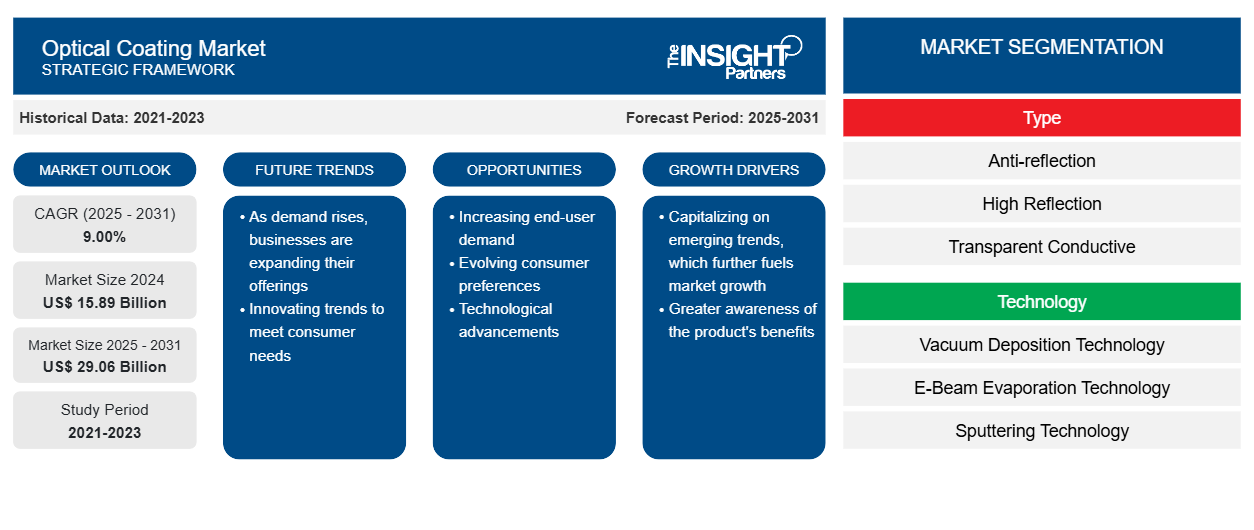

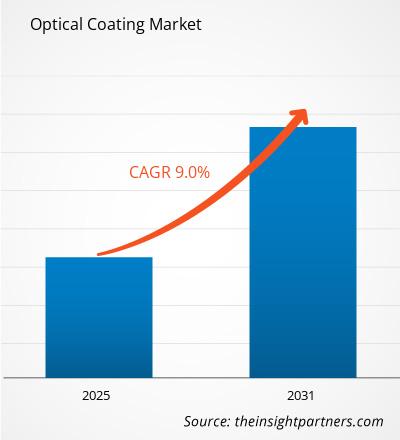

The optical coatings market is expected to grow from US$ 13.38 billion in 2022 to US$ 22.40 billion by 2031, with an estimated CAGR of 9.0% from 2022 to 2031.

An optical coating is made of a combination of thin film layers that create interference effects to enhance transmission or reflection properties within an optical system. An optical coating is composed of a blend of thin layers of materials such as metals, rare earth materials, or oxides. The performance of an optical coating is dependent upon the number of layers, the thickness of the individual layers, and the refractive index difference at the layer interfaces. They are integral in almost every optical instrument, from eyeglasses and telescopes to simple or complex mirrors.

MARKET DYNAMICS

Optical coatings are used in many electronic applications where light must travel through optical surfaces. Optical antireflective coatings are used on tablet and cell phone screens for various purposes, including making text easier to read in daylight. These coatings are used on the semiconductor diode lasers' facets. Since the Internet of Things (IoT) is becoming more prevalent across a wide range of industries, the demand for semiconductors has proliferated in recent years. These factors are propelling the growth of the optical coatings market.

MARKET SCOPE

The "Global Optical Coatings Market Analysis to 2031" is a specialized and in-depth study of the optical coatings market with a special focus on the global market trend analysis. The report aims to provide an overview of the optical coatings market with detailed market segmentation. It provides key statistics on the status of leading market players and offers major trends and opportunities in the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Optical Coating Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Optical Coating Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MARKET SEGMENTATION

The global optical coatings market is categorized into type, technology, and end-use industry. Based on type, the market is segmented into antireflection, high reflection, transparent conductive, filter, beamsplitter, electrochromic, and others. In terms of technology, the market is segmented into vacuum deposition technology, e-beam evaporation technology, sputtering technology, and others. Based on end-use industry, the market is segmented into electronics & semiconductor, military & defense, automotive, solar power, medical, consumer goods, and others.

REGIONAL FRAMEWORK

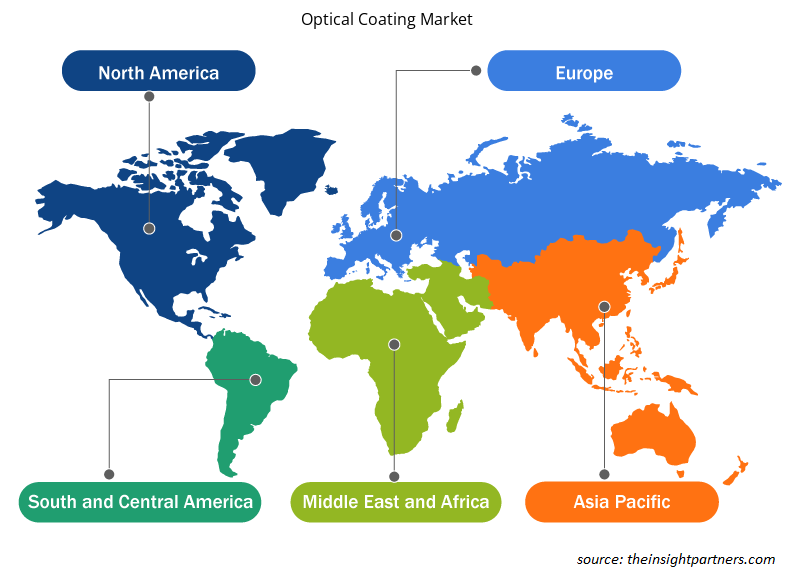

The global optical coatings market is segmented into five major regions North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. The report covers an analysis and forecast of 18 countries globally, along with current trends and opportunities prevailing in these regions.

Asia Pacific dominated the optical coatings market in 2021. The regional market growth is mainly boosted by the rise in demand from electronics & semiconductors, solar energy, and defense sectors. Many Asian countries have started initiatives to promote the growth of the semiconductor & electronics industry. For instance, the Make in India initiative is being promoted by India for automotive, semiconductor, and aerospace products. This initiative will benefit the country's ability to produce automobile glass sheets, solar panels, optoelectronic components, and other electronic devices. Thus, such initiatives of the government of countries in the Asia Pacific region led to the development of the electronics & semiconductors manufacturing industry, leading to dominance in the optical coatings market.

The report analyzes the factors, such as drivers, restraints, opportunities, and future trends, that impact the optical coatings market. It also provides an exhaustive Porter's five forces analysis, highlighting the factors influencing the market in these regions.

IMPACT OF COVID-19 PANDEMIC

The COVID-19 pandemic severely affected many industries. The imposition of the lockdown temporarily discontinued various manufacturing activities, resulting in a decrease in supply, which substantially impacted the optical coatings market. Transportation, manufacturing, oil & gas, automobiles, and energy industries saw a prolonged shutdown, causing a dramatic decline in the global demand for optical coatings. The electronics & semiconductor industry is among the drastically affected industries due to its reliance on the severely hit China and other Asian countries. Segments in this industry, such as consumer electronics, consumer goods, and automotive, were at high risk. In contrast, other segments, including cloud-computing data centers, communication & connectivity technology, and healthcare, remained unaffected. However, during the pandemic, the demand for medical devices increased, which boosted the need for optical coatings.

Furthermore, the economies started reviving their operations in 2021. The growing adoption of 5G technology is increasing the demand for electronic devices such as 5G modems, 5G routers, MIMO antenna, 5G New Radio (5GNR), C-RAN units, multichannel highly integrated RF transceivers, and voltage-controlled crystal oscillators (VCXOs). Moreover, the requirement for enhanced memory and storage is expected to increase demand for microchips. That opens up an unprecedented opportunity for semiconductor businesses. Thus, the increased demand from the electronics & semiconductor industry is expected to boost the growth of the optical coatings market. Additionally, the increasing production of automobiles, solar power, medical, and consumer goods industries in Europe, the US, and Asia Pacific is expected to create opportunities for optical coatings.

MARKET PLAYERS

The reports cover key developments in organic and inorganic growth strategies in the optical coatings market. Various companies are focusing on organic growth strategies such as product launches, product approvals, patents, and events. Inorganic growth strategy activities witnessed in the market were acquisitions, partnerships, and collaborations. These activities have paved the way for business expansion and the customer base of market players. Market players are anticipated to have lucrative growth opportunities in the coming years due to the rising demand for optical coatings.

The report includes key company profiles operating in the optical coatings market, along with their SWOT analysis and market strategies. It also focuses on leading industry players with information, such as company profiles, components and services offered, financial information of the last three years, and key development in the past five years.

Key Companies Operating in Optical Coatings Market

- DuPont de Nemours, Inc.

- PPG Industries, Inc.

- Nippon Electric Glass Co., Ltd.

- Reynard Corporation

- Abrisa Technologies

- Alluxa, Inc

- Artemis Optical Ltd.

- Cascade Optical Corporation

- Chroma Technology Corp.

- Coherent Corp.

The Insight Partner's dedicated research and analysis team consists of experienced professionals with advanced statistical expertise and offers various customization options in the existing study.

Report ScopeOptical Coating Market Regional Insights

The regional trends and factors influencing the Optical Coating Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Optical Coating Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Optical Coating Market

Optical Coating Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 15.89 Billion |

| Market Size by 2031 | US$ 29.06 Billion |

| Global CAGR (2025 - 2031) | 9.00% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

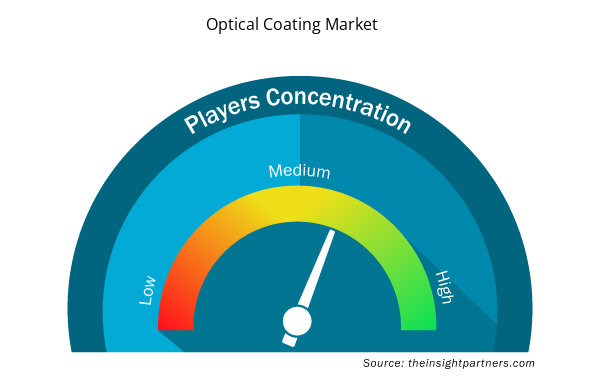

Optical Coating Market Players Density: Understanding Its Impact on Business Dynamics

The Optical Coating Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Optical Coating Market are:

- Abrisa Technologies

- Alluxa

- Artemis Optical Ltd.

- Cascade Optical Corporation

- Chroma Technology Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Optical Coating Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Technology, End-Use Industry, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies

1. Abrisa Technologies

2. Alluxa

3. Artemis Optical Ltd.

4. Cascade Optical Corporation

5. Chroma Technology Corporation

6. II-VI Optical Systems

7. Inrad Optics

8. Reynard Corporation

9. SCHOTT AG

10. VIAVI Solutions Inc.

Get Free Sample For

Get Free Sample For