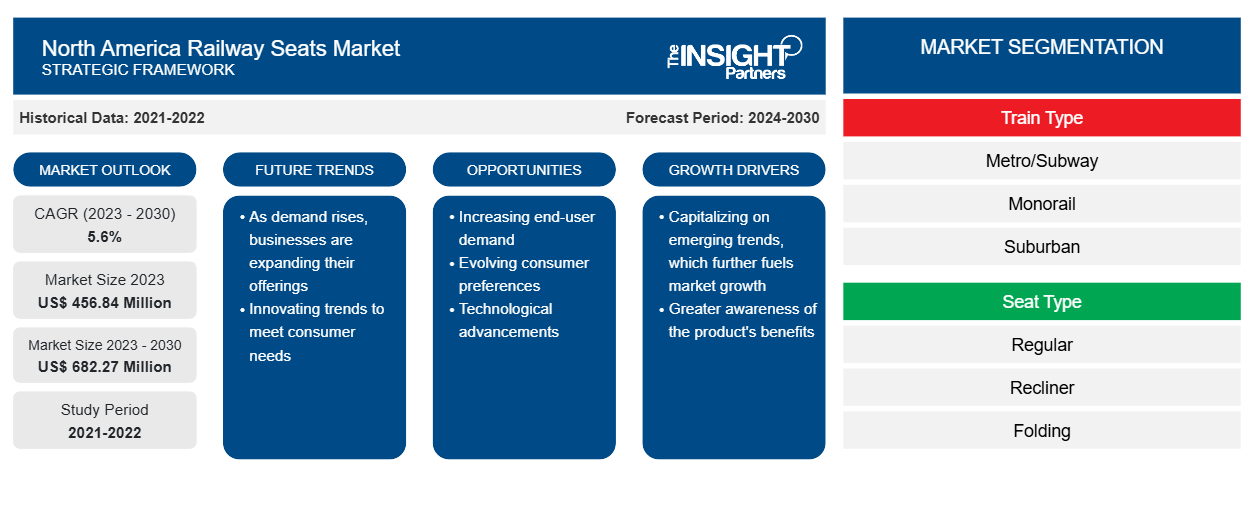

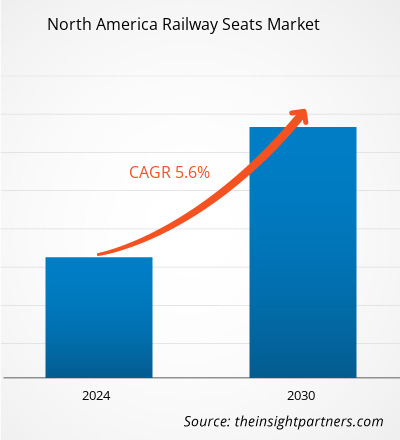

The North America railway seats market size is expected to grow from US$ 456.84 million in 2023 to US$ 682.27 million by 2030; it is estimated to record a CAGR of 5.6% from 2023 to 2030.

Railway Seats Market Analyst Perspective:

The growing government investment in constructing railway infrastructure to meet the rising transport needs of people is one of the major factors driving the North America railway seats market. Also, as a train is a more environment-friendly, time-saving, and comfortable mode of transport, passenger traffic is rising, boosting the growth of the North America railway seats market. In addition, with the increase in population in North America, road traffic is also increasing, which is raising the need for a cheaper, sustainable, and faster mode of transport like railways. Because of this, various companies are developing new trains in the region. Due to the rising number of new train production, the demand for seats that provide comfort and safety to passengers is increasing, creating an opportunity for the growth of the North America railway seats market. Moreover, the growing refurbishment of the train interior is expected to raise the demand for comfortable railway seats, propelling the market growth during the forecast period.

Market Overview:

Railway seats allow the passenger to travel comfortably to their destination. Railway seats are one of the most vital parts of rail interiors, as along with comfort, they also provide safety to passengers while traveling. In North American trains, different types of seats are provided for different classes. Comfortable seats with ample legroom and reclining to relax are provided for coach class, and seats with more amenities, including extra legroom and a wide and comfortable seat, are provided for business class. Also, the seats with adjustable headrests, lumbar support, footrests, and handy individual outlets to charge devices are provided for first class. In addition, there are also accessible seats, particularly for passengers with disabilities and mobility impairments.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Railway Seats Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Railway Seats Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Growing Investments in Railway Infrastructure Driving North America Railway Seats Market

Growing population and increasing road traffic are raising the demand for rail transport in North American countries. Governments of various countries in North America are investing in improving the railway infrastructure in the region. In October 2020, the US Federal Railroad Administration (FRA) announced that they had selected 50 rail projects in 29 states of the US to provide them funding under the Fiscal Year 2020 Consolidated Rail Infrastructure and Safety Improvements (CRISI) Programme. Under this initiative, the projects will receive a total investment of US$ 320.6 million to improve rail safety, efficiency, and reliability of freight and intercity passenger services. In November 2021, the US government announced that it had passed a US$ 1 trillion infrastructure bill. Under this, the government will work on upgrading America’s roads, railways, and other transportation infrastructure. Also, out of this, the government designated US$ 66 billion to improve the rail system. In June 2021, the government of Canada announced that they had allocated around US$ 19 million for 147 projects as part of the Rail Safety Improvement Programme. With this, the government will focus on improving railway safety along with enhancing public confidence in the nation’s rail transportation system. Thus, the growing investments by the government in the railway infrastructure by improving railway safety will help attract more passengers toward rail transport, which drives the North America railway seats market growth.

Railway Seats Market Segmental Analysis:

Based on train type, the railway seats market size is bifurcated into:

- Metro/Subway

- Monorail

- Suburban

- Trams.

The metro/subway segment held the largest North America railway seats market share in 2022. The metro/subway segment of the railway seats market is witnessing significant growth due to increasing urbanization and growing demand for efficient public transportation systems. As more cities invest in metro/subway infrastructure, comfortable and durable seating solutions become paramount. The driving factor for this segment is the rising urban population seeking rapid transit options that alleviate traffic congestion and reduce travel times, which will further boost the North America railway seats market growth during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Railway Seats Market Regional Analysis:

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The North America railway seats market is broadly segmented into the US, Canada, and Mexico. The US held the largest North America railway seats market share in 2022. According to the International Union of Railways (UIC), in the second half of 2022, the railway sector of the US witnessed a tremendous recovery in the rail passenger traffic post-lockdown. Because of the rise in passenger traffic, the government of the US is increasing its investment in improving the railway infrastructure. In November 2021, the government of the US announced that it had passed a US$ 1 trillion infrastructure bill. Out of this, the government has designated US$ 66 billion to improve the rail system. In addition, various companies in the country are also working on developing environment-friendly trains to further reduce CO2 emissions. In February 2023, Stadler announced that it had signed a contract with the Utah State University (USU) and the ASPIRE Engineering Research Centre to develop a battery-driven passenger train based on the FLIRT Akku concept. This new battery train is being developed to meet the requirements of the American market. Furthermore, to provide more comfort and safety to the passenger, various rail companies are refurbishing the interior of the old trains. In July 2022, Metrolink announced its first refurbished train car is into service in California, offering passengers a more comfortable and safe experience. This train car is the first of the 50 cars that will be renovated in the near future. The train cars consist of improved features, including vinyl seating, non-carpeted flooring, enhanced air filtration, and UV lighting for bacteria, air pollutants, and virus protection. Thus, the growing government investment in railway infrastructure, production of new trains, and increasing refurbishment of old trains are contributing to the growing railway seats market size in the US.

Key Player Analysis:

Freedman Seating Co, Seats Inc, Franz Kiel GmbH, American Seating Inc, United Safety & Survivability Corp, PowerRail Holdings Inc, Baultar Concept Inc, Compin Group SA, Guangdong Huatie Tongda High-speed Railway Equipment Corp, Transcal Holdings Ltd, and Grammer AG are a few North America railway seats market players covered in the report. GRAMMER AG and Freedman Seating Co are the top two North America railway seats market players owing to the diversified product portfolio offered.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies operating in the North America railway seats market. A few recent key market developments are listed below:

- In 2021, Compin USA announced that they will locate a manufacturing plant in the Wayland facility to build seats for transportation industry projects, including Amtrak’s next-generation high-speed trainsets that are being manufactured by Alstom in Hornell.

- In 2019, MBTA launched a new rail car with freedman seats. Under a US$ 118 million contract, CAF USA Inc. provided 24 low-floor light-rail vehicles. The company produced shells and frames at its Spain facility and completed final assembly and testing at its Elmira, New York, plant.

North America Railway Seats Market Regional Insights

The regional trends and factors influencing the North America Railway Seats Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses North America Railway Seats Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for North America Railway Seats Market

North America Railway Seats Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 456.84 Million |

| Market Size by 2030 | US$ 682.27 Million |

| Global CAGR (2023 - 2030) | 5.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2030 |

| Segments Covered |

By Train Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

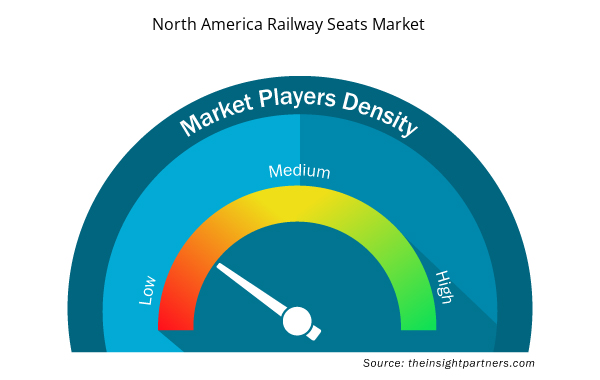

North America Railway Seats Market Players Density: Understanding Its Impact on Business Dynamics

The North America Railway Seats Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the North America Railway Seats Market are:

- Magna International Inc

- Freedman Seating Co

- Camira Group Inc

- Seats Inc

- Franz Kiel GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the North America Railway Seats Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aquaculture Market

- Transdermal Drug Delivery System Market

- Parking Management Market

- Adaptive Traffic Control System Market

- Drain Cleaning Equipment Market

- Educational Furniture Market

- Customer Care BPO Market

- Workwear Market

- Hot Melt Adhesives Market

- Advanced Planning and Scheduling Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Train Type, and Seat Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - North America Railway Seats Market

- Magna International Inc

- Freedman Seating Co

- Camira Group Inc

- Seats Inc

- Franz Kiel GmbH

- Lantal Textiles Inc

- American Seating Inc

- United Safety & Survivability Corp

- PowerRail Holdings Inc

- Baultar Concept Inc

- Compin Group SA

Get Free Sample For

Get Free Sample For