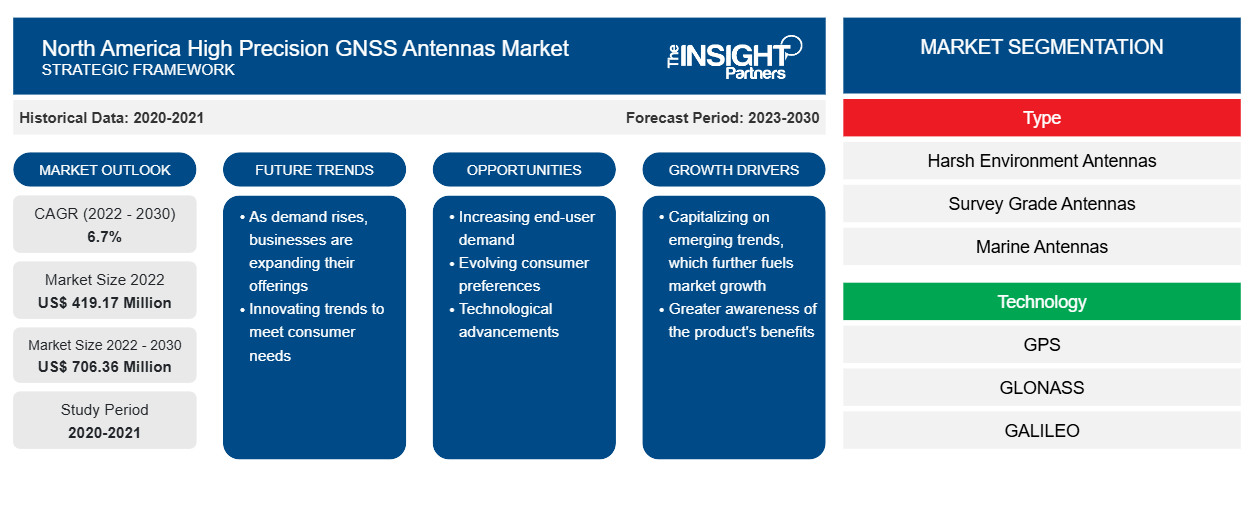

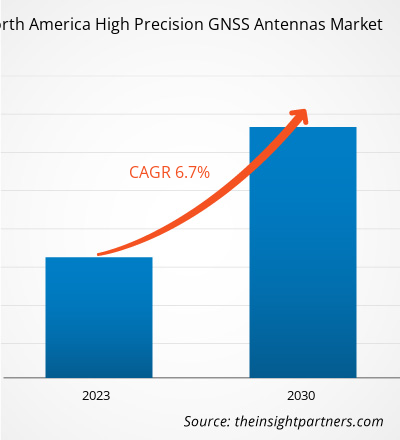

The North America high precision GNSS antennas market size is estimated to grow from US$ 419.17 million in 2022 to US$ 706.36 million by 2030; it is estimated to grow at a CAGR of 6.7% from 2022 to 2030.

America High Precision GNSS Antennas Market Analyst Perspective:

The North America High Precision GNSS antennas market has witnessed significant growth in recent years. Factors, such as the increasing use of military spending on drones and strategic initiatives by North America high precision GNSS antennas market players, are anticipated to drive the North America high precision GNSS antennas market during the forecast period.

America High Precision GNSS Antennas Overview:

The North America high precision GNSS antennas market consists of countries such as the US, Canada, and Mexico. Global Navigation Satellite System (GNSS) is addressed to a constellation of satellites that provides signals from space that transmit positioning and timing data to GNSS receivers. The receivers then use this data to determine the location. GNSS provides global coverage. A GNSS antenna is a device that is used in GNSS systems and is designed and developed to receive and amplify the radio signals transferred on specific frequencies by GNSS satellites and transform them into an electronic signal for use by a GNSS or GPS receiver. The output of the GNSS or GPS antenna is fed into a GNSS or GPS receiver that can compute the precise position.

The demand for high precision GNSS antennae is rising owing to its surging demand from the military & defense, construction, agriculture, transportation, marine, and other sectors. These antennas are widely adopted for survey and mapping applications. It is also used in geophysics, geology, and archaeology. For example, the GNSS system helps with the high precision measurements of crustal strain. It helps to interpret the cause of deformation, which includes a dike or sill beneath the surface of an active volcano.

The North America high precision GNSS antennas market is witnessing growth due to the wide focus of the military & defense sectors on the development and use of autonomous vehicles, unmanned aerial vehicles (UAVs), and automatic guided vehicles (AGVs) in the military forces. Large deployment and development of drones for various military and non-military operations further drive the North America high precision GNSS antennas market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

America High Precision GNSS Antennas Market Driver:

Strategic Initiatives by Market Players to Drive Growth of the North America High Precision GNSS Antennas Market

The North America high precision GNSS antennas market growth is driven by the strategic initiatives taken by the market players. GNNS antennas are used in several applications to provide accurate positioning information. They are developed and used in multiple shapes and sizes, and each has its benefits. For example, in the automotive, GNSS is used to display the location, speed, direction, and nearby streets and points of interest. In the air navigation system, GNSS is used to verify the aircraft's arrival at turn points in gliding competitions. In the marine system, GNSS is used in boats and ships to navigate in the world's lakes, seas and oceans. Thus, such a wide demand for GNSS in several industries encourages the North America high precision GNSS antennas market players to implement a wide range of organic and inorganic growth strategies to cater to the growing demand from several industry verticals, which in turn is driving the North America high precision GNSS antennas market growth.

A few of the growth strategies in the North America high precision GNSS antennas market are mentioned below:

- In January 2020, Modular Mining, a leader in delivering real-time computer-based mine management solutions, launched a new Customer Experience Center (CEC) in the company's corporate headquarters in Tucson, US. As the company commercially provides MM2 High-Precision Global Navigation Satellite System (HP-GNSS) system, this launch of the new center helped the company to expand its business more by catering to more customers.

- In March 2023, Septentrio, a provider of high-precision GNSS positioning solutions, announced the commencement of the Agnostic Corrections Partner Program. This program assists the use of Septentrio receivers with several high-accuracy services, offering varying levels of accuracy, coverage, and delivery methods. This also permits integrators and users to select the service that is best suitable for their specific application and business model.

- In November 2022, Linx Technologies, now part of TE Connectivity, expanded its Splatch antenna series with the launch of the ANT-GNL1-nSP, a surface-mount embedded GNSS antenna that supports GPS, Galileo, GLONASS, Beidou, and QZSS in the L1/E1/B1 bands.

America High Precision GNSS Antennas Market Segmentation and Scope:

The “North America High Precision GNSS Antennas market” is segmented on the basis of type, technology, frequency range, and end user. Based on type, the North America high precision GNSS antennas market is segmented into harsh environment antennas, survey grade antennas, and marine antenna. Based on technology, the North America high precision GNSS antennas market is categorized into GPS, GLONASS, and GALILEO. Based on frequency range, the North America high precision GNSS antennas market is segmented into L1, L2, and L5. Based on end user, the North America high precision GNSS antennas market is segmented into consumer electronics, military and defense, aviation, construction and mining, and others. Based on geography, the North America high precision GNSS antennas market is segmented into the US, Canada, and Mexico.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

Based on technology, the North America high precision GNSS antennas market is segmented into GPS, GLONASS, and GALILEO. The GPS segment holds the largest market share in the North America High Precision GNSS antennas market. Global Positioning System (GPS) is one of the most widely used GNSS systems. GPS currently has 31 operational satellites. Specifically, it refers to the NAVSTAR GPS, a constellation of satellites developed by the US Department of Defense (DoD). Formerly, the GPS was developed for military use, but later, it was made accessible to civilians as well. This system provides continuous positioning and timing information globally under any weather conditions. GNSS is used in association with GPS systems to provide precise and accurate location positioning anywhere on Earth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The US holds one of the largest North America High Precision GNSS market shares. According to the International Trade Administration (ITA), the US has one of the largest automotive markets in the world. According to ITA, the US, the technically advanced nation, is expected to remain the leading market for the 21st-century automotive industry owing to its large consumer base, available infrastructure, open investment policy, strong R&D capabilities, a highly skilled workforce, and local and state government incentives. Therefore, the demand for automobiles from the US contributes to the growing demand for high precision GNSS antennae for its application in the vehicle navigation system. The demand for high precision GNSS antennae is increasing in applications such as off-road and recreational. For example, according to the National Ski Areas Association (NSAA), American ski resorts reported 64.7 million visits during 2022–2023, a 6.6% increase over the previous year. In skiing competitions, high precision GNSS antenna is mounted on the enthusiast’s helmet for the data collection to get precise knowledge of the rate of descent, lateral accelerations, and gate crossing times. Thus, the rise in such activities drives the North America high precision GNSS antennas market in the US.

Key Player Analysis:

Hexagon AB, Trimble Inc, Septentrio NV, 2J Antennas S.R.O., Tallysman, Taoglas, Abracon, u-Box Holding AG, Quectel Wireless Solutions Co Ltd, and Dayton-Granger Inc are among the key North America High Precision GNSS antennas market players profiled in the report.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions and new product launches are highly adopted by companies in the North America high precision GNSS antennas market. A few recent key North America high precision GNSS antennas market developments are listed below:

- In September 2023, u-blox announced the u-blox NEO-F10N, its latest positioning module. It supports L1/L5 GNSS bands from multiple constellations (including NavIC) to provide solid meter-level position accuracy in urban areas. u-blox also introduces the new ANN-MB5 L1/L5 antenna together with the u-blox NEO-F10N to strengthen u-blox’s F10 dual-band solution. This tailored antenna offers customers an easy and reliable option for meter-level applications that require multi-band and multi-constellation support, even in challenging environments.

- In June 2023, u-blox announced two new modules based on the u-blox F9 high-precision GNSS platform. The low-power NEO-F9P supports precise navigation and automation of moving industrial machinery, and the ZED-F9P-15B provides customers in the mobile robotics market with an L1/L5 option in addition to the L1/L2 bands. The module delivers centimeter-level accuracy in seconds and comes in the smallest ever high-precision module form factor—50% smaller than the regular u-blox ZED form factor. This small size, coupled with very low power consumption and ANN-MB1 antenna compatibility, makes the u-blox NEO-F9P ideally suited for a wide range of use cases, including precise navigation and automation in smart antennas, UAVs, and mobile robotics.

- In June 2023, Abracon partnered with u-blox, a renowned global leader in the development of cutting-edge IoT communication modules, GNSS modules, chips, and services. This strategic collaboration between both companies aims to deliver a comprehensive turnkey IoT solution to their joint customers by combining Abracon's high-performance antennas with u-blox's industry-leading IoT module solutions.

- In January 2023, Abracon, a leader in passive components, announced the new product release for the Ultra-Wideband (UWB) Antennas, including the Ultra-Wide Band 3.3–7.2 GHz Chip Antenna, the Ultra-Wide Band 3.7–4.2 GHz Chip Antenna, and the Ultra-Wide Band 6.2–8.2 GHz Chip Antenna solutions. Abracon’s Ultra-Wideband (UWB) antennas are designed for the next generation of connectivity. These antennas provide best-in-class performance, offer high efficiency and low power consumption, and meet industry needs for fast/stable data transmission. The low power requirements of UWB antennas result in increased battery life, reducing overall operational costs.

- In February 2023, Taoglas, a trusted provider of antennas and IoT components that help solve complex engineering problems announced that it completed a transaction that resulted in a majority ownership from Graham Partners, a private investment firm targeting technology-driven advanced manufacturing companies. The deal will support Taoglas’ continued expansion of in-house RF engineering expertise and design globally, new product development, sales channels, and customer base across a wide range of IoT industries, including mobility, infrastructure, transportation, medical, industrial, and smart city verticals.

North America High Precision GNSS Antennas Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 419.17 Million |

| Market Size by 2030 | US$ 706.36 Million |

| Global CAGR (2022 - 2030) | 6.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Technology, Frequency Range, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Strategic initiatives by market players can be one of the drivers for the North America high precision GNSS antenna market.

The incremental growth expected to be recorded for the North America high precision GNSS antenna market during the forecast period is US$ 287.20 million.

Advent of advanced robotics solutions is making positive impact, which is anticipated to play a significant role in the North America high precision GNSS antenna market in the coming years.

The North America high precision GNSS antenna market is expected to reach US$ 706.36 million by 2030.

The North America high precision GNSS antenna market was estimated to be US$ 419.17 million in 2022 and is expected to grow at a CAGR of 6.7% % during the forecast period 2023 - 2030.

The key players holding majority shares in the North America high precision GNSS antenna market are HEXAGON; Trimble Inc.; 2J Antennas, s.r.o.; Tallysman; and DAYTON-GRANGER, INC.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - North America High Precision GNSS Antenna Market

- Hexagon AB

- Trimble Inc

- Septentrio NV

- 2J Antennas S.R.O.

- Tallysman

- Taoglas

- Abracon

- u-blox Holding AG

- Quectel Wireless Solutions Co Ltd

- Dayton-Granger Inc

Get Free Sample For

Get Free Sample For