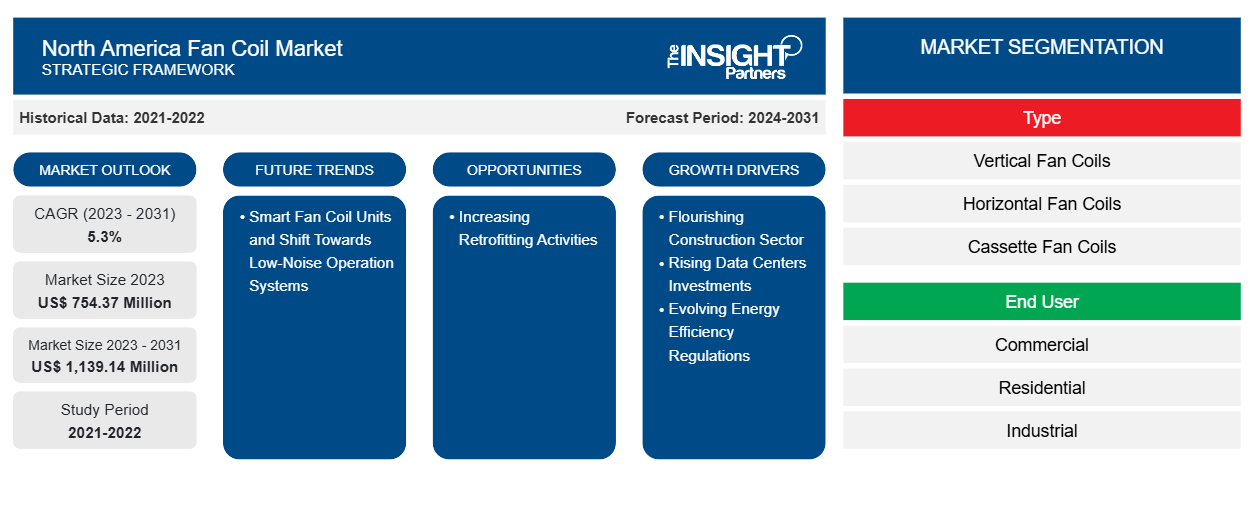

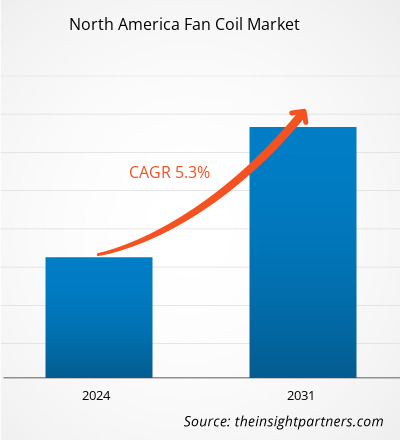

The North America fan coil market was valued at US$ 754.37 million in 2023 and is projected to reach US$ 1,139.14 million by 2031. The market is estimated to record a CAGR of 5.3% from 2023 to 2031. Smart fan coil units and a shift toward low-noise operations are likely to remain a key market trends in the coming years.

North America Fan Coil Market Analysis

Modern fan coil units are becoming an integral part of the Internet of Things (IoT) ecosystem. These units can be easily automated and controlled by connecting them with other smart devices. Homeowners can combine fan coil units with smart home systems for automated climate management, or they can remotely change settings using smartphones. In accordance with the users' everyday activities, this connectivity guarantees peak performance and energy efficiency. Advanced sensor technologies are being explored for their potential to make fan coil units smarter in improving indoor comfort and air quality. Thus, such innovative fan coil units would be able to make dynamic adjustments based on sensors' abilities to determine temperature, humidity, occupancy, and air contaminants. The development of fan coil units running on renewable energy sources is also underway in the North American market. Clean energy for heating and cooling may be obtained by connecting these units to geothermal, solar, and wind power sources. This integration encourages a more sustainable and greener energy landscape in addition to lowering dependency on fossil fuels. Thus, advanced sensors and smart connectivity, and innovations regarding energy efficiency and integration with renewable energy are making fan coil units more intelligent, efficient, and user-friendly. As a result, they are expected to play a crucial role in creating comfortable, healthy, and sustainable indoor environments in North American countries in the coming years.

North America Fan Coil Market Overview

A fan coil unit (FCU) is employed to heat or cool spaces without a requirement for ductwork. These units are operated either manually through on/off switches or using thermostats to control the temperature inside the concerned spaces. A fan coil unit consists of components such as air intake, filter, fan, cooling coil, heating coil, discharge, and grille. Fan coil units are frequently found in offices and other commercial structures. The North America fan coil market growth is ascribed to factors such as the flourishing construction sector, rising data center investments, and evolving energy efficiency regulations. Further, increasing retrofitting activities are expected to provide lucrative growth opportunities for the market in the coming years. Smart fan coil units and a shift toward low-noise operation are emerging as significant trends in the North America fan coil market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Fan Coil Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Fan Coil Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Fan Coil Market Drivers and Opportunities

Flourishing Construction Sector Propels Market Growth

The North American construction sector has recorded significant growth in recent years. The US construction sector continues to show remarkable resilience compared to the rest of the world, with a substantial number of enterprises operating across segments such as office buildings, retail spaces, and industrial facilities. According to Dodge Construction Network, the count of construction projects in the US jumped 6% through the first 8 months of 2024 compared to the same period in 2023. According to the US Census Bureau, and the US Department of Housing and Urban Development, the country reached the mark of ~1.406 million completions of privately owned housing units as of August 2023, indicating an increase of 5.3% from the revised estimate of ~1.335 million in July 2023 and a 3.8% rise compared to the ~1.355 million completions in August 2022. The construction industry in the US has experienced a notable increase in investments in recent years owing to factors such as economic recovery, urbanization, and infrastructure needs. According to ABC, construction spending in the US rose at a rate greater than 41% from April 2020 to July 2024.

Fan coils are commonly used in residential, commercial, and industrial buildings that use ducted split air conditioning or central plant cooling. The adoption of fan coils is increasing with an upsurge in new residential and commercial projects with the growing construction industry. These units offer compact solutions that can fit into various architectural designs, making them ideal for both high-rise buildings and smaller spaces. Furthermore, the compatibility of fan coils with modern smart building technologies complements automation and energy management strategies implemented in newly constructed facilities. Thus, as urban development continues, the integration of fan coil units becomes essential, driving the North America fan coil market growth.

Increasing Retrofitting Activities to Generate Growth Opportunities in Market in Future

Retrofitting refers to the process of updating existing buildings to improve their energy efficiency and performance. This practice has emerged as a critical movement across North America due to the urgent need to address climate change and aging infrastructure. Major cities in the US, such as New York, Toronto, and San Francisco, are emphasizing on retrofitting projects; property owners in these cities are also increasingly upgrading their existing buildings to meet modern energy efficiency standards and sustainability goals. According to a report by JLL, the US needs to triple its retrofit rate as of 2023 to meet net-zero targets by 2050. The report estimated that deep retrofits of whole office buildings could bring 40–60% energy efficiency savings, compared to 10–15% brought by light retrofits. As per the Pembina Report on Beyond Energy Efficiency in 2024, Canada needs to retrofit 600,000 existing homes and 32 million square meters of existing commercial spaces each year to reach 2050 net-zero targets. In May 2021, the Canada Greener Homes Grant program was launched with a budget to support 700,000 retrofits over a period of 7 years. Such rising retrofitting activities to meet stringent energy efficiency standards and sustainability goals are likely to stimulate the need for replacing outdated HVAC systems with modern fan coil units that offer superior energy performance and smart building integration capabilities. Thus, rising retrofitting activities provide lucrative growth opportunities for the North America fan coil market.

North America Fan Coil Market Report Segmentation Analysis

Key segments that contributed to the derivation of the North America fan coil market analysis are type and end user.

- Based on type, the market is segmented into cassette fan coils, horizontal fan coils, vertical fan coils, wall-mounted fan coils, and others. The vertical fan coils segment dominated the market in 2023.

- Based on end user, the market is segmented into commercial, residential, and industrial. The commercial industry segment dominated the market in 2023.

North America Fan Coil Market Share Analysis by Country

- The North America fan coil market is segmented into the US, Canada, and Mexico. In terms of revenue, in 2023, the US held the largest share of the market. The market in North America is expected to witness significant growth during the forecast period owing to factors such as the increasing demand for energy-efficient HVAC solutions in commercial and residential buildings, including hotels, offices, hospitals, and multi-family residential complexes. The rising adoption of fan coil units can be attributed to their ability to provide individual zone temperature control and relatively compact size. The increasing number of housing projects with high construction spending, fast urbanization, and rising disposable income also favors the growth of the North America fan coil market growth in North America. Stringent government regulations such as ASHRAE (American Society of Heating, Refrigerating, and Air-Conditioning Engineers) and requirements outlined in building codes also contribute to the market.

North America Fan Coil Market Regional Insights

The regional trends and factors influencing the North America Fan Coil Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses North America Fan Coil Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for North America Fan Coil Market

North America Fan Coil Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 754.37 Million |

| Market Size by 2031 | US$ 1,139.14 Million |

| Global CAGR (2023 - 2031) | 5.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

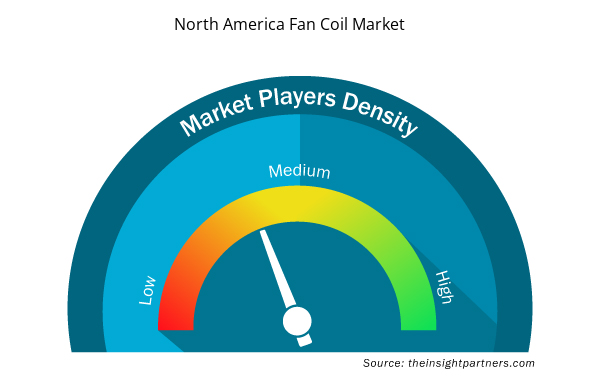

North America Fan Coil Market Players Density: Understanding Its Impact on Business Dynamics

The North America Fan Coil Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the North America Fan Coil Market are:

- Carrier Global Corp

- Daikin Industries Ltd

- Johnson Controls International Plc

- TROX GmbH

- Swegon Group AB

- Midea Group Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the North America Fan Coil Market top key players overview

North America Fan Coil Market News and Recent Developments

The North America fan coil market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the North America fan coil market are listed below:

- Carrier's latest single-stage heat pump launch marks the first heat pumps available to the field that are R-454B compatible well in advance of the 2025 regulatory shift. R-454B, known commercially as Puron Advance, is Carrier's refrigerant of choice for all ducted and ductless residential and light commercial applications. In addition to heat pumps, Carrier has also begun taking orders for R-454B compatible fan coils and evaporator coils.

(Source: Carrier, Press Release, March 2024)

- Daikin Applied announced that it had made a majority investment in Varitec Solutions, a Phoenix-based leader in designing, developing, and installing large-scale, energy-efficient HVAC systems for commercial buildings. Varitec's expertise in supporting engineers, contractors, and building owners with innovative solutions and quick delivery, combined with Daikin's industry leadership, serves customers as a unified source for comprehensive HVAC technology and services.

(Source: Daikin Applied, Press Release, October 2024)

North America Fan Coil Market Report Coverage and Deliverables

The "North America Fan Coil Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- North America fan coil market size and forecast at regional and country levels for all the key market segments covered under the scope

- North America fan coil market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- North America fan coil market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the North America fan coil market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The incremental growth expected to be recorded for the North America fan coil market during the forecast period is US$ 384.77 million.

The North America fan coil marketis expected to reach US$ 1139.14 million by 2031.

The key players holding majority shares in the North America fan coil market are DAIKIN INDUSTRIES, Ltd; Carrier; Midea; Johnson Controls; and Systemair AB.

Smart fan coil units and shift toward low-noise operations are anticipated to play a significant role in the North America fan coil market in the coming years.

Flourishing construction sector, rising data centre investments, and evolving energy efficiency regulations are the major factors that propel the North America fan coil market.

The North America fan coil market was estimated to be US$ 754.37 million in 2023 and is expected to grow at a CAGR of 5.3 % during the forecast period 2023 – 2031.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - North America Fan Coil Market

- Carrier Global Corp

- Daikin Industries Ltd

- Johnson Controls International Plc

- TROX GmbH

- Swegon Group AB

- Midea Group Co Ltd

- Zehnder Group AG

- Inner-Cool Systems

- Williams

- Ice Air

Get Free Sample For

Get Free Sample For