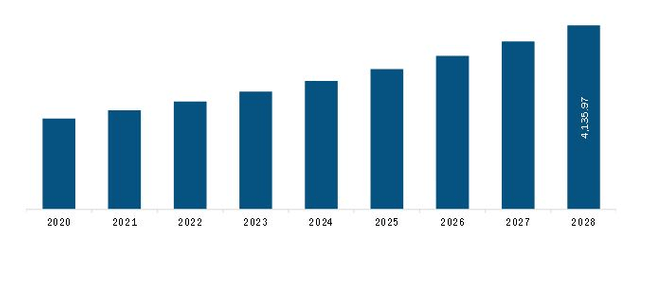

The North America semiconductor IP market is expected to grow from US$ 2,226.34 million in 2021 to US$ 4,135.97 million by 2028; it is expected to register a CAGR of 9.3% from 2021 to 2028.

The emerging electronic and semiconductor technologies are paving the way for introducing automation in the manufacturing sector. Automation has transformed factory floor operations, manufacturing employment, and sector dynamics for the past two decades. Current prominent trends in the manufacturing sector, such as robotics, machine learning, and artificial intelligence, have enabled machines to match or even overcome humans in various activities, including the cognitive activities involved at different levels of manufacturing. The automation of any lean assembly line has been observed to raise the overall productivity by 10–20%. Further, Industry 4.0 is another prominent trend that is anticipated to fuel the manufacturing sector in the coming years. The advent of Industry 4.0 or the Industrial Internet of Things (IIoT) involves the use of collaborative robots and automated guided vehicles (AGVs); it is further anticipated to boost the productivity of the manufacturing sector.

Semiconductor fabrication plants are increasingly investing in manufacturing integrated circuits globally. The emergence of the COVID-19 pandemic in 2020 hampered the dynamics of the semiconductor IP industry owing to raw material and labor shortages. Semiconductor fabrication companies have planned to invest in new fabrication facilities to cater to the growing demand for integrated chips from various industries. In January 2022, Intel planned to invest over ~US$ 20 billion to build two new manufacturing facilities for semiconductor chips in Ohio, the US.

Industrial IoT can connect machines, tools, and sensors on the shop floor to give process engineers and managers much-needed visibility into production. Thus, with the pace of ongoing IoT emergence and deployments, the global semiconductor industry is expected to benefit from innovations across the technology value chain. As cloud computing becomes mainstream in the IoT industry, semiconductor companies need to continuously focus on innovations to interact between connected devices and smart devices. The semiconductor industry drives the North America market growth with the increased adoption of products incorporated with IoT sensors, such as smart watches, glasses, smartphones, and other wearable devices.

With the new features and technologies, vendors attract new customers to grow their footprints in emerging markets. This factor is likely to drive the semiconductor IP market. The North America semiconductor IP market is expected to grow at a substantial CAGR during the forecast period.

North America Semiconductor IP Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Semiconductor IP Market Segmentation

The market for North America semiconductor IP market is segmented into type, source, and industry vertical. Based on type, the North America semiconductor IP market is segmented into processor SIP, interface SIP, physical SIP, analog SIP, and others. Based on source, the market is bifurcated into licensing and royalty. Based on industry vertical, the market is segmented into telecom, automotive, industrial, electronics, medical, and others. Based on country, the North America semiconductor IP market is segmented into the US, Canada, and Mexico.

North America Semiconductor IP Market Companies

ARM Holdings Plc.; Faraday Technology Corporation; CEVA, Inc.; Imagination Technologies Group PLC; Lattice Semiconductor Corporation; Rambus Inc.; Intel Corporation; Xilinx, Inc.; VeriSilicon Holdings Co. Ltd.; Cadence Design Systems, Inc.; and Synopsys, Inc. are among the leading companies operating in the North America semiconductor IP market.

North America Semiconductor IP Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2,226.34 Million |

| Market Size by 2028 | US$ 4,135.97 Million |

| Global CAGR (2021 - 2028) | 9.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

- ARM Holdings Plc

- Faraday Technology Corporation

- CEVA, Inc.

- Imagination Technologies Group PLC

- Lattice Semiconductor Corporation

- Rambus Inc.

- Intel Corporation

- Xilinx, Inc.

- VeriSilicon Holdings Co. Ltd.

- Cadence Design Systems, Inc.

- Synopsys, Inc.

Get Free Sample For

Get Free Sample For