 61.2%. The growth in the event industry during the pre-pandemic era was attributed to the rise in the number of corporate companies and the frequency of events organized. A survey conducted by Meeting Professional International (MPI) and Event MB reveals the negative impacts of the COVID-19 on the events industry in North America, with around 96% of event cancellations and rising risks related to job security. Terminated contracts led to significant revenue losses, further impacting the North American events industry during the pandemic. However, as the economies began to open and recover from the COVID-19 crisis, event planners and organizers in North America turned toward technology to find a new way of attending events. Many organizations are embracing virtual events to substitute in-person events. Virtual events enable event organizers to connect and maintain a business relationship with a large number of audiences. There has been a surge in numerous video conferencing platforms, social media, and event planning apps to organize virtual events. According to Events MB, 73% of event planners have successfully transitioned their events to the internet. This is estimated to boost the growth of the event apps market in North America. With new guidelines in 2021, states such as Maryland and Texas started reopening their economies, allowing businesses to operate without capacity restrictions. The Centers for Disease Control and Prevention (CDC) encourages event organizers to adhere to the regulations on gatherings and provides event organizers with crucial roadmaps to resuming events in the US. Event planners can currently organize events in some states in America; however, the global events industry is anticipated to stabilize after 2023.

North America Event Apps Market Insight

Government Initiatives and Investments Drive North America Event Apps Market Growth

The growth of the meetings & events industry is largely dependent on the economy, as event spending is reduced. Government initiatives and investments in the US are helping develop infrastructure and promote new venues for corporate events. According to the independent global advisory firm Oxford Economics findings, face-to-face meetings and events play an integral role in the US economy. The government is pouring hundreds of billions of dollars into the meetings & events industry as it is one of the major contributors and supporters of jobs in the US economy. The demand for events and event management applications is high in North America as various associations are dependent on conferences to deliver education, and medical conferences rely on symposiums to share scientific breakthroughs. The Meetings Mean Business Coalition (MMBC), formed during the 2008 financial crisis, emphasizes the important role meetings play in helping people get business done. The MMBC and Events Industry Council (EIC) have created extensive protocols to outline best practices to protect attendees and employees in the US.

End User Segment Insights

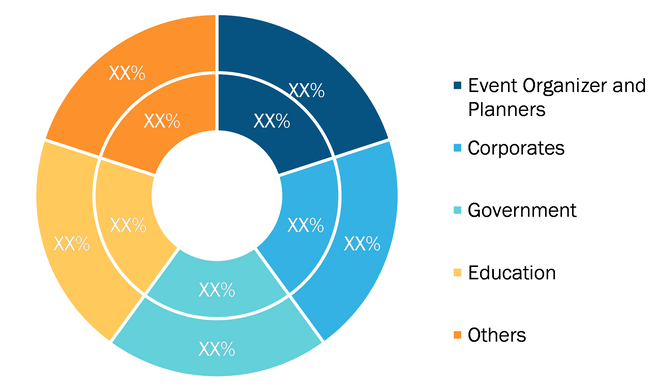

In terms of end user, the North America event apps market is segmented into event organizers and planners, corporate, government, education, and others. Mobile event apps provide a platform for end users to stay connected from anywhere and at any time with their team, volunteers, logistics managers, and attendees. End users can monitor the event planning and communicate with their team members from their mobile phones when they are away from the event location.

North America Event Apps Market, by End User (% share)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Note: The outer circle represents the market size for 2028, and the inner circle represents the market size for 2022.

Type Segment Insights

Based on type, the North America Event Apps market is segmented into enterprise event apps, hybrid apps, corporate meeting apps, conference apps, trade show apps, festival apps, and sports event apps. The enterprise event apps segment held the largest share in 2021 and is expected to continue its growth during the forecast period. The hybrid apps segment is anticipated to be the fastest-growing segment during the forecast period. Event apps are found in a wide variety of event types. These apps are present in many industries, from conferences and trade shows to university and even entertainment events. With solutions for networking, content absorption, and audience engagement, event apps are truly created to handle every aspect of the event process. The event apps provide both increased convenience for attendees and improved management efficiency for planners, resulting in providing benefits to everyone who engages with event apps.

Operating System Segment Insights

Based on operating system, the North America event apps market is segmented into iOS, Android, and web-based. Mobile devices are evolving into increasingly sophisticated and general-purpose computers, which has led to the development of various platforms and operating systems in the mobile space. The various features, GUI, processing speed, and, most importantly, the applications available for the device depend on the underlying OS.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America Event Apps Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Companies operating in the North America event apps market focus on strategies such as mergers, acquisitions, and market initiatives to maintain their market positions. A few of the notable developments by key players in the North America Event Apps market are listed below:

- In April 2022, Cvent announced the replacement of crowdcompass by Attendee Cvent will retire the CrowdCompass mobile event app at the end of 2022 in favor of Attendee Hub, which the company launched in 2020 as Cvent Engagement Hub.

- In November 2021, Evenium announced new updates for its events app. ConnexMe's new design places the video stream and live comment streams side by side, eliminating the need for a separate window for conversation or Q&A.

The report segments the North America event apps market as follows:

The North America event apps market is segmented based on type, operating system, and end user. Based on type, the North America Event Apps market is categorized into enterprise event apps, hybrid apps, corporate meeting apps, conference apps, trade show apps, festival apps, and sports event apps. Based on operating system, the North America event apps market is segmented into iOS, Android, and web-based. Based on end user, the North America Event Apps market is categorized into event organizers and planners, corporates, government, education, and others.

North America Event Apps Market – Company Profiles

- Whova

- Cvent Inc.

- Evenium

- Eventbase Technology Inc.

- Livestorm

- Meeting Application

- On24

- Spotme

- Webex Events (Formerly Socio)

- Yapp Inc.

North America Event Apps Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 370.92 Million |

| Market Size by 2028 | US$ 832.41 Million |

| CAGR (2022 - 2028) | 14.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

North America Event Apps Market Players Density: Understanding Its Impact on Business Dynamics

The North America Event Apps Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the North America Event Apps Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For