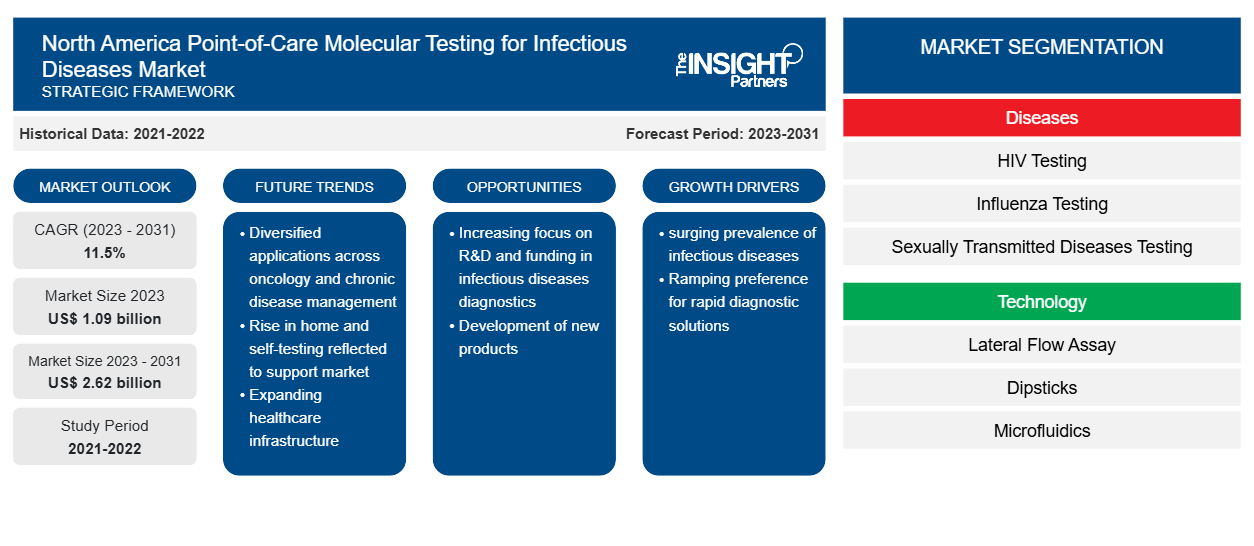

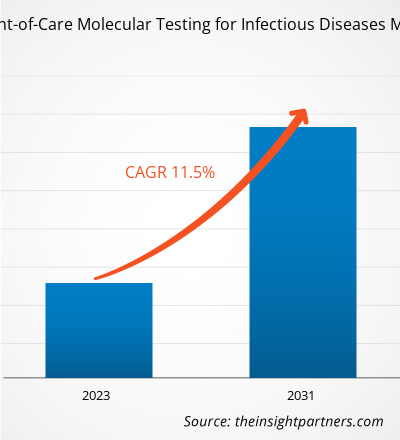

The North America point-of-care molecular testing for infectious diseases market size is projected to reach US$ 2.62 billion by 2031 from US$ 1.09 billion in 2023. The market is expected to register a CAGR of 11.5% during 2023–2031. The rising number of product approvals and launches are likely to remain a key trend in the market.

North America Point-of-Care Molecular Testing for Infectious Diseases Market Analysis

The surging prevalence of infectious diseases and the preference for rapid diagnostic solutions are the key factors driving the market development. Furthermore, the rising focus on R&D and funding in infectious disease diagnostics is expected to create lucrative opportunities for the growth of the North American point-of-care testing in the infectious disease market in the coming years. For instance, in January 2023, 19 to Zero, a nonprofit behavioral sciences initiative group, received financing from BD through an educational grant for a point-of-care testing pilot in the primary care environment. A financial award was accompanied by the provision of multiple BD Veritor Plus System Analyzers and BD Veritor System for Rapid Detection Assays to facilitate point-of-care diagnostic testing for influenza A and B, RSV, SARS-CoV-2, Group A strep, and triplex.

North America Point-of-Care Molecular Testing for Infectious Diseases Market Overview

Infectious diseases adversely affect public health, causing morbidity, mortality, and economic burdens. The effective management, treatment, and prevention of these health conditions require accurate and timely diagnosis. Molecular diagnostics techniques, laboratory-based assays, and point-of-care tests are employed for the diagnosis of HIV, tuberculosis, and hepatitis C; human papillomavirus screening for cervical cancer; and the monitoring of health and treatment progress in patients. Healthcare providers turn to point-of-care testing to streamline diagnostic processes, reduce turnaround times, and enhance patient care. These tests also ease diagnoses during infectious disease outbreaks. According to data published by the CDC in 2022, Florida (US) suffered the onset of concurrent epidemics of hepatitis A, invasive meningococcal disease (IMD), and mpox (formerly known as monkeypox). Mpox cases were more strongly concentrated in South Florida and peaked in August. In contrast, the hepatitis A and IMD epidemics were centered in Central Florida and peaked from March to June. Nearly 2,845 cases of mumps were reported in Florida as part of a worldwide outbreak. HIV infection was found in 52% of mpox patients compared to 21% of hepatitis A and 34% of IMD cases. These pathogens include hepatitis A, mpox, and meningococcal disease. The need for quick identification and containment of infectious pathogens propelled the demand for innovative point-of-care testing solutions in North America.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Point-of-Care Molecular Testing for Infectious Diseases Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Point-of-Care Molecular Testing for Infectious Diseases Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Point-of-Care Molecular Testing for Infectious Diseases Market Drivers and Opportunities

Preference for Rapid Diagnostic Solutions Favors Market Growth

Healthcare providers emphasize on the quick and accurate diagnosis of infectious diseases such as HIV infections, hepatitis, and influenza. POC testing aids in the rapid identification of specific viruses and bacteria, enabling timely treatment decisions and improved patient outcomes. The time taken by POC tests to deliver results may vary from minutes to hours, whereas traditional laboratory testing may take days to produce results. Simple test kits detect proteins released by pathogens or those present on cell surfaces, among others, from samples; they can also detect human antibodies produced in response to infection from blood or serum. The rapid turnaround time enables the prompt initiation of appropriate treatments and helps prevent the spread of infectious diseases within communities. Advancements in POC testing technologies have further enhanced these diagnostic devices with greater accuracy, sensitivity, and ease of use, making them more reliable and user-friendly for healthcare professionals. These technological innovations have expanded the capabilities of POC testing for infectious diseases, allowing for the detection of a wider range of pathogens with greater precision. Additionally, the increasing inclination toward personalized medicine in healthcare has propelled the demand for POC testing products. By providing real-time diagnostic information at the point of care, POC testing enables healthcare providers to tailor treatment plans based on each patient's infection profile, leading to more effective and personalized care.

Increasing Focus on R&D and Funding in Infectious Disease Diagnostics

Research and development (R&D) is an essential component for pharmaceutical and biopharmaceutical companies. R&D enables market players to develop new products for various therapeutic applications with significant medical and commercial potential. The following table displays the annual funding for various research and disease categories based on contracts, grants, and other funding mechanisms adopted by the NIH.

Infectious Diseases and Fundings

Research/Disease Areas | 2019 (US$ Million) | 2020 (US$ Million) | 2021 (US$ Million) | 2022 (US$ Million) |

Emerging Infectious Diseases | 2,950 | 4,867 | 5,069 | 4,318 |

Infectious Diseases | 6,313 | 8,301 | 8,599 | 8,019 |

Sexually Transmitted Infections | 354 | 394 | 404 | 419 |

Note: The current conversion rate is considered for the currencies.

Source: Annual Reports and The Insight Partners Analysis

In response to the shortage of laboratory capabilities and molecular testing reagents, coupled with the rising cases of infectious diseases, diagnostic testing manufacturers offer fast and easy-to-use devices to facilitate out-of-laboratory testing.

North America Point-of-Care Molecular Testing for Infectious Diseases Market Report Segmentation Analysis

Key segments that contributed to the derivation of the North America point-of-care molecular testing for infectious diseases market analysis are disease, technology, prescription testing, sample, distribution channel, and end user.

- Based on disease, the North America point-of-care molecular testing for infectious diseases market is divided into HIV testing, influenza testing, sexually transmitted diseases testing, hepatitis C virus testing, tropical diseases testing, respiratory infection testing, hospital-acquired infections, strep, and others. The market is further divided on the basis of molecular diagnostics into polymerase chain reactions (PCR), isothermal nucleic acid amplification technology (INAAT), and others. The respiratory infection testing segment held the largest market share in 2023.

- By technology, the market is segmented into lateral flow assay, dipsticks, microfluidics, molecular diagnostics, immunoassays, solid phase, and others. The lateral flow assay segment held the largest share of the market in 2023.

- In terms of sample, the market is segmented into blood samples, urine samples, nasal and oropharyngeal swabs, and others. The blood sample segment held the largest market share in 2023.

- In terms of end user, the market is segmented into hospitals and clinics, home care settings, ambulatory and urgent care facilities, nursing homes and assisted living facilities, research laboratories, and diagnostics centers. The market is further divided on the basis of hospitals and clinics into clinical laboratories, professional physician offices, and others. The hospitals and clinics segment held the largest market share in 2023.

North America Point-of-Care Molecular Testing for Infectious Diseases Market Share Analysis by Country

The scope of the North America point-of-care molecular testing for infectious diseases market report is mainly divided into three countries: US, Canada, and Mexico.

The increasing prevalence of infectious diseases, the rising geriatric population, and a surging number of product launches by key players are the primary contributors to the point-of-care testing for infectious diseases market growth in the US. Aging is a prominent risk factor for infectious diseases, as people aged more than 60 may have compromised immunity. According to a study published by the Population Reference Bureau in 2020, the population of individuals aged 65 and above was 55 million in the US in 2020, and the number is expected to reach 95 million by 2060. Regulatory agencies in the US rigorously monitor the development of point-of-care (POC) testing products. For instance, in March 2021, the US Food Drug Administration (FDA) authorized Binx Health IO CT/NG Assay for community-based clinics, urgent care settings, and outpatient healthcare facilities; it is the first POC testing product for diagnosing chlamydial and gonorrheal infections.

North America Point-of-Care Molecular Testing for Infectious Diseases Market Regional Insights

The regional trends and factors influencing the North America Point-of-Care Molecular Testing for Infectious Diseases Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses North America Point-of-Care Molecular Testing for Infectious Diseases Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for North America Point-of-Care Molecular Testing for Infectious Diseases Market

North America Point-of-Care Molecular Testing for Infectious Diseases Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.09 billion |

| Market Size by 2031 | US$ 2.62 billion |

| Global CAGR (2023 - 2031) | 11.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Diseases

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

North America Point-of-Care Molecular Testing for Infectious Diseases Market Players Density: Understanding Its Impact on Business Dynamics

The North America Point-of-Care Molecular Testing for Infectious Diseases Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the North America Point-of-Care Molecular Testing for Infectious Diseases Market are:

- Abbott Laboratories

- Agilent Technologies Inc

- Becton Dickinson and Co

- Bio-Rad Laboratories Inc

- Cardinal Health Inc,

- Danaher Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the North America Point-of-Care Molecular Testing for Infectious Diseases Market top key players overview

North America Point-of-Care Molecular Testing for Infectious Diseases Market News and Recent Developments

The North America point-of-care molecular testing for infectious diseases market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the North America point-of-care molecular testing for infectious diseases market are listed below:

- Roche received FDA approval for the first molecular test to screen for malaria in blood donors in the US. Roche's cobas Malaria test was approved by the FDA for use on the cobas 6800/8800 Systems. The test identifies infected blood units, making the process of blood donation and transfusion safer. The test screens for the five main species of Plasmodium parasites that cause infection in humans. It can be used to screen blood, organ, and tissue donors, thereby improving blood safety and availability. (Source: QuidelOrtho, Company Website, April 2024)

North America Point-of-Care Molecular Testing for Infectious Diseases Market Report Coverage and Deliverables

The “North America Point-of-Care Molecular Testing for Infectious Diseases Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- North America point-of-care molecular testing for infectious diseases market size and forecast at regional and country levels for all the key market segments covered under the scope

- North America point-of-care molecular testing for infectious diseases market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- North America point-of-care molecular testing for infectious diseases market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the North America point-of-care molecular testing for infectious diseases market.

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Real-Time Location Systems Market

- Rugged Phones Market

- Hydrogen Storage Alloys Market

- Personality Assessment Solution Market

- Social Employee Recognition System Market

- Lymphedema Treatment Market

- Print Management Software Market

- Aesthetic Medical Devices Market

- Clear Aligners Market

- Oxy-fuel Combustion Technology Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The rising number of product approvals and launches are likely to be key trends in the market in the future.

Key market players include Abbott Laboratories, Agilent Technologies Inc, Becton Dickinson and Co, Bio-Rad Laboratories Inc, Cardinal Health Inc, Danaher Corp, Cue Health Inc, QuidelOrtho Corp, Thermo Fisher Scientific Inc, and F. Hoffmann-La Roche Ltd.

The surging prevalence of infectious diseases and the preference for rapid diagnostic solutions are the key driving factors behind the market development. Further, the increasing focus on R&D and funding in infectious disease diagnostics are expected to bolster the growth of the market in the coming years.

The North America point-of-care testing for infectious diseases market is segmented into the US, Canada, and Mexico. The US held the largest market share in 2023.

The market is expected to register a CAGR of 11.5% during 2023–2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - North America Point-of-Care Molecular Testing for Infectious Diseases Market

- Abbott Laboratories

- Agilent Technologies Inc

- Becton Dickinson and Co

- Bio-Rad Laboratories Inc

- Cardinal Health Inc,

- Danaher Corp

- Cue Health Inc,

- QuidelOrtho Corp

- Thermo Fisher Scientific Inc

- F. Hoffmann-La Roche Ltd.

Get Free Sample For

Get Free Sample For