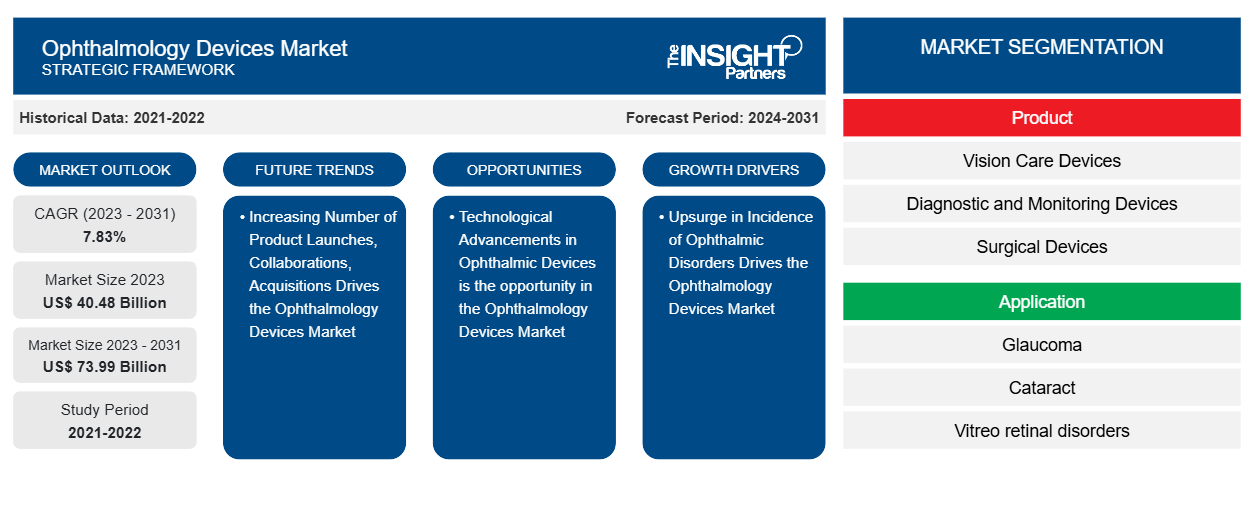

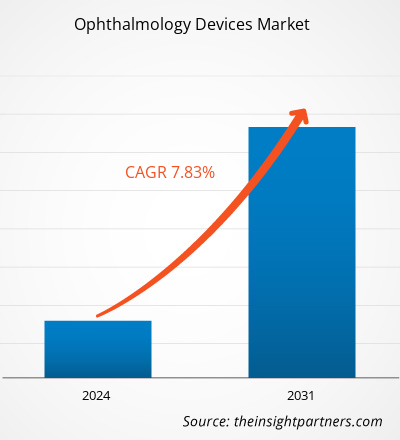

The ophthalmology devices market size is projected to reach US$ 73.99 billion by 2031 from US$ 40.48 billion in 2023. The market is expected to register a CAGR of 7.83% in 2023–2031. The rising prevalence of ophthalmic disorders is likely to remain a key ophthalmology devices market trend.

Ophthalmology Devices Market Analysis

Ophthalmic devices are designed for surgical, diagnostic, and vision correction purposes. These devices have gained substantial importance over the years due to the high incidence of cataracts, glaucoma, and other vision-related issues. Moreover, companies in the ophthalmology devices market are introducing technologically advanced contact lenses and spectacle lenses. The demand for ophthalmic diagnosis and monitoring devices is on the rise due to advancements in medical technologies, an upsurge in the prevalence of eye diseases caused by changing lifestyles, the increasing incidence of chronic diseases, and the burgeoning aging population. Advanced technologies such as artificial intelligence (AI), telemedicine, and the Internet of Things (IoT) play a pivotal role in eye screening procedures, thereby boosting operational efficiency, accuracy, cost-efficiency, and access to ophthalmic care.

Ophthalmology Devices Market Overview

Technological innovation has always been fundamental to any discipline of life sciences, including ophthalmology, as modern devices are key to accurate diagnosis and improved treatments. Advancements in medications, diagnostic devices, laser systems, and surgical techniques have enabled the improved diagnosis of glaucoma, cataracts and macular degeneration, and dry eye disease. Factors such as upsurge in the incidence of ophthalmic disorders, and increasing number of product launch, acquisition and collaboration is driving the market growth. In addition, technological advancements in ophthalmic devices is acting as an opportunity for the market. However, the high cost of ophthalmic surgeries is the major factor hindering the market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ophthalmology Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Ophthalmology Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Ophthalmology Devices Market Drivers and Opportunities

Advancements in Ophthalmology Devices Favor Market Growth

Virtual reality, 3D imaging, and Big Data and artificial intelligence (AI) are being used for data analysis in ophthalmology. These tools have made it possible to gain accurate and reliable results. Tools such as AI are being used in the screening of diabetic retinopathy, lesion detection, and disease progress monitoring (e.g., progress of age-related macular degeneration or macular edema). However, these tools are still under development as they are being evaluated for their suitability in diagnostic and prognostic applications in ocular pathologies. Minimally invasive surgeries such as LASIK (i.e., laser-assisted in situ keratomileusis) surgery, femtosecond laser surgery, multi-wavelength diabetic retinopathy treatment, and ultrasound phacoemulsification are likely to increase the demand for ophthalmology devices, in turn, propelling the overall market growth.

Growing Focus on Telemedicine to Generate Opportunities in Market

Technological innovation has always been fundamental to any discipline of life sciences, including ophthalmology, as modern devices are key to accurate diagnosis and improved treatments. Advancements in medications, diagnostic devices, laser systems, and surgical techniques have enabled the improved diagnosis of glaucoma, cataracts and macular degeneration, and dry eye disease. Virtual reality, 3D imaging, and big data and artificial intelligence (AI) are being used for data analysis in ophthalmology. These tools have made it possible to gain accurate and reliable results. Tools such as AI are being used in the screening of diabetic retinopathy, detection of lesions, and monitoring of the progress of certain diseases such as age-related macular degeneration or macular edema. However, these tools are still under development as they are being evaluated for their suitability in diagnostic and prognostic applications in ocular pathologies. Minimally invasive surgeries such as LASIK (i.e., laser-assisted in situ keratomileusis) surgery, femtosecond laser surgery, multi-wavelength diabetic retinopathy treatment, and ultrasound phacoemulsification are likely to increase the demand for ophthalmology devices, in turn, propelling the overall market growth.

Ophthalmology Devices Market Report Segmentation Analysis

Key segments that contributed to the derivation of the ophthalmology devices market analysis are product, vision care devices, diagnostic and monitoring devices, surgical devices, application, and end user.

- Based on product, the ophthalmology devices market is divided into vision care devices, surgical devices, and diagnostic and monitoring devices. The vision care devices segment held the largest market share in 2023.

- Based on application, the market is segmented into glaucoma, cataract, vitreoretinal disorder, refractory disorder, and others. The glaucoma segment held a major market share in 2023.

- In terms of end user, the market is segmented into hospitals and eye clinics, academic and research laboratories, and others. The hospitals and eye clinics segment dominated the market in 2023.

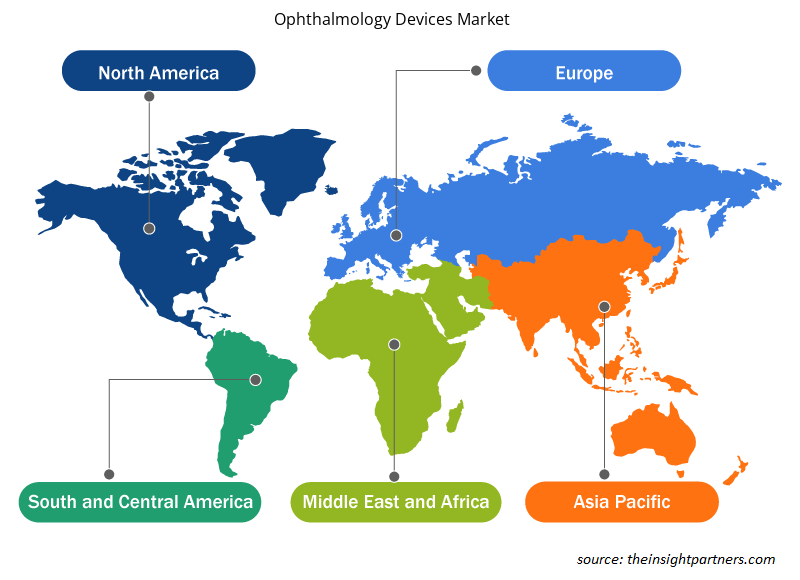

Ophthalmology Devices Market Share Analysis by Geography

The geographic scope of the ophthalmology devices market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The market growth in North American region can be attributed to the rising prevalence of eye diseases such as glaucoma and cataracts, and the presence of major manufacturers in North American countries.

Ophthalmology Devices Market Regional Insights

The regional trends and factors influencing the Ophthalmology Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Ophthalmology Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Ophthalmology Devices Market

Ophthalmology Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 40.48 Billion |

| Market Size by 2031 | US$ 73.99 Billion |

| Global CAGR (2023 - 2031) | 7.83% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

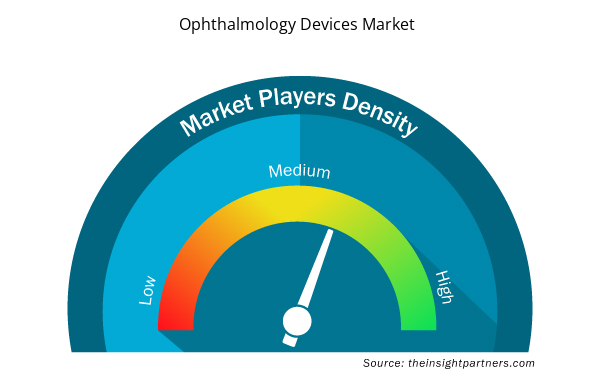

Ophthalmology Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Ophthalmology Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Ophthalmology Devices Market are:

- Johnson & Johnson Vision Care Inc.

- Alcon AG

- Carl Zeiss Meditec

- Bausch & Lomb Inc

- Essilor International SAS

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Ophthalmology Devices Market top key players overview

Ophthalmology Devices Market News and Recent Developments

The ophthalmology devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the ophthalmology devices market are mentioned below:

- Topcon Corporation acquired VISIA Imaging S.r.l., an ophthalmic device manufacturer headquartered in suburban Florence, Italy. With the acquisition, Topcon intends to further strengthen its well-positioned portfolio of fundus imaging devices—which includes fundus cameras and optical coherence tomography. This acquisition enhances Topcon’s development and production capabilities of anterior segment devices and software. The acquisition is also meant to strengthen its standing as a top producer of ophthalmic diagnostic tools. (Source: Topcon, Press Release, July 2021)

- Iridex Corporation entered into a strategic collaboration with Topcon Corporation. Iridex Corporation is a renowned provider of innovative ophthalmic laser-based medical products for treating glaucoma and retinal diseases. Iridex acquired Topcon’s PASCAL product line, combining its own MicroPulse technology with Topcon’s PASCAL laser platform. This collaboration is likely to help Iridex expand its share in the market for retinal scanning laser products. (Source: Iridex Corporation, Newsletter, March 2021)

Ophthalmology Devices Market Report Coverage and Deliverables

The “Ophthalmology Devices Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Ophthalmology devices market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Ophthalmology devices market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Ophthalmology devices market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the ophthalmology devices market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, and End-User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Factors such as the growing prevalence of ophthalmic disorders and the rising geriatric population prone to various eye disorders. However, the high cost of ophthalmic devices and lack of awareness related to these devices in developing countries hinder the ophthalmology devices market growth. Additionally, technological advancements are anticipated to bring new ophthalmology devices market trends in the coming years.

Ophthalmology devices are medical equipment used for vision correction, eye disease diagnosis, and surgical procedures. These devices include invasive devices such as implantable devices (intraocular lenses and glaucoma stents), and noninvasive diagnostic equipment and instruments. Key factors driving the market growth include the growing prevalence of ophthalmic disorders and the rising geriatric population prone to various eye disorders. However, the high cost of ophthalmic devices and lack of awareness related to these devices in developing countries hinder the ophthalmology devices market growth. Additionally, technological advancements are anticipated to bring new ophthalmology devices market trends in the coming years.

The ophthalmology devices market majorly consists of the players, including Johnson & Johnson Vision Care Inc., Alcon AG, Carl Zeiss Meditec, Bausch & Lomb Inc, Essilor International SAS, Nidek Co Ltd, Topcon Corp, Haag-Streit AG, Ziemer Ophthalmic Systems AG, and Hoya Corp.

The ophthalmology devices market was valued at US$ 40.48 billion in 2023.

The ophthalmology devices market is expected to be valued at US$ 73.99 billion in 2031.

Based on product, the ophthalmology devices market is divided into vision care devices, surgical devices, and diagnostic and monitoring devices. The vision care devices segment held the largest market share in 2023.

Based on application, the market is segmented into glaucoma, cataract, vitreoretinal disorder, refractory disorder, and others. The glaucoma segment held a major market share in 2023.

In terms of end user, the market is segmented into hospitals and eye clinics, academic and research laboratories, and others. The hospitals and eye clinics segment dominated the market in 2023.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Ophthalmology Devices Market

- Johnson & Johnson Vision Care Inc.

- Alcon AG

- Carl Zeiss Meditec

- Bausch & Lomb Inc

- Essilor International SAS

- Nidek Co Ltd

- Topcon Corp

- Haag-Streit AG

- Ziemer Ophthalmic Systems AG

- Hoya Corp.

Get Free Sample For

Get Free Sample For