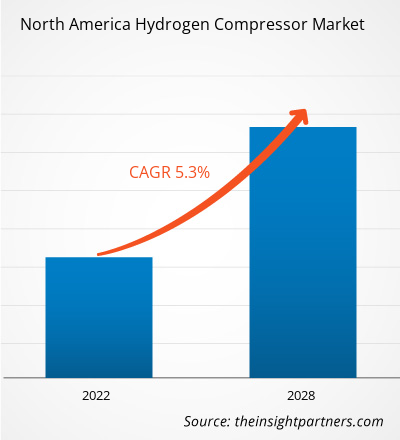

The hydrogen compressor market was valued at US$ 448.7 million in 2021 and is projected to reach US$ 643.6 million by 2028; it is expected to grow at a CAGR of 5.3% from 2021 to 2028.

Due to expanding regional demand for distillate fuel oil and severe sulfur content standards, the demand for hydrogen is increasing across the refining industry. The need for hydrogen compressors has increased as their use has grown in refining processes. Oil-based compressors are more efficient than oil-free compressors because oil acts as a cooling medium, removing around 80% of the heat created by the compressor during compression. Therefore, there has been a major increase in the need for oil-based compressors in recent years. As a result, this factor is likely to have a significant impact on the hydrogen compressor market growth during the forecast period. Increasing need for hydrogen from the refining industry and the growing emphasis on using clean hydrogen propel the demand for hydrogen compressors.

In January 2021, the US Department of Energy's (DOE) Office of Fossil Energy (FE) announced plans to allocate US$ 160 million in federal funds to help recalibrate the country's extensive fossil fuel and power infrastructure for decarbonized energy and commodity production. The funding for cost-shared cooperative agreements was targeted at developing technology for the generation, transportation, storage, and use of fossil-based hydrogen, to achieve net-zero carbon emissions. The funds will be used to support various research initiatives focusing on hydrogen compressor innovation.

Based on type, the North America hydrogen compressor market is bifurcated into oil-based and oil-free. Based on stage, the North America hydrogen compressor market is bifurcated into single-stage and multi-stage. Based on end user, the North America hydrogen compressor market is segmented into chemicals, oil and gas, automotive and transportation, renewable energy, and others. Based on discharge pressure range, the North America hydrogen compressor market is segmented into less than 13000 psig, 13001 psig–14000 psig, and more than 14000 psig. Based on power range, the North America hydrogen compressor market is segmented into less than 1 MW, 1 MW to 5 MW, 5 MW to 10 MW, and more than 10 MW. Based on application, the North America hydrogen compressor market is segmented into H2 liquid, H2 pipeline, H2 for industry/ammonia, H2 storage, H2 trailer/cylinder filling, H2 large fuel station, and H2 small fuel station. Based on compressor type, the North America hydrogen compressor market is segmented into reciprocating and diaphragm compressors and piston ring compressors.

Impact of COVID-19 Pandemic on hydrogen compressor market

The COVID-19 pandemic is wreaking havoc on energy networks across North America, stifling investment and slowing the spread of crucial clean energy technology. Prior to the crisis, clean energy technology progress had been promising but uneven. According to the International Energy Agency annual Tracking Clean Energy Progress report, only 6 out of 46 technologies and sectors were "on pace" to reach long-term sustainability goals in 2019. In addition, prior to the COVID-19 pandemic, low-carbon versions of hydrogen had acquired extraordinary traction. The deployment of hydrogen-producing electrolyzers was predicted to set new milestones in the following years.

Moreover, numerous projects using Carbon capture, utilisation and storage to manufacture hydrogen from fossil fuels are in the works or have declared plans to begin operations in the early 2020s. The global economic slump, supply chain interruptions, and lower capital spending by firms, which may also prioritize other business sectors, may jeopardize these projects and potential advancements. These obstacles could hinder the demonstration of critical end-use technologies required for hydrogen's inclusion into the economy.

Lucrative Regions for hydrogen compressor market

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights– hydrogen compressor market

Growing Oil & Gas Industry in North America

Major countries in North America, such as the US, Canada, and Mexico, have a huge oil & gas industry. The growing investments in the oil & gas industry boost the development of hydrogen compressors. As of January 2019, the US had 130 operational petroleum refineries, while Canada had 14 refineries and two asphalt refineries. In addition, enterprises in the region are striving to increase the production of green energy fuels. For instance, Pemex, Mexico's national oil business operating six petroleum refineries, revealed its plans to build a massive oil refinery in May 2019. Furthermore, the company aided natural gas production in the US by increasing its export business of LNG capacity and expanding its power to influence new markets. As a result, the growing oil & gas industry necessitates efficient energy storage anytime it is needed.

Furthermore, North America, notably the US, has historically been the most significant market for oil & gas. Also, drilling activity is expected to increase in the coming years across the region. The increasing government investments in oil & gas projects in the region propel the demand for hydrogen compressors integrated with energy storage systems. Several active oil & gas projects in North America also boost the growth of the hydrogen compressors market in the region.

Type-Based hydrogen compressor market Insights

Based on type, the North America hydrogen compressor market is bifurcated into oil-based and oil-free. Oil-based hydrogen compressors are likely to dominate the market over the forecast period, owing to their cheaper cost, longer life, and higher efficiency, making them ideal for use in various sectors.

Stage-Based hydrogen compressor market Insights

Based on stage, the North America hydrogen compressor market is bifurcated into single-stage and multi-stage. The number of times air is compressed between the inlet valve and the tool nozzle is the fundamental difference between single-stage and multi-stage compressors. A single-stage compressor compresses the air once; a multi-stage compressor compresses the air many times for double the pressure.

End User-Based hydrogen compressor market Insights

Based on end user, the North America hydrogen compressor market is segmented into chemicals, oil and gas, automotive and transportation, renewable energy, and others. The oil and gas industry uses technologically advanced devices and solutions to optimize product quality and quantity. Hydrogen is also used in the chemical sector to produce methanol and ammonia. Methanol and ammonia account for more than half of all hydrogen consumed worldwide. Chemicals are produced in large quantities throughout North America. Furthermore, large investments in developing new hydrogen plants are projected in North America, which is expected to drive the market throughout the projection period.

Discharge Pressure Range-Based hydrogen compressor market Insights

Based on discharge pressure range, the North America hydrogen compressor market is less than 13000 psig, 13001 psig–14000 psig, and more than 14000 psig. The lightest gas in the universe is hydrogen. Under normal atmospheric pressure, one liter of this gas weighs only 90 mg, making it 11 times lighter than air.

Power Range-Based hydrogen compressor market Insights

Based on power range, the North America hydrogen compressor market is segmented into less than 1 MW, 1 MW to 5 MW, 5 MW to 10 MW, and more than 10 MW. The less than 1 MW segment is dominating the market due to wide-range adoption in end-user industries and small-scale projects.

Application-Based hydrogen compressor market Insights

Based on application, the North America hydrogen compressor market is segmented into H2 liquid, H2 pipeline, H2 for industry/ammonia, H2 storage, H2 trailer/cylinder filling, H2 large fuel station, and H2 small fuel station. Industrial trucks (for instance, forklifts) and passenger cars powered by hydrogen fuel cells are finding new markets. Indoor and outdoor hydrogen filling stations are being created to support these vehicles. A fuel cell is a device that produces electricity by combining hydrogen and oxygen from the air in an electrochemical reaction. It may power an electric motor and propel a vehicle.

Compressor Type-Based hydrogen compressor market Insights

Based on compressor type, the North America hydrogen compressor market is segmented into diaphragm compressors and piston compressors. Hydrogen is climbing to the top of the energy industry's quest for clean, long-term solutions.

Players operating in the market are mainly focused on developing advanced and efficient products.

- In January 2021, Burckhardt Compression AG entered into a partnership with Shell New Energies. The partnership is formed for the development of heavy-duty hydrogen refueling compressor systems. In accordance with this, Burckhardt Compression AG planned to develop a new facility at Winterthur, Switzerland, dedicated to heavy-duty hydrogen refueling compressor systems.

- In April 2021, PDC Machines and its partner Ivys Energy Solutions announced a collaboration with ENGV. The collaboration was established to deliver fuel fast at the CSIRO's Victorian hydrogen hub in Melbourne. ENGV will provide integration, installation, and operational services for the station in Melbourne.

North America Hydrogen Compressor Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 448.7 Million |

| Market Size by 2028 | US$ 643.6 Million |

| Global CAGR (2021 - 2028) | 5.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Stage, End User, Discharge Pressure Range, Power Range, Application, and Compressor Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Canada, Mexico, United States

Trends and growth analysis reports related to Energy and Power : READ MORE..

The List of Companies - North America Hydrogen Compressor Market

- Atlas Copco

- Burckhardt Compression AG

- Fluitron, Inc.

- Gardner Denver

- HAUG Sauer Kompressoren AG

- Howden Group

- HYDRO-PAC, INC.

- Lenhardt & Wagner

- NEUMAN & ESSER GROUP

- PDC MACHINES INC.

Get Free Sample For

Get Free Sample For