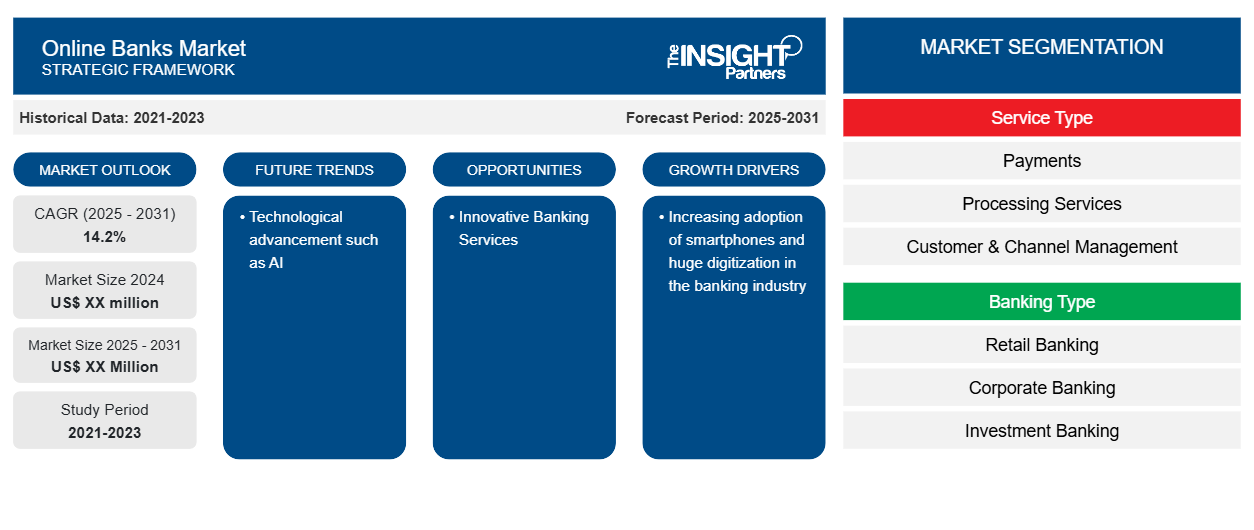

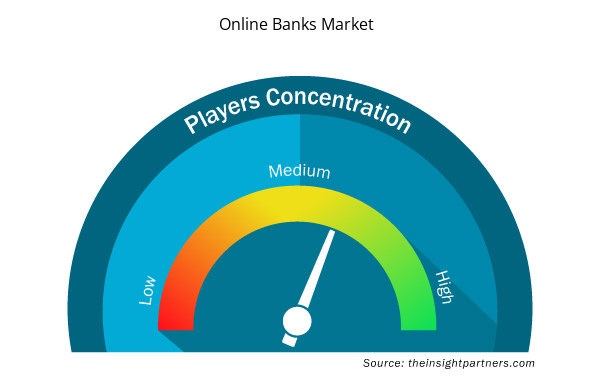

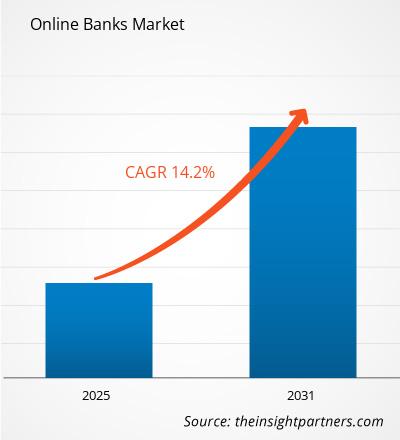

The online banks market size is expected to register a CAGR of 14.2% during 2023–2031. Technological advancement, such as AI is likely to remain a key trend in the market.

Online Banks Market Analysis

Online banking has predominantly changed consumers' lives. Similarly, the landscape of online banks for businesses has also changed. From traditional banking to modern banking, fintechs have evolved. Moreover, in response to the global change in the post-Covid age, banks have expanded their services over the Internet. In such a scenario, security risks have also increased. Due to incidents of fraud, phishing, and hacking of sensitive data, banks are implementing various security measures to safeguard the information of their clients.

Online Banks Market Overview

Online banks allow to carry out financial transactions via the Internet. Almost all of the services typically provided by a local branch are offered using Internet banking, including online bill payments, transfers, and deposits. Online banking has become a common method of conducting business with a bank. The majority of routine banking tasks can be done online, saving time in visiting a bank.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Online Banks Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Online Banks Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Online Banks Market Drivers and Opportunities

Increasing Adoption of Smartphones to Favor Market

The increasing adoption of smartphones is a major driving force behind the growth of the online banks market. As more people around the world own smartphones, they have access to convenient and versatile banking options right at their fingertips. Smartphones enable users to avail banking services such as account opening, bank statements, and others form anywhere at any time. This convenience appeals to and encourages the adoption of online banks.

Innovative Banking Services

Every bank's future relies on how successfully it can use the newest technologies to concentrate on the needs, desires, and behaviors of customers. Hence, banking organizations are continuously innovating their services in order to remain competitive in the market. Innovative banking services such as advanced self-service capabilities, instant payments, biometric technology, chatbots, and others. These innovative banking services give rise to a completely new online banking environment that alters how consumers adopt banking services.

Online Banks Market Report Segmentation Analysis

Key segments that contributed to the derivation of the online banks market analysis are service type and banking type.

- Based on service type, the online bank market is divided into payments, processing services, customer & channel management, wealth management, and others. The payments segment held the largest market share in 2023.

- By banking type, the market is segmented into retail banking, corporate banking, and investment banking. The retail banking segment held the largest market share in 2023.

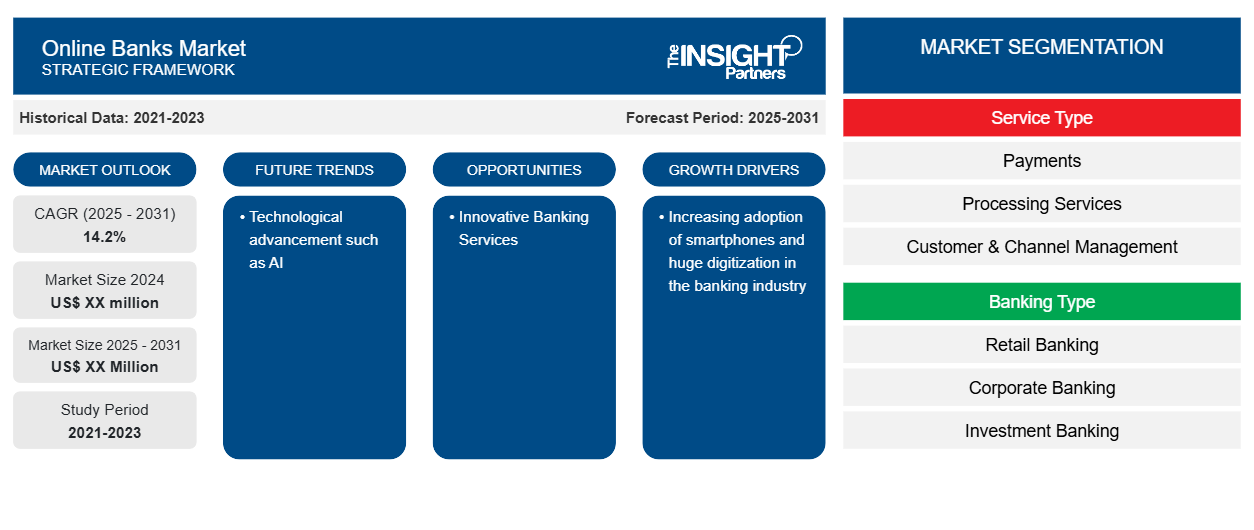

Online Banks Market Share Analysis by Geography

The geographic scope of the online banks market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The North American online banks market is a rapidly growing sector that is driven by technological advancements and the increasing demand for personalized and efficient customer experiences. North America, which includes countries such as the United States and Canada, is known for its strong technological infrastructure and high adoption rates of digital solutions. With the widespread adoption of smartphones and advanced banking infrastructure, consumers are increasingly turning to online banking services.

Online Banks Market Regional Insights

The regional trends and factors influencing the Online Banks Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Online Banks Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Online Banks Market

Online Banks Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 14.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

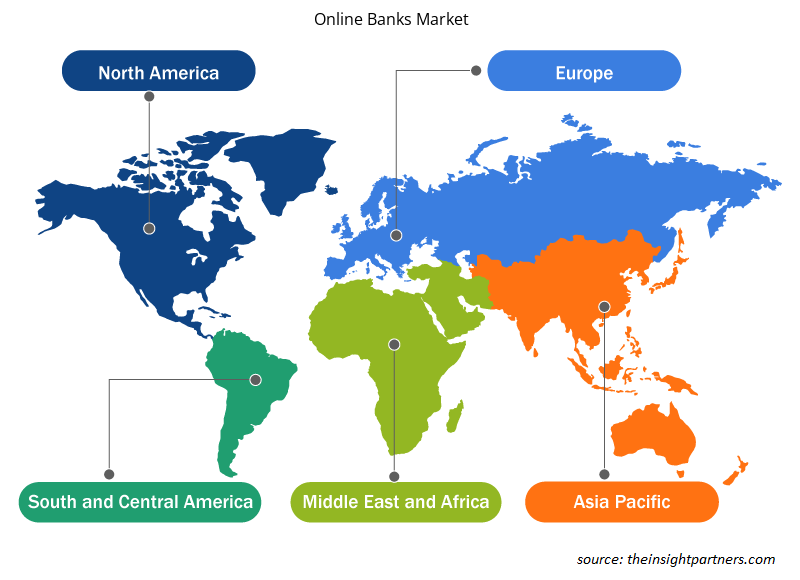

Online Banks Market Players Density: Understanding Its Impact on Business Dynamics

The Online Banks Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Online Banks Market are:

- ACI Worldwide Inc

- CGI Inc.

- Capital Banking Solution

- COR Financial Solutions Limited

- EdgeVerve Systems Limited

- Fiserv Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Online Banks Market top key players overview

Online Banks Market News and Recent Developments

The online banks market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the online bank market are listed below:

- Axis Bank, one of the largest private sector banks in India, today announced the launch of ‘open by Axis Bank,’ its digital bank proposition in its latest advertising campaign that focuses on the Bank’s digital capabilities. The Open 2023 campaign highlights the top 15 features of the Bank’s digital offerings. The launch is a culmination of the Bank’s multiyear effort to launch a digital bank within the bank, which is focused on delivering a personalized, intuitive, and hassle-free digital banking experience. (Source: Axis Bank, Press Release, October 2023)

- U.S. Bank unveiled an online marketplace of third-party payment and treasury solutions that are fully integrated with U.S. Bank systems. The helps corporate treasury teams easily identify and adopt technology connected with the bank, such as treasury management systems and working capital automation tools. (Source: U.S. Bank, Press Release, September 2023)

Online Banks Market Report Coverage and Deliverables

The “Online Banks Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Online banks market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Online banks market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Online banks market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the online banks market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on the request are additional 3–5 company profiles and country-specific analysis of 3–5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

The leading players operating in the online banks market are ACI Worldwide Inc., CGI Inc., Capital Banking Solution, COR Financial Solutions Limited, EdgeVerve Systems Limited, Fiserv Inc., Microsoft, Oracle, Tata Consultancy Services Limited, Temenos, Capital Banking Solution, Tata Consultancy Services Limited, Fiserv, Inc, Edgeverve Systems Limited, FIS Global, Finastra, Plaid, Infosys, Nelito Systems Pvt. Ltd., Modefin, and Alkami Technology, Inc.

Technological advancement such as AI is anticipated to play a significant role in the global online banks market in the coming years.

The global online banks market is expected to grow at a CAGR of 14.2% during the forecast period 2024 - 2031.

The major factors driving the online banks market are the increasing adoption of smartphones and huge digitization in the banking industry.

Get Free Sample For

Get Free Sample For