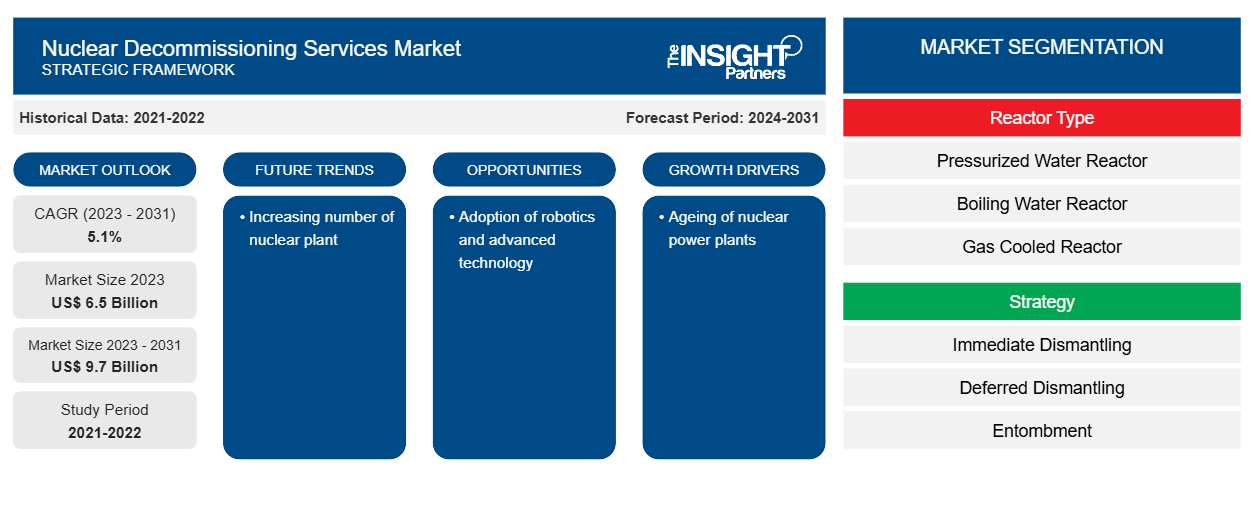

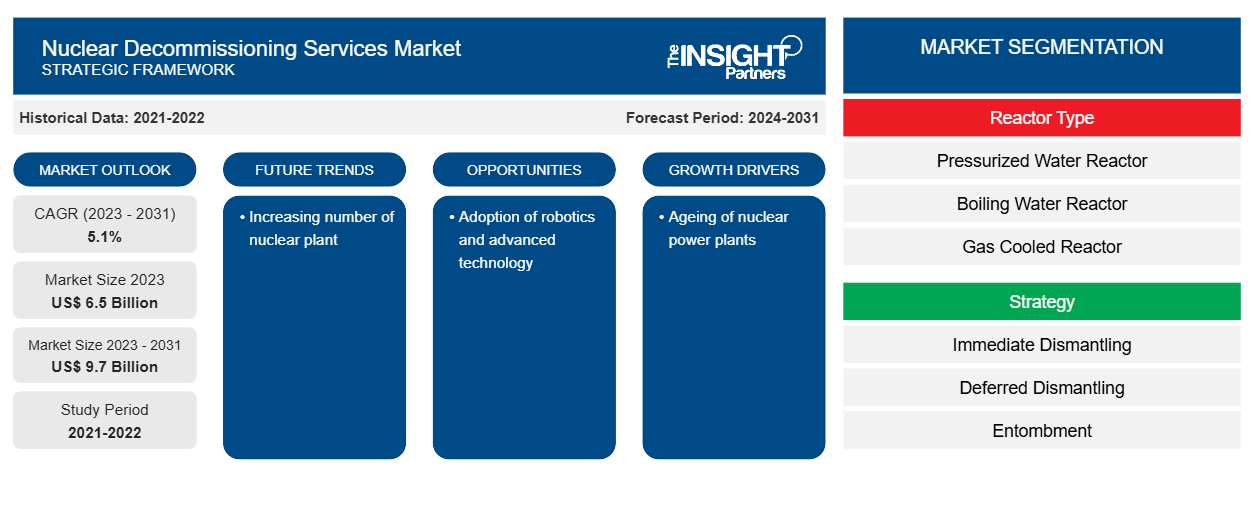

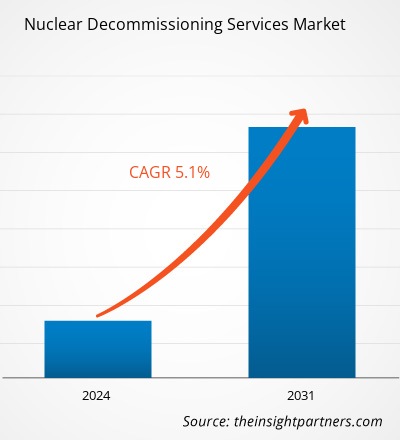

The Nuclear Decommissioning Services Market size is projected to reach US$ 9.7 billion by 2031 from US$ 6.5 billion in 2023. The market is expected to register a CAGR of 5.1% in 2023–2031. As the demand for the focus on sustainability is increasing, the usage and dependency on nuclear plants are increasing, and such an increase in sustainability is leading to the building of new power plants. As per the data published by the US Energy Department, the country is planning to add a new AP1000 reactor in the first quarter of 2024.

Nuclear Decommissioning Services Market Analysis

The demand and adoption of nuclear decommissioning services are high in the European region. Europe region has the highest number of nuclear power plants globally. As per a recent study, Europe has approximately 140 power plants. In France, there as approximately 60 nuclear power plants, whereas Russia follows the ranking with 45 nuclear power plants. Thus, owing to the high number of power plants in the European region, the demand for nuclear decommissioning services is high compared to any other region. As the demand for services is high in the region, the innovation in the decommissioning is highly seen. For instance, Slovakia recently completed its decommissioning of its state-owned power plant. During this, the government utilized digital technologies such as virtual modeling and simulations.

Nuclear Decommissioning Services Market Overview

Nuclear power plants globally are mainly operated on three different reactor types: pressurized water, boiling water, and gas-cooled. Most of the nuclear power plants that are being used currently are powered by pressurized water reactors. One of the benefits of the pressurized water reactor is that these reactors are more stable and easier to operate and maintain. Thus, the adoption of the pressurized water reactor is more compared to the other two reactor types. Across the globe, there are approximately 224 nuclear power plants that have pressurized water reactors, whereas boiling water reactors operate 7 power plants, and another type of reactor operates 71. Thus, the demand for the pressurized power plant decommissioning is more compared to other type of reactors.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nuclear Decommissioning Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nuclear Decommissioning Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Nuclear Decommissioning Services Market Drivers and Opportunities

Ageing of nuclear power plants

As the demand for energy across the globe has increased in the past few years, the dependency on the nuclear power plant has increased. Thus, governments across the world started building nuclear power plants. Many of the power plants that are operating globally are near the end of their operational life. For instance, the European region and the UK together have approximately 109 power plants, and approximately 95 of them are near to end of their life. Such aging of the power plant is driving the demand for nuclear decommissioning services.

Adoption of robotics and advanced technology

Owing to the high risks of hazards and the time required, the adoption of robots and drones is increasing worldwide. In addition, to reduce the radiological risks, developed nations have started using virtual reality and simulation technology. The 3D simulations are also helping to understand the real-time effect of the nuclear decommissioning process. Moreover, these technologies are also aiding in workers training part. Such benefits of robotics and advanced technology are projected to create lucrative opportunities in the near future.

Nuclear Decommissioning Services Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Nuclear Decommissioning Services Market analysis are reactor type, strategy, application, and capacity.

- Based on reactor type, the Nuclear Decommissioning Services Market is divided into pressurized water reactors, boiling water reactors, and gas-cooled reactors. The pressurized water reactor segment held a larger market share in 2023.

- By strategy, the market is segmented into neurogenerative immediate dismantling, deferred dismantling, and entombment. The immediate dismantling segment held the largest share of the market in 2023.

- In terms of application, the market is bifurcated into commercial power reactors, research power reactors, and prototypes. The commercial power reactor segment dominated the market in 2023.

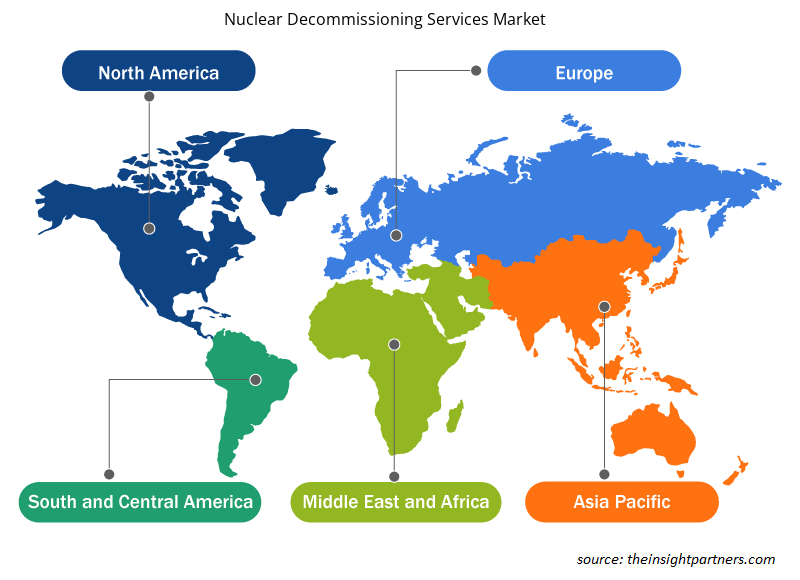

Nuclear Decommissioning Services Market Share Analysis by Geography

The geographic scope of the Nuclear Decommissioning Services Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America.

Europe region led the market owing to a high number of power plants and aged power plants. North America held the second-highest market share in 2023. North America region is again bifurcated into the US, Canada, and Mexico. The US is projected to dominate the North American market during the aging nuclear plants. US has 86 nuclear power plants, and approximately half of them are near to end of their lifespan. Such aging is projected to create lucrative opportunities during the forecast period.

Nuclear Decommissioning Services Market Regional Insights

The regional trends and factors influencing the Nuclear Decommissioning Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Nuclear Decommissioning Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Nuclear Decommissioning Services Market

Nuclear Decommissioning Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.5 Billion |

| Market Size by 2031 | US$ 9.7 Billion |

| Global CAGR (2023 - 2031) | 5.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Reactor Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Nuclear Decommissioning Services Market Players Density: Understanding Its Impact on Business Dynamics

The Nuclear Decommissioning Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Nuclear Decommissioning Services Market are:

- AECOM

- Ansaldo Energia S.p.A.

- Babcock International Group PLC

- Bechtel Corporation

- EnergySolutions

- GEHitachi Nuclear Energy (GEH)

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Nuclear Decommissioning Services Market top key players overview

Nuclear Decommissioning Services Market News and Recent Developments

The Nuclear Decommissioning Services Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for speech and language disorders and strategies:

- UK’s Imperial College research reactor was successfully decommissioned under the regulator's control. (Source: UK Nuclear Regulation Office, Press Release/Company Website/Newsletter, 2024)

- EnergySolution acquired the closed Kewaunee nuclear power plant for the potential use of this nuclear site. (Source: EnergySolution, Press Release/Company Website/Newsletter, 2023)

Nuclear Decommissioning Services Market Report Coverage and Deliverables

The “Nuclear Decommissioning Services Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Retinal Imaging Devices Market

- Data Center Cooling Market

- Foot Orthotic Insoles Market

- Industrial Inkjet Printers Market

- Transdermal Drug Delivery System Market

- Cosmetic Bioactive Ingredients Market

- Microplate Reader Market

- Water Pipeline Leak Detection System Market

- Webbing Market

- Online Recruitment Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Reactor Type ; Strategy ; Application ; Capacity

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Canada, China, France, Germany, India, Italy, Japan, Russian Federation, South Korea, United Kingdom, United States

Get Free Sample For

Get Free Sample For