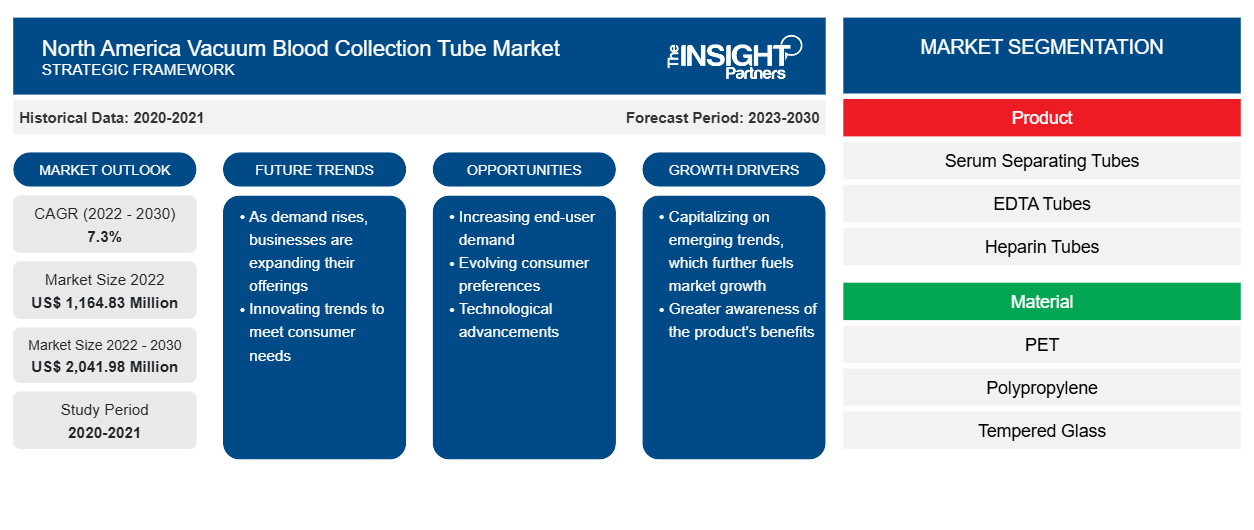

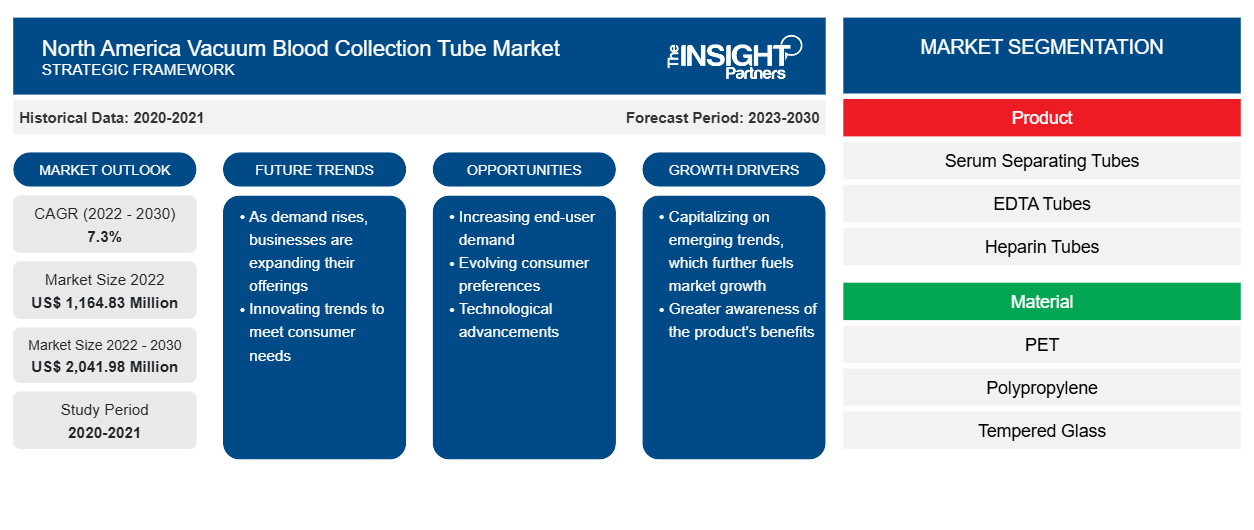

The North American vacuum blood collection tube market value is projected to grow from US$ 1,164.83 million in 2022 to US$ 2,041.98 million by 2030. The vacuum blood collection tube market is further anticipated to record a CAGR of 7.3% from 2022 to 2030.

Market Insights and Analyst View:

Vacuum tubes are utilized to draw a specific volume of blood. Blood specimens are collected in tubes with various additives such as EDTA, heparin, and serum for various types of tests. These additives are identified by the color of the cap. Key factors driving the vacuum blood collection tube market growth include the increasing number of surgeries and growing blood donation rate and blood tests. However, the risk associated with needlestick injuries hinders the market growth.

Growth Drivers and Restraints:

North America has witnessed an overall increase in the demand for surgical procedures in recent years. This can be attributed to factors such as advancements in medical technology, an aging population, and a greater emphasis on proactive healthcare management. With the rise in the prevalence of heart, liver, kidney, and other chronic diseases, the number of surgeries performed annually has also increased notably. According to the report “Chronic Kidney Disease in the United States, 2023” by the Centers for Disease Control and Prevention, 14% of ~35.5 million people in the US suffer from chronic kidney disease (CKD). CKD has a higher prevalence in people aged 65 years or older (34%) than in people aged 45–64 years (12%) or 18–44 years (6%). Furthermore, the “Life and expectations post-kidney transplant: a qualitative analysis of patient responses” study published in 2019 reported that ~17,600 kidney transplants are performed each year in the US.

According to the American Joint Replacement Registry (AJRR) on Knee and Hip Arthroplasty’s 7th annual report, ~2 million hip and knee procedures were performed between 2019 and 2020 in the US. Angioplasty and atherectomy are two of the most common procedures performed in the US. According to the most recent interventional cardiology procedural data, more than 965,000 angioplasties are performed in the US each year. An angioplasty, also known as percutaneous coronary intervention (PCI), is a procedure in which a stent is inserted into a blocked or constricted artery. The development of advanced surgical techniques and procedures has increased the range and complexity of surgeries performed. Minimally invasive procedures, robotic-assisted surgeries, and other innovative techniques have gained popularity due to their potential for faster recovery, reduced complications, and improved patient outcomes. These advancements require accurate and reliable diagnostic information, which, in turn, drives the demand for vacuum blood collection tubes to collect samples for pre-operative testing and post-operative monitoring.

Advances in anesthesia and blood management also play a crucial role in surgical procedures, and accurate pre-operative patient assessment and monitoring are essential for successful outcomes. Blood management, including appropriate interventions to prevent excessive bleeding or clotting, also contributes to surgical success and patient safety. Vacuum blood collection tubes are used for pre-operative blood tests to assess coagulation parameters, blood typing, and screening for infectious diseases, helping healthcare providers make informed decisions regarding anesthesia management and blood transfusions during surgeries.

An increase in organ transplant procedures performed across the US results in an upsurge of blood transfer procedures that need collection units such as bags and tubes. The American Cancer Society estimates that more than 1.9 million people are likely to be diagnosed with cancer in 2023. Many cancer patients need to undergo blood transfusion procedures as a part of the management of chemotherapy or radiation side effects or to make up for the blood lost during surgeries. According to the United Network for Organ Sharing, 42,887 organ transplants were performed in the US in 2022, recording an increase of 3.7% over 2021. The American Red Cross Blood Services reported that every two seconds, a need for blood arises for cancer therapies, surgeries, traumatic injuries, and other chronic illness treatments in the US. Thus, the rise in the number of surgeries and blood transfusions fuels the demand for vacuum blood collection tubes, boosting the North American vacuum blood collection tube market

However, there is a risk of percutaneous injury associated with a needle. According to the American Medical Association estimates, each year, ~600,000 to 800,000 needlestick injuries occur in the US. There are various risks associated with blood drawing, such as pain, bruising, infection, bleeding, fainting, and hematoma at the injection site. Several diseases are transmitted through these injuries, including hepatitis B, acquired immune deficiency syndrome (AIDS), and hepatitis C. As a result of accidental punctures, hazardous fluids can be injected into the body through the skin by contaminated needles. Injecting hazardous drugs is possible; however, the most significant concern is infection with infectious fluids, especially in the blood. Even small amounts of infectious fluid can spread diseases. Thus, these factors have also surfaced as a significant deterrent for the North American vacuum blood collection tube market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Vacuum Blood Collection Tube Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Vacuum Blood Collection Tube Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The North American vacuum blood collection tube market is segmented on the basis of product, material, application, and end user. Based on product, the market is divided into heparin tubes, EDTA tubes, glucose tubes, serum separating tubes, ERS tubes, and others. The vacuum blood collection tube market, by material, is segmented into PET, polypropylene, and tempered glass. Based on application, the market is segmented into blood routine examination, biochemical test, and coagulation testing. In terms of end users, the vacuum blood collection tube market is segmented into hospitals and clinics, ambulatory surgical centers, pathology labs, and blood banks. The North American vacuum blood collection tube market, by country, is segmented into the US, Canada, and Mexico.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

The North America vacuum blood collection tube market, by product, is segmented into heparin tubes, EDTA tubes, glucose tubes, serum separating tubes, ERS tubes, and others. In 2022, the serum separating tubes segment held the largest share of the market. The EDTA tubes segment is expected to grow at the highest CAGR during 2022–2030. Serum separating tubes (SSTs) are coated with micro silica particles, which induces clotting blood, and the barrier gel effectively separates serum from fibrin and cells while restricting substance exchange between blood cell and serum. During centrifugation, the clot activator (silica particle) speeds up clotting and acts as a barrier gel, separating serum from fibrin and cells. SSTs are commonly used for blood serum biochemistry, immunology, serology, drug testing, etc. Both non-vacuum and vacuum gel and clot activator tubes are available in the market.

Vacuum Blood Collection Tube Market, by Product– 2022 and 2030

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Based on material, the North America vacuum blood collection tube market is segmented into PET, polypropylene, and tempered glass. The PET segment held the largest share of the market in 2022 and is expected to register the highest CAGR during 2022–2030.

Based on application, the North America vacuum blood collection tube market is segmented into blood routine examination, biochemical test, and coagulation testing. The blood routine examination segment held the largest share of the market in 2022, and the biochemical test segment is anticipated to register the highest CAGR in the market during 2022–2030.

Based on end users, the North America vacuum blood collection tube market is segmented into hospitals and clinics, ambulatory surgical centers, pathology labs, and blood banks. The hospitals and clinics segment held the largest share of the market in 2022, and the blood banks segment is anticipated to register the highest CAGR in the market during 2022–2030.

Regional Analysis:

The US is estimated to hold the largest share of the vacuum blood collection tube market during 2022–2030. Although the US has a well-developed healthcare sector equipped with highly advanced equipment and instruments, it experiences increasing incidences of chronic diseases and multiple organ dysfunction syndromes or sepsis, which is likely to favor the growth of the vacuum blood collection tube market. According to the report “Chronic Kidney Disease in the United States, 2023” by the Centers for Disease Control and Prevention, 14% of ~35.5 million people suffer from chronic kidney disease (CKD) in the US. Furthermore, 9 in 10 people are not aware that they are suffering from CKD. Hypertension, diabetes, heart disease, and obesity are the causes of CKD. Thus, with the growing incidences of high blood pressure, heart disease, diabetes, and obesity, the demand for blood testing for diagnostics and research purposes increases in the US, which propels the vacuum blood collection tube market growth in North America.

An increase in organ transplant procedures performed across the US can be associated with an upsurge in blood transfer procedures that require blood testing to identify blood groups and tissue types. The American Cancer Society estimates that more than 1.9 million people will be diagnosed with cancer in 2023. Many cancer patients need to undergo blood transfusion procedures as a part of the management of chemotherapy or radiation side effects or to make up for the blood lost during surgeries. According to the United Network for Organ Sharing (UNOS), 42,887 organ transplants were performed in the US in 2022, recording an increase of 3.7% over 2021. The American Red Cross Blood Services reported that someone in the US requires blood for cancer therapies, surgeries, traumatic injuries, and other chronic illness treatments every two seconds. Thus, the demand for vacuum blood collection tubes increases with the increasing demand for blood testing due to rising incidences of kidney and other chronic diseases in the US.

Industry Developments and Future Opportunities:

Various initiatives by key players operating in the global vacuum blood collection tube market are listed below:

- In July 2023, SARSTEDT AG & Co KG launched 360 solutions that will be used to improve specimen quality, reduce turnaround time, and automate labs of all sizes with customizable modular systems. The company has demonstrated S-Monovette and Tempus600 at the AACC Annual Scientific Meeting & Clinical Lab Expo. The conferences have helped in showcasing products' specifications.

- In June 2022, Cardinal Health announced the acquisition of ScalaMed, a HIPAA-compliant smart platform that transmits medicines directly to patients via a secure mobile app. ScalaMed's technology and assets are being transferred to Outcomes, a Cardinal Health firm, as part of the transaction. ScalaMed shifts prescription management from the provider to the patient, allowing patients to transfer prescriptions issued by their clinician to any pharmacy for the initial fill. The platform provides patients with increased freedom, easier access, and price comparison when choosing a pharmacy.

- In April 2021, Greiner Bio-One launched VACUETTE line, the innovative evoprotect safety Blood Collection Set. It meets the requirements of the EU Directive 2010/32. It is an innovative safety mechanism that can be conveniently activated while the needle is in the vein protects blood collection staff against potential injuries.

Competitive Landscape and Key Companies:

Becton Dickinson and Co, Greiner Bio-One International GmbH, Sekisui Chemical Co Ltd, SARSTEDT AG & Co KG, Cardinal Health Inc, McKesson Corp, HemaSource Inc, and Medline Industries LP are among the prominent players operating in the vacuum blood collection tube market. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios.

North America Vacuum Blood Collection Tube Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,164.83 Million |

| Market Size by 2030 | US$ 2,041.98 Million |

| Global CAGR (2022 - 2030) | 7.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Frequently Asked Questions

What are vacuum blood collection tubes?

Vacuum tubes are utilized to draw a specific volume of blood. Blood specimens are collected in tubes with various additives such as EDTA, heparin, and serum for various types of tests. These additives are identified by the color of the cap.

Which product segment dominates the North America vacuum blood collection tube market?

The North America vacuum blood collection tube market, by product, is segmented into heparin tubes, EDTA tubes, glucose tubes, serum separating tubes, ERS tubes, and others. In 2022, the serum separating tubes segment held the largest share of the market.

What was the estimated North America vacuum blood collection tube market size in 2022?

The North America vacuum blood collection tube market was valued at US$ 1,164.83 million in 2022.

What factors drive the North America vacuum blood collection tube market?

Factors such as increasing number of surgeries and growing blood donation rate and blood tests propel market growth.

What are the growth estimates for the North America vacuum blood collection tube market till 2030?

The North America vacuum blood collection tube market is expected to be valued at US$ 2,041.98 million in 2030.

Which end user segment dominates the North America vacuum blood collection tube market?

Based on end user, the North America vacuum blood collection tube market is segmented into hospitals and clinics, ambulatory surgical centers, pathology labs, and blood banks. The hospitals and clinics segment held the largest share of the market in 2022 and blood banks is anticipated to register the highest CAGR in the market during 2022–2030.

Which application segment dominates the North America vacuum blood collection tube market?

Based on application, the North America vacuum blood collection tube market is segmented into blood routine examination, biochemical test, and coagulation testing. The blood routine examination segment held the largest share of the market in 2022, and the biochemical test segment is anticipated to register the highest CAGR in the market during 2022–2030.

Which material segment dominates the North America vacuum blood collection tube market?

Based on material, the North America vacuum blood collection tube market has been segmented into PET, polypropylene, and tempered glass. The PET segment held the largest share of the market in 2022 and is expected to grow at the highest CAGR during 2022–2030.

Who are the major players in the North America vacuum blood collection tube market?

The North America vacuum blood collection tube market majorly consists of the players, including Becton Dickinson and Co, Greiner Bio-One International GmbH, Sekisui Chemical Co Ltd, SARSTEDT AG & Co KG, Cardinal Health Inc, McKesson Corp, HemaSource Inc, and Medline Industries LP.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - North America Vacuum Blood Collection Tube Market

- Becton Dickinson and Co

- Greiner Bio-One International GmbH

- Sekisui Chemical Co Ltd

- SARSTEDT AG & Co KG

- Cardinal Health Inc

- McKesson Corp

- HemaSource Inc

- Medline Industries LP

Get Free Sample For

Get Free Sample For