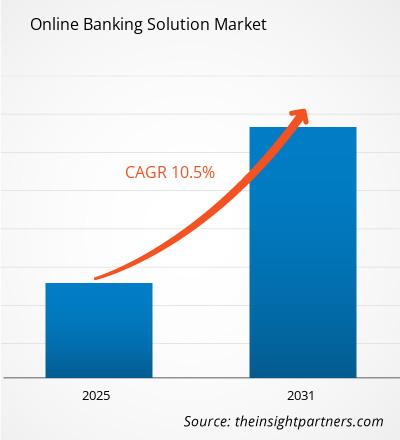

The Online Banking Solution Market is expected to register a CAGR of 10.5% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The research on the Online Banking Solution market conducts an in-depth analysis of the current status of this vital industry, while highlighting areas for further growth. They are segmented into banking type, solution, and others. The segmentation would also provide details on particular market dynamics and consumer preferences of different applications.

Purpose of the Report

The report Online Banking Solution Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Online Banking Solution Market Segmentation

Banking Type

- Information Services

- Transactional Services

- Customer and Channel Management

- Others

Solution

- Payment

- Processing

- customer and channel

- risk management

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Online Banking Solution Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Online Banking Solution Market Growth Drivers

- Growth in Fintech: Online banking is bound to keep developing alongside the growth in fintech innovations. Basically, because scrum fintech companies keep pushing the right buttons with their new products and solutions that dare mainstream banking, established banks really do not have much of a choice but to step up their online banking services simply to keep up. Such dynamism nurtures innovation and builds an environment in which banks will be compelled to adapt to constantly evolving customer needs. Increased users exert pressure on the financial institutions to further develop their online services. In essence, this is a race in which the institution has to innovate their services just to meet customer expectations.

- Demand for Convenience: Online banking provides the platform for account management, the ability to execute transactions, and other various financial products at any time of the day. To that effect, it has been said that 59 percent of consumers prefer online banking due to its ease and convenience; banks are also investing in user interfaces and mobile phones. In addition, COVID-19 hastened the adoption of online banking solutions due to lockdown and social distancing, forcing many consumers to shift to digital channels. In fact, McKinsey recorded an astonishing use of digital banking during the pandemic, registering at 20% and with many users suggesting usage for a very long period beyond the loosening of restrictions. Such rapid movement underlines the imperative for hardening digital platforms in banks to make them sufficiently secure to reassure customers.

- Need for Legal Compliance: Banks ensure that this legal compliance inspires higher degrees of trust and confidence among customers. Other key trends of change in the online banking arena are through the integration of artificial intelligence and machine learning. These technologies allow banks to offer personalized services, enhance fraud detection, and improve customer service via chatbots and virtual assistants.

Online Banking Solution Market Future Trends

- Dominance in mobile banking: Dominance in mobile banking is an indicator of the most profound trend in the online banking solution market. Changing consumer preferences in the wake of smartphone usage have led consumers to manage their finances increasingly on mobile applications. No wonder, mobile offerings are high on the priority list of most banks, with features such as mobile check deposits, instant fund transfers, and real-time account management. This would further customer convenience and also provide an excellent way to take on competition in digital-first markets. Online banking could also be done with AI in assistance, so as to revolutionize the way it communicates with its customers.

- AI-powered chatbots and virtual assistants: These technologies can handle consumer queries and responses with desired efficiency, deliver personalized advisory services in finance, and generally raise the level of engagement between banks and their customers. With the use of big data analytics, banks can analyze user behavior in order to make interactions and recommendations much more personalized, thus making the experience more rewarding for customers. The main focus of online banking would be on a strong security system. Due to the increase in cyber-related threats, banks have begun their early adoption of multi-factor authentication, biometric verification, and more complex encryption. Full-scale protection over customer data instills trust and confidence in online banking platforms; thus, while still primary, highly secure institutions where safety measures are strong would be a better choice in retaining and attracting customers.

- Personalization of services: With data analytics, a bank gets the opportunity to render personalized financial products and customized services to customers, per each one's needs and preferences. Such personalization enhances satisfaction and increases customer loyalty, as users feel valued and understood. Such banks draw one's attention to financial wellness and, in general, to consumer education. It provides tools for customers in order for them to take control of their finances by setting a budget and achieving savings goals.

Online Banking Solution Market Opportunities

- Developing user-friendly mobile applications: Now that consumers increasingly use their smartphones to conduct daily financial transactions, banks can cash in on this trend by developing user-friendly mobile applications through which frictionless experiences can be enabled. Embedding such features as biometric authentication, personalized dashboards, and instant notifications of transactions, therefore, will enhance customer satisfaction and loyalty.

- Offering Innovative Banking Solutions: Even a bank in this regard could present itself as a trusted advisor and hence offer budgeting tools, savings goal trackers, and financial planning resources. This could also mean that with increased interest in sustainability, new opportunities will arise where the banking industry will be able to lead in green finance initiatives-such as eco-friendly investment products or loans for sustainable projects that are in demand by the environmentally conscious consumer.

- Collaboration and Partnership: The sharing of best practices with FinTech firms is building innovation and increasing the services available. This will facilitate old banks with more agile startups to achieve better technological synergy, and introduce newer solutions like blockchain for safe transactions or data analytics for personal, customized marketing.

Online Banking Solution Market Regional Insights

The regional trends and factors influencing the Online Banking Solution Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Online Banking Solution Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Online Banking Solution Market

Online Banking Solution Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 10.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Banking Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

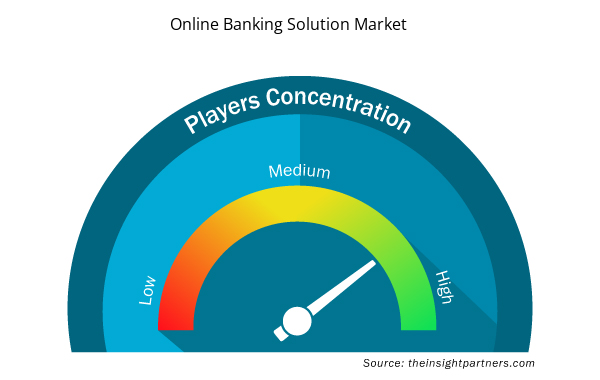

Online Banking Solution Market Players Density: Understanding Its Impact on Business Dynamics

The Online Banking Solution Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Online Banking Solution Market are:

- ACI Worldwide, Inc.

- Broadridge Financial Solutions, Inc.

- Capital Banking Solutions

- Cor Financial Solutions Limited

- EdgeVerve Systems Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Online Banking Solution Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Online Banking Solution Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Online Banking Solution Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Artificial Intelligence in Healthcare Diagnosis Market

- Trade Promotion Management Software Market

- Nuclear Decommissioning Services Market

- Electronic Shelf Label Market

- Online Recruitment Market

- Malaria Treatment Market

- Airline Ancillary Services Market

- Mesotherapy Market

- Industrial Valves Market

- Mail Order Pharmacy Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

Some of the customization options available based on request are additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

Key players in this market are - ACI Worldwide Inc, Broadridge Financial Solutions Inc, Capital Banking Solutions, Cor Financial Solutions Limited, EdgeVerve Systems Limited, Fiserv Inc, Nelito Systems Ltd, Oracle Corporation, SAB2I

The market is expected to register a CAGR of 10.5% during 2023-2031

The main driving factors for the online banking solution market would be increasing digital adoption, consumer demand for convenient services, the influence of COVID-19, security issues, regulatory compliance, integration of AI technologies, and the impact of fintech innovations. As such, interlinked factors create a future of banking where electronic solutions become an inevitable element of financial organizations that have set goals to please modern consumers as well as enjoy a higher level of competitiveness.

The online banking solution market is characterized by trends such as the dominance of mobile banking, the integration of AI, enhanced security measures, personalization of services, and a focus on financial wellness.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

1. ACI Worldwide, Inc.

2. Broadridge Financial Solutions, Inc.

3. Capital Banking Solutions

4. Cor Financial Solutions Limited

5. EdgeVerve Systems Limited

6. Fiserv, Inc.

7. Nelito Systems Ltd.

8. Oracle Corporation

9. SAB2I

10. Temenos Group AG

Get Free Sample For

Get Free Sample For