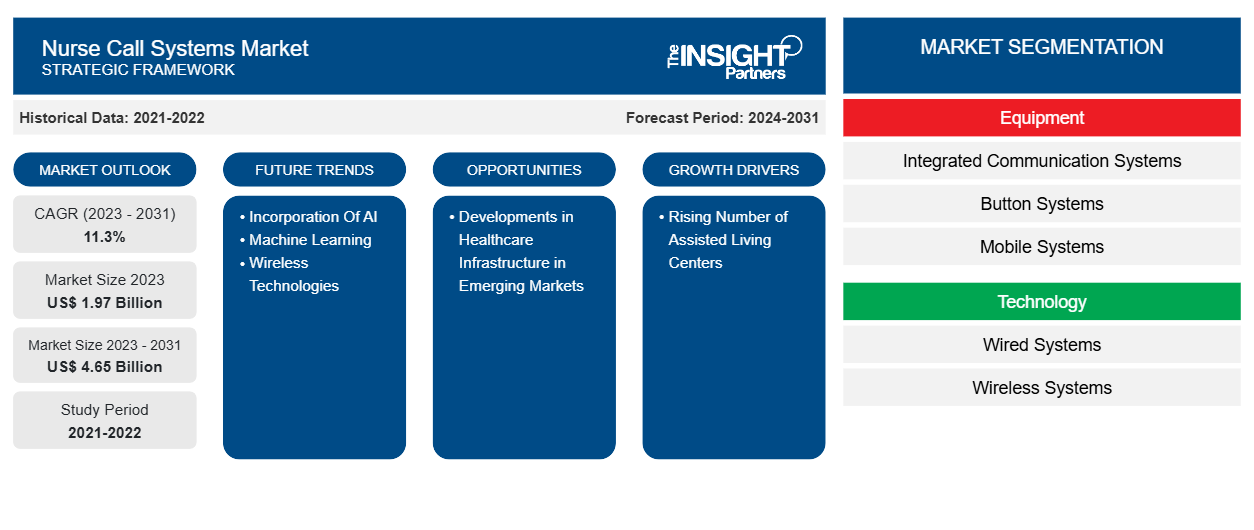

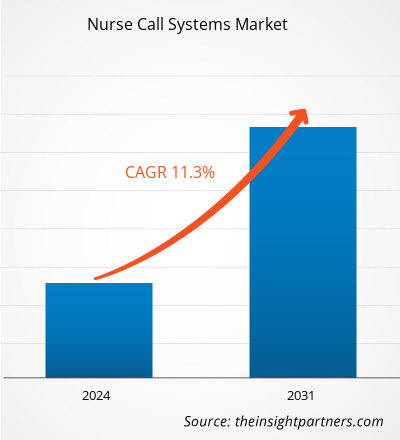

The nurse call systems market size is projected to reach US$ 4.65 billion by 2031 from US$ 1.97 billion in 2023. The market is expected to register a CAGR of 11.3% during 2023–2031. The incorporation of AI, machine learning, and wireless technologies is likely to act as a future trend in the market.

Nurse Call Systems Market Analysis

The nurse call systems market is expanding due to technological advancements, increased demand for healthcare efficiency, and an aging population. Key players in the market are focusing on innovative, sustainable products to cater to the evolving needs as well as increasing demand for efficient healthcare services. In addition, developments in healthcare infrastructure in emerging countries act as an opportunity for the nurse call systems market growth.

Nurse Call Systems Market Overview

Asia Pacific is expected to register the highest CAGR in the nurse call systems market during the forecast period. Key market players operational in Asia Pacific are adopting strategies such as mergers, acquisitions, product launches, and fundraising to expand their presence. For instance, in August 2024, Fanvil Technology Co., Ltd., a China-based company, launched its latest update: Nurse Call System, V1.0 Beta. This update is packed with new features to provide nurse call and emergency call solutions for caregivers, elders, and patients. Furthermore, in August 2024, Mingke Technology launched its cutting-edge nurse call system designed to revolutionize the way healthcare providers communicate and respond to patient needs. This system integrates the latest advancements in communication technology and is set to significantly improve patient care, safety, and operational efficiency across hospitals and healthcare facilities.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nurse Call Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Nurse Call Systems Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Nurse Call Systems Market Drivers and Opportunities

Rising Number of Assisted Living Centers Fuels Market Growth

As per the American Health Care Association, the US had ~30,600 assisted living centers in 2021 that owned approximately 1.2 million licensed beds. Nearly 56% of these were chain-affiliated communities (part of an organization managing at least two communities), and more than 40% were independently owned centers. According to the US Census Bureau's 2021 County Business Patterns Survey, states with the most assisted living communities include California (4,100), Washington (1,902), Florida (1,804), Texas (1,295), Wisconsin (1,272), and Oregon (1,208). Further, as per the Canadian Institute for Health Information, there were ~2,076 long-term care homes in Canada in 2021, of which 46% were publicly owned and 54% were privately owned. Ontario has 627 long-term care homes in total; 16% of these are publicly owned, 57% of the total are owned by private for-profit organizations, and 27% are owned by private not-for-profit organizations. Quebec has approximately 440 long-term care homes, including 88% publicly owned and 12% privately owned centers. Similarly, as per the Carehome UK, there are about 16,700 care homes in the UK. Of which, 70% of care homes are residential settings, while 30% are nursing homes.

Assisted living centers or assisted living communities generally serve people who require help in their daily activities and healthcare-related services. These centers or communities have secure premises that resemble homes, benefitting the occupants through independence, companionship, and privacy. Moreover, the diverse culture of residents and caregivers encourages socialization and friendly relations between them. Close monitoring of patients is required in assisted living centers. Various parts of these centers are equipped with nurse call systems to ensure residents' safety and well-being. The increasing number of assisted living centers is the key factor driving the growth of the nurse call system market, as these facilities continuously strive to improve residents' safety and care quality by adopting technologically advanced devices.

Developments in Healthcare Infrastructure in Emerging Markets to Generate Growth Opportunities

Emerging nations in Asia Pacific, the Middle East, and Latin America are heavily investing in their healthcare infrastructure. Governments of countries in these regions are making healthcare reforms and taking initiatives to improve access to quality healthcare. The Ayushman Bharat Health Infrastructure Mission is India's grand initiative to fortify its healthcare infrastructure, underscoring the country's dedication to wellness. The India Investment Grid (IIG) showcases 1,157 investment projects worth US$ 31.28 billion in the healthcare sector across all the states of the country. Further, as per the International Trade Administration, the Saudi Arabian Government plans to invest over US$ 65 billion under Vision 2030 to develop the country's healthcare infrastructure, reorganize and privatize health services and insurance, launch 21 "health clusters" across the country, and expand the provision of e-health services. Additionally, the country aims to raise the contribution of the private sector in healthcare from 40% to 65% by 2030, targeting the privatization of 290 hospitals and 2,300 primary health centers, thereby creating significant commercial opportunities for international companies to enter into its developing healthcare market. Thus, the flourishing healthcare sectors in developing countries are likely to create significant opportunities for the adoption of nurse call systems.

Nurse Call Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the nurse call systems market analysis are equipment, technology, application, and end user.

- The nurse call systems market, based on equipment, is segmented into integrated communication systems, button systems, mobile systems, and intercom systems. In 2023, the integrated communication systems segment held the largest share of the market.

- Based on technology, the market is segmented into wired systems and wireless systems. In 2023, the wired segment held a larger share of the market.

- By application, the market is segmented into emergency medical alarms, wanderer control, workflow support, and others. The emergency medical alarms segment dominated the market in 2023.

- Based on end user, the nurse call systems market is segmented into hospitals, nursing homes and assisted living centers, clinics, and others. In 2023, the hospital segment held the largest market share.

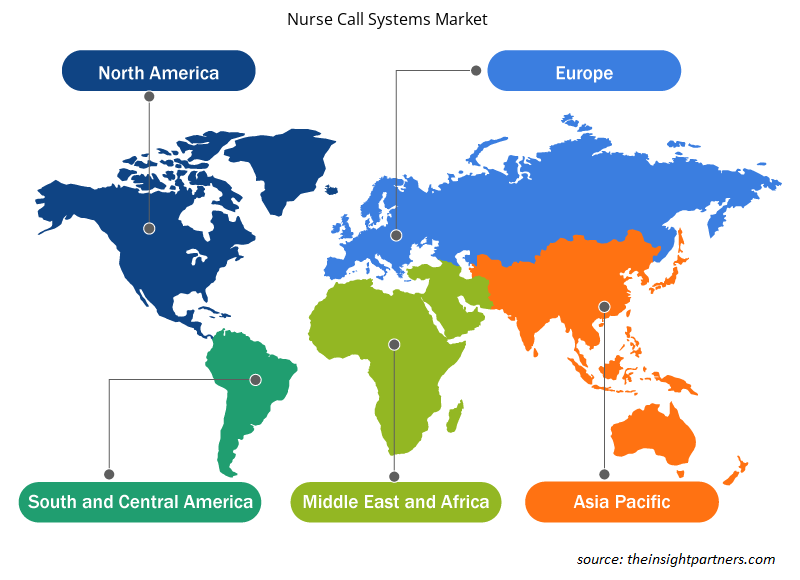

Nurse Call Systems Market Share Analysis by Geography

The geographic scope of the nurse call systems market report is mainly divided into five regions: North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the market in 2023. The US is the largest contributor to the nurse call systems market in this region. The market in the US is experiencing robust growth owing to rising incidence of Alzheimer's disease, growing penetration of various market players, and increasing number of assisted living centers across the country. Canada and Mexico are experiencing a rise in awareness programs and initiatives. These countries are also expected to face the increasing prevalence of dementia. In addition, the increase in medical tourism in Mexico is likely to enhance the growth of the nurse call systems market in this country during the forecast period.

Nurse Call Systems Market Regional Insights

The regional trends and factors influencing the Nurse Call Systems Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Nurse Call Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Nurse Call Systems Market

Nurse Call Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.97 Billion |

| Market Size by 2031 | US$ 4.65 Billion |

| Global CAGR (2023 - 2031) | 11.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Equipment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

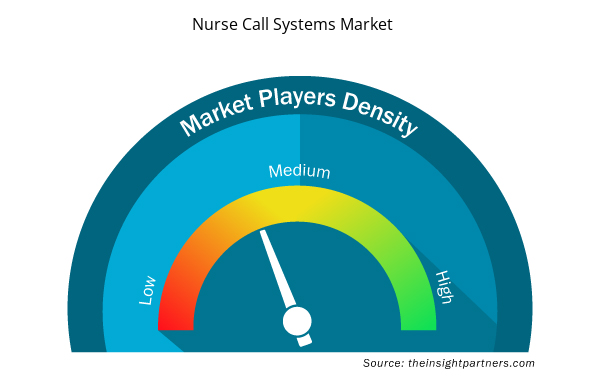

Nurse Call Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Nurse Call Systems Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Nurse Call Systems Market are:

- Ascom Holding AG

- Honeywell International Inc

- Siemens AG

- Ametek Inc

- Austco Communication Systems Pty Ltd

- Intercall Systems Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Nurse Call Systems Market top key players overview

Nurse Call Systems Market News and Recent Developments

The nurse call systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market are listed below:

- Ascom, a global leader in healthcare communication and workflow solutions, signed a comprehensive framework agreement with Istekki, a significant Finnish healthcare organization. The 5-year agreement includes the installation of nurse call systems in acute and long-term care institutions, with an estimated value of EUR 6 million. (Source: Ascom Holding AG, Company Website, April 2024)

- Honeywell announced its commitment to developing technology-led solutions for the future of healthcare delivery. Building on its deep expertise in the hospital setting, Honeywell signed Memorandums of Understanding (MOUs) with two leading healthcare companies, which would be potentially followed by further collaborations in the US and around the world. The agreements provide a framework to co-innovate error-prone processes and tasks, enhance the patient experience, and improve operational agility through digitalization. (Source: Honeywell International Inc, Company Website, September 2022)

Nurse Call Systems Market Report Coverage and Deliverables

The "Nurse Call Systems Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Nurse call systems market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Nurse call systems market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Nurse call systems market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the nurse call systems market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Cut Flowers Market

- Single Pair Ethernet Market

- Small Internal Combustion Engine Market

- Online Recruitment Market

- Transdermal Drug Delivery System Market

- Digital Language Learning Market

- Space Situational Awareness (SSA) Market

- Nuclear Waste Management System Market

- Aircraft MRO Market

- Artwork Management Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Equipment ; Technology ; Application ; End User and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America dominated the market in 2023.

The rising number of assisted living centers, recent developments by market players, and increasing incidences of Alzheimer's disease are among the most significant factors fueling the market growth.

The incorporation of AI, machine learning, and wireless technologies is expected to be a prime trend in the market in the coming years.

Ascom Holding AG, Honeywell International Inc, Siemens AG, Ametek Inc, Austco Communication Systems Pty Ltd, Intercall Systems Inc., Schrack Seconet AG, TigerConnect, Securitas AB, and Baxter International Inc are among the key players in the market.

The nurse call systems market value is expected to reach US$ 4.65 billion by 2031.

The market is expected to register a CAGR of 11.3% during 2023–2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Nurse Call Systems Market

- Ascom Holding AG

- Honeywell International Inc

- Siemens AG

- Ametek Inc

- Austco Communication Systems Pty Ltd

- Intercall Systems Inc.

- Schrack Seconet AG

- TigerConnect

- Securitas AB

- Baxter International Inc

Get Free Sample For

Get Free Sample For