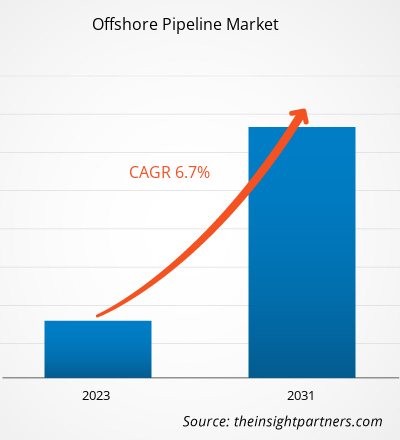

The offshore pipeline market size is projected to reach US$ 21,044.7 million by 2031 from US$ 15,277.3 million in 2022. The market is expected to register a CAGR of 6.7% during 2023–2031. Increasing offshore oil and gas production, rising production of new oil rigs, and reconstruction of existing and old offshore oil and gas rigs are among the key factors driving the offshore pipeline market.

Offshore Pipeline Market Analysis

The offshore pipeline market is expected to experience considerable growth owing to the rising number of natural gas projects as well as the discovery of new oil fields, particularly in remote locations. Additionally, the depletion of existing oil and gas reserves in various countries has created a demand for cross-border pipelines for the supply of oil and gas-related products, which is boosting the growth of the offshore pipeline market. The increasing demand for cost-effective transportation methods for oil and gas is also one of the major factors expected to boost the demand for offshore pipelines in the oil & gas sector worldwide.

Offshore Pipeline Market Overview

Population explosion and corresponding industrialization have triggered the demand for energy at the global level. The rise in energy consumption has boosted the need for oil and gas in developing and developed economies. It has resulted in driving the demand for offshore pipeline infrastructure across the globe. Asia Pacific is the largest consumer of crude oil and gas. Further, highly industrialized countries in the Asia Pacific, including China, India, Japan, and South Korea, are reporting increasing overall energy consumption. Their focus on boosting domestic oil production through various enhanced oil recovery techniques is promoting the market for offshore pipelines in Asia Pacific to meet the growing oil demand.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Offshore Pipeline Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Offshore Pipeline Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Offshore Pipeline Market Drivers and Opportunities

Increasing Demand for Natural Gas and Crude Oil

The demand for oil and natural gas is witnessing a constant increase across the world. The US and China have registered the most noticeable growth. The surge in industrial production, along with the high demand for trucking services, is boosting the demand for petrochemicals, thereby fuelling the growth of the offshore pipeline market. Moreover, the growth in air traffic volumes worldwide, particularly in Asia, is another significant factor resulting in increased oil consumption.

The Organization of the Petroleum Exporting Countries (OPEC) published “The 2020 OPEC World Oil Outlook” in October 2020. As per the outlook, the COVID-19 pandemic led to a downturn in oil demand; however, it was expected that global energy demand would register constant growth in the future, rising by a noteworthy 25% by 2045. The outlook further anticipates oil to be the largest contributor in the energy mix market, contributing 27% of the overall energy share by 2045. The demand for oil products is estimated to rise at more than ~47 Mb/day during 2022–2025 in OECD countries. On the other hand, the demand in non-OECD countries is projected to rise by 22.5 MB/day during the forecast period.

Constant Efforts to Improve Oil Recovery Operations

Various countries are investing in rejuvenating their existing oil resources in order to boost domestic oil production and decrease their dependence on oil imports. Over recent decades, the steam injection method has been exploited commercially to improve recovery from conventional heavy oil reservoirs in their later stages of development. The injected steam increases the overall pressure of an offshore oil reservoir, which helps improve the mobility ratio of crude oil and allows it to flow efficiently. As a result, the enhanced oil recovery methods help revitalize extraction processes in existing offshore oil wells. Thus, the expansion of oil and gas operations is anticipated to offer promising growth opportunities to the offshore pipeline market players in the coming years.

Offshore Pipeline Market Report Segmentation Analysis

Key segments that contributed to the derivation of the offshore pipeline market analysis are type and end user.

- Based on diameter, the offshore pipeline market has been divided into less than 24 inches and more than 24 inches. The less than 24-inch segment held a larger market share in 2023.

- By line type, the offshore pipeline market is segmented into transport lines, export lines, and others. The transport line segment held the largest market share in 2023.

- In terms of products, the market is segmented into oil, gas, and refined products. The refined products segment dominated the market in 2023.

Offshore Pipeline Market Share Analysis by Geography

The geographic scope of the offshore pipeline market report is mainly divided into five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Europe dominated the offshore pipeline market in 2023. The market in Europe is segmented into Germany, Norway, Italy, Russia, the UK, and the Rest of Europe. Europe is the second largest producer of petroleum products globally, persisting an oil refining capacity of more than 15%. The gas industry in Europe has observed various shifts owing to the rising LNG demand. Further, Norway and Russia still maintain their position as natural gas suppliers, whereas Germany, France, and Italy are the main importers of natural gas. Thus, the rising number of natural gas projects, as well as the discovery of new oil fields, particularly in remote locations, will most likely accelerate the demand for offshore pipeline systems and services.

Offshore Pipeline Market Regional Insights

Offshore Pipeline Market Regional Insights

The regional trends and factors influencing the Offshore Pipeline Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Offshore Pipeline Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Offshore Pipeline Market

Offshore Pipeline Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 15,277.3 Million |

| Market Size by 2031 | US$ 21,044.7 Million |

| Global CAGR (2023 - 2031) | 6.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Diameter

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

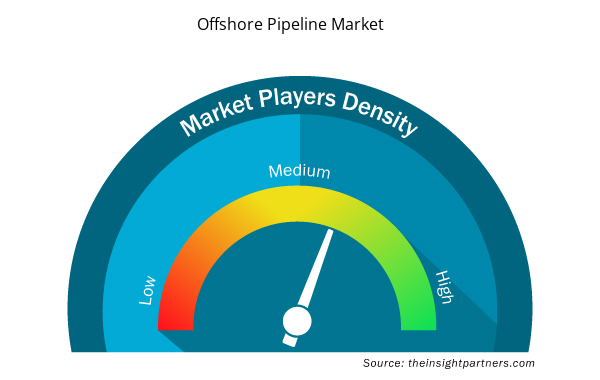

Offshore Pipeline Market Players Density: Understanding Its Impact on Business Dynamics

The Offshore Pipeline Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Offshore Pipeline Market are:

- Enbridge Inc

- Saipem SpA

- McDermott International Ltd.

- Allseas Group SA

- China Petroleum Pipeline Engineering Ltd

- Kinder Morgan

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Offshore Pipeline Market top key players overview

Offshore Pipeline Market News and Recent Developments

The offshore pipeline market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the offshore pipeline market are listed below:

- In July 2023, Kinder Morgan and Howard Energy Partners expanded their Eagle Ford natural gas transportation systems. Tejas is constructing a 67-mile pipeline, and Dos Caminos is constructing a 62-mile pipeline. The projects are expected to be completed in Q4 2023 and deliver up to 2 billion cubic feet/day of natural gas to the US Gulf Coast markets. The US$ 251 million expansion project is a critical supply link for power generators, industrial customers, and LNG exporters along the Texas intrastate pipeline network.

- In February 2023, Enagas signed an agreement with Reganosa in which Enagas paid 54 million euros to Reganosa to purchase a network of 130 km of natural gas pipelines. The efficient operation and supply security of the Iberian gas market is dependent on this network.

Offshore Pipeline Market Report Coverage and Deliverables

The “Offshore Pipeline Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Offshore pipeline market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Offshore pipeline market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Offshore pipeline market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the offshore pipeline market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Digital Language Learning Market

- Small Molecule Drug Discovery Market

- Nuclear Waste Management System Market

- Procedure Trays Market

- Constipation Treatment Market

- Social Employee Recognition System Market

- Malaria Treatment Market

- Queue Management System Market

- Small Internal Combustion Engine Market

- Pipe Relining Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Diameter , Line Type , and Product

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Norway, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The offshore pipeline market is expected to register a CAGR of 6.7% during 2023–2031.

The offshore pipeline market size is projected to reach US$ 21,044.7 million by 2031

The key players in the offshore pipeline market are - Enbridge Inc., Saipem SpA, McDermott International Ltd., Allseas Group SA, China Petroleum Pipeline Engineering Ltd, Kinder Morgan, TC Energy Corporation, Energy Transfer, Bechtel Corporation, Transneft

Increasing demand for natural gas and crude oil and various countries are investing in rejuvenating their existing oil resources in order to boost domestic oil production anticipated to drive offshore pipeline market

Europe dominated the offshore pipeline market in 2023.

Get Free Sample For

Get Free Sample For