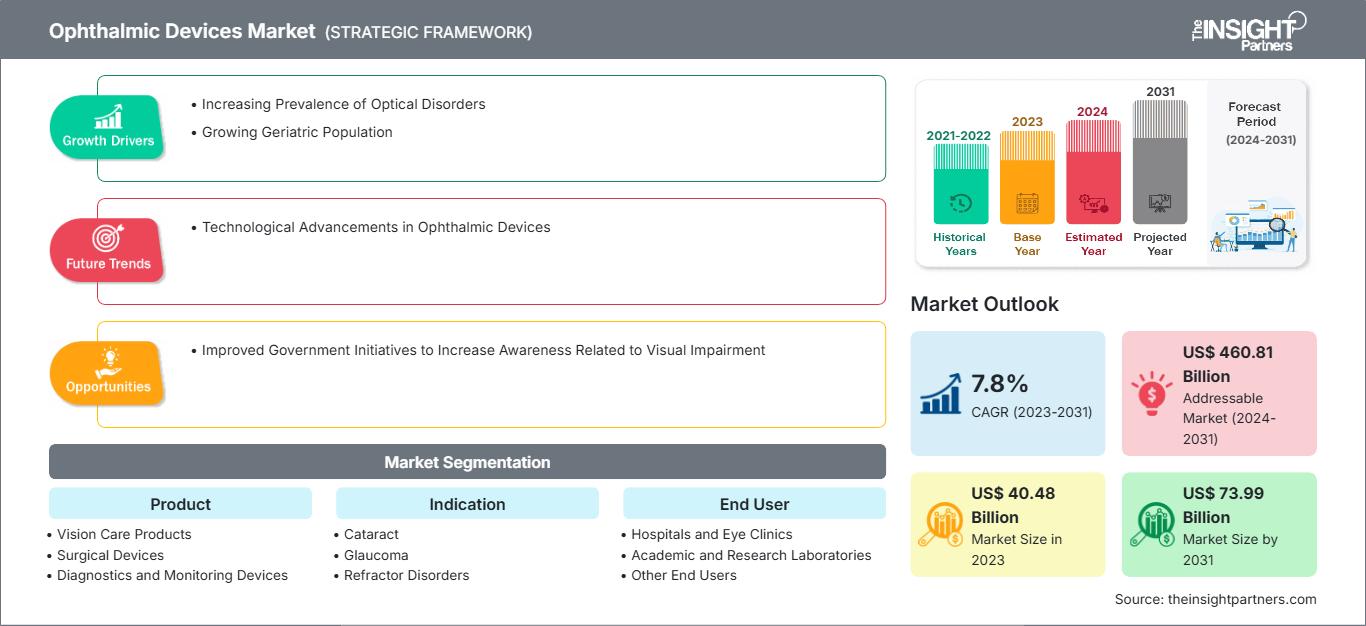

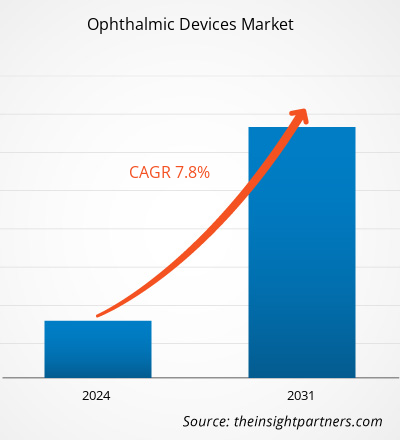

The ophthalmic devices market size is projected to reach US$ 73.99 billion by 2031 from US$ 40.48 billion in 2023; the market is estimated to record a CAGR of 7.8% during 2023–2031.

Ophthalmic devices are medical equipment used for vision correction, diagnosis, and surgical purposes. The awareness and adoption of ophthalmic devices have surged in recent years due to an upsurge in cases of glaucoma, cataracts, and other vision-related illnesses. The rising geriatric population and surging prevalence of optical disorders are projected to bolster the ophthalmic devices market in the coming years. The ophthalmic devices market trends include technological advancements in ophthalmic devices that will favor the growth of the market in the future.

Growth Drivers:

An upsurge in the geriatric population in developed countries such as the US, the UK, Canada, and Japan, and developing countries such as China, India, and South Korea is driven by the modernization of healthcare facilities and improvements in healthcare services, which has improved the life expectancy in these countries. The aging population has a heavy impact on the social and economic fronts in the world. New techniques are being adopted in various countries across the world to safely and effectively treat the elderly populations. Thus, the increased quality of life has resulted in decreased death rates, in turn causing a surge in the geriatric population. According to the World Health Organization 2022 data, 1 out of every 6 persons will be aged 60 years and above by 2030; the population of people aged 60 and above is expected to grow from 900 million in 2021 to 2 billion by 2050. The percentage of the worldwide population in this age group will double from 12% in 2015 to 22% by 2050. As per the Department of Economic and Social Affairs, the United Nations report for 2019, ~703 million individuals are aged 65 years and above, and the number is estimated to double to 1.5 billion by 2050.

Glaucoma is a prominent cause of blindness among people aged 60 and above, and people are six times more likely to develop glaucoma after reaching the age of 60. As per the National Glaucoma Research Fact Sheet 2022, more than 3 million Americans have glaucoma, out of which 2.7 million people living with the condition are aged 40 and older. The other causes of blindness include diabetic retinopathy, age-related macular degeneration, and retinal detachment. The Centers for Disease Control and Prevention states that the prevalence of diabetic retinopathy was lowest among people younger than 25 years (13.0%) and highest among people from the age group of 65–79 (28.4%) in the US in 2021. Age-related eye diseases are also cited as the leading causes of blindness and low vision in the US. Thus, the aging population is more susceptible to various ocular diseases that require early diagnosis and treatment, which, in turn, drives the demand for ophthalmic devices, contributing to the ophthalmic devices market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ophthalmic Devices Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The ophthalmic devices market analysis has been carried out by considering the following segments: product, indication, end user, and geography. Based on product, the market is segmented into vision care products, surgical devices, and diagnostics and monitoring devices. In terms of indication, the market is classified into cataract, glaucoma, refractor disorders, and other indications. Based on end user, the market is categorized into hospitals and eye clinics, academic and research laboratories, and other end users. The scope of the ophthalmic devices market report covers North America (US, Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), the Middle East & Africa (Saudi Arabia, South Africa, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

The ophthalmic devices market, by product, is categorized into vision care products, surgical devices, and diagnostics and monitoring devices. The vision care products segment held a significant market share in 2023. It is anticipated to record the highest CAGR in the market during 2023–2031.

Based on indication, the market is categorized into cataract, glaucoma, refractor disorders, and other indications. The glaucoma segment held a significant ophthalmic devices market share in 2023 and is estimated to register the highest CAGR during 2023–2031.

Based on end user, the market is segmented into hospitals and eye clinics, academic and research laboratories, and other end users. The hospital and eye clinics segment held a significant ophthalmic devices market share in 2023 and is expected to register the highest CAGR during 2023–2031.

Regional Analysis:

In terms of geography, the ophthalmic devices market is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2023, North America captured a significant share of the market. In 2023, the US dominated the ophthalmic devices market in this region. The market growth in North America is attributed to the growing burden of eye diseases, such as cataracts, glaucoma, diabetic retinopathy, age-related macular degeneration (AMD), and refractive diseases; increasing geriatric population; the surging acceptance of technologically advanced ophthalmic devices; and the presence of significant market players in the region. With the surging population of people aged 65 and above, cases of age-related diseases such as AMD are on the rise in the US. According to the National Institutes of Health report, the number of people with AMD rose by 18% from 2000–2010, reaching 2.07 million by 2010 from 1.75 million in 2000. By 2050, the number is projected to reach 5.44 million from 2.07 million. According to the study “Prevalence of Diabetic Retinopathy in the US in 2021,” published in 2023, ~9.6 million people were living with diabetic retinopathy, and ~1.8 million people were living with vision-threatening diabetic retinopathy in 2021 in the US. This leads to a greater demand for diagnostic ophthalmic tools, thereby propelling the ophthalmic devices market growth in the region.

Ophthalmic Devices Market Regional InsightsThe regional trends and factors influencing the Ophthalmic Devices Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Ophthalmic Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Ophthalmic Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 40.48 Billion |

| Market Size by 2031 | US$ 73.99 Billion |

| Global CAGR (2023 - 2031) | 7.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Ophthalmic Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Ophthalmic Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Ophthalmic Devices Market top key players overview

Industry Developments and Future Opportunities:

The ophthalmic devices market report includes company positioning and concentration to evaluate the performance of competitors in the market. As per company press releases, a few initiatives taken by key players operating in the market are mentioned below:

- In July 2021, Topcon Corporation acquired VISIA Imaging S.r.l, an ophthalmic device manufacturer headquartered in suburban Florence, Italy. With the acquisition, Topcon intends to further strengthen its well-positioned portfolio of fundus imaging devices—which includes fundus cameras and optical coherence tomography. This acquisition enhances Topcon’s development and production capabilities of anterior segment devices and software. The acquisition is also meant to strengthen Topcon's standing as a top producer of ophthalmic diagnostic tools.

- In March 2021, Iridex Corporation entered into a strategic collaboration with Topcon Corporation. Iridex Corporation is a renowned provider of innovative ophthalmic laser-based medical products for treating glaucoma and retinal diseases. Iridex acquired Topcon’s PASCAL product line, combining its own MicroPulse technology with Topcon’s PASCAL laser platform, to expand its share in the market for retinal scanning laser products.

Competitive Landscape and Key Companies:

The ophthalmic devices market forecast can help stakeholders plan their growth strategies. Alcon, Topcon, Bausch + Lomb, Carl Zeiss Meditec, Haag Streit Holding, Essilor, Johnson & Johnson Vision, Nidek Co. Ltd, Hoya Corporation, and CooperVision are among the prominent players profiled in the market. These companies focus on introducing new high-tech products, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide.

Frequently Asked Questions

What was the estimated ophthalmic devices market size in 2023?

Which segment is dominating the ophthalmic devices market?

Who are the major players in the ophthalmic devices market?

What is the driving and restraining factors for the ophthalmic devices market?

What are the growth estimates for the ophthalmic devices market till 2031?

What are ophthalmic devices?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For