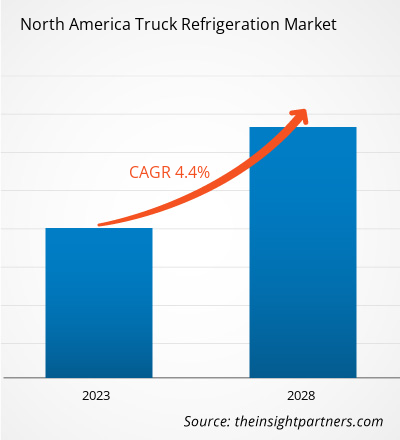

The North America truck refrigeration market is expected to grow from US$ 1,614.12 million in 2022 to US$ 2,084.80 million by 2028; it is estimated to record a CAGR of 4.4% from 2023 to 2028.

Demand for frozen food increased rapidly in North America during the peak of the COVID-19 outbreak in 2020. According to the American Frozen Food Institute (AFFI), frozen food sales increased to US$ 65.8 billion in 2020 from US$ 54 billion in 2019, a rise by 22%. Compared to pre-pandemic levels, the demand for frozen processed meat, frozen snacks, frozen seafood, and other frozen foods has doubled. In 2020, unit sales of frozen processed meat such as chicken nuggets and sausages increased by 21.8% compared to 2019, while the sales of frozen snacks and frozen seafood increased by 25.5% and 12.4%, respectively. The sales of frozen processed meat were US$ 4.9 billion in 2022 and increased by 74.3% compared to 2019. Similarly, frozen snack sales reached US$ 3.5 billion in 2022 and increased by 58.5% compared to 2019, while frozen seafood sales reached US$ 7.1 billion and increased by 36.9%.

Furthermore, according to AFFI’s data, in 2022, frozen food sales reached US$ 72.2 billion and increased by 8.6% from sales in 2021. It was also seen that frozen food sales increased by US$ 19.4 billion between 2018 and 2022. Refrigeration truck is an integral part of the logistic and supply chain of perishable and sensitive goods. Thus, the rising demand for frozen food in North America propels the need for truck refrigeration systems to safely transport frozen food from one place to another, driving the North America truck refrigeration market growth.

North America Truck Refrigeration Market: Key Players

Mitsubishi Heavy Industries Ltd, Denso Corp, Klinge Corporation, Carrier Global Corp, Webasto Thermo & Comfort, Thermo King (Trane Technologies), Daikin Industries Ltd, Arctic Traveler (Canada) Ltd, Zanotti Canada Inc, and Volta Air Technology Inc are a few major North America truck refrigeration market players. The rising technological advancements in refrigeration units by these market players boost the market growth. In March 2023, Carrier Transicold introduced its new X4 7700 trailer refrigeration unit, which offers a 96% reduction in particulate emissions and helps save fuel by ∼20% to 25%. Thus, the growing innovation by market players will further propel the North America truck refrigeration market growth in the coming years.

North America Truck Refrigeration Market: by Type

Based on type, the North America truck refrigeration market is segmented into split systems and roof mounted systems. The split systems segment held a larger market share in 2022. The system is designed to meet the distribution industry's needs and offer the utmost flexibility in handling the temperatures for refrigerated products, such as frozen and chilled goods.

Impact of COVID-19 Pandemic on North America Truck Refrigeration Market

The sudden onset of the COVID-19 outbreak across North America hampered the market in Q1 of 2020. The regional government bodies temporarily shut down various manufacturing facilities to stop the spread of the novel coronavirus. However, in Q4 of 2020, refrigeration truck manufacturing activities restarted as lockdown restrictions were eased. Thus, the North America truck refrigeration market started to stabilize. In addition, an upsurge in the demand to transport food products and pharmaceutical goods propelled the need for advanced and efficient refrigerated trucks, fueling the growth of the market.

North America Truck Refrigeration Market: Market Initiative

Companies operating in the market adopt various strategies to expand their footprint worldwide and meet the growing customer demand. The North America truck refrigeration market players are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings.

- In 2022, Four Canadian companies – Cold Star Solutions from Victoria, Volta Air from Burnaby in B.C., Lion Electric from Saint-Jerome, and Fourgons Leclair from Terrebonne in Quebec – worked together to get the Lion6 truck rolling.

- In 2023, a Chinese auto manufacturer Jianghuai Automobile Co. Ltd. (JAC Motors) announced that it had equipped its first all-electric truck with Carrier Transicold's Xarios 8 refrigeration unit and power box converter.

North America Truck Refrigeration Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The North America truck refrigeration market is segmented on the basis of type, application, industry vertical, and class. In terms of type, the market is bifurcated into split systems and roof mounted systems. Based on application, the market is bifurcated into frozen and chilled. Based on industry vertical, the market is segmented into food & beverage, pharmaceutical, chemical, and others. By class, the market is segmented into 2–3 (light commercial vehicle) and 4–7 (medium & heavy commercial vehicle). Based on country, the market is segmented into the US, Canada, and Mexico.

North America Truck Refrigeration Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,614.12 Million |

| Market Size by 2028 | US$ 2,084.80 Million |

| Global CAGR (2023 - 2028) | 4.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Application, Industry Vertical, and Class

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Canada, United States

Frequently Asked Questions

The North America truck refrigeration market is expected to be valued at US$ 1,614.12 million in 2022

The driving factors impacting the truck refrigeration market are:

1. Increasing Demand for Frozen Food

2. Growing Technological Advancements in Refrigeration Units

The future trend expected to positively impact the truck refrigeration market is increasing focus on electric trucks across the region.

The key players holding the major market share of the truck refrigeration market are

Carrier; Webasto Thermo & Comfort ; DAIKIN INDUSTRIES, Ltd; Thermo King; and MITSUBISHI HEAVY INDUSTRIES THERMAL SYSTEMS, LTD.

The split systems segment led the truck refrigeration market in 2022.

Ans: The US holds a major market share in North America truck refrigeration market in 2022.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - North America Truck Refrigeration Market

- Mitsubishi Heavy Industries Ltd

- Denso Corp

- Klinge Corporation

- Carrier Global Corp

- Webasto Thermo & Comfort

- Thermo King (Trane Technologies)

- Daikin Industries Ltd

- Arctic Traveler (Canada) Ltd

- Zanotti Canada Inc

- Volta Air Technology Inc

Get Free Sample For

Get Free Sample For