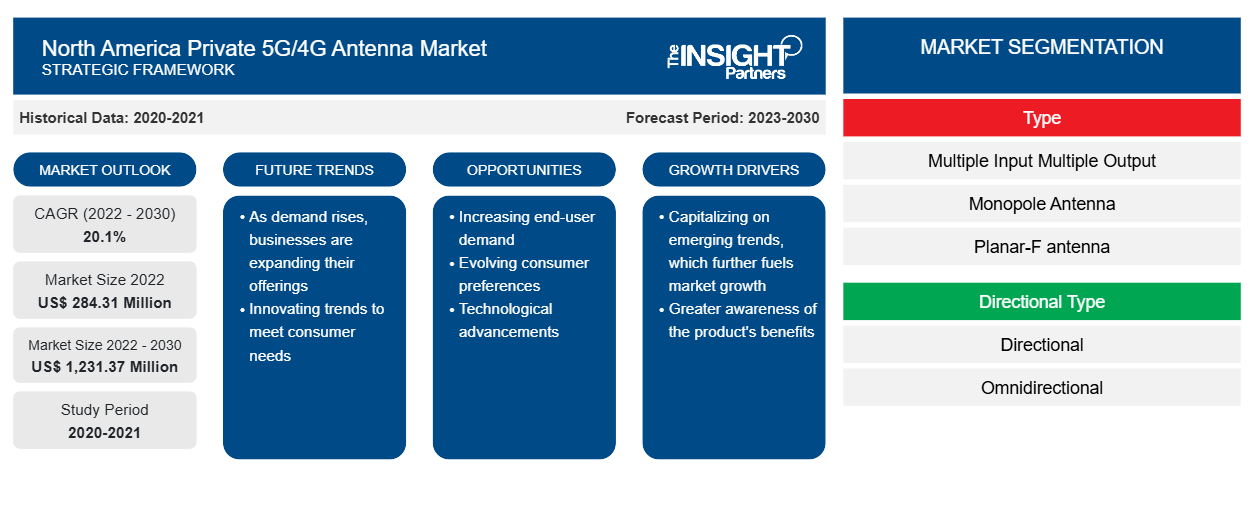

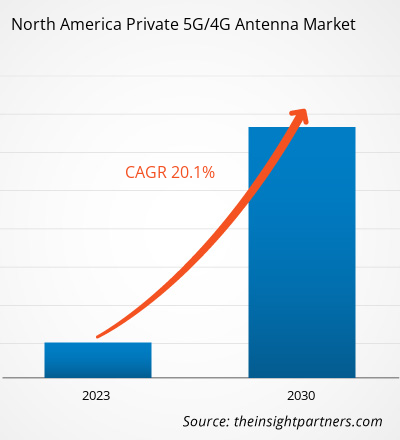

The North America private 5G/4G antenna market size was valued at US$ 284.31 million in 2022 and is expected to reach US$ 1,231.37 million by 2030. The North America private 5G/4G antenna market is estimated to record a CAGR of 20.1% from 2022 to 2030.

Analyst Perspective:

The North America private 5G/4G antenna market is driven by the increasing demand for high-speed, reliable, and secure wireless connectivity. The transition from 4G to 5G networks signifies a leap in wireless communication capabilities. While 4G provides high-speed internet, 5G brings ultra-low latency, increased bandwidth, and connectivity for a massive number of devices simultaneously. Private antennas are evolving to support the advanced features of 5G such as beamforming and massive MIMO, to enhance network performance and coverage. Industries, enterprises, and critical infrastructure sectors increasingly adopt private networks for enhanced security, reliability, and control over their communication networks. Private antennas enable the establishment of dedicated networks, providing localized and customized connectivity solutions for specific applications.

North America Private 5G/4G Antenna Market Overview:

The integration of private 5G/4G antennas is crucial for the realization of Industry 4.0, facilitating seamless communication between devices and systems in smart factories and industrial settings. Private antennas designed for IIoT applications offer robust and low-latency connectivity, supporting the interconnectivity of sensors, machines, and automation systems. Private antennas, particularly those designed for small cell deployments, contribute to extending coverage and enhancing network capacity, addressing challenges in urban and high-density environments. The North America private 5G/4G antenna market growth is driven by the transition to advanced mobile networks, demand for private connectivity solutions, and integration of wireless communication technologies across diverse industries.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Private 5G/4G Antenna Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Private 5G/4G Antenna Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Private 5G/4G Antenna Market Driver:

Increasing Demand for Private Networks Drives North America Private 5G/4G Antenna Market Growth

Demand for private networks is increasing across diverse industries such as manufacturing, transportation, healthcare, and utilities due to rising awareness regarding its benefits, including enhanced security, low latency, and high reliability. Industries dealing with sensitive data or mission-critical operations, such as healthcare and utilities, place a high emphasis on data security and privacy. Private networks provide a higher security level than public networks, as they operate within a closed network environment. This closed environment minimizes the threat of illegal access and data breaches, safeguarding the confidentiality and integrity of critical information. Applications that require real-time communication and rapid response times, such as industrial automation and autonomous vehicles, demand low-latency networks. Private networks offer lower latency compared to public networks since they have dedicated infrastructure and are not subject to congestion caused by shared resources. This low latency enables industries to achieve rapid data transmission and quick response times, which is critical for time-sensitive applications.

Private networks provide high reliability and network availability, which is crucial for industries where downtime can have significant consequences. For instance, in manufacturing, a network outage can disrupt production lines and lead to financial losses. Private networks provide dedicated and robust connectivity, reducing the threat of network failures and ensuring uninterrupted operations. In June 2023, Nokia unveiled a purpose-built fixed wireless access (FWA) receiver for the North America market. Nokia targeted the FastMile 5G receiver that delivers high speeds over long distances to serve suburban and rural underserved communities. The receiver supported all North American 5G mid and low spectrum bands and 4G bands, including Citizens Broadband Radio Service (CBRS). It also supported up to 4CA NR carrier aggregation, allowing operators to bundle bands for higher throughput. Additionally, it supported non-standalone 4G-5G networks and standalone 5G. Thus, increasing demand for private networks drives the North America private 5G/4G antenna market growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Private 5G/4G Antenna Market Report Segmentation and Scope:

Based on type, North America private 5G/4G antenna market is segmented into Planar-F antenna (PIFA), Multiple Input Multiple Output (MIMO), monopole antenna, and others. Based on directional type, the North America Private 5G/4G Antenna Market is bifurcated into directional and omnidirectional. By industry verticals, the North America Private 5G/4G Antenna Market is segmented into manufacturing, IT and telecom, healthcare, transport and logistics, aerospace and defense, and others. Based on country, the North America private 5g/4g antenna market is segmented into the US, Canada, and Mexico.

North America Private 5G/4G Antenna Market Segmental Analysis:

Based on type, North America private 5G/4G antenna market is segmented into multiple input multiple output (MIMO), monopole antenna, planar-F antenna (PIFA), and others.

Multiple Input Multiple Output (MIMO) is an antenna technology employed in wireless communication systems. It utilizes multiple antennas at both the transmitting and receiving ends to enhance system performance. MIMO takes advantage of the spatial dimension for multiplexing, as well as the time and frequency dimensions, without necessitating changes to the system's bandwidth requirements. In the scope of private 5G/4G antenna deployments, MIMO technology plays a critical role in improving the operation and capacity of wireless networks. In 5G MIMO systems, numerous small antennas are utilized to increase bandwidth for users and accommodate more users per antenna. Unlike 4G MIMO, which employs a frequency division duplex (FDD) system to support multiple devices, private 5G/4G antenna massive MIMO utilizes a different setup known as a time division duplex (TDD). The incorporation of multiple antennas in MIMO systems enables enhanced coverage, increased capacity, and improved performance in private networks. MIMO facilitates the support of more users, faster data rates, and overall enhancement of wireless communication quality within private networks.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Private 5G/4G Antenna Market Regional Analysis:

The North America private 5G/4G antenna market is segmented into the US, Canada, and Mexico. In 2022, the US led the North America private 5g/4g antenna market with a substantial revenue share of 82.66%. Continuous technological advancements by tech giants, along with notable investments in R&D activities, have created a stir in the region's competitive market. Since the region is known for adopting advanced technologies in their initial stages, the scope for private 5G/4G antennas also increases. Moreover, North America is one of the largest markets for private 5G networks due to various factors such as the presence of a large number of enterprises and organizations that are early adopters of new technologies, a strong focus on innovation and digital transformation, government support for the deployment of private 5G/4G antenna networks, and well-developed ecosystem of private 5G network providers. Further, the US is one of the world's leading markets for private LTE and 5G wireless networks.

Moreover, the adoption of automation across all major industries in North America such as manufacturing, retail, healthcare, and IT & telecom propels the deployment of private 5G/4G antennas. In November 2021, 7-Heaven, a retailer in Canada, launched mobile checkouts across the nation. Similarly, Couche-Tard launched touchless self-checkout systems across its 7,000 stores in the US, Canada, and other European countries in January 2022. These factors are expected to increase the demand for new private 5G/4G antenna deployments, thereby contributing to the growth of the North American private 5G/4G antenna market.

Over the years, North America has been the pioneer in the rapid adoption of advanced and new technologies. The presence of multiple industries, constant investments in technological advancements, and the rise in demand for rapid data transmission from commercial subscribers propel the deployment of private 5G/4G antennas across the region.

North America Private 5G/4G Antenna Market Key Player Analysis:

Telefonaktiebolaget LM Ericsson; Amphenol Corp; Antenova Ltd.; TE Connectivity Ltd; Taoglas; Cisco Systems Inc.; Panorama Antennas Ltd.; Huber+Suhner AG; Infinite Electronics International, Inc.; and Capestone BV are among the key players operating in the private 5G/4G antenna market. Various other companies are introducing new technologies and product offerings to contribute to the proliferation of the private 5G/4G antenna market. Several other major companies have been analyzed during this research study to get a holistic view of the ecosystem.

North America Private 5G/4G Antenna Market Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the North America private 5G/4G antenna market. A few recent key North America private 5G/4G antenna market developments are listed below:

- In 2023, Taoglas developed the TGX.04, a 4×5G/4G MIMO cross-polarized omnidirectional dipole antenna. The wideband antenna covers all worldwide sub-6 GHz cellular bands from 400 to 6,000 MHz. It uses four dipole antennas to offer the best possible quality improvements and throughput in transmitting and receiving signal levels, leading to better coverage and performance, specifically in urban environments. It is designed for multiple mounting options to accept a variety of use cases and is supplied with 3m of low-loss cable with SMA (M) connectors.

- In 2023, Panorama Antennas launched the new BAT[G]M4-6-60. Designed to transform the original Batwing antenna into a versatile 4×4 MiMo solution, the BAT[X]M4 range offers a comprehensive solution for 4G/5G connectivity in a discrete package. With the added option of GPS/GNSS and dual-band 2.4/5.0–7.2GHz Wi-Fi 6E, this antenna range is a game changer for covert public safety vehicles.

- In 2023, the newly released series of cellular adhesive flexible printed circuit (FPC) antennas from Linx Technologies (Linx) (now a part of TE Connectivity (TE), a world leader in connectors and sensors) targets 5G New Radio, LTE, and cellular IoT (LTE-M, NB-IoT) applications requiring a cost-effective and capable antenna solution.

- In 2023, Capestone, a leading specialized distributor and service provider of 5G/4G & IoT networks, announced its expansion with a new private 5G/4G antenna division, responding to increasing demand for private networks. The company stated that it can serve its more than 1,000 EMEA channel partners even better through this complete offering. Companies are getting even more control over users, data traffic, and devices on the network with private 5G/4G antenna solutions.

North America Private 5G/4G Antenna Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 284.31 Million |

| Market Size by 2030 | US$ 1,231.37 Million |

| Global CAGR (2022 - 2030) | 20.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Directional Type, and Industry Verticals

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players, holding majority shares, in the North America private 5G/4G antenna market includes Telefonaktiebolaget LM Ericsson, Amphenol Corporation, TE Connectivity, Cisco Systems Inc, and Infinite Electronics International, Inc.

US is anticipated to grow with the highest CAGR over the forecast period.

The Multiple Input Multiple Output (MIMO) segment led the private 5G/4G antenna market with a significant share in 2022.

The private 5G/4G antenna market was valued at US$ 284.31 million in 2022 and is projected to reach US$ 1231.37 million by 2030; it is expected to grow at a CAGR of 20.1% during 2022–2030.

Increasing demand for private networks and need for enhanced network security and control are the driving factors impacting the private 5G/4G antenna market.

Evolution of open RAN (Radio Access Network) and advancements in antenna technology are the future trends of the North America private 5G/4G antenna market.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - North America Private 5G/4G Antenna Market

- Telefonaktiebolaget LM Ericsson

- Amphenol Corp

- Antenova Ltd.

- TE Connectivity Ltd

- Taoglas

- Cisco Systems Inc

- Panorama Antennas Ltd.

- Huber+Suhner AG

- Infinite Electronics International, Inc.

- Capestone BV

Get Free Sample For

Get Free Sample For