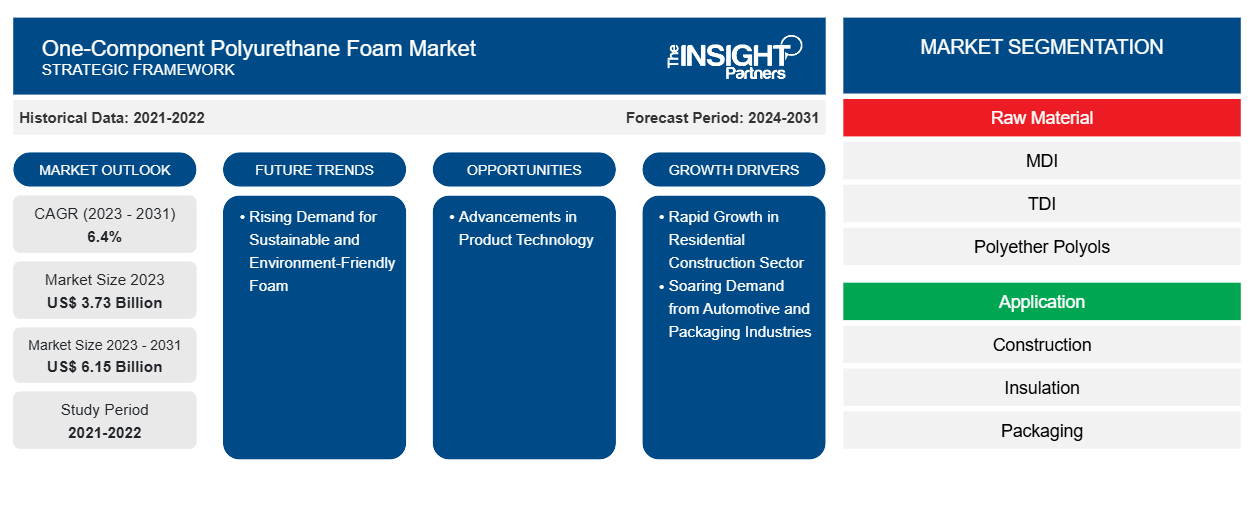

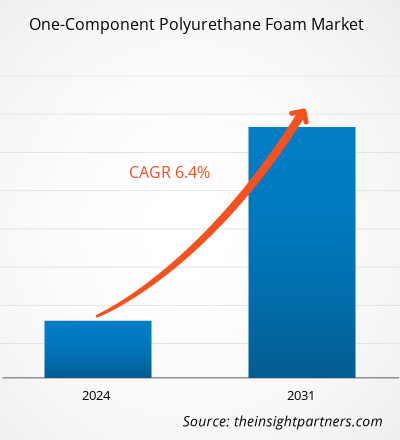

The one-component polyurethane foam market is projected to reach US$ 6.15 billion by 2031 from US$ 3.73 billion in 2023. The market is expected to register a CAGR of 6.4% during 2023–2031. The massive growth of residential projects owing to urban agglomerations and soaring demand from automotive and packaging industries owing to supportive government policies are the current transformative trends in the one-component polyurethane foam market

One-Component Polyurethane Foam Market Analysis

The versatility of one-component polyurethane (PU) foam extends beyond insulation to other applications such as sealing, bonding, and filling. The ability of one-component PU foam to provide reliable adhesion, moisture resistance, and durability makes it a valuable asset in ensuring the structural integrity and longevity of residential buildings. In the automotive industry, one-component PU foam is used to provide sound and vibration damping, seal joints or cavities to prevent water and oil penetration, and provide energy absorption in case of a crash. The automotive industry is growing in various countries across the world due to factors such as the transition toward electric vehicles, economic growth, increasing population, government support for automotive production, and rising investments in the industry. Advancements in application technology that have improved dispensing equipment and automated application systems have streamlined the use of one-component PU foam. These innovations reduce waste, enhance precision, and lower labor costs, making PU foam a more cost-effective solution. Thus, the continuous technological progress in formulating and applying one-component PU foam opens up new growth opportunities for the market.

One-Component Polyurethane Foam Market Overview

On-component polyurethane foam offers excellent thermal and acoustic insulation properties, ease of use, and efficiency in improving energy efficiency in buildings. The product’s convenience and efficiency drive its popularity. One-component polyurethane foam is typically packaged in pressurized cans, allowing for direct application without the need for mixing or specialized equipment. This ease of use makes it highly attractive for contractors and DIY enthusiasts alike. The growing emphasis on energy-efficient buildings has significantly boosted the demand for one-component polyurethane foam. Its ability to provide airtight seals and improve the thermal performance of buildings makes it a preferred choice among builders and contractors. The automotive industry also represents a vital segment of the one-component polyurethane foam market. The material is used for its soundproofing and vibration-damping properties, which are crucial for enhancing the comfort and durability of vehicles. As industries continue to innovate and seek more efficient building and manufacturing solutions, the market for one-component polyurethane foam is poised for continued expansion.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

One-Component Polyurethane Foam Market Drivers and Opportunities

Soaring Demand from Automotive and Packaging Industries

The automotive and packaging industries are among the major end-use industries of one-component polyurethane foam. In the automotive industry, one-component polyurethane foam is used to provide soundproofing, sealing joints and cavities to prevent the entry of water and oil; it absorbs high-impact energies during a crash. As the automotive industry is growing across the world due to the transition toward electric vehicles, economic growth, and increasing population, supportive government policies for automotive production and rising investments are prominently observed in the industry. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the global sales of passenger cars increased from 84.8 million in 2022 to 93.5 million in 2023. In December 2022, the passenger vehicle market in China expanded due to increased retail sales. Further, India has a strong automotive industry in terms of domestic demand and exports. In the country, the automobile sector received a cumulative equity FDI inflow of about US$ 34.11 billion between April 2000 and December 2022. Several automakers have started investing heavily in various segments of the industry in India to keep up with the growing demand. In February 2023, Nissan and Renault announced their plan to invest US$ 600 million in India over the next 3–5 years to expand their share in the passenger cars and electric vehicles market. All these factors are driving the growth of the automotive industry in India, which subsequently propels the market for one-component polyurethane foam.

With its excellent cushioning properties and high durability, one-component polyurethane foam is an ideal material for protecting fragile and valuable items, reducing the risk of damage. The surge in e-commerce and online shopping has led to an unprecedented increase in the volume of packages being shipped worldwide. This boom necessitates robust and efficient packaging solutions to ensure product safety during transit. Therefore, the strong growth of the automotive industry and packaging in various countries across the world is driving the demand for one-component polyurethane foam.

Advancements in Product Technology

Innovations in formulation and application techniques have significantly enhanced the performance characteristics of polyurethane foam, making it more versatile and efficient. Modern one-component polyurethane foams are engineered to offer superior adhesion, faster curing times, and improved thermal and acoustic insulation properties. These enhancements expand the foam's applicability across various industries, including construction, automotive, and packaging, thereby driving broader adoption. In the construction sector, technological advancements have led to the development of polyurethane foams with enhanced fire resistance and environmental sustainability. These new formulations meet stricter building codes and regulations, particularly in terms of fire safety and reduced emissions of VOCs. Such improvements make one-component polyurethane foams attractive for builders and contractors looking for reliable, compliant, and eco-friendly insulation and sealing solutions. The construction industry's shift toward sustainable building practices further amplifies the demand for advanced polyurethane foam products. The ability to apply the foam more efficiently and consistently is particularly advantageous in large-scale manufacturing and construction projects, where time and resource optimization are critical. Subsequently, the continuous technological progress in formulating and applying one-component polyurethane foam opens up new growth opportunities for the market.

One-Component Polyurethane Foam Market Report Segmentation Analysis

Key segments that contributed to the derivation of the one-component polyurethane foam market analysis are raw material, application, and end use.

- Based on raw material, the one-component polyurethane foam market is segmented into methylene diphenyl diisocyanate, toluene diisocyanate, polyether polyols, polyester polyols, and others. The polyether polyols segment held the largest market share in 2023.

- By application, the market is categorized into construction, insulation, packaging, automotive, and others. The construction segment held the largest share of the market in 2023.

In terms of end use, the market is bifurcated into residential and commercial. In 2023, the commercial segment dominated the market.

One-Component Polyurethane Foam Market Share Analysis by Geography

The geographic scope of the one-component polyurethane foam market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In 2023, Asia Pacific dominated the one-component polyurethane foam market share. As polyurethane foam provides superior thermal insulation and effectively seals gaps and cracks, it is the most favored choice among builders and developers for a range of residential, commercial, and industrial projects across the region. According to the Sustainable Development Goals 2030, the Asian Development Bank announced its plans to promote inclusive and sustainable industrialization by constructing resilient infrastructure and fostering innovation in Asia Pacific. Many governments across Asia Pacific prioritize infrastructural development projects owing to which several investments are made in large-scale projects, such as transportation networks, energy facilities, and public amenities. According to the Department for Promotion of Industry and Internal Trade report, the Government of India announced its plans to promote infrastructure and construction services through smart city missions, supportive policies, large budget allocation, and flexible FDI norms.

North America held the second-largest share in the one-component polyurethane foam market in 2023. The US one-component polyurethane foam market is growing at a substantial pace owing to the progress of the construction industry and the presence of several prominent automotive manufacturers. According to the OICA, commercial vehicle production in the US increased from 10.1 million in 2022 to 10.6 million vehicles in 2023, nearly 16% higher than in 2022. In addition, the US is witnessing a significant rise in the demand for electric vehicles. According to a 2022 report by the International Energy Agency, the sales of electric cars in the country doubled (6.6 million units) in 2021 compared to 2020; the share of electric vehicles in total vehicle sales increased by 4.5%. Thus, the ongoing proliferation of construction and automotive industries is expected to positively benefit the one-component polyurethane foam market in North America.

One-Component Polyurethane Foam Market Regional Insights

The regional trends and factors influencing the One-Component Polyurethane Foam Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses One-Component Polyurethane Foam Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for One-Component Polyurethane Foam Market

One-Component Polyurethane Foam Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.73 Billion |

| Market Size by 2031 | US$ 6.15 Billion |

| Global CAGR (2023 - 2031) | 6.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Raw Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

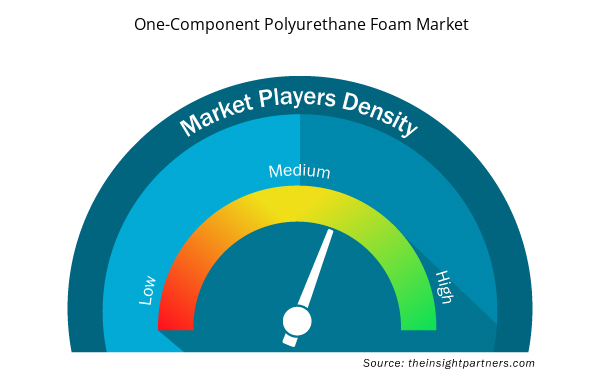

One-Component Polyurethane Foam Market Players Density: Understanding Its Impact on Business Dynamics

The One-Component Polyurethane Foam Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the One-Component Polyurethane Foam Market are:

- Henkel AG & Co KGaA

- Sika AG

- The Dow Chemical Co

- BASF SE

- Huntsman Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the One-Component Polyurethane Foam Market top key players overview

One-Component Polyurethane Foam Market News and Recent Developments

The one-component polyurethane foam market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the one-component polyurethane foam market are listed below:

- In a strategic alliance geared toward driving sustainable change in the construction industry, Polish construction chemicals supplier Selena Group and plastics manufacturer Covestro have united their expertise to craft a more sustainable range of polyurethane foams for enhancing building thermal insulation. This collaboration embodies their shared commitment to embracing a co-creative approach that should spearhead a transformative shift in the construction sector, in line with the principles of the European Green Deal, Fit for 55, and the overarching goal of achieving carbon neutrality in the building sector by 2050. (Source: Covestro, Press Release, September 2023)

- Automotive experts from Huntsman have added a series of new lightweight, durable polyurethane foam technologies to the company’s battery solutions portfolio that have been developed for the potting and fixation of cells mounted in electric vehicle (EV) batteries. The new range also includes products that can be used as a moldable encapsulant in battery modules or packs. (Source: Huntsman, Press Release, April 2024)

One-Component Polyurethane Foam Market Report Coverage and Deliverables

The “One-Component Polyurethane Foam Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- One-component polyurethane foam market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- One-component polyurethane foam market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- One-component polyurethane foam market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the one-component polyurethane foam market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Sleep Apnea Diagnostics Market

- Redistribution Layer Material Market

- USB Device Market

- Point of Care Diagnostics Market

- Influenza Vaccines Market

- Hand Sanitizer Market

- Non-Emergency Medical Transportation Market

- Nitrogenous Fertilizer Market

- Machine Condition Monitoring Market

- Dealer Management System Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Within residential construction, the versatility of one-component polyurethane (polyurethane) foam extends beyond insulation to other applications such as sealing, bonding, and filling. It is commonly used to seal gaps around windows and doors, adhere to drywall panels, fill voids in concrete structures, and soundproof interior spaces. The ability of one-component polyurethane foam to provide reliable adhesion, moisture resistance, and durability makes it a valuable asset in ensuring the structural integrity and longevity of residential buildings.

Asia Pacific is the largest region of global one-component polyurethane foam market. As the region continues to witness an increase in automobile production and sales, there is an increasing demand for vehicles equipped with advanced soundproofing and vibration-damping features. According to the International OICA, Asia-Oceania's vehicle production increased from 50 million in 2022 to 55.1 million in 2023.

In terms of end use, the one-component polyurethane foam market is bifurcated into residential and commercial. In 2023, the residential segment is projected to grow at the fastest CAGR. One-component polyurethane foam is commonly employed in sealing joints around windows and doors, filling gaps around plumbing and electrical penetrations, and insulating HVAC ducts.

Based on raw material, the one-component polyurethane foam market is segmented into methylene diphenyl diisocyanate, toulene diisocyanate, polyether polyols, polyester polyols, and others. In 2023, the polyether polyols segment held the largest market share and is expected to register the highest CAGR from 2023 to 2031. Polyether polyols provide one-component polyurethane foam with excellent moisture resistance, low viscosity, and high reactivity, which are crucial for achieving uniform foam expansion and curing.

The major players operating in the global one-component polyurethane foam market are Henkel AG & Co KGaA; Sika AG; The Dow Chemical Co; BASF SE; Huntsman Corp; Industrial Products LTD.; Selena Group; BOSTIK BENELUX B.V. (Den Braven); Tremco CPG Inc; and Soudal Group.

One-component polyurethane foam is typically with little or no volatile organic compounds (VOC). However, propellants used in some of the aerosol products do contribute to the VOC content. The propellant gas in canned one-component polyurethane foam can contain hazardous air pollutants (HAPs), which have replaced HCFC-22 since 2002. On application, the gas that expels the foam from the aerosol cans is completely released into the atmosphere, contributing to air pollution and posing health risks to both workers and end users.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - One-Component Polyurethane Foam Market

- Henkel AG & Co KGaA

- Sika AG

- The Dow Chemical Co

- BASF SE

- Huntsman Corp

- Industrial Products LTD.

- Selena Group

- BOSTIK BENELUX B.V. (Den Braven)

- Tremco CPG Inc

- Soudal Group

Get Free Sample For

Get Free Sample For