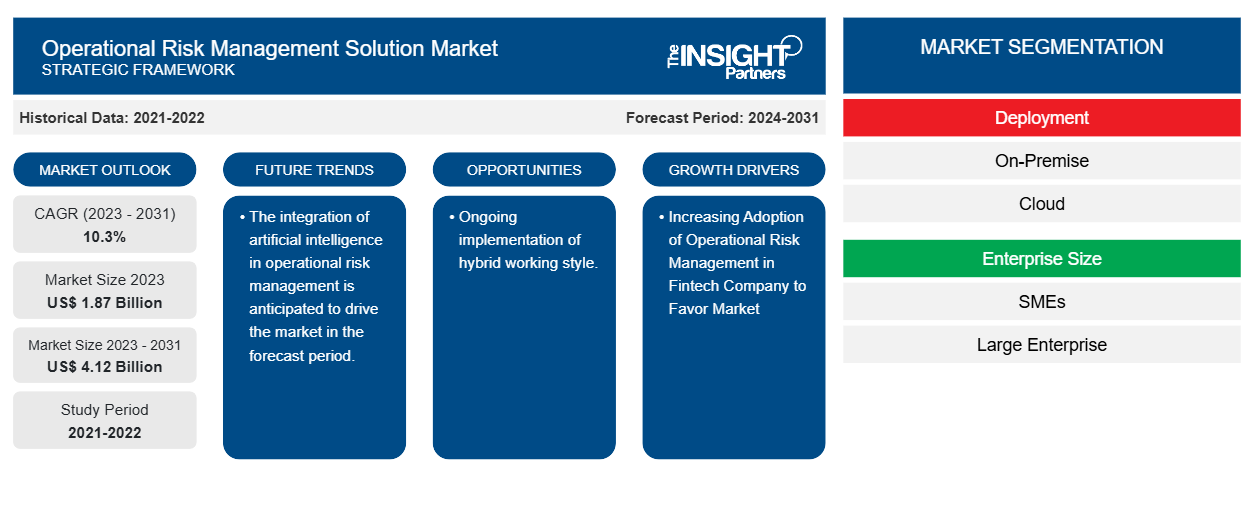

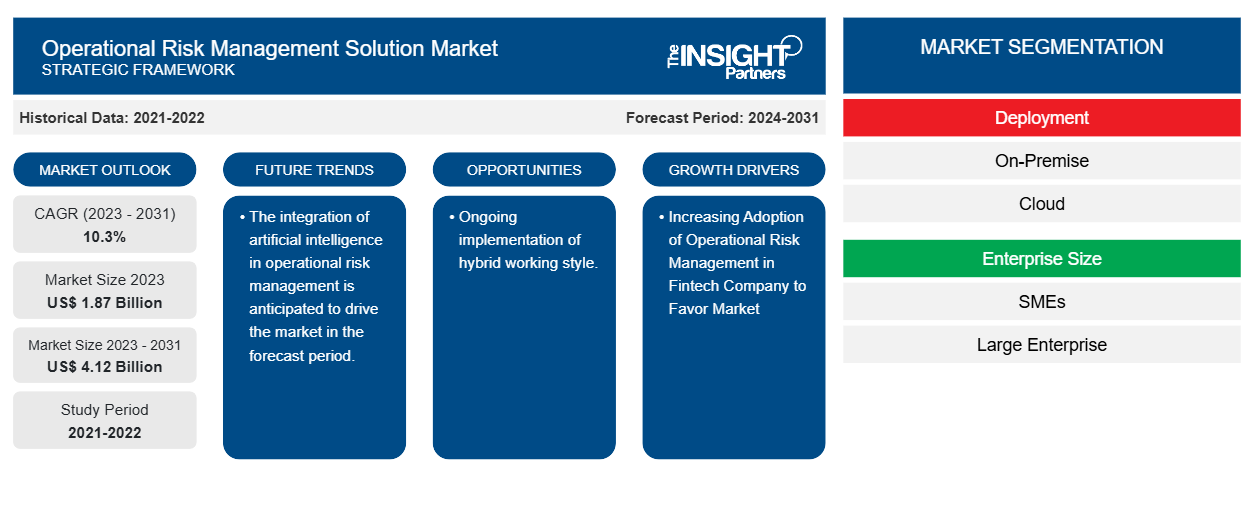

The operational risk management solution market size is projected to reach US$ 4.12 billion by 2031 from US$ 1.87 billion in 2023. The market is expected to register a CAGR of 10.3% during 2023–2031. Increasing adoption of operational risk management in fintech companies and rising instances of cyber-attacks in various organizations are likely to be key drivers and trends in the operational risk management solution market.

Operational Risk Management Solution Market Analysis

The operational risk management market is experiencing significant growth globally. This growth is attributed to the increasing adoption of operational risk management in fintech companies and rising instances of cyber-attacks in various organizations. Moreover, the ongoing implementation of hybrid working styles and integration of artificial intelligence in operational risk management is anticipated to hold significant opportunities for the operational risk management market in the coming years.

Operational Risk Management Solution Market Overview

Operational risk management (ORM) is a processes that encompass risk assessment, decision-making, and performance of risk control to reduce such threats to appropriate levels. Operational risk management directed to all sectors and industries, including operational risks for banks and financial services, will look changed from operational risks for a manufacturing facility. Ultimately, a strong operational risk management process is required for any organization to avoid potentially disastrous issues and to guarantee business continuity.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Operational Risk Management Solution Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Operational Risk Management Solution Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Operational Risk Management Solution Market Drivers and Opportunities

Increasing Adoption of Operational Risk Management in Fintech Company to Favor Market

The increasing adoption of operational risk management in fintech companies is indeed driving the market. The finance technology and industries are expanding at a fast pace, and so is the number of companies in the industry. Fintech companies face stringent regulatory needs. As the number of companies grows, the demand for compliance and regulations increases. Moreover, fintech companies comprise various financial data with sensitive information, and this data cannot afford to be breached. The operational risk management solution here helps and prevents the fintech companies' data from breaching. Thus, considering the above parameters, the increasing adoption of operational risk management in fintech companies is driving the operational risk management solution market growth.

Ongoing implementation of hybrid working style.

The ongoing implementation of a hybrid working style is anticipated to hold several opportunities for the market. The hybrid working environment is dependent on a complex infrastructure and needs a strong IT infrastructure to manage remote-working employees and office-working employees. Further, cybercrime continues to grow in sophistication, and businesses adopting a hybrid work model must maintain their vigilance with robust controls surrounding data security. The hybrid work models have risks such as cyber security relaxed standards, staff retention, and many more. Operational risk management solutions offer prevention for these risks. Thus, considering the above parameters, the ongoing implementation of a hybrid working style is anticipated to hold several opportunities for the market.

Operational Risk Management Solution Market Report Segmentation Analysis

Key segments that contributed to the derivation of the operational risk management solution market analysis are deployment and enterprise size.

- Based on deployment, the operational risk management solution market is divided into on-premise and cloud. The on-premise segment is anticipated to hold a significant market share in the forecast period.

- Based on enterprise size, the operational risk management solution market is divided into SMEs and large enterprises. The SME segment is anticipated to hold a significant market share in the forecast period.

Operational Risk Management Solution Market Share Analysis by Geography

The geographic scope of the operational risk management solution market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the operational risk management solution market. The North American market is segmented into the US, Canada, and Mexico. The market is experiencing significant growth in the regions. This growth is attributed to the increasing hybrid workplace environment in the region. High technology adoption trends in various industries in the North American region have fuelled the growth of the operational risk management solution market. Factors such as increased adoption of digital tools and high technological spending by government agencies are expected to drive the North American operational risk management solution market growth.

Moreover, a strong emphasis on research and development in the developed economies of the US and Canada is forcing the North American players to bring technologically advanced solutions into the market. In addition, the US has a large number of operational risk management solution market players who have been increasingly focusing on developing innovative solutions. All these factors contribute to the region's growth of the operational risk management solution market.

Operational Risk Management Solution Market Regional Insights

The regional trends and factors influencing the Operational Risk Management Solution Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Operational Risk Management Solution Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Operational Risk Management Solution Market

Operational Risk Management Solution Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.87 Billion |

| Market Size by 2031 | US$ 4.12 Billion |

| Global CAGR (2023 - 2031) | 10.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Operational Risk Management Solution Market Players Density: Understanding Its Impact on Business Dynamics

The Operational Risk Management Solution Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Operational Risk Management Solution Market are:

- Adapt IT Holdings Ltd

- MetricStream

- RSA Security

- TPSCO LLC

- SAP SE

- Shell International BV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Operational Risk Management Solution Market top key players overview

Operational Risk Management Solution Market News and Recent Developments

The operational risk management solution market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the operational risk management solution market are listed below:

- The Australian Prudential Regulation Authority (APRA) announced the finalization of Prudential Standard CPS 230 Operational Risk Management (CPS 230). According to APRA, CPS 230 is aimed at enhancing the ability of APRA-regulated entities to manage operational risks and address business disruptions. (Source: APRA Company Website, July 2023)

- Tata Consultancy Services (TCS) launched an agile and intuitive risk-based monitoring solution for clinical trials that enables intelligent decision-making, increased compliance and improves study efficacy. (Source: TCS Company Website, April 2022)

Operational Risk Management Solution Market Report Coverage and Deliverables

The “Operational Risk Management Solution Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Operational risk management solution market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Operational risk management solution market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Operational risk management solution market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the operational risk management solution market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Deployment and Enterprise Size

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

North America is anticipated to dominate the operational risk management solution market in 2023.

Increasing adoption of operational risk management in fintech companies and rising instances of cyber-attacks in various organizations are some of the factors driving the operational risk management solution market.

The integration of artificial intelligence in operational risk management is anticipated to drive the market in the forecast period.

The key players holding majority shares in the global operational risk management solution market are Adapt IT Holdings Ltd, MetricStream, RSA Security, TPSCO LLC, SAP SE, Shell International BV, Sphera Solutions, Tenforce, Cura Global GRC Solutions PTE Ltd, OCEG.

The global operational risk management solution market is expected to reach US$ 4.12 billion by 2031.

The expected CAGR of the operational risk management solution market is 10.3%.

Get Free Sample For

Get Free Sample For