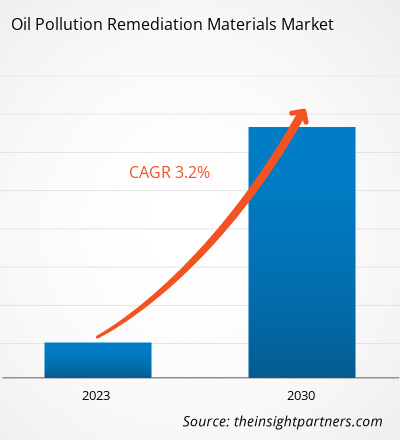

[Research Report] The oil pollution remediation materials market analysis was valued at US$ 3,684.36 million in 2022 and is expected to reach US$ 4,749.56 million by 2030; it is estimated to register a CAGR of 3.2% from 2022 to 2030.

Market Analysis

The oil pollution remediation materials are utilized to reduce the high risk of contamination of water bodies due to various oil exploration, transport, and industrial operational activities that are taking place across the globe. The remediation techniques are majorly classified into physical remediation, chemical remediation, thermal remediation, and bioremediation. They are considered extremely important for tackling the problems of marine oil spills. The physical remediation consists of materials such as booms, skimmers, and adsorbent materials. The chemical remediation materials include dispersants and solidifiers.

Major factors driving the oil pollution remediation materials market growth are the rising offshore oil exploration and transportation activities and government regulations related to oil spill preparedness and responses. In the past few years, governments of various countries have designed oil spill cleanup regulations to ensure a prompt and effective response to environmental emergencies. These regulations typically outline procedures, technologies, and standards that companies must follow to contain, control, and clean up oil spills. Regulations often stipulate the type of remediation materials that must be employed to minimize environmental impact and ensure effective cleanup. The rising need for effective oil spill cleanup propels the demand for remediation materials.

As environmental concerns and regulations intensify, there is a growing emphasis on using advanced and eco-friendly materials for remediation. Certain absorbents, dispersants, and barriers may be mandated to meet safety and efficacy standards, promoting the use of environment-friendly and efficient materials in oil spill response efforts. Governments and the oil industry have preparedness plans to conduct regular oil spill response. Government mandates to address oil spills promptly, and minimization of ecological impact have driven the demand for absorbents, dispersants, and other remediation materials. In 2023, the US Environmental Protection Agency strengthened standards to improve oil spill responses in the US waters and adjoining shorelines under the federal government’s National Contingency Plan (NCP). The standards include the development of effective oil spill remediation products, such as chemical and biological agents, and the provision of transparency and information related to the use of these products.

Increased offshore exploration and drilling activities, transportation of oil via pipelines or tankers, and human errors during oil extraction and storage propel the chances of oil spill incidences. According to the International Energy Agency, the global oil demand rebounded in 2021, and Asia is expected to account for 77% of oil demand by 2025. Asia’s oil import requirements are expected to surpass 31 million barrels per day by 2025. Governments of various countries in Asia Pacific have initiated oil projects to cater to the rising demand for oil in the region. In 2023, PETRONAS and its Petroleum Arrangement Contractors reported 19 oil and gas exploration discoveries and two exploration-appraisal successes, contributing to more than 1 billion barrels of oil equivalent of new resources for Malaysia. This is the result of an intensified exploration program pursued in the last few years, which saw the drilling of 25 wells. Since 2015, it is the highest number of exploration wells drilled in a single year.

Growth Drivers and Challenges

According to a report released by the US Energy Information Administration on January 2024, crude oil production has increased since the COVID-19 pandemic as of January 9, 2024, reversing a two-year decline. The US crude oil production rose from 11.27 million barrels/day in 2021 to 13.21 million barrels/day in 2023 and is forecasted to reach 13.44 million barrels/day by 2024. According to the Canada Energy Regulator, most of the crude oil produced in Canada is shipped using pipelines from western provinces to refineries in the US, Ontario, and Quebec. According to the report published by Bruegel AISBL in 2023, Russia was among the top five largest energy producers and consumers across the world in 2021. During the same year, it produced 595.2 million metric ton of crude oil, of which 286.6 million metric ton was exported. Thus, the rising offshore oil exploration and transportation activities drive the oil pollution remediation materials market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Oil Pollution Remediation Materials Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Oil Pollution Remediation Materials Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope

The "Global Oil Pollution Remediation Materials Market Forecast Analysis" has been carried out by considering the following segments: type and geography. The report provides key statistics on the use of oil pollution remediation materials across the world, along with their demand in major regions and countries. In addition, the report provides a qualitative assessment of factors affecting the market performance in major regions and countries. It also includes a comprehensive analysis of the leading players in the oil pollution remediation materials market and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in generating higher revenues.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global market, which helps understand the entire supply chain and various factors influencing the oil pollution remediation materials market growth.

Segmental Analysis

The global oil pollution remediation materials market is segmented on the basis of type. Based on type, the market is segmented into physical remediation (booms, skimmers, and adsorbent materials), chemical remediation (dispersants and solidifiers), thermal remediation, and bioremediation. The physical remediation segment holds the largest oil pollution remediation materials market share. Physical remediation is commonly used to control oil spills in a water environment. It is used to contain and recover oil that remains on the water surface without changing its properties. It is also mainly used as a barrier to control the spreading of oil spills without changing its physical and chemical characteristics. The most common advantage of using physical remediation methods is that oil retains its properties. Therefore, it can still be refined and used in the future, reducing waste and potentially mitigating financial losses. The physical remediation process includes booms, skimmers, and sorbent materials.

Regional Analysis

The report provides a detailed overview of the global oil pollution remediation materials market with respect to five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. The Middle East & Africa (MEA) accounted for the largest global oil pollution remediation materials market share and was valued at over US$ 1,500 million in 2022. The Middle East & Africa (MEA) marks the presence of major oil drilling businesses operating in the region. The market in Asia Pacific (APAC) is expected to reach over US$ 1,000 million by 2030. The market in North America is expected to record a CAGR of ~3% from 2022 to 2030. The Middle East & Africa is home to major crude oil reserves; the number of crude oil exploration activities has surged notably in this region in the past few years. Developments in technologies that aid in oil exploration and production operations have propelled the risk of oil spills, driving the demand for oil pollution remediation materials and services. Thus, developments in technologies are contributing to the growing oil pollution remediation materials market size in the Middle East & Africa.

Oil Pollution Remediation Materials Market Regional Insights

Oil Pollution Remediation Materials Market Regional Insights

The regional trends and factors influencing the Oil Pollution Remediation Materials Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Oil Pollution Remediation Materials Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Oil Pollution Remediation Materials Market

Oil Pollution Remediation Materials Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3.68 Billion |

| Market Size by 2030 | US$ 4.75 Billion |

| Global CAGR (2022 - 2030) | 3.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Oil Pollution Remediation Materials Market Players Density: Understanding Its Impact on Business Dynamics

The Oil Pollution Remediation Materials Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Oil Pollution Remediation Materials Market are:

- Sarva Bio Remed LLC

- Oil Technics Ltd

- Ansell Ltd

- Oil-Dri Corp of America

- Verde Environmental Group Ltd

- Ecolab Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Oil Pollution Remediation Materials Market top key players overview

Competitive Landscape and Key Companies

Sarva Bio Remed LLC, Oil Technics Ltd, Ansell Ltd, Oil-Dri Corp of America, Verde Environmental Group Ltd, Ecolab Inc, Cosco Shipping Heavy Industry Co Ltd, Regenesis, TOLSA SA, and CL Solutions LLC are among the prominent players profiled in the oil pollution remediation materials market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The oil pollution remediation materials market report also includes company positioning and concentration to evaluate the performance of competitors/players in the market.

Industry Developments and Future Opportunities

Initiatives taken by the key players operating in the oil pollution remediation materials market are listed below:

In November 2022, Ansell Ltd invested ~US$ 80 million in the greenfield manufacturing plant in India.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on type, the bioremediation segment is expected to grow fastest during the forecast period. Bioremediation involves the use of additives to accelerate biodegradation, a natural process in which microorganisms break down complex compounds into simpler products to obtain energy and nutrients. Biostimulation and bioaugmentation are two widely used bioremediation approaches.

Increased offshore exploration and drilling activities, transportation of oil via pipelines or tankers, and human errors during oil extraction and storage propel the chances of oil spill incidences. According to the International Energy Agency, the global oil demand rebounded in 2021, and Asia is expected to account for 77% of oil demand by 2025. Asia’s oil import requirements are expected to surpass 31 million barrels per day by 2025. Governments of various countries in Asia Pacific have initiated oil projects to cater to the rising demand for oil in the region.

Based on type, the oil pollution remediation materials market is segmented into physical remediation (booms, skimmers, and adsorbent materials), chemical remediation (dispersants and solidifiers), thermal remediation, and bioremediation. Physical remediation is commonly used to control oil spills in a water environment. It is used to contain and recover oil that remains on the water surface without changing its properties. It is also mainly used as a barrier to control the spreading of oil spills without changing its physical and chemical characteristics.

The major players operating in the global oil pollution remediation materials market are Sarva Bio Remed LLC, Oil Technics Ltd, Ansell Ltd, Oil-Dri Corp of America, Verde Environmental Group Ltd, Ecolab Inc, Cosco Shipping Heavy Industry Co Ltd, Regenesis, TOLSA SA, CL Solutions LLC, Procon Environmental Technologies (Pty) Ltd, Brady Corp, Oil Spill Eater International Corp, Osprey Spill Control, NOV Inc, Fender & Spill Response Services LLC, RX Marine International, Cura Inc, Compania Espanola de Petroleos SA, and SkimOIL LLC.

Rising awareness of environmental issues across the world has led to an emphasis on sustainable practices. Stringent environmental regulations and compliance standards have prompted companies to adopt clean and environment-friendly practices. Companies and governments seek remediation solutions that minimize ecological impact. Thus, market players offering eco-friendly solutions for oil spill cleanup are likely to attract a large customer base and gain favor with regulatory bodies. This demand for eco-friendly solutions aligns with global efforts to mitigate the impact of pollution and support the development of green technologies.

Middle East & Africa accounted for the largest share of the global oil pollution remediation materials market. The Middle East & Africa is home to major crude oil reserves; the number of crude oil exploration activities has surged notably in this region in the past few years. Developments in technologies that aid in oil exploration and production operations have propelled the risk of oil spills, driving the demand for oil pollution remediation materials and services.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Oil Pollution Remediation Materials Market

- Sarva Bio Remed LLC

- Oil Technics Ltd

- Ansell Ltd

- Oil-Dri Corp of America

- Verde Environmental Group Ltd

- Ecolab Inc

- Cosco Shipping Heavy Industry Co Ltd

- Regenesis

- TOLSA SA

- CL Solutions LLC

Get Free Sample For

Get Free Sample For