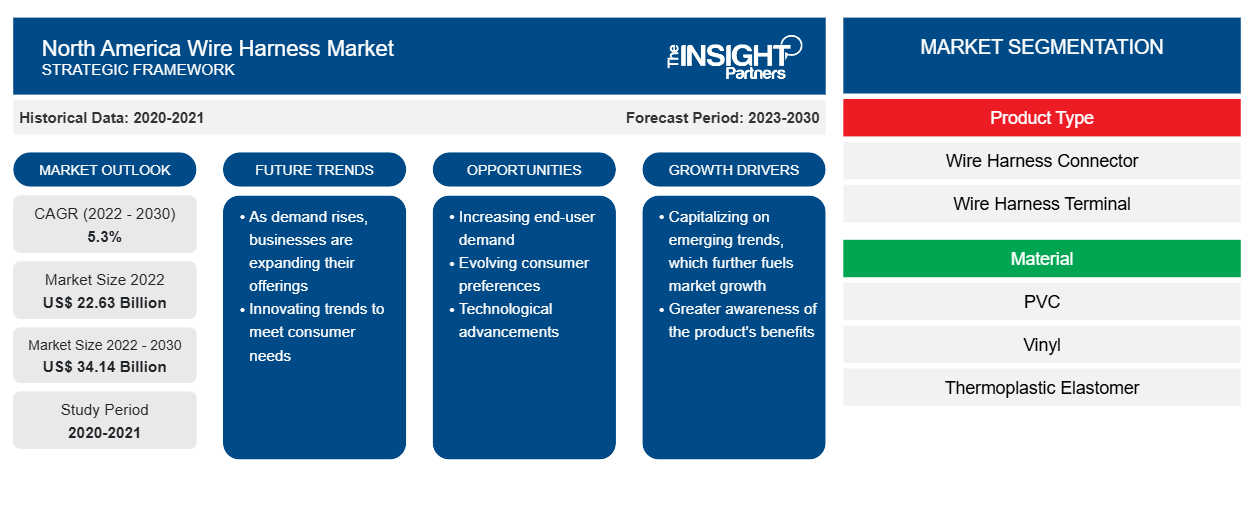

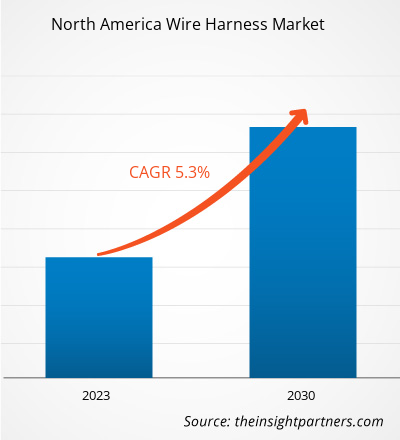

The North America wire harness market is expected to grow from US$ 22.63 billion in 2022 to, US$ 34.14 billion by 2030; it is estimated to register a CAGR of 5.3% from 2022 to 2030.

Analyst Perspective:

The major stakeholders in the North America wire harness market ecosystem include component suppliers, wire harness manufacturers, and end users. The demand for wire harnesses is driven by factors such as booming automobile sector across the region, technological advancements in appliance manufacturing, and increasing demand for wire harnesses to achieve electric connectivity. Fujikura Ltd.; Motherson Group; Nexans; Sumitomo Electric Industries, Ltd.; and Yazaki Corporation are among the major wire harness market players operating in the ecosystem. The organic and inorganic developments done by wire harness manufacturers led to the wire harness market growth. In March 2021, Lear acquired M&N Plastics, a plastic components for automotive electrical distribution manufacturer and injection molding specialist. This acquisition extends Lear's capacity to produce high-voltage wire harnesses. The major end users of the North America wire harness market ecosystem are automobile, agriculture, appliances, and others. Thus, the increasing adoption of wire harness by these industries has propelled the North America wire harness market growth.

Market Overview:

Wire harness (also known as cable harness) are used to transmit electrical power and signals in industries such as automobile, food & beverage, agriculture, and electronics. The North America wire harness market players are compelled to follow stringent regulations and standards. One such standard is IPC/WHMA-A-620 Revision D, introduced by IPC and Wiring Harness Manufacturer’s Association (WHMA), for the acceptance and requirements of wire harness assemblies. Further, governments’ encouragement in various industries is one of the factors contributing to the North America wire harness market growth. Based on material, the North America wire harness market is segmented into PVC, vinyl, thermoplastic elastomer, polyurethane, and polyethylene. Wire harnesses manufactured using these materials can withstand varied environmental conditions; thus, end users purchase wire harnesses as per the need. For instance, a wire harness made of polyethylene is suitable for use in moist environments, as polyethylene can resist moisture.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

North America has been experiencing a significant increase in wire and cable consumption lately. The growing need for renewable energy is accelerating the use of wires and cables. For instance, in 2022, about 4,243 billion kWh (or about 4.24 trillion kWh) of electricity was generated at utility-scale electricity generation facilities in the US. About 18% of electricity was generated from nuclear energy and nearly 22% from renewable energy sources. According to the US Energy Information Administration, an additional 58 billion kWh of electricity generation was from small-scale solar photovoltaic systems in 2022.Therefore, the growing need for renewable energy, and the increasing electricity generation is bossting the North America wire harness market growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis: By Material

Polyvinyl chloride is a thermoplastic material known for its versatility and perhaps the most commonly used wire/cable material. PVC has a good combination of properties, which explains why it is popularly used for cable insulation and sheathing. PVC is durable, UV resistant, can resist water and chemicals. Although other materials are gradually replacing it, PVC compounds are still the most widely used polymeric materials in the global cable industry, and in 2018, it accounted for 53% of the total global tonnage. Several companies in the North America wire harness market offer PVC-composed wire harnesses for different applications. For instance, Dongguan Yixian Electronic Tech., Co., Ltd. offers customized wire harnesses for automobile, home appliances, and motorcycle applications.

North America Wire Harness Market Revenue and Forecast to 2030 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

In North America, the US is one of the primary markets for wire harnesses. The country boasts a robust presence in the automotive and aerospace sectors, which are major end users of wire harnesses. For instance, the US automobile industry produced about 9.17 million cars in 2021. The numbers include passenger cars, light commercial vehicles, heavy trucks, and long-distance buses.

Similarly, based on the report by Airbus, North American airlines have ordered more than 2,500 commercial aircraft for domestic and international passenger services and freight and freight transport. In the future, North American airlines are expected to require ~5,600 additional aircraft. Thus, the growing production of vehicles and airplanes will increase the demand for wire harness connectors and terminals, which is anticipated to boost the market growth over the forecast period.

Key Player Analysis:

Fujikura Ltd.; Furukawa Electric Co. Ltd.; Lear; LEONI; Motherson Group; Nexans; Sumitomo Electric Industries, Ltd; THB Group; Yazaki Corporation; and Yura Corporation are among the key North America wire harness market players.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the North America wire harness market. The North America wire harness market players are mainly focused on the development of advanced and efficient systems. A few recent key market developments are listed below:

- In 2021, Lear acquired M&N Plastics, Michigan-based engineered plastic components for automotive electrical distribution manufacturer and injection moulding specialist. This acquisition extends Lear's capacity to produce high-voltage wire harnesses.

- In 2020, The Schleuniger Group acquired Cirris Systems Corp., a leading wire harness testing equipment supplier, to strengthen its position in the cables, harnesses, and connectors market.

North America Wire Harness Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 22.63 Billion |

| Market Size by 2030 | US$ 34.14 Billion |

| Global CAGR (2022 - 2030) | 5.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, Material, End User, and Country

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The North America wire harness market was US$ 22.63 billion in the year 2022 and is expected to grow at a CAGR of 5.3 %, during 2022 - 2030.

Growing Technological Innovations in Automobiles is driving the North America wire harness.

The lightweight wire harness in the North America wire harness market is experiencing significant growth due to benefits such as reduced weight, improved durability, and reduced cost.

US is anticipated to grow with the highest CAGR over the forecast period.

The US held the largest market share in 2022, followed by Canada.

The key players, holding majority shares, in North America Wire Harness market includes Fujikura Ltd.; Furukawa Electric Co. Ltd.; Lear; LEONI; Motherson Group; Nexans; Sumitomo Electric Industries, Ltd; THB Group; Yazaki Corporation; Yura Corporation.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - North America Wire Harness Market

- DRÄXLMAIER Group

- Fujikura Ltd.

- Lear Corporation

- Sumitomo Electric Industries, Ltd.

- LEONI AG

- Yazaki Corporation

- FURUKAWA ELECTRIC CO., LTD.

- Motherson Sumi Systems Ltd.

- Kato Cable

- YURA Corporation

Get Free Sample For

Get Free Sample For