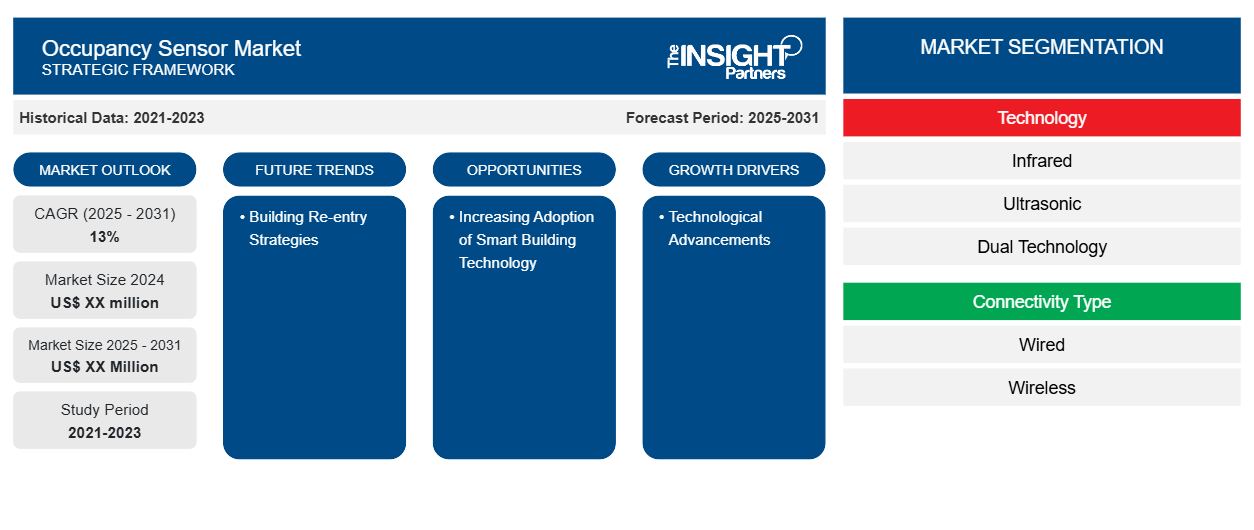

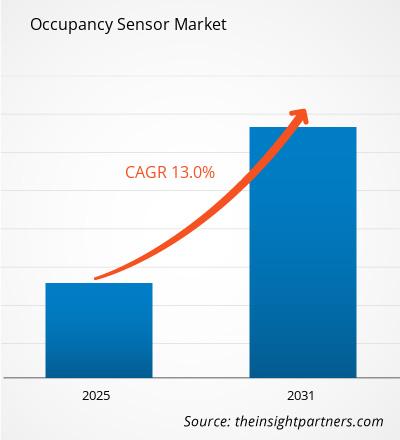

The Occupancy sensor market is expected to register a CAGR of 13.0% during 2023–2031. Increasing adoption of smart building technology is likely to remain a key trend in the market.

Occupancy Sensor Market Analysis

- The growth of the occupancy sensor market is driven by various factors, which include rising demand for automotive vehicles, incorporation of occupancy detection sensors into passenger vehicles, growing reliance on electronic systems to improve the safety, comfort, and efficiency of the passengers in the automotive sector, and implementation through government regulations.

- Moreover, the market is still eyeing sensor innovation as one of the trendiest landscapes within the automotive industry, with huge investments by stakeholders as an indication of technological advancements and smart sensor adoption. Not only the occupant sensors limited in the automotive sector, but occupancy sensors are also used in building re-entry strategies for the detection of motion, thus indicating that a person is present and providing opportunities for building owners and tenants of various sectors.

Occupancy Sensor Market Overview

- This includes devices such as all-encompassing under-occupant sensors, passive infrared sensors, ultrasonic sensors, microwave sensors, and even smart meters and keycard locks for hotel rooms. These devices are mainly used for energy conservation, automatic control, and compliance with building codes. The pit is sensitive to passengers, comfort, and the efficiency requirements that industries have designed occupant sensors for. For example, the automotive market is booming in innovation and investment for the adoption of smart sensors.

- Occupancy sensors have been designed for use in building re-entry strategies, motion detection, and an indication that an individual is moving in, thereby saving energy and announcing the coming of an occupant, among a variety of conveniences brought to the building owner, tenant, and guest's fingertips.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Occupancy Sensor Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Occupancy Sensor Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Occupancy Sensor Market Drivers and Opportunities

Technological Advancements

- The global occupancy sensor market is mainly driven by significant technological improvements and innovations in the adoption of smart sensors that are more focused on enhancing safety, energy efficiency, and automatic control in both automotive and building applications. Occupancy detection sensor integration into the automotive sector is influenced by the increasing demand for safety and comfort characteristics in vehicles, new energy vehicles, and connected and future autonomous vehicles, which will all benefit from the technological advancements made in sensor design and manufacturing.

- Further, the market will surge as much as automakers invest in innovative technologies for the development of safer and more efficient vehicles, showing an interest in enhancing safety and efficiency through technology. All these point to the fact that the global occupancy sensor market is focused on providing enhanced safety, energy efficiency, and automatic control in automotive and building applications, wherein technological advancements act as the major growth accelerator.

Building Re-entry Strategies

- This is an opportunity that occupancy sensors can offer to building owners and tenants in different parts of the economy the detect people's movement and, in turn, create trigger alerts. This capability results not only in saving energy but also in carrying substantive savings. However, the occupancy sensors do not stop at giving convenience benefits; the sensors improve the user experience and operational efficiency of buildings, make adjustments of the environmental conditions hassle-free and automatic upon detection of the presence of occupants, and thus result in a built environment that is more sustainable and comfortable.

- Therefore, the widespread implementation of occupancy sensors has the potential to revolutionize the operational and environmental performance of wide-ranging sectors critical for building owners concerning several compelling advantages for building owners and occupants.

Occupancy Sensor Market Segmentation

Key segments that contributed to the derivation of the Occupancy Sensor market analysis are type, connectivity type, application, and end user.

- Based on type, the market is segmented into infrared, ultrasonic, and dual technology.

- In terms of connectivity type, the market is segmented into wired and wireless.

- Based on application, the market is divided into lighting, HVAC, and security & surveillance.

- In terms of end users, the market is segmented into residential and commercial.

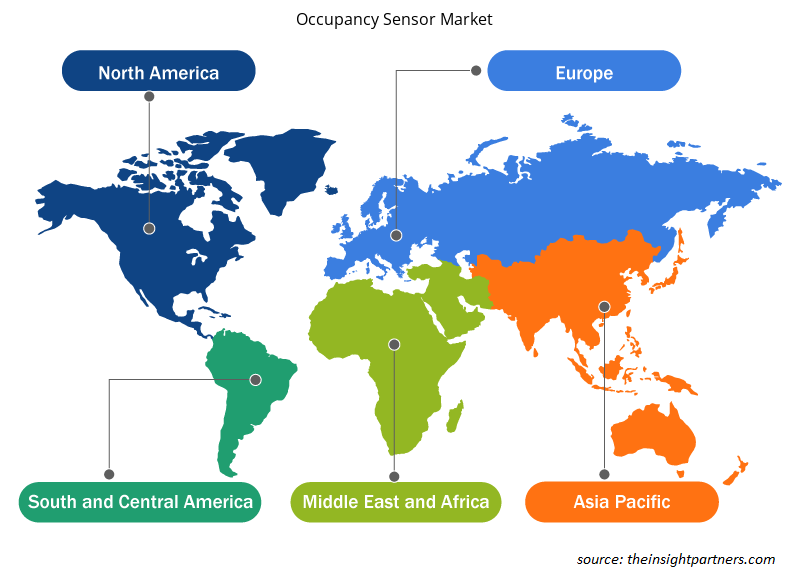

Occupancy Sensor Market Share Analysis by Geography

- The Occupancy Sensor market report comprises a detailed analysis of five major geographic regions, which includes current and historical market size and forecasts for 2021 to 2031, covering North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and South & Central America.

- Each region is further sub-segmented into respective countries. This report provides analysis and forecasts of 18+ countries, covering mechanical keyboards market dynamics such as drivers, trends, and opportunities that are impacting the markets at the regional level.

- Also, the report covers PEST analysis, which involves the study of major factors that influence the Occupancy Sensor market in these regions.

Occupancy Sensor Market Regional Insights

The regional trends and factors influencing the Occupancy Sensor Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Occupancy Sensor Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Occupancy Sensor Market

Occupancy Sensor Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 13% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Occupancy Sensor Market Players Density: Understanding Its Impact on Business Dynamics

The Occupancy Sensor Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Occupancy Sensor Market are:

- Schneider Electric

- Eaton Corporation PLC

- Lutron Electronics

- Leviton

- Johnson Controls, Inc.

- Honeywell International, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Occupancy Sensor Market top key players overview

Occupancy Sensor Market News and Recent Developments

The Occupancy Sensor market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Occupancy Sensor market are listed below:

- NOVELDA, innovator of the world’s most reliable ultra-wideband (UWB) radar sensors, announces it will demonstrate the new multi-target seat occupancy detection function of its NOVELDA X7 UWB In-Cabin Sensor at Embedded World 2024. NOVELDA’s X7 radar chip is already capable of performing the world´s lowest power presence detection, child presence detection (CPD), and vital signs monitoring. X7 now adds seat occupancy detection capability through a software upgrade. A single UWB sensor can detect human presence in each seat within the car cabin, making it the most reliable and cost-effective seat occupancy radar solution on the market.

(Source: Novelda AS, Company Website, April 2024)

Occupancy Sensor Market Report Coverage and Deliverables

The "Occupancy Sensor Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Occupancy Sensor market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Occupancy Sensor market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Occupancy Sensor market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Occupancy Sensor market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Global Occupancy Sensor market is expected to grow at a CAGR of 13.0% during the forecast period 2023 - 2031.

Technological advancements in occupancy sensors are the major factor driving the market growth.

Increasing adoption of smart building technology is likely to remain a key trend in the market.

The leading players operating in the market are Schneider Electric, Eaton Corporation PLC, Lutron Electronics, Leviton, Johnson Controls, Inc., Honeywell International, Inc., General Electric Company, Acuity Brands, Legrand S.A., and Hubbell Incorporated.

The report can be delivered in PDF/PPT format; we can also share an Excel dataset based on the request.

Some of the customization options available based on request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies

Get Free Sample For

Get Free Sample For