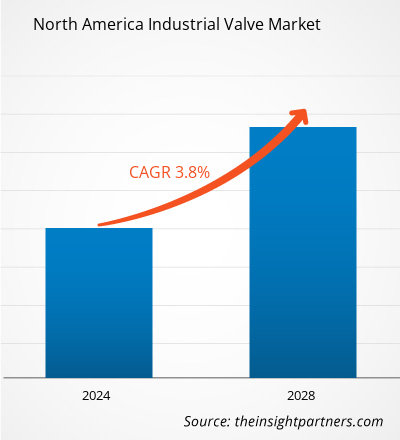

The North America industrial valve market is expected to grow from US$ 22,718.55 million in 2023 to US$ 27,405.72 million by 2028; it is estimated to record a CAGR of 3.8% from 2023 to 2028.

The US is one of the largest natural gas producers in the world. According to the US Energy Information Administration (EIA), in 2021, the country produced ~34,517,798 million cubic feet (MMcf) of natural gas and consumed 30,664,951 MMcf of natural gas. In addition, the country exported 3,560,818 MMcf of liquefied natural gas (LNG). Also, the country has more than 3 million miles of mainline and other pipelines, which link natural gas production areas and storage facilities with consumers. The US government is further working on expanding the natural gas pipeline infrastructure of the country. In 2022, the US government approved various projects to increase the capacity to transport natural gas in the country. For example, Columbia Gulf Transmission’s Louisiana XPress Project increased its capacity by 493 MMcf/d from Mississippi to Louisiana and 50 MMcf/d from Tennessee to Mississippi. Under this project, the company added and upgraded compressor stations to increase natural gas deliverability from the Appalachian Basin. Similarly, Florida Gas Transmission’s Mobile County Project increased its capacity by 175 MMcf/d from Mississippi to Alabama by modifying the CS10 compressor station in Mississippi. Thus, such infrastructural expansion in the US is raising the need for industrial valves in the region, fueling the market growth.

Moreover, various new oil and gas construction projects are under progress in Canada and Mexico. In Q2 2022, the construction work of the Centre of Excellence for Carbon Capture & Removal project started in Burnaby, British Columbia, Canada. It involved the construction of a CCS plant, which will help capture and store up to 2,000 metric tons of CO2 per day. Similarly, the construction of the Vista Pacifico Liquified Natural Gas Plant project commenced in Q2 2022, with an investment of US$ 2,000 million. Under this project, an LNG export terminal will be constructed on 150 hectares of land in the Municipality of Ahome, Topolobampo, Sinaloa, Mexico. Thus, such oil and gas construction projects will raise the demand for industrial valves as they help ensure the safe and efficient operation of various processes in upstream, midstream, and downstream applications. Also, valves regulate fluid flow, maintain pressure and temperature levels, and provide isolation and control for various industrial applications involving liquids, such as pipeline and distribution infrastructure. In the oil & gas industry, valves are used in pipeline systems transporting and distributing crude oil, natural gas, and other refined products, as they provide tight shutoff, high flow capacity, and quick operation. Also, they are used to isolate wellheads during drilling, completion, and production phases to ensure safety and control over the flow of oil and gas. Therefore, the expansion of the oil & gas industry in North America is raising the need for industrial valves, fueling the North America industrial valve market growth.

North America Industrial Valve Market Revenue and Forecast to 2028 (US$ Million)

North America Industrial Valve Market: Key Players

Major North America industrial valve market players include CRANE CO., Flowserve Corporation, Emerson Electric Co., CIRCOR INTERNATIONAL, SPIRAX SARCO, SCHLUMBERGER LIMITED, Velan Inc., The Weir Group PLC, Frontier Valve International, and FITOK Group. These market players are continuously working on developing advanced products. For instance, in October 2021, Emerson launched the ASCO Series 062 Rocker Isolation Valve, which is designed particularly for the most demanding fluid control manifolds in the clinical laboratory such as immunoassay analyzers, hematology, sample preparation and pre-analytical, and DNA sequencing instruments. Thus, such development by the market players will fuel the North America industrial valve market growth during the forecast period.

North America Industrial Valve Market: By Component

Based on material, the North America industrial valve market is segmented into cast iron, steel, cryogenic, alloy-based, and others. The steel segment held the largest share in the North America industrial valve market in 2021. The increasing use of steel valves in water, gas, petrochemical, and chemical supply processes, as well as in general-purpose applications, is fueling the segment growth in North America.

Impact of COVID-19 Pandemic on North America Industrial Valve Market

The sudden onset of the COVID-19 outbreak across North America hampered the industrial valve market in Q1 of 2020. The rapid spread of COVID-19 urged governments of North American countries to impose strict restrictions on human movement, which led to the shutdown of manufacturing activities. However, in Q1 of 2021, the North America industrial valve market started reviving with ease in lockdown restrictions. Various industrial valve manufacturers pst-lockdown worked on developing technologically advance industrial valve and came up with the smart valve. Thus, such innovation by the market players is projected to fuel the North America industrial valve market.

North America Industrial Valve Market: Market Initiative

Market initiatives are a strategy adopted by companies to expand their footprint worldwide and meet the growing customer demand. The North America industrial valve market players are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings.

- In 2021, Crane’s new FK-TrieX full port triple offset isolation valves offered reliability, safety, and efficient operation for various severe service applications. The FK-TrieX features superior fugitive emissions control, enhanced reliability with a unique bi-directional bubble-tight shutoff, and minimizes the total cost of ownership.

- In 2021, Crane Fluid Systems published a new General Valves catalog for promoting the entire range of new valves, which included ball valves, butterfly valves, check valves, gate valves, globe valves, and radiator valves.

North America Industrial Valve Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 22,718.55 Million |

| Market Size by 2028 | US$ 27,405.72 Million |

| Global CAGR (2023 - 2028) | 3.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2028 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- MEMS Foundry Market

- Nitrogenous Fertilizer Market

- Resistance Bands Market

- Hydrocephalus Shunts Market

- Aerosol Paints Market

- Trade Promotion Management Software Market

- Investor ESG Software Market

- Lyophilization Services for Biopharmaceuticals Market

- Employment Screening Services Market

- Batter and Breader Premixes Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material, Valve Type, Ball Valve, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Canada, Mexico, United States

Frequently Asked Questions

Steel material type is the leading material segment in the industrial valves market.

The incremental growth of industrial valves market during the forecast period is US $ 4,687.17 million.

Growing Investment in Water and Wastewater Infrastructure. Access to clean and safe drinking water is critical for public health and economic prosperity. Due to the rising demand for clean drinking water, governments of various countries are investing in enhancing drinking water infrastructure

The industrial valves market is estimated to grow at US$ 27,405.72 million in 2028 at a CAGR of 3.8%.

Rising Expansion in Oil & Gas industry and strategic alliance by market players such as acquisition and merger is driving the industrial valves market.

CRANE CO., Flowserve Corporation, Emerson Electric Co., SCHLUMBERGER LIMITED, and Velan Inc. are the key players holding the major market share in the industrial valves market.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Industrial Valves Market

- Crane Co

- Velan Inc

- Emerson Electric Co

- Flowserve Corp

- Spirax Sarco Engineering Plc

- Schlumberger NV

- CIRCOR International Inc

- FITOK GmbH

- The Weir Group PL

- Frontier Valve International Ltd

- GWC Italia SpA

- Admiral Valve LLC

- Allagash International Group LLC

- American Valve Inc

- Champion Valves Inc

- Cornerstone Valve LLC

- Dezurik Inc

- Descote Inc

- Everlasting Valve Co Inc

- Henry Pratt Co LLC

Get Free Sample For

Get Free Sample For