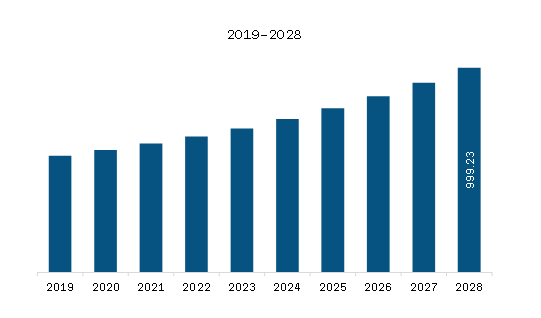

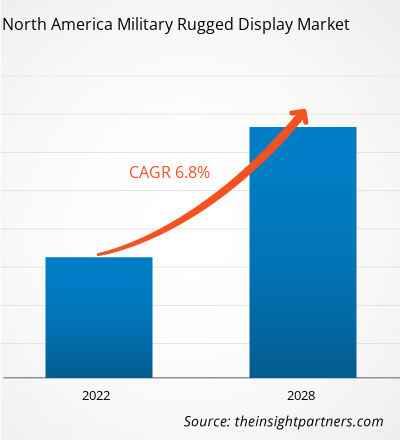

The military rugged display market in North America is expected to grow from US$ 628.89 million in 2021 to US$ 999.23 million by 2028; it is estimated to grow at a CAGR of 6.8% from 2021 to 2028.

Situational awareness or being aware of the location is paramount among the soldiers during the battle. The modern battlefield presents several challenges to situation awareness, which poses a substantial threat to the dismounted soldiers as well as vehicles (land, air, and naval). This is due to the fact that enemies or militant forces are using advanced technologies, which creates challenging situations for armed forces during decision making. Owing to enhance situational awareness among the on-battle soldiers, the demand for rugged devices is consistently growing, supporting the generating a generous amount of demand for the rugged display that functions smoothly under harshest environments. This factor is driving the military rugged display market. The modern-day dismounted soldiers and other armed forces utilize several types of rugged devices, enabling the users to understand the nearby scenario and allow them to navigate their paths quickly. The quick response of the users is attainable from the data relayed on screens of rugged devices. The rugged display manufacturers increasingly emphasize designing and developing advanced technology rugged displays to benefit the military users. For instance, resistive touchscreens have been the norm among the military forces as well as rugged display manufacturers over the years; however, in recent times, the rugged display manufacturers are shifting their focus from resistive touchscreens displays to capacitive touchscreen displays. This is due to the fact that the capacitive touchscreens are technologically advanced and are highly sensitive to touches. The high sensitivity allows the user to navigate their maps on the devices smoothly and quickly, which enables them to relocate themselves to a safer area. Also, the capacitive screens are brighter, and the data are easily readable under sunrays. This improves situational awareness on the battlefield. Such advancements are attracting several military forces across the region, which is driving the North America military rugged display market.

The US is the largest military client worldwide and has many defense contractors across its borders. The exponential rise in the COVID-19 cases led the government of this country to impose strict restrictions on public activities in Q2 and Q3 of 2020. Many manufacturing plants were either temporarily shut down or operating with a limited workforce. The pandemic, and consequent travel restrictions also led to disruptions in the supply chain of equipment and related components in 2020. In addition, the demand for defense equipment decelerated in the country during the global crisis. The US Department of Defense (DoD) suspended military troops and vehicle (ground, airborne, and naval) deployments across the world, which was another concern for the defense equipment manufacturers, as the discontinuation of several operations disrupted the regular procurement trend. The Canadian defense forces have showed marginal growth in military spending since the outbreak of COVID-19. Although the country has several military equipment manufacturers, the emergence of the COVID-19 pandemic resulted in slower growth in the procurement of military equipment and vehicles (ground, airborne, and naval).

North America Military Rugged Display Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Military Rugged Display Market Segmentation

North America Military Rugged Display Market – By Product

- Smartphone and Handheld Computer

- Laptop and Notebook

- Avionics Display

- Vehicle Mounted Computer

- Panel PC and Mission Critical Display

North America Military Rugged Display Market – By Display Size

- Less Than 10 Inches

- 10 - 15 Inches

- More Than 15 Inches

North America Military Rugged Display Market – By Screen Type

- Touchscreen

- Resistive

- Capacitive

- Non-Touchscreen

North America Military Rugged Display Market – By Resolution

- High Definition (HD)

- Full High Definition (FHD)

North America Military Rugged Display Market – By Users

- Air Force

- Naval Force

- Land Force

North America Military Rugged Display Market– By Country

- US

- Canada

North America Military Rugged Display Market-Companies Mentioned

- Assured Systems Ltd

- Aydin Displays

- CP Technologies LLC

- Crystal Group, Inc.

- General Digital Corporation

- Hatteland Technology AS

- Neuro Logic Systems, Inc

- Winmate Inc.

- ZMicro, Inc.

North America Military Rugged Display Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 628.89 Million |

| Market Size by 2028 | US$ 999.23 Million |

| Global CAGR (2021 - 2028) | 6.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

- Assured Systems Ltd

- Aydin Displays

- CP Technologies LLC

- Crystal Group, Inc.

- General Digital Corporation

- Hatteland Technology AS

- Neuro Logic Systems, Inc

- Winmate Inc.

- ZMicro, Inc.

Get Free Sample For

Get Free Sample For