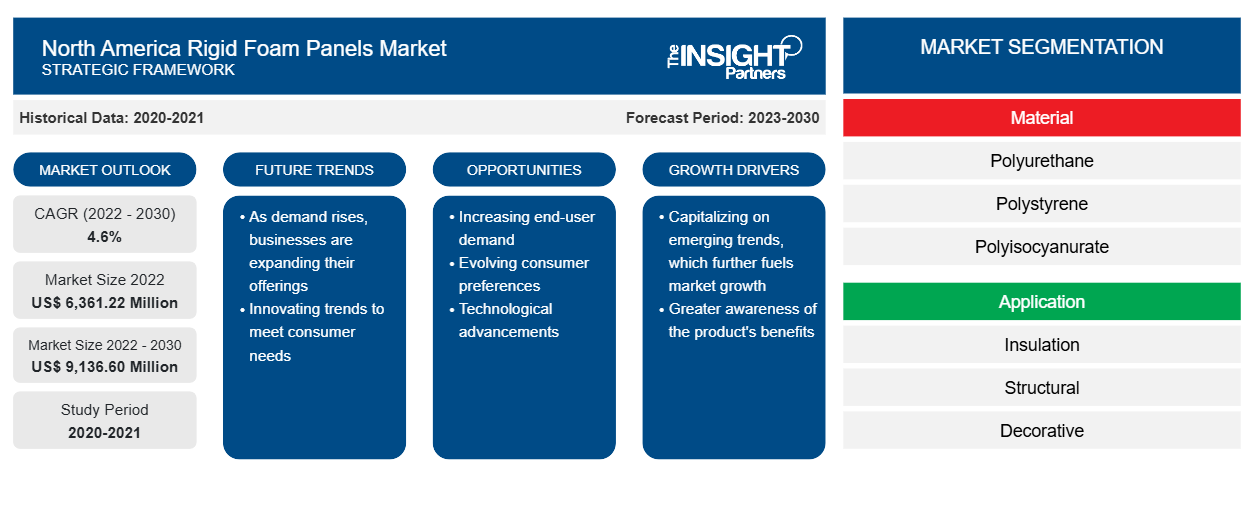

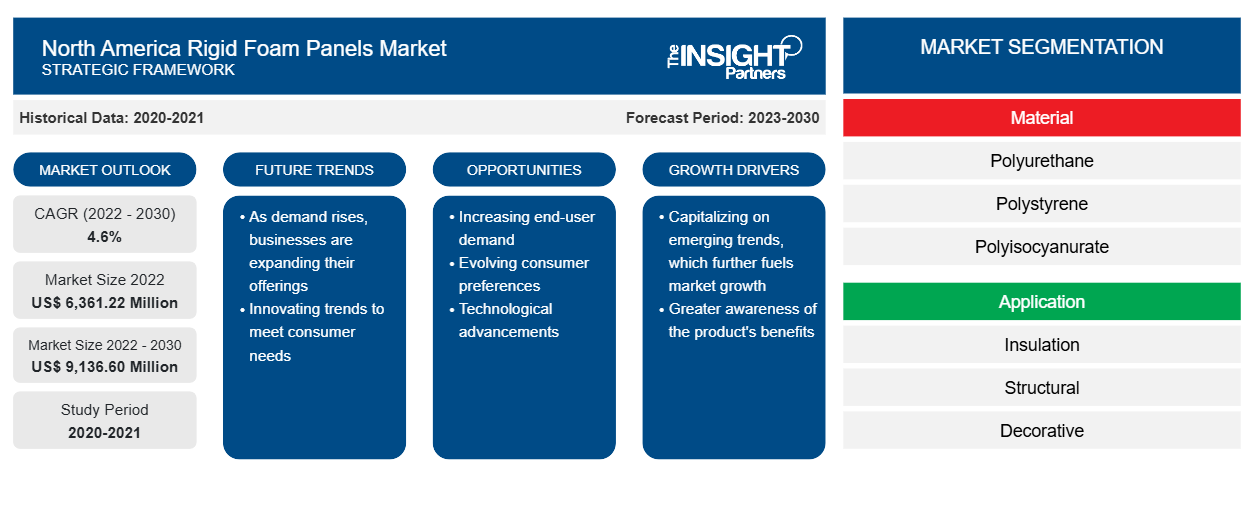

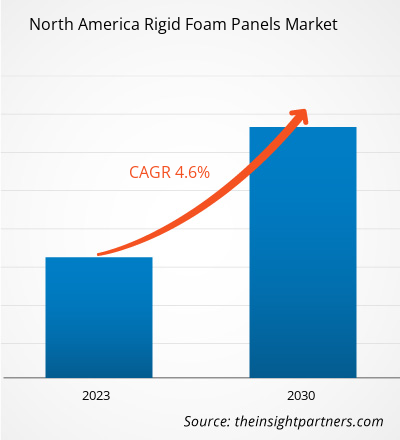

The North America rigid foam panels market size is expected to reach US$ 9,136.60 million by 2030 from US$ 6,361.22 million in 2022; it is estimated to register a CAGR of 4.6% from 2022 to 2030.

MARKET ANALYSIS

Rigid foam panels are made from foam plastics such as polyurethane (PUR), polyisocyanurate (PIR), and polystyrene, or from fibrous materials such as fiberglass and slag wool. Rigid foam panels are often used to provide thermal insulation in the building envelope in order to reduce thermal bridging. The North America rigid foam panels market size is expected to surge in the coming years owing to the expanding construction industry.

Moreover, the automotive industry is increasingly incorporating rigid foam panels for interior components, acoustic insulation, and structural enhancements, propelled by the imperative of reducing weight to enhance fuel efficiency and curb emissions. Simultaneously, the packaging segment is witnessing an uptick in demand for rigid foam panels, primarily for safeguarding fragile goods during transit, underpinning its role in ensuring product integrity. Furthermore, environmental considerations are reshaping the market landscape, fostering the development of eco-friendly rigid foam panels crafted from recycled materials or with minimized environmental footprints

GROWTH DRIVERS AND CHALLENGES

Rigid foam panels made from materials such as polyisocyanurate, extruded polystyrene, and expanded polystyrene are valued for their insulating properties, as they offer durability, energy savings, and moisture control. Rigid foam panels are commonly used as insulation materials in walls, roofs, and floors. Rigid foam panels help reduce energy consumption and minimize the carbon footprint of buildings due to their high insulation properties. According to the US Department of Energy, heating and cooling accounts for approximately half of the energy used in a typical home in the US. Thus, rigid foam insulation products are highly used in the building and construction industry because they help consumers lower their energy bills by reducing air leaks and decreasing the transfer of heat between indoor and outdoor environments. As moisture can increase mold and mildew in the building envelope when it passes through the walls, rigid foam panels, when installed properly, provide a layer of protection against moisture.

Furthermore, cold storage facilities are compelled to maintain low operating temperatures of up to −30°C, owing to which effective insulation that limits heat gain is needed; otherwise, a lot of stress is placed on the refrigeration equipment. Also, running costs can quickly get out of control due to excessive consumption of energy. All insulation materials are designed to block the flow of heat from warm areas to cooler areas. Rigid foam panels are the best options for cold storage applications due to their high R-values, ability to provide continuous insulation, and durability. In North America, the growth of e-commerce and the importance of maintaining food safety and quality for meat, seafood, and other food products are driving the growth of the cold storage infrastructure sector. Therefore, increasing deployment of rigid foam panels drives the North America rigid foam panels market growth. Contrastingly, as all plastics used in making rigid foam panel products are made out of petrochemicals found in oil and are arduous to dispose of, the increasing use of plastics has led to extensive plastic landfills. The waste results in deteriorating soil and underground water bodies and causes global warming. All these raw materials adversely impact human health, wildlife, marine life, and the environment. Therefore, the harmful impact of raw materials of rigid foam panel products on the environment hampers the North America market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Rigid Foam Panels Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Rigid Foam Panels Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "North America Rigid Foam Panels Market Analysis and Forecast to 2030" is a specialized and in-depth study focusing significantly on North American market trends and growth opportunities. The report aims to provide an overview of the market with detailed segmentation on the basis of material, application, end-use, and geography. It also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the North America rigid foam panels market trends, which helps understand the entire supply chain and various factors influencing the market growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SEGMENTAL ANALYSIS

The North America rigid foam panels market is segmented on the basis of material, application, and end use. Based on material, the market is subsegmented into polyurethane, polystyrene, polyisocyanurate, and others. The polyisocyanurate segment accounts for the largest North America rigid foam panels market share. Polyisocyanurate is also known as polyiso. Polyisocyanurate rigid foam panels, also known as PIR foam panels, are a type of insulation material that offers excellent thermal performance and fire resistance. These panels are composed of a closed-cell foam core made from polyisocyanurate, a type of thermosetting plastic, which is sandwiched between two facings. The facings can be made from materials such as aluminum foil, fiberglass, or other laminates. Polyisocyanurate foam panels have the highest R-value per inch (R-6.5 to R-6.8) of any rigid foam panels. This type of rigid foam panel usually comes with a reflective foil facing on both sides, so it can also serve as a radiant barrier. Another important characteristic of polyisocyanurate rigid foam panels is their fire resistance. PIR foam panels have excellent fire-retardant properties, as they are manufactured with flame retardants that inhibit the spread of flames and limit smoke generation. Although polyisocyanurate foam panels are more expensive than other types of rigid foam panels, they offer the most benefits. On the flip side, these types of panels tend to absorb water, making them unsuitable for below-grade waterproofing applications.

Based on application, the North America rigid foam panels market is segmented into insulation, structural, decorative, and others. The insulation segment accounts for the largest North America rigid foam panels market share. Rigid foam panels have a high insulation value, which makes them ideal for use in buildings and other applications where thermal insulation is needed. Rigid foam panels are commonly used as insulation materials in roofs, walls, and floors in the building and construction industry. The benefits of rigid foam panel insulation are enhanced moisture control, continuous insulation, and its ability to address thermal bridging. Based on end use, the market is segmented into construction, cold storage, food and beverage, pharmaceutical, automotive, and others. The construction segment accounts for the largest share. The rising cost of energy in North America has swayed home builders toward the use of thermally efficient insulators such as rigid foam panels. The most common rigid foam panels used as thermal insulators for building and construction uses are made from expanded polystyrene (EPS), extruded polystyrene (XPS), and polyisocyanurate. Rigid foam panels can significantly reduce a building's energy use and lead to controlling indoor temperature. Rigid foam panels are used to reduce the heat transfer between the house interior and the external environment. Their use in the construction of houses and buildings reduces the energy needed for heating and cooling the interior spaces.

North America Rigid Foam Panels Market – by Application, 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REGIONAL ANALYSIS

The North America rigid foam panels market report provides a detailed overview of the market concerning three major countries—the US, Canada, and Mexico. The US accounted for the largest market share and was valued at over US$ 5,400 million in 2022. The US marks a large number of modern construction activities in the region. The market in Canada is expected to reach over US$ 800 million by 2030. The market in Mexico is expected to record a CAGR of ~4% from 2022 to 2030. In North America, the rigid foam panels market growth is driven by factors such as the growing use of rigid foam panels from various application sectors, strong growth of the construction industry, and various advantages of rigid foam panels. The construction sector in North America is witnessing growth due to a robust economy and increased federal and state financing for commercial and institutional structures.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

A few initiatives taken by the key players operating in the North America rigid foam panels market are listed below:

- In January 2023, INDEVCO North America acquired Perma R Products to expand its product portfolio and distribution of rigid foam insulation and building envelope products across North America.

- In October 2022, BASF SE developed PU rigid foam systems, Elastopor & Elastopir, containing recycled PET. The product aimed to reduce the carbon footprint of buildings.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Owens Corning, Perma R Products Inc, Carlisle Companies Inc, Kingspan Group Plc, DuPont de Nemours Inc, General Plastics Manufacturing Co, Insulation Depot Inc, Metro Home Insulation LLC, Gold Star Insulation LP, and Johns Manville Corp. are among the prominent players operating in the North America rigid foam panels market. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The North America rigid foam panels market report also includes company positioning and concentration to evaluate the performance of competitors/players in the market.

North America Rigid Foam Panels Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 6,361.22 Million |

| Market Size by 2030 | US$ 9,136.60 Million |

| Global CAGR (2022 - 2030) | 4.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material, Application, and End Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Rigid foam panels made from materials such as polyisocyanurate, extruded polystyrene, and expanded polystyrene are valued for their insulating properties, as they offer durability, energy savings, and moisture control. Rigid foam panels are commonly used as insulation materials in walls, roofs, and floors. Rigid foam panels help reduce energy consumption and minimize the carbon footprint of buildings due to their high insulation properties.

The major players operating in the North America rigid foam panels market are Owens Corning, Perma R Products Inc, Carlisle Companies Inc, Kingspan Group Plc, DuPont de Nemours Inc, General Plastics Manufacturing Co, Insulation Depot Inc, Metro Home Insulation LLC, Gold Star Insulation LP, and Johns Manville Corp.

Based on application, the North America rigid foam panels market is segmented into insulation, structural, decorative, and others. Rigid foam panels have a high insulation value, which makes them ideal for use in buildings and other applications where thermal insulation is needed. Rigid foam panels are commonly used as insulation materials in roofs, walls, and floors in the building and construction industry. The benefits of rigid foam panel insulation are enhanced moisture control, continuous insulation, and its ability to address thermal bridging.

Based on material, the market is subsegmented into polyurethane, polystyrene, polyisocyanurate, and others. The polyisocyanurate segment accounts for the largest North America rigid foam panels market share. Polyisocyanurate is also known as polyiso. Polyisocyanurate rigid foam panels, also known as PIR foam panels, are a type of insulation material that offers excellent thermal performance and fire resistance.

Players operating in the North America rigid foam panels market are focusing on adopting strategies such as investment in research and development activities, product launches, and expansions to fulfill the growing demand for high-quality and innovative products. In 2020, Zotefoams expanded its High-Performance Product (HPP) line with the introduction of its latest polyvinylidene fluoride (PVDF) foam, ZOTEK F X.R. This OSU grade foam is extra-rigid closed cell crosslinked foam and is available in densities of 120 kg/m3 and 150 kg/m3.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - North America Rigid Foam Panels Market

- Owens Corning

- Perma R Products Inc

- Carlisle Companies Inc

- Kingspan Group Plc

- DuPont de Nemours Inc

- General Plastics Manufacturing Co

- Insulation Depot Inc

- Metro Home Insulation LLC

- Gold Star Insulation LP

- Johns Manville Corp.

Get Free Sample For

Get Free Sample For