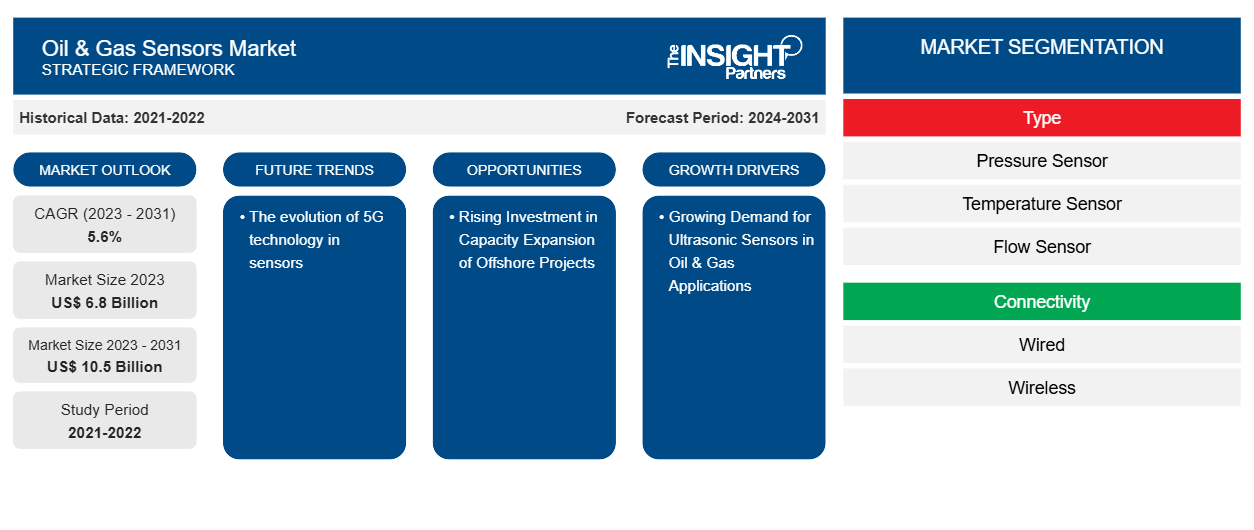

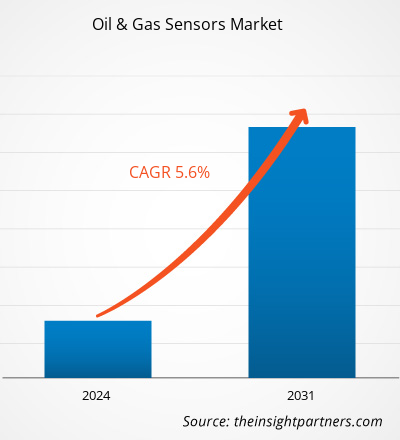

The oil & gas sensors market size is expected to reach US$ 10.5 billion by 2031 from US$ 6.8 billion in 2023. The market is estimated to record a CAGR of 5.6% from 2023 to 2031. The evolution of 5G technology in sensors is likely to remain a key trend in the market.

Oil & Gas Sensors Market Analysis

Oil & gas sensors have found various upstream, midstream, and downstream applications, including optimizing pipeline performance, measuring flow, detecting leaks, and preventing potential accidents or environmental hazards by ensuring workers' safety. Growing demand for operational reliability and efficiency, rising need for early detection of potential hazards, increasing industrial automation, and favorable government initiatives are propelling the oil & gas sensors market. Moreover, the expanding oil & gas industry and the growing need for real-time monitoring of oil & gas plants are boosting the market growth. Technological advancement and integration of cutting-edge technologies such as AI and IoT in the development of advanced sensors contribute significantly to the oil & gas sensors market growth.

Oil & Gas Sensors Market Overview

Sensors detect and measure physical input changes in the environment and convert them into an output that can be easily read by a human or machine. A sensor turns a physical phenomenon into a measurable analog voltage or digital signal that is displayed or transmitted for further processing. Industries such as oil & gas use sensors to monitor temperature, measure distance, adjust pressure, and detect smoke, among others. The oil & gas industry heavily relies on sensors for continuous monitoring and measurement working of oil & gas plants by avoiding unscheduled disruptions and machine maintenance. Oil and gas sensors can withstand extremely high temperatures or hazardous environments and are explosion-proof/intrinsically safe, corrosion-resistant, waterproof/submersible, and resistant to dust (IP-rated). These features support the oil & gas industry to accurately monitor wells and pipelines, subsea applications, wellhead instrumentation, rudder reference, and storage tanks and oil wells.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Oil & Gas Sensors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Oil & Gas Sensors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Oil & Gas Sensors Market Drivers and Opportunities

Growing Demand for Ultrasonic Sensors in Oil & Gas Applications

The oil & gas business is becoming increasingly important as countries seek alternative decarbonized renewable energy sources. However, the growing demand for oil & gas has led to high production output from existing infrastructure that must be more dependable and efficient. To meet these demands, oil & gas sensor companies, such as Fuji Electric Co Ltd, Honeywell International Inc, Siemens AG, and Murata Manufacturing Co Ltd, are offering ultrasonic sensors that measure liquids in severe and complex process conditions. These sensors are widely used for remote monitoring, condition monitoring & maintenance, analysis & simulation, and flow control in various oil & gas applications. An ultrasonic flow sensor is used in upstream, midstream, and downstream applications to compute the mass flow or volume flow of fluids in pipelines, tanks, and other processing equipment. The sensor also monitors equipment such as monitor pumps, flowlines, valves, and any other component that requires a precise flow rate to maintain the flow of oil. Moreover, the growing demand for nonintrusive measurement in midstream and downstream oil & gas applications is increasing the requirement for ultrasonic sensors for monitoring liquid volumes during various chemical reactions at the refining and purification processes. These sensors accurately monitor the flow of liquid without interrupting ongoing operations.

Rising Investment in Capacity Expansion of Offshore Projects

Offshore renewables, such as offshore wind and ocean energy, have the potential to speed the global energy transition while creating new economic and social opportunities. According to the most recent data published by the International Renewable Energy Agency (IRENA) in June 2023, the capacity of offshore wind accounted to be more than 55 gigawatts (GW) in 2022, while ocean energy installed capacity was 0.535 GW in 2021. By 2030, offshore wind and ocean energy are expected to generate 380 GW and 350 GW, respectively, due to increasing investment in ocean energy technologies. This boosts the adoption of oil & gas sensors among users to monitor water quality, detect oil spills, and assess the impact of offshore drilling activities on oil & gas applications.

Oil & Gas Sensors Market Report Segmentation Analysis

Key segments that contributed to the derivation of the oil & gas sensors market analysis are type, connectivity, function, and application.

- Based on type, the oil & gas sensors market is segmented into pressure sensor, temperature sensor, flow sensor, and level sensor. The pressure sensor segment held the largest market share in 2023.

- Based on connectivity, the oil & gas sensors market is segmented into wired and wireless. The wired segment dominated the market in 2023.

- By function, the market is segmented into remote monitoring, condition monitoring and maintenance, analysis and simulation, and others. The remote monitoring segment dominated the market in 2023.

- In terms of application, the oil & gas sensors market is segmented into upstream, midstream, and downstream. The upstream segment held the largest market share in 2023.

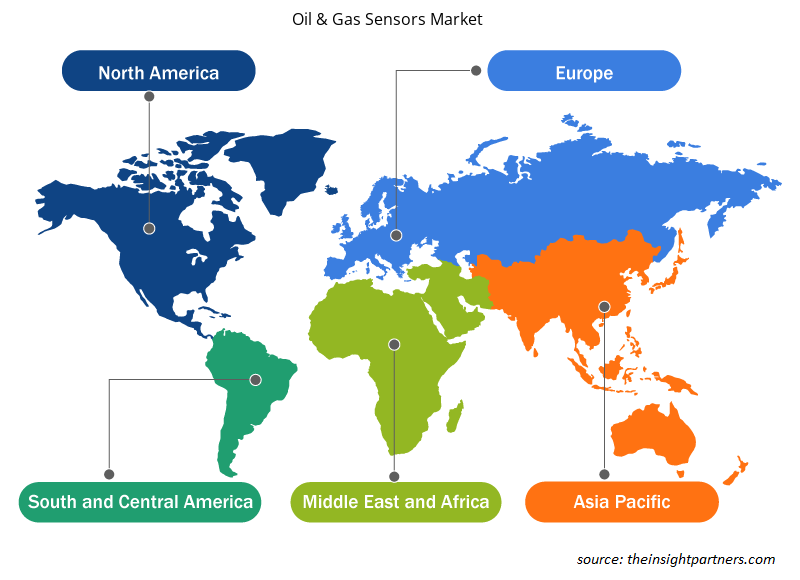

Oil & Gas Sensors Market Share Analysis by Geography

The oil & gas sensors market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2023, followed by Europe and APAC.

The oil & gas sensors market growth in North America is attributed to the growing adoption of oil & gas sensors across upstream, midstream, and downstream applications, among others, for monitoring the working of devices and equipment used in the energy & power sector. Moreover, expansion activities of the oil & gas industries are anticipated to create lucrative opportunities for the market growth during the forecast period.

Oil & Gas Sensors Oil & Gas Sensors Market Regional Insights

The regional trends and factors influencing the Oil & Gas Sensors Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Oil & Gas Sensors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Oil & Gas Sensors Market

Oil & Gas Sensors Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.8 Billion |

| Market Size by 2031 | US$ 10.5 Billion |

| Global CAGR (2023 - 2031) | 5.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

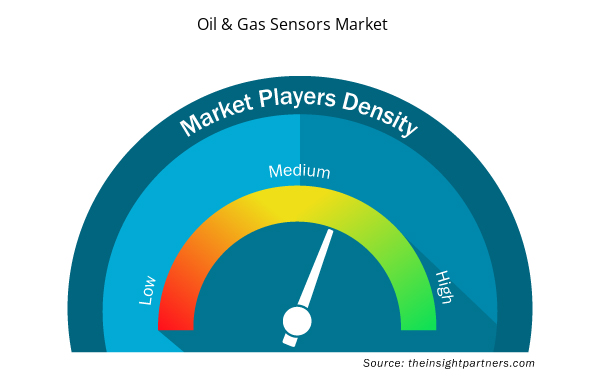

Oil & Gas Sensors Market Players Density: Understanding Its Impact on Business Dynamics

The Oil & Gas Sensors Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Oil & Gas Sensors Market are:

- Honeywell International Inc

- TE Connectivity Ltd

- Robert Bosch GmbH

- ABB Ltd

- Siemens AG

- Rockwell Automation Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Oil & Gas Sensors Market top key players overview

Oil & Gas Sensors Market News and Recent Developments

The oil & gas sensors market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the oil & gas sensors market are listed below:

- NevadaNano, an innovator in environmental, social, and governance (ESG) solutions, announced that it had closed its Series C funding round. First-time investors Honeywell Ventures and Emerson Ventures led the round, joined by several existing investors. (Source: NevadaNano, Press Release, November 2023)

- ABB launched its new FusionAir Smart Sensor, a touch-free room sensor with optional room control sensors capable of monitoring the temperature, humidity, carbon dioxide (CO2), and VOCs to improve the overall IAQ and reduce the risk of viral exposure. (Source: ABB Ltd, Press Release, October 2021)

Oil & Gas Sensors Market Report Coverage and Deliverables

The "Oil & Gas Sensors Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Oil & gas sensors market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Oil & gas sensors market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Oil & gas sensors market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the oil & gas sensors market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Pharmacovigilance and Drug Safety Software Market

- Aesthetic Medical Devices Market

- Military Rubber Tracks Market

- Cosmetic Bioactive Ingredients Market

- Integrated Platform Management System Market

- Explosion-Proof Equipment Market

- Terahertz Technology Market

- Employment Screening Services Market

- Resistance Bands Market

- Social Employee Recognition System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America dominated the oil & gas sensors market in 2023.

The growing demand for ultrasonic sensors in oil & gas applications is the major factors that propel the market growth.

Evolution of 5G technology in sensors to play a significant role in the oil & gas sensors market in the coming years.

The key players holding majority shares in the global oil & gas sensors market are Honeywell International Inc, TE Connectivity Ltd, Robert Bosch GmbH, ABB Ltd, Siemens AG, Rockwell Automation Inc, Analog Devices Inc, Emerson Electric Co, SKF AB, and GE Vernova.

The oil & gas sensors market is anticipated to reach US$ 10.5 billion by 2031.

The oil & gas sensors market is estimated to record a CAGR of 5.6% from 2023 to 2031.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Oil and Gas Sensors Market

- Honeywell International Inc

- TE Connectivity Ltd

- Robert Bosch GmbH

- ABB Ltd

- Siemens AG

- Rockwell Automation Inc

- Analog Devices Inc

- Emerson Electric Co

- SKF AB

- GE Vernova

Get Free Sample For

Get Free Sample For